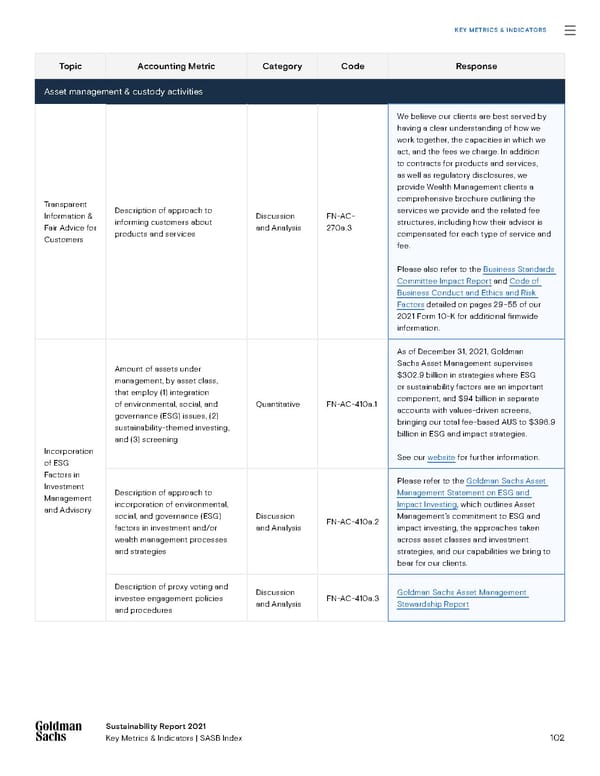

102 Sustainability Report 2021 Key Metrics & Indicators | SASB Index Sustainability Report 2021 Key Metrics & Indicators Topic Accounting Metric Category Code Response Asset management & custody activities Transparent Information & Fair Advice for Customers Description of approach to informing customers about products and services Discussion and Analysis FN-AC- 270a.3 We believe our clients are best served by having a clear understanding of how we work together, the capacities in which we act, and the fees we charge. In addition to contracts for products and services, as well as regulatory disclosures, we provide Wealth Management clients a comprehensive brochure outlining the services we provide and the related fee structures, including how their advisor is compensated for each type of service and fee. Please also refer to the Business Standards Committee Impact Report and Code of Business Conduct and Ethics and Risk Factors detailed on pages 29–55 of our 2021 Form 10-K for additional firmwide information. Incorporation of ESG Factors in Investment Management and Advisory Amount of assets under management, by asset class, that employ (1) integration of environmental, social, and governance (ESG) issues, (2) sustainability-themed investing, and (3) screening Quantitative FN-AC-410a.1 As of December 31, 2021, Goldman Sachs Asset Management supervises $302.9 billion in strategies where ESG or sustainability factors are an important component, and $94 billion in separate accounts with values-driven screens, bringing our total fee-based AUS to $396.9 billion in ESG and impact strategies. See our website for further information. Description of approach to incorporation of environmental, social, and governance (ESG) factors in investment and/or wealth management processes and strategies Discussion and Analysis FN-AC-410a.2 Please refer to the Goldman Sachs Asset Management Statement on ESG and Impact Investing , which outlines Asset Management’s commitment to ESG and impact investing, the approaches taken across asset classes and investment strategies, and our capabilities we bring to bear for our clients. Description of proxy voting and investee engagement policies and procedures Discussion and Analysis FN-AC-410a.3 Goldman Sachs Asset Management Stewardship Report KEY METRICS & INDICATORS

Goldman Sachs Group Sustainability Report Page 101 Page 103

Goldman Sachs Group Sustainability Report Page 101 Page 103