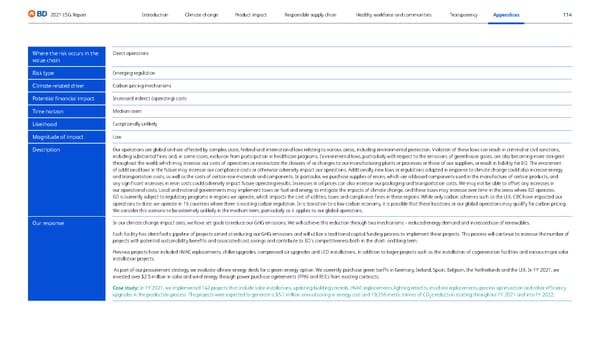

114 2021 ESG Report Transparency Appendices Responsible supply chain Product impact Climate change Introduction Healthy workforce and communities Where the risk occurs in the value chain Direct operations Risk type Emerging regulation Climate-related driver Carbon-pricing mechanisms Potential financial impact Increased indirect (operating) costs Time horizon Medium-term Likelihood Exceptionally unlikely Magnitude of impact Low Description Our operations are global and are affected by complex state, federal and international laws relating to various areas, including environmental protection. Violation of these laws can result in criminal or civil sanctions, including substantial fines and, in some cases, exclusion from participation in healthcare programs. Environmental laws, particularly with respect to the emissions of greenhouse gases, are also becoming more stringent throughout the world, which may increase our costs of operations or necessitate the closures of or changes to our manufacturing plants or processes or those of our suppliers, or result in liability for BD. The enactment of additional laws in the future may increase our compliance costs or otherwise adversely impact our operations. Additionally, new laws or regulations adopted in response to climate change could also increase energy and transportation costs, as well as the costs of certain raw materials and components. In particular, we purchase supplies of resins, which are oil-based components used in the manufacture of certain products, and any significant increases in resin costs could adversely impact future operating results. Increases in oil prices can also increase our packaging and transportation costs. We may not be able to offset any increases in our operational costs. Local and national governments may implement taxes on fuel and energy to mitigate the impacts of climate change, and these taxes may increase over time in the areas where BD operates. BD is currently subject to regulatory programs in regions we operate, which impacts the cost of utilities, taxes and compliance fines in these regions. While only carbon schemes such as the U.K. CRC have impacted our operations to date, we operate in 16 countries where there is existing carbon regulation. In a transition to a low-carbon economy, it is possible that these locations or our global operations may qualify for carbon pricing. We consider this scenario to be extremely unlikely in the medium-term, particularly as it applies to our global operations. Our response In our climate change impact area, we have set goals to reduce our GHG emissions. We will achieve this reduction through two mechanisms – reduced energy demand and increased use of renewables. Each facility has identified a pipeline of projects aimed at reducing our GHG emissions and will utilize a traditional capital funding process to implement these projects. This process will continue to increase the number of projects with potential sustainability benefits and associated cost savings and contribute to BD’s competitiveness both in the short- and long-term. Previous projects have included HVAC replacements, chiller upgrades, compressed-air upgrades and LED installations, in addition to larger projects such as the installation of cogeneration facilities and various major solar installation projects. As part of our procurement strategy, we evaluate all new energy deals for a green-energy option. We currently purchase green tariffs in Germany, Ireland, Spain, Belgium, the Netherlands and the U.K. In FY 2021, we invested over $2.5 million in solar and wind energy through power purchase agreements (PPA) and RECs from existing contracts. Case study: In FY 2021, we implemented 142 projects that include solar installations, updating building controls, HVAC replacements, lighting retrofits, machine replacements, process optimization and other efficiency upgrades in the production process. The projects were expected to generate a $5.1 million annual saving in energy cost and 19,266 metric tonnes of CO 2 e reduction starting throughout FY 2021 and into FY 2022.

BD ESG Report Page 113 Page 115

BD ESG Report Page 113 Page 115