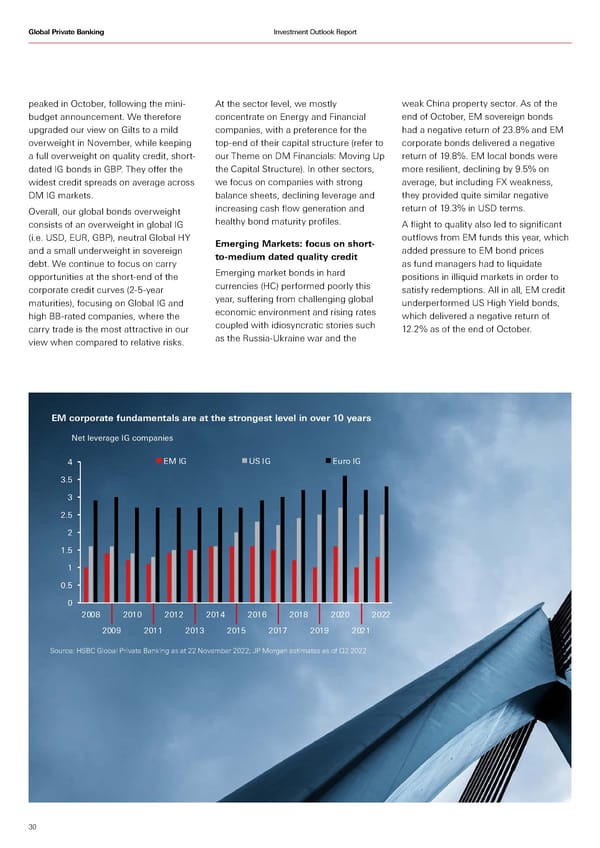

Global Private Banking Investment Outlook Report peaked in October, following the mini- At the sector level, we mostly weak China property sector. As of the budget announcement. We therefore concentrate on Energy and Financial end of October, EM sovereign bonds upgraded our view on Gilts to a mild companies, with a preference for the had a negative return of 23.8% and EM overweight in November, while keeping top-end of their capital structure (refer to corporate bonds delivered a negative a full overweight on quality credit, short- our Theme on DM Financials: Moving Up return of 19.8%. EM local bonds were dated IG bonds in GBP. They offer the the Capital Structure). In other sectors, more resilient, declining by 9.5% on widest credit spreads on average across we focus on companies with strong average, but including FX weakness, DM IG markets. balance sheets, declining leverage and they provided quite similar negative Overall, our global bonds overweight increasing cash flow generation and return of 19.3% in USD terms. consists of an overweight in global IG healthy bond maturity profiles. A flight to quality also led to significant (i.e. USD, EUR, GBP), neutral Global HY Emerging Markets: focus on short- outflows from EM funds this year, which and a small underweight in sovereign to-medium dated quality credit added pressure to EM bond prices debt. We continue to focus on carry as fund managers had to liquidate opportunities at the short-end of the Emerging market bonds in hard positions in illiquid markets in order to corporate credit curves (2-5-year currencies (HC) performed poorly this satisfy redemptions. All in all, EM credit maturities), focusing on Global IG and year, suffering from challenging global underperformed US High Yield bonds, high BB-rated companies, where the economic environment and rising rates which delivered a negative return of carry trade is the most attractive in our coupled with idiosyncratic stories such 12.2% as of the end of October. view when compared to relative risks. as the Russia-Ukraine war and the EM corporate fundamentals are at the strongest level in over 10 years Net leverage IG companies 4 EM IG IG Ero IG 3.5 3 2.5 2 1.5 1 0.5 0 2008 2010 2012 2014 2016 2018 2020 2022 2009 2011 2013 2015 2017 2019 2021 Source: HSBC Global Private Banking as at 22 November 2022; JP Morgan estimates as of Q2 2022 30

HSBC Investment Outlook Q1 2023 Page 29 Page 31

HSBC Investment Outlook Q1 2023 Page 29 Page 31