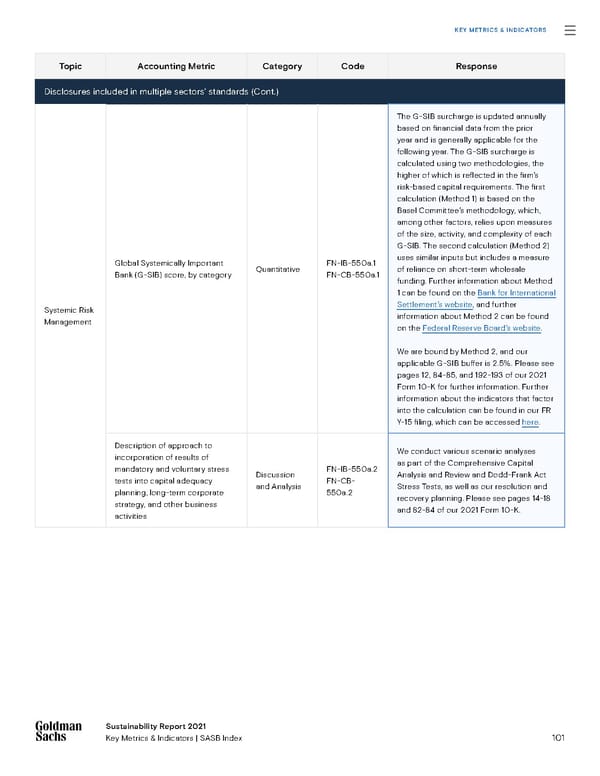

101 Sustainability Report 2021 Key Metrics & Indicators | SASB Index Sustainability Report 2021 Key Metrics & Indicators Topic Accounting Metric Category Code Response Disclosures included in multiple sectors’ standards (Cont.) Systemic Risk Management Global Systemically Important Bank (G-SIB) score, by category Quantitative FN-IB-550a.1 FN-CB-550a.1 The G-SIB surcharge is updated annually based on financial data from the prior year and is generally applicable for the following year. The G-SIB surcharge is calculated using two methodologies, the higher of which is reflected in the firm’s risk-based capital requirements. The first calculation (Method 1) is based on the Basel Committee’s methodology, which, among other factors, relies upon measures of the size, activity, and complexity of each G-SIB. The second calculation (Method 2) uses similar inputs but includes a measure of reliance on short-term wholesale funding. Further information about Method 1 can be found on the Bank for International Settlement’s website , and further information about Method 2 can be found on the Federal Reserve Board’s website . We are bound by Method 2, and our applicable G-SIB buffer is 2.5%. Please see pages 12, 84-85, and 192-193 of our 2021 Form 10-K for further information. Further information about the indicators that factor into the calculation can be found in our FR Y-15 filing, which can be accessed here . Description of approach to incorporation of results of mandatory and voluntary stress tests into capital adequacy planning, long-term corporate strategy, and other business activities Discussion and Analysis FN-IB-550a.2 FN-CB- 550a.2 We conduct various scenario analyses as part of the Comprehensive Capital Analysis and Review and Dodd-Frank Act Stress Tests, as well as our resolution and recovery planning. Please see pages 14-18 and 82-84 of our 2021 Form 10-K. KEY METRICS & INDICATORS

Goldman Sachs Group Sustainability Report Page 100 Page 102

Goldman Sachs Group Sustainability Report Page 100 Page 102