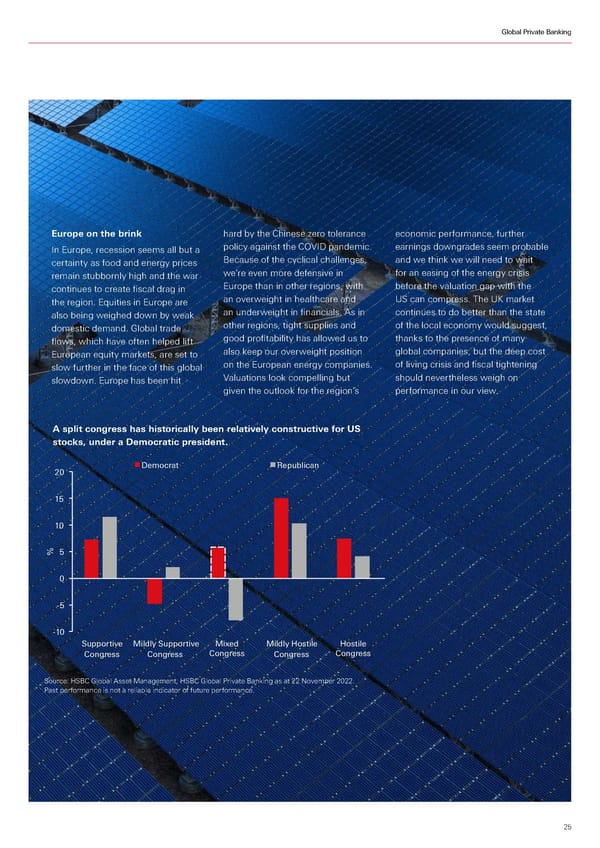

Global Private Banking Europe on the brink hard by the Chinese zero tolerance economic performance, further In Europe, recession seems all but a policy against the COVID pandemic. earnings downgrades seem probable certainty as food and energy prices Because of the cyclical challenges, and we think we will need to wait remain stubbornly high and the war we’re even more defensive in for an easing of the energy crisis continues to create fiscal drag in Europe than in other regions, with before the valuation gap with the the region. Equities in Europe are an overweight in healthcare and US can compress. The UK market also being weighed down by weak an underweight in financials. As in continues to do better than the state domestic demand. Global trade other regions, tight supplies and of the local economy would suggest, flows, which have often helped lift good profitability has allowed us to thanks to the presence of many European equity markets, are set to also keep our overweight position global companies, but the deep cost slow further in the face of this global on the European energy companies. of living crisis and fiscal tightening slowdown. Europe has been hit Valuations look compelling but should nevertheless weigh on given the outlook for the region’s performance in our view. A split congress has historically been relatively constructive for US stocks, under a Democratic president. 20 Democrat Repulican 15 10 % 5 0 -5 -10 Supportive Mildly Supportive Mixed Mildly Hostile Hostile Congress Congress Congress Congress Congress Source: HSBC Global Asset Management, HSBC Global Private Banking as at 22 November 2022. Past performance is not a reliable indicator of future performance. 25

HSBC Investment Outlook Q1 2023 Page 24 Page 26

HSBC Investment Outlook Q1 2023 Page 24 Page 26