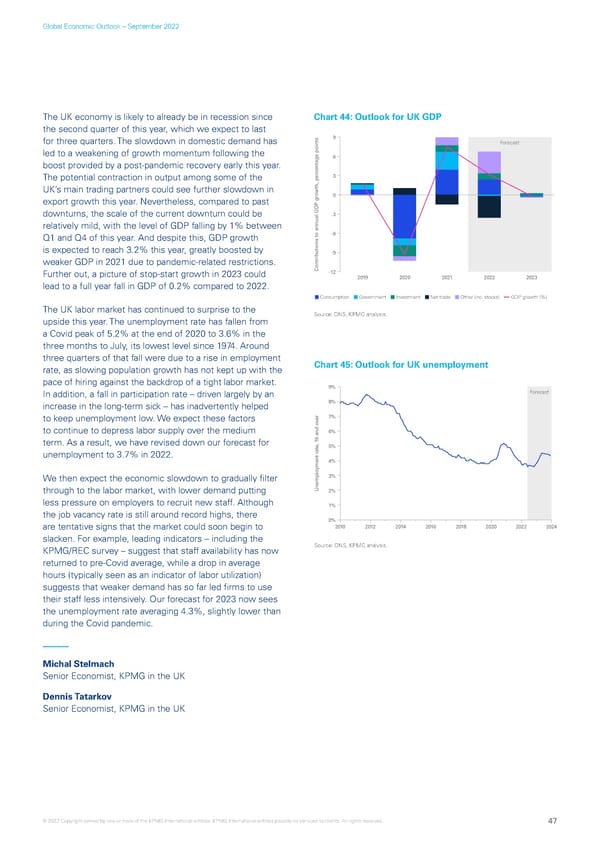

Global Economic Outlook – September 2022 The UK economy is likely to already be in recession since Chart 44: Outlook for UK GDP the second quarter of this year, which we expect to last for three quarters. The slowdown in domestic demand has 9 Forecast led to a weakening of growth momentum following the 6 boost provided by a post-pandemic recovery early this year. The potential contraction in output among some of the 3 UK’s main trading partners could see further slowdown in export growth this year. Nevertheless, compared to past 0 downturns, the scale of the current downturn could be -3 relatively mild, with the level of GDP falling by 1% between Q1 and Q4 of this year. And despite this, GDP growth -6 is expected to reach 3.2% this year, greatly boosted by -9 weaker GDP in 2021 due to pandemic-related restrictions. Further out, a picture of stop-start growth in 2023 could Contributions to annual GDP growth, percentage points-12 2019 2020 2021 2022 2023 lead to a full year fall in GDP of 0.2% compared to 2022. Consumption Government Investment Net trade Other (inc. stocks) GDP growth (%) The UK labor market has continued to surprise to the Source: ONS, KPMG analysis. upside this year. The unemployment rate has fallen from a Covid peak of 5.2% at the end of 2020 to 3.6% in the three months to July, its lowest level since 1974. Around three quarters of that fall were due to a rise in employment Chart 45: Outlook for UK unemployment rate, as slowing population growth has not kept up with the pace of hiring against the backdrop of a tight labor market. 9% In addition, a fall in participation rate – driven largely by an Forecast increase in the long-term sick – has inadvertently helped 8% to keep unemployment low. We expect these factors ver 7% to continue to depress labor supply over the medium 6% term. As a result, we have revised down our forecast for 6 and o 5% unemployment to 3.7% in 2022. 4% We then expect the economic slowdown to gradually filter 3% through to the labor market, with lower demand putting Unemployment rate, 12% less pressure on employers to recruit new staff. Although 1% the job vacancy rate is still around record highs, there 0% are tentative signs that the market could soon begin to 2010 2012 2014 2016 2018 2020 2022 2024 slacken. For example, leading indicators – including the KPMG/REC survey – suggest that staff availability has now Source: ONS, KPMG analysis. returned to pre-Covid average, while a drop in average hours (typically seen as an indicator of labor utilization) suggests that weaker demand has so far led firms to use their staff less intensively. Our forecast for 2023 now sees the unemployment rate averaging 4.3%, slightly lower than during the Covid pandemic. Michal Stelmach Senior Economist, KPMG in the UK Dennis Tatarkov Senior Economist, KPMG in the UK © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 47

KPMG Global Economic Outlook - H2 2022 report Page 46 Page 48

KPMG Global Economic Outlook - H2 2022 report Page 46 Page 48