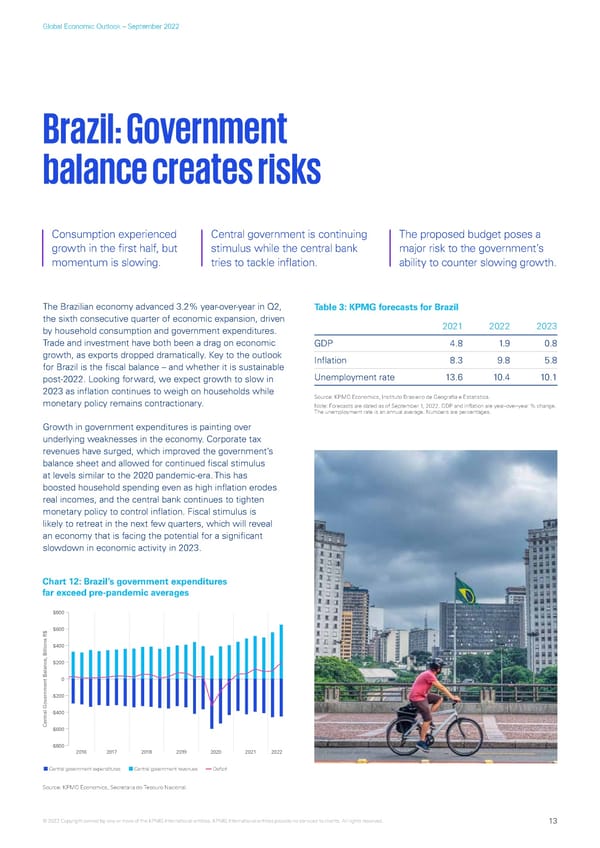

Global Economic Outlook – September 2022 Brazil: Government balance creates risks Consumption experienced Central government is continuing The proposed budget poses a growth in the first half, but stimulus while the central bank major risk to the government’s momentum is slowing. tries to tackle inflation. ability to counter slowing growth. The Brazilian economy advanced 3.2% year-over-year in Q2, Table 3: KPMG forecasts for Brazil the sixth consecutive quarter of economic expansion, driven 2021 2022 2023 by household consumption and government expenditures. Trade and investment have both been a drag on economic GDP 4.8 1. 9 0.8 growth, as exports dropped dramatically. Key to the outlook Inflation 8.3 9.8 5.8 for Brazil is the fiscal balance – and whether it is sustainable post-2022. Looking forward, we expect growth to slow in Unemployment rate 13.6 10.4 10.1 2023 as inflation continues to weigh on households while Source: KPMG Economics, Instituto Brasieiro de Geografia e Estatistica. monetary policy remains contractionary. Note: Forecasts are dated as of September 1, 2022. GDP and inflation are year-over-year % change. The unemployment rate is an annual average. Numbers are percentages. Growth in government expenditures is painting over underlying weaknesses in the economy. Corporate tax revenues have surged, which improved the government’s balance sheet and allowed for continued fiscal stimulus at levels similar to the 2020 pandemic-era. This has boosted household spending even as high inflation erodes real incomes, and the central bank continues to tighten monetary policy to control inflation. Fiscal stimulus is likely to retreat in the next few quarters, which will reveal an economy that is facing the potential for a significant slowdown in economic activity in 2023. Chart 12: Brazil’s government expenditures far exceed pre-pandemic averages $800 $600 $400 $200 0 vernment Balance, Billions R$ -$200 -$400 Central Go-$600 -$800 2016 2017 2018 2019 2020 2021 2022 Central government expenditures Central government revenues Deficit Source: KPMG Economics, Secretaria do Tesouro Nacional. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 13

KPMG Global Economic Outlook - H2 2022 report Page 12 Page 14

KPMG Global Economic Outlook - H2 2022 report Page 12 Page 14