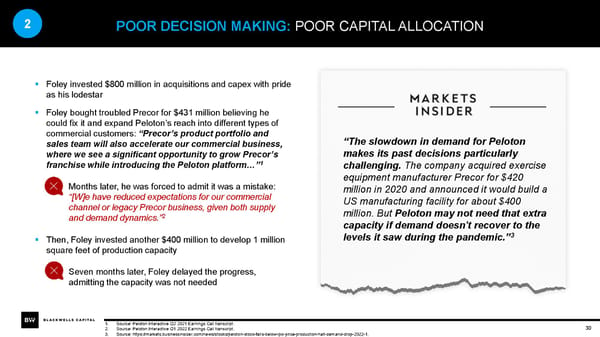

2 POOR DECISION MAKING: POOR CAPITAL ALLOCATION ▪ Foley invested $800 million in acquisitions and capex with pride as his lodestar ▪ Foley bought troubled Precor for $431 million believing he could fix it and expand Peloton’s reach into different types of commercial customers: “Precor’s product portfolio and “The slowdown in demand for Peloton sales team will also accelerate our commercial business, makes its past decisions particularly where we see a significant opportunity to grow Precor’s franchise while introducing the Peloton platform…”1 challenging. The company acquired exercise – Months later, he was forced to admit it was a mistake: equipment manufacturer Precor for $420 “[W]e have reduced expectations for our commercial million in 2020 and announced it would build a channel or legacy Precor business, given both supply US manufacturing facility for about $400 2 million. But Peloton may not need that extra and demand dynamics.” capacity if demand doesn't recover to the ▪ Then, Foley invested another $400 million to develop 1 million levels it saw during the pandemic.”3 square feet of production capacity – Seven months later, Foley delayed the progress, admitting the capacity was not needed 1. Source: Peloton Interactive Q2 2021 Earnings Call transcript. 30 2. Source: Peloton Interactive Q1 2022 Earnings Call transcript. 3. Source: https://markets.businessinsider.com/news/stocks/peloton-stock-falls-below-ipo-price-production-halt-demand-drop-2022-1.

BW Peloton Presentation Feb 07 2022 Page 29 Page 31

BW Peloton Presentation Feb 07 2022 Page 29 Page 31