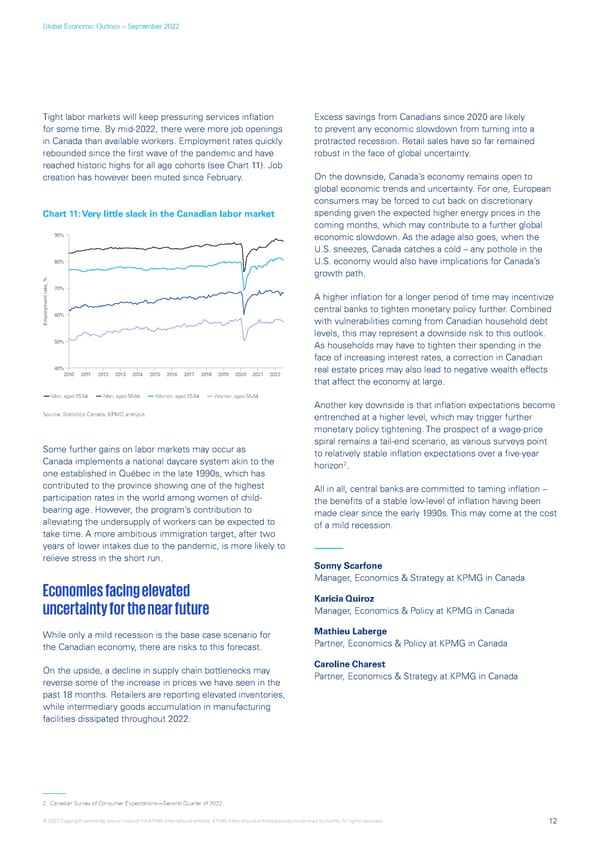

Global Economic Outlook – September 2022 Tight labor markets will keep pressuring services inflation Excess savings from Canadians since 2020 are likely for some time. By mid-2022, there were more job openings to prevent any economic slowdown from turning into a in Canada than available workers. Employment rates quickly protracted recession. Retail sales have so far remained rebounded since the first wave of the pandemic and have robust in the face of global uncertainty. reached historic highs for all age cohorts (see Chart 11). Job creation has however been muted since February. On the downside, Canada’s economy remains open to global economic trends and uncertainty. For one, European consumers may be forced to cut back on discretionary Chart 11: Very little slack in the Canadian labor market spending given the expected higher energy prices in the coming months, which may contribute to a further global 90% economic slowdown. As the adage also goes, when the U.S. sneezes, Canada catches a cold – any pothole in the 80% U.S. economy would also have implications for Canada’s growth path. 70% A higher inflation for a longer period of time may incentivize central banks to tighten monetary policy further. Combined 60% with vulnerabilities coming from Canadian household debt Employment rate, % levels, this may represent a downside risk to this outlook. 50% As households may have to tighten their spending in the face of increasing interest rates, a correction in Canadian 40% real estate prices may also lead to negative wealth effects 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 that affect the economy at large. Men, aged 25-54 Men, aged 55-64 Women, aged 25-54 Women, aged 55-64 Another key downside is that inflation expectations become Source: Statistics Canada, KPMG analysis. entrenched at a higher level, which may trigger further monetary policy tightening. The prospect of a wage-price Some further gains on labor markets may occur as spiral remains a tail-end scenario, as various surveys point Canada implements a national daycare system akin to the to relatively stable inflation expectations over a five-year 2 one established in Québec in the late 1990s, which has horizon . contributed to the province showing one of the highest All in all, central banks are committed to taming inflation – participation rates in the world among women of child- the benefits of a stable low-level of inflation having been bearing age. However, the program’s contribution to made clear since the early 1990s. This may come at the cost alleviating the undersupply of workers can be expected to of a mild recession. take time. A more ambitious immigration target, after two years of lower intakes due to the pandemic, is more likely to relieve stress in the short run. Sonny Scarfone Manager, Economics & Strategy at KPMG in Canada Economies facing elevated Karicia Quiroz uncertainty for the near future Manager, Economics & Policy at KPMG in Canada While only a mild recession is the base case scenario for Mathieu Laberge the Canadian economy, there are risks to this forecast. Partner, Economics & Policy at KPMG in Canada On the upside, a decline in supply chain bottlenecks may Caroline Charest reverse some of the increase in prices we have seen in the Partner, Economics & Strategy at KPMG in Canada past 18 months. Retailers are reporting elevated inventories, while intermediary goods accumulation in manufacturing facilities dissipated throughout 2022. 2 Canadian Survey of Consumer Expectations—Second Quarter of 2022. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 12

KPMG Global Economic Outlook - H2 2022 report Page 11 Page 13

KPMG Global Economic Outlook - H2 2022 report Page 11 Page 13