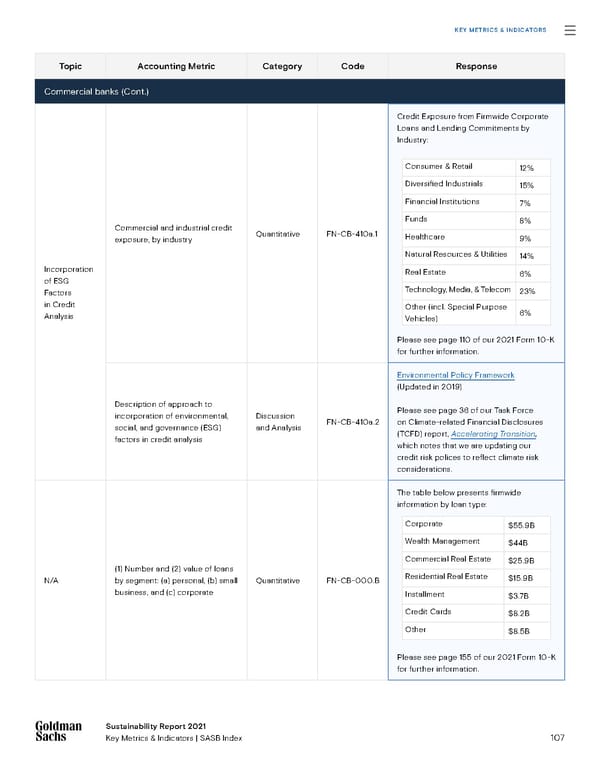

107 Sustainability Report 2021 Key Metrics & Indicators | SASB Index Sustainability Report 2021 Key Metrics & Indicators Topic Accounting Metric Category Code Response Commercial banks (Cont.) Incorporation of ESG Factors in Credit Analysis Commercial and industrial credit exposure, by industry Quantitative FN-CB-410a.1 Credit Exposure from Firmwide Corporate Loans and Lending Commitments by Industry: Please see page 110 of our 2021 Form 10-K for further information. Description of approach to incorporation of environmental, social, and governance (ESG) factors in credit analysis Discussion and Analysis FN-CB-410a.2 Environmental Policy Framework (Updated in 2019) Please see page 36 of our Task Force on Climate-related Financial Disclosures (TCFD) report, Accelerating Transition , which notes that we are updating our credit risk polices to reflect climate risk considerations. N/A (1) Number and (2) value of loans by segment: (a) personal, (b) small business, and (c) corporate Quantitative FN-CB-000.B The table below presents firmwide information by loan type: Please see page 155 of our 2021 Form 10-K for further information. Consumer & Retail 12% Diversified Industrials 15% Financial Institutions 7% Funds 8% Healthcare 9% Natural Resources & Utilities 14% Real Estate 6% Technology, Media, & Telecom 23% Other (incl. Special Purpose Vehicles) 6% Corporate $55.9B Wealth Management $44B Commercial Real Estate $25.9B Residential Real Estate $15.9B Installment $3.7B Credit Cards $8.2B Other $8.5B KEY METRICS & INDICATORS

Goldman Sachs Group Sustainability Report Page 106 Page 108

Goldman Sachs Group Sustainability Report Page 106 Page 108