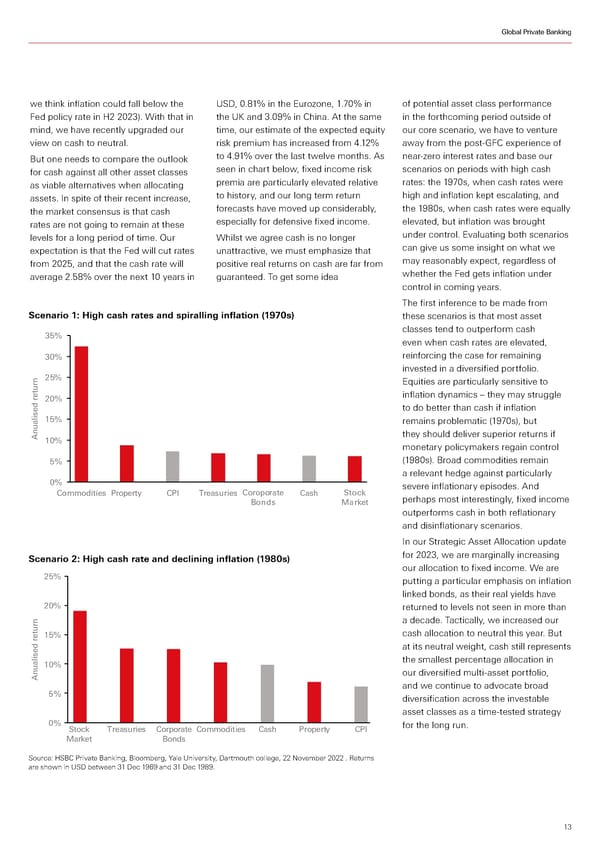

Global Private Banking we think inflation could fall below the USD, 0.81% in the Eurozone, 1.70% in of potential asset class performance Fed policy rate in H2 2023). With that in the UK and 3.09% in China. At the same in the forthcoming period outside of mind, we have recently upgraded our time, our estimate of the expected equity our core scenario, we have to venture Are Diversified view on cash to neutral. risk premium has increased from 4.12% away from the post-GFC experience of But one needs to compare the outlook to 4.91% over the last twelve months. As near-zero interest rates and base our for cash against all other asset classes seen in chart below, fixed income risk scenarios on periods with high cash as viable alternatives when allocating premia are particularly elevated relative rates: the 1970s, when cash rates were Portfolios Still a assets. In spite of their recent increase, to history, and our long term return high and inflation kept escalating, and the market consensus is that cash forecasts have moved up considerably, the 1980s, when cash rates were equally rates are not going to remain at these especially for defensive fixed income. elevated, but inflation was brought levels for a long period of time. Our Whilst we agree cash is no longer under control. Evaluating both scenarios expectation is that the Fed will cut rates unattractive, we must emphasize that can give us some insight on what we Better Option from 2025, and that the cash rate will positive real returns on cash are far from may reasonably expect, regardless of average 2.58% over the next 10 years in guaranteed. To get some idea whether the Fed gets inflation under control in coming years. The first inference to be made from than Cash?Scenario 1: High cash rates and spiralling inflation (1970s) these scenarios is that most asset 35% classes tend to outperform cash even when cash rates are elevated, 30% reinforcing the case for remaining invested in a diversified portfolio. 25% Equities are particularly sensitive to 20% inflation dynamics – they may struggle to do better than cash if inflation 15% remains problematic (1970s), but Anualisedreturn10% they should deliver superior returns if monetary policymakers regain control 5% (1980s). Broad commodities remain a relevant hedge against particularly 0% severe inflationary episodes. And Commodities Property CPI Treasuries Coroporate Cash Stock perhaps most interestingly, fixed income Bonds Market outperforms cash in both reflationary and disinflationary scenarios. In our Strategic Asset Allocation update Scenario 2: High cash rate and declining inflation (1980s) for 2023, we are marginally increasing our allocation to fixed income. We are 25% putting a particular emphasis on inflation linked bonds, as their real yields have 20% returned to levels not seen in more than a decade. Tactically, we increased our 15% cash allocation to neutral this year. But at its neutral weight, cash still represents 10% the smallest percentage allocation in Anualised return our diversified multi-asset portfolio, and we continue to advocate broad 5% diversification across the investable asset classes as a time-tested strategy 0% Stock Treasuries Corporate Commodities Cash Property CPI for the long run. Market Bonds Source: HSBC Private Banking, Bloomberg, Yale University, Dartmouth college, 22 November 2022 . Returns are shown in USD between 31 Dec 1969 and 31 Dec 1989. 13

HSBC Investment Outlook Q1 2023 Page 12 Page 14

HSBC Investment Outlook Q1 2023 Page 12 Page 14