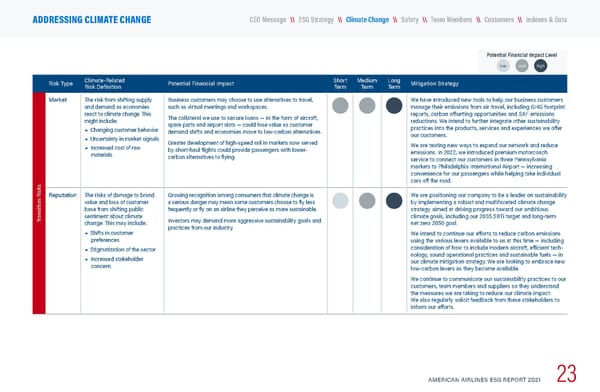

Potential Financial Impact Level low med high Risk Type Climate-Related Risk Definition Potential Financial Impact Short Term Medium Term Long Term Mitigation Strategy Transition Risks Market The risk from shifting supply and demand as economies react to climate change. This might include: • Changing customer behavior • Uncertainty in market signals • Increased cost of raw materials Business customers may choose to use alternatives to travel, such as virtual meetings and workspaces. The collateral we use to secure loans — in the form of aircraft, spare parts and airport slots — could lose value as customer demand shifts and economies move to low-carbon alternatives. Greater development of high-speed rail in markets now served by short-haul flights could provide passengers with lower- carbon alternatives to flying. We have introduced new tools to help our business customers manage their emissions from air travel, including GHG footprint reports, carbon offsetting opportunities and SAF emissions reductions. We intend to further integrate other sustainability practices into the products, services and experiences we offer our customers. We are testing new ways to expand our network and reduce emissions. In 2022, we introduced premium motorcoach service to connect our customers in three Pennsylvania markets to Philadelphia International Airport — increasing convenience for our passengers while helping take individual cars off the road. Reputation The risks of damage to brand value and loss of customer base from shifting public sentiment about climate change. This may include: • Shifts in customer preferences • Stigmatization of the sector • Increased stakeholder concern Growing recognition among consumers that climate change is a serious danger may mean some customers choose to fly less frequently or fly on an airline they perceive as more sustainable. Investors may demand more aggressive sustainability goals and practices from our industry. We are positioning our company to be a leader on sustainability by implementing a robust and multifaceted climate change strategy aimed at driving progress toward our ambitious climate goals, including our 2035 SBTi target and long-term net zero 2050 goal. We intend to continue our efforts to reduce carbon emissions using the various levers available to us at this time — including consideration of how to include modern aircraft, efficient tech - nology, sound operational practices and sustainable fuels — in our climate mitigation strategy. We are looking to embrace new low-carbon levers as they become available. We continue to communicate our sustainability practices to our customers, team members and suppliers so they understand the measures we are taking to reduce our climate impact. We also regularly solicit feedback from these stakeholders to inform our efforts. AMERICAN AIRLINES ESG REPORT 2021 23 \\ Indexes & Data \\ Customers \\ Team Members \\ Safety \\ ESG Strategy CEO Message ADDRESSING CLIMATE CHANGE \\ Climate Change

American Airlines ESG Report Page 23 Page 25

American Airlines ESG Report Page 23 Page 25