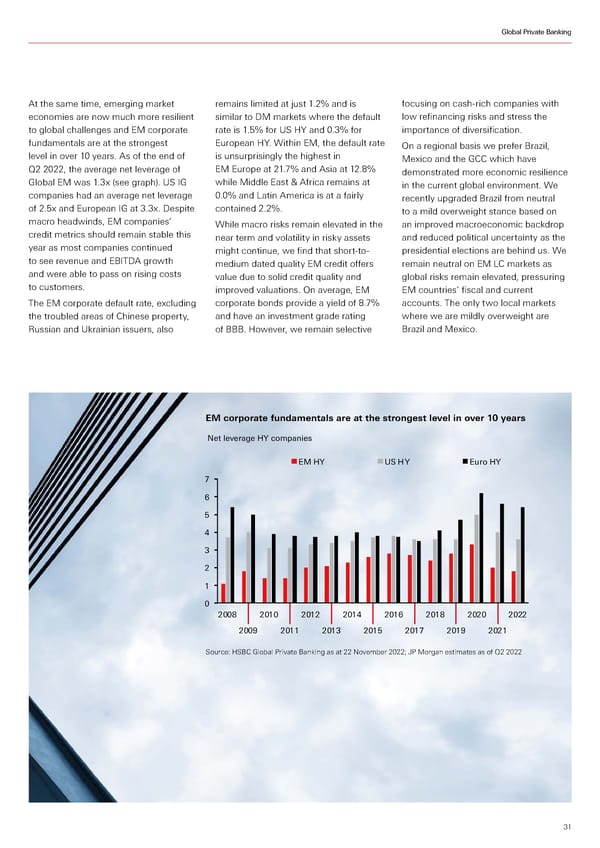

Global Private Banking At the same time, emerging market remains limited at just 1.2% and is focusing on cash-rich companies with economies are now much more resilient similar to DM markets where the default low refinancing risks and stress the to global challenges and EM corporate rate is 1.5% for US HY and 0.3% for importance of diversification. fundamentals are at the strongest European HY. Within EM, the default rate On a regional basis we prefer Brazil, level in over 10 years. As of the end of is unsurprisingly the highest in Mexico and the GCC which have Q2 2022, the average net leverage of EM Europe at 21.7% and Asia at 12.8% demonstrated more economic resilience Global EM was 1.3x (see graph). US IG while Middle East & Africa remains at in the current global environment. We companies had an average net leverage 0.0% and Latin America is at a fairly recently upgraded Brazil from neutral of 2.5x and European IG at 3.3x. Despite contained 2.2%. to a mild overweight stance based on macro headwinds, EM companies’ While macro risks remain elevated in the an improved macroeconomic backdrop credit metrics should remain stable this near term and volatility in risky assets and reduced political uncertainty as the year as most companies continued might continue, we find that short-to- presidential elections are behind us. We to see revenue and EBITDA growth medium dated quality EM credit offers remain neutral on EM LC markets as and were able to pass on rising costs value due to solid credit quality and global risks remain elevated, pressuring to customers. improved valuations. On average, EM EM countries’ fiscal and current The EM corporate default rate, excluding corporate bonds provide a yield of 8.7% accounts. The only two local markets the troubled areas of Chinese property, and have an investment grade rating where we are mildly overweight are Russian and Ukrainian issuers, also of BBB. However, we remain selective Brazil and Mexico. EM corporate fundamentals are at the strongest level in over 10 years Net leverage HY companies EM HY U HY Ero HY 7 6 5 4 3 2 1 0 2008 2010 2012 2014 2016 2018 2020 2022 2009 2011 2013 2015 2017 2019 2021 Source: HSBC Global Private Banking as at 22 November 2022; JP Morgan estimates as of Q2 2022 31

HSBC Investment Outlook Q1 2023 Page 30 Page 32

HSBC Investment Outlook Q1 2023 Page 30 Page 32