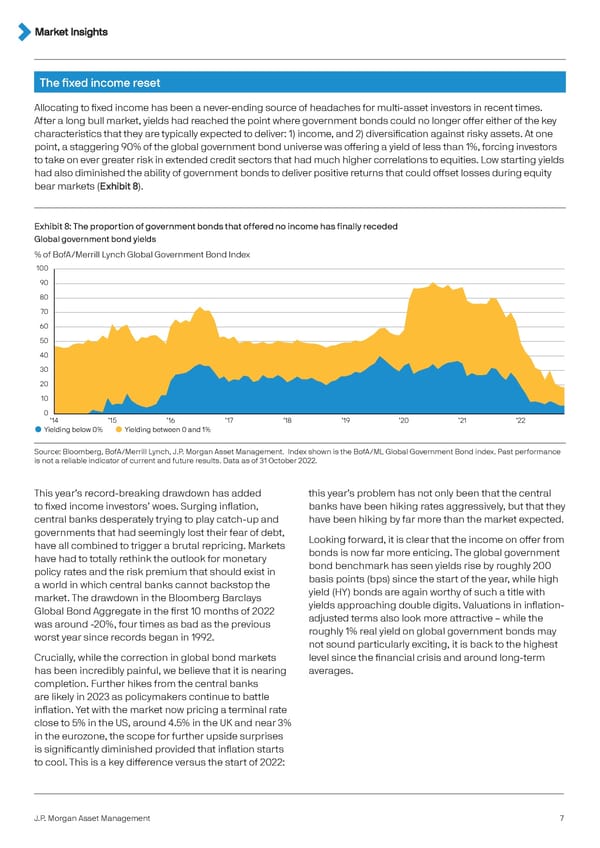

The fixed income reset Allocating to fixed income has been a never-ending source of headaches for multi-asset investors in recent times. After a long bull market, yields had reached the point where government bonds could no longer offer either of the key characteristics that they are typically expected to deliver: 1) income, and 2) diversification against risky assets. At one point, a staggering 90% of the global government bond universe was offering a yield of less than 1%, forcing investors to take on ever greater risk in extended credit sectors that had much higher correlations to equities. Low starting yields had also diminished the ability of government bonds to deliver positive returns that could offset losses during equity bear markets (Exhibit 8). Exhibit 8: The proportion of government bonds that offered no income has finally receded Global government bond yields % of BofA/Merrill Lynch Global Government Bond Index 100 90 80 70 60 50 40 30 20 10 0 ’14 ’15 ’16 ’17 ’18 ’19 ’20 ’21 ’22 Yielding below 0% Yielding between 0 and 1% Source: Bloomberg, BofA/Merrill Lynch, J.P. Morgan Asset Management. Index shown is the BofA/ML Global Government Bond index. Past performance is not a reliable indicator of current and future results. Data as of 31 October 2022. This year’s record-breaking drawdown has added this year’s problem has not only been that the central to fixed income investors’ woes. Surging inflation, banks have been hiking rates aggressively, but that they central banks desperately trying to play catch-up and have been hiking by far more than the market expected. governments that had seemingly lost their fear of debt, Looking forward, it is clear that the income on offer from have all combined to trigger a brutal repricing. Markets bonds is now far more enticing. The global government have had to totally rethink the outlook for monetary bond benchmark has seen yields rise by roughly 200 policy rates and the risk premium that should exist in basis points (bps) since the start of the year, while high a world in which central banks cannot backstop the yield (HY) bonds are again worthy of such a title with market. The drawdown in the Bloomberg Barclays yields approaching double digits. Valuations in inflation- Global Bond Aggregate in the first 10 months of 2022 adjusted terms also look more attractive – while the was around -20%, four times as bad as the previous roughly 1% real yield on global government bonds may worst year since records began in 1992. not sound particularly exciting, it is back to the highest Crucially, while the correction in global bond markets level since the financial crisis and around long-term has been incredibly painful, we believe that it is nearing averages. completion. Further hikes from the central banks are likely in 2023 as policymakers continue to battle inflation. Yet with the market now pricing a terminal rate close to 5% in the US, around 4.5% in the UK and near 3% in the eurozone, the scope for further upside surprises is significantly diminished provided that inflation starts to cool. This is a key difference versus the start of 2022: J.P. Morgan Asset Management 7

J.P. Morgan Investment Outlook 2023 Page 6 Page 8

J.P. Morgan Investment Outlook 2023 Page 6 Page 8