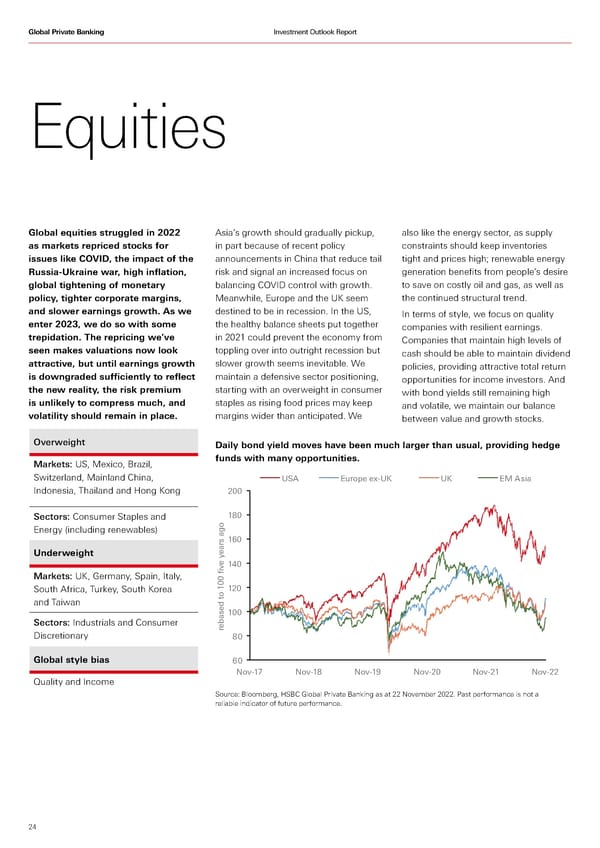

Global Private Banking Investment Outlook Report Equities Global equities struggled in 2022 Asia’s growth should gradually pickup, also like the energy sector, as supply as markets repriced stocks for in part because of recent policy constraints should keep inventories issues like COVID, the impact of the announcements in China that reduce tail tight and prices high; renewable energy Russia-Ukraine war, high inflation, risk and signal an increased focus on generation benefits from people’s desire global tightening of monetary balancing COVID control with growth. to save on costly oil and gas, as well as policy, tighter corporate margins, Meanwhile, Europe and the UK seem the continued structural trend. and slower earnings growth. As we destined to be in recession. In the US, In terms of style, we focus on quality enter 2023, we do so with some the healthy balance sheets put together companies with resilient earnings. trepidation. The repricing we’ve in 2021 could prevent the economy from Companies that maintain high levels of seen makes valuations now look toppling over into outright recession but cash should be able to maintain dividend attractive, but until earnings growth slower growth seems inevitable. We policies, providing attractive total return is downgraded sufficiently to reflect maintain a defensive sector positioning, opportunities for income investors. And the new reality, the risk premium starting with an overweight in consumer with bond yields still remaining high is unlikely to compress much, and staples as rising food prices may keep and volatile, we maintain our balance volatility should remain in place. margins wider than anticipated. We between value and growth stocks. Overweight Daily bond yield moves have been much larger than usual, providing hedge Markets: US, Mexico, Brazil, funds with many opportunities. Switzerland, Mainland China, USA Europe ex-UK UK E Asa Indonesia, Thailand and Hong Kong 200 Sectors: Consumer Staples and 180 Energy (including renewables) 160 Underweight 140 Markets: UK, Germany, Spain, Italy, South Africa, Turkey, South Korea 120 and Taiwan 100 Sectors: Industrials and Consumer rebased to 100 five years ago Discretionary 80 Global style bias 60 Nov-17 Nov-18 Nov-19 Nov-20 Nov-21 Nov-22 Quality and Income Source: Bloomberg, HSBC Global Private Banking as at 22 November 2022. Past performance is not a reliable indicator of future performance. 24

HSBC Investment Outlook Q1 2023 Page 23 Page 25

HSBC Investment Outlook Q1 2023 Page 23 Page 25