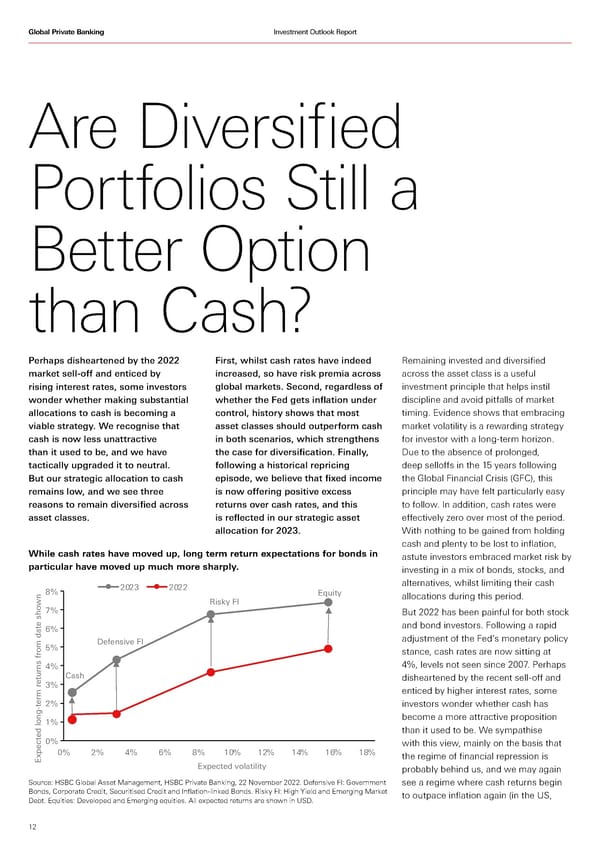

Global Private Banking Investment Outlook Report Are Diversified Portfolios Still a Better Option than Cash? Perhaps disheartened by the 2022 First, whilst cash rates have indeed Remaining invested and diversified market sell-off and enticed by increased, so have risk premia across across the asset class is a useful rising interest rates, some investors global markets. Second, regardless of investment principle that helps instil wonder whether making substantial whether the Fed gets inflation under discipline and avoid pitfalls of market allocations to cash is becoming a control, history shows that most timing. Evidence shows that embracing viable strategy. We recognise that asset classes should outperform cash market volatility is a rewarding strategy cash is now less unattractive in both scenarios, which strengthens for investor with a long-term horizon. than it used to be, and we have the case for diversification. Finally, Due to the absence of prolonged, tactically upgraded it to neutral. following a historical repricing deep selloffs in the 15 years following But our strategic allocation to cash episode, we believe that fixed income the Global Financial Crisis (GFC), this remains low, and we see three is now offering positive excess principle may have felt particularly easy reasons to remain diversified across returns over cash rates, and this to follow. In addition, cash rates were asset classes. is reflected in our strategic asset effectively zero over most of the period. allocation for 2023. With nothing to be gained from holding cash and plenty to be lost to inflation, While cash rates have moved up, long term return expectations for bonds in astute investors embraced market risk by particular have moved up much more sharply. investing in a mix of bonds, stocks, and 2023 2022 alternatives, whilst limiting their cash 8% Equity allocations during this period. Risky FI 7% But 2022 has been painful for both stock 6% and bond investors. Following a rapid Defensive FI adjustment of the Fed’s monetary policy 5% stance, cash rates are now sitting at 4% 4%, levels not seen since 2007. Perhaps Cash disheartened by the recent sell-off and 3% enticed by higher interest rates, some te€ etuns f€ ate sh‚n2% investors wonder whether cash has 1% become a more attractive proposition than it used to be. We sympathise 0% with this view, mainly on the basis that Exete n0% 2% 4% 6% 8% 10% 12% 14% 16% 18% the regime of financial repression is Exete vatiity probably behind us, and we may again Source: HSBC Global Asset Management, HSBC Private Banking, 22 November 2022. Defensive FI: Government see a regime where cash returns begin Bonds, Corporate Credit, Securitised Credit and Inflation-linked Bonds. Risky FI: High Yield and Emerging Market to outpace inflation again (in the US, Debt. Equities: Developed and Emerging equities. All expected returns are shown in USD. 12

HSBC Investment Outlook Q1 2023 Page 11 Page 13

HSBC Investment Outlook Q1 2023 Page 11 Page 13