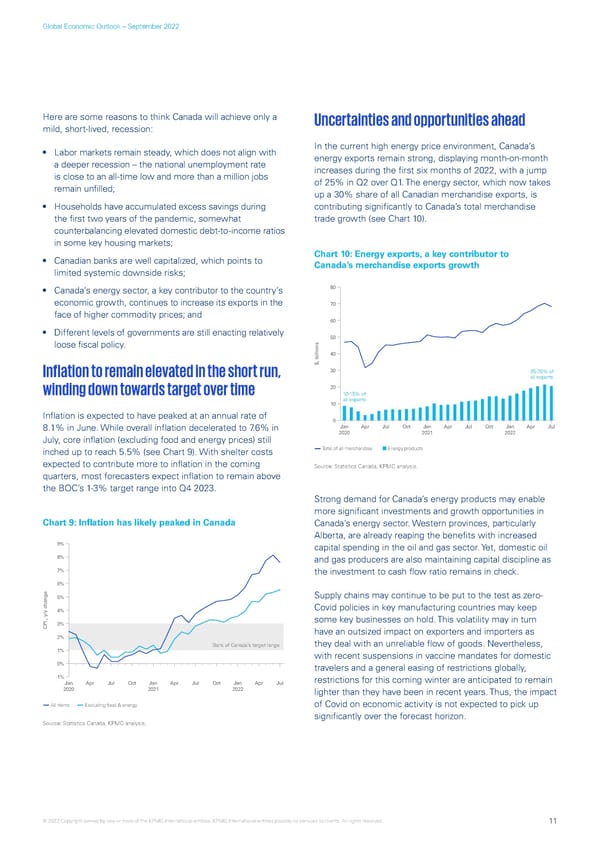

Global Economic Outlook – September 2022 Here are some reasons to think Canada will achieve only a Uncertainties and opportunities ahead mild, short-lived, recession: • Labor markets remain steady, which does not align with In the current high energy price environment, Canada’s a deeper recession – the national unemployment rate energy exports remain strong, displaying month-on-month is close to an all-time low and more than a million jobs increases during the first six months of 2022, with a jump remain unfilled; of 25% in Q2 over Q1. The energy sector, which now takes up a 30% share of all Canadian merchandise exports, is • Households have accumulated excess savings during contributing significantly to Canada’s total merchandise the first two years of the pandemic, somewhat trade growth (see Chart 10). counterbalancing elevated domestic debt-to-income ratios in some key housing markets; • Canadian banks are well capitalized, which points to Chart 10: Energy exports, a key contributor to limited systemic downside risks; Canada’s merchandise exports growth • Canada’s energy sector, a key contributor to the country’s 80 economic growth, continues to increase its exports in the 70 face of higher commodity prices; and 60 • Different levels of governments are still enacting relatively 50 loose fiscal policy. 40 $, billions Inflation to remain elevated in the short run, 30 25-30% of all exports winding down towards target over time 20 10-15% of 10 all exports Inflation is expected to have peaked at an annual rate of 0 8.1% in June. While overall inflation decelerated to 7.6% in Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul 2020 2021 2022 July, core inflation (excluding food and energy prices) still inched up to reach 5.5% (see Chart 9). With shelter costs Total of all merchandise Energy products expected to contribute more to inflation in the coming Source: Statistics Canada, KPMG analysis. quarters, most forecasters expect inflation to remain above the BOC’s 1-3% target range into Q4 2023. Strong demand for Canada’s energy products may enable more significant investments and growth opportunities in Chart 9: Inflation has likely peaked in Canada Canada’s energy sector. Western provinces, particularly Alberta, are already reaping the benefits with increased 9% capital spending in the oil and gas sector. Yet, domestic oil 8% and gas producers are also maintaining capital discipline as 7% the investment to cash flow ratio remains in check. 6% 5% Supply chains may continue to be put to the test as zero- hange Covid policies in key manufacturing countries may keep 4% 3% some key businesses on hold. This volatility may in turn CPI , y/y c have an outsized impact on exporters and importers as 2% they deal with an unreliable flow of goods. Nevertheless, Bank of Canada’s target range 1% with recent suspensions in vaccine mandates for domestic 0% travelers and a general easing of restrictions globally, -1% restrictions for this coming winter are anticipated to remain Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul 2020 2021 2022 lighter than they have been in recent years. Thus, the impact All items Excluding food & energy of Covid on economic activity is not expected to pick up significantly over the forecast horizon. Source: Statistics Canada, KPMG analysis. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 11

KPMG Global Economic Outlook - H2 2022 report Page 10 Page 12

KPMG Global Economic Outlook - H2 2022 report Page 10 Page 12