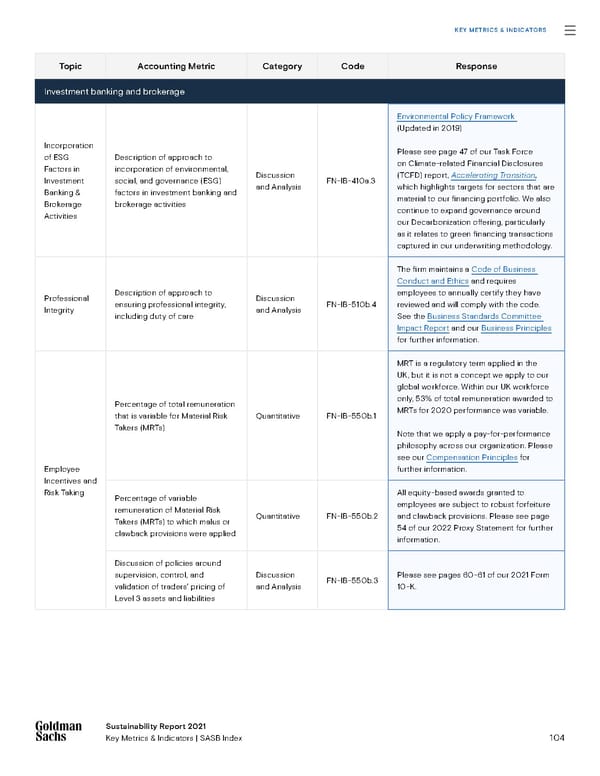

104 Sustainability Report 2021 Key Metrics & Indicators | SASB Index Sustainability Report 2021 Key Metrics & Indicators Topic Accounting Metric Category Code Response Investment banking and brokerage Incorporation of ESG Factors in Investment Banking & Brokerage Activities Description of approach to incorporation of environmental, social, and governance (ESG) factors in investment banking and brokerage activities Discussion and Analysis FN-IB-410a.3 Environmental Policy Framework (Updated in 2019) Please see page 47 of our Task Force on Climate-related Financial Disclosures (TCFD) report, Accelerating Transition , which highlights targets for sectors that are material to our financing portfolio. We also continue to expand governance around our Decarbonization offering, particularly as it relates to green financing transactions captured in our underwriting methodology. Professional Integrity Description of approach to ensuring professional integrity, including duty of care Discussion and Analysis FN-IB-510b.4 The firm maintains a Code of Business Conduct and Ethics and requires employees to annually certify they have reviewed and will comply with the code. See the Business Standards Committee Impact Report and our Business Principles for further information. Employee Incentives and Risk Taking Percentage of total remuneration that is variable for Material Risk Takers (M R Ts) Quantitative FN-IB-550b.1 MRT is a regulatory term applied in the UK, but it is not a concept we apply to our global workforce. Within our UK workforce only, 53% of total remuneration awarded to MRTs for 2020 performance was variable. Note that we apply a pay-for-performance philosophy across our organization. Please see our Compensation Principles for further information. Percentage of variable remuneration of Material Risk Takers (MRTs) to which malus or clawback provisions were applied Quantitative FN-IB-550b.2 All equity-based awards granted to employees are subject to robust forfeiture and clawback provisions. Please see page 54 of our 2022 Proxy Statement for further information. Discussion of policies around supervision, control, and validation of traders’ pricing of Level 3 assets and liabilities Discussion and Analysis FN-IB-550b.3 Please see pages 60-61 of our 2021 Form 10-K. KEY METRICS & INDICATORS

Goldman Sachs Group Sustainability Report Page 103 Page 105

Goldman Sachs Group Sustainability Report Page 103 Page 105