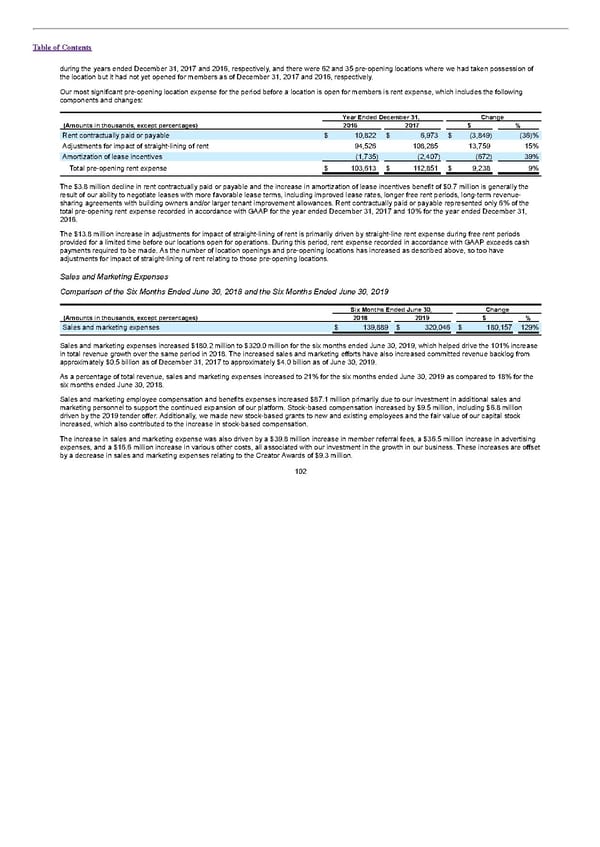

Table of Contents during the years ended December 31, 2017 and 2016, respectively, and there were 62 and 35 pre-opening locations where we had taken possession of the location but it had not yet opened for members as of December 31, 2017 and 2016, respectively. Our most significant pre-opening location expense for the period before a location is open for members is rent expense, which includes the following components and changes: Year Ended December 31, Change (Amounts in thousands, except percentages) 2016 2017 $ % Rent contractually paid or payable $ 10,822 $ 6,973 $ (3,849) (36)% Adjustments for impact of straight-lining of rent 94,526 108,285 13,759 15% Amortization of lease incentives (1,735) (2,407) (672) 39% Total pre-opening rent expense $ 103,613 $ 112,851 $ 9,238 9% The $3.8 million decline in rent contractually paid or payable and the increase in amortization of lease incentives benefit of $0.7 million is generally the result of our ability to negotiate leases with more favorable lease terms, including improved lease rates, longer free rent periods, long-term revenue- sharing agreements with building owners and/or larger tenant improvement allowances. Rent contractually paid or payable represented only 6% of the total pre-opening rent expense recorded in accordance with GAAP for the year ended December 31, 2017 and 10% for the year ended December 31, 2016. The $13.8 million increase in adjustments for impact of straight-lining of rent is primarily driven by straight-line rent expense during free rent periods provided for a limited time before our locations open for operations. During this period, rent expense recorded in accordance with GAAP exceeds cash payments required to be made. As the number of location openings and pre-opening locations has increased as described above, so too have adjustments for impact of straight-lining of rent relating to those pre-opening locations. Sales and Marketing Expenses Comparison of the Six Months Ended June 30, 2018 and the Six Months Ended June 30, 2019 Six Months Ended June 30, Change (Amounts in thousands, except percentages) 2018 2019 $ % Sales and marketing expenses $ 139,889 $ 320,046 $ 180,157 129% Sales and marketing expenses increased $180.2 million to $320.0 million for the six months ended June 30, 2019, which helped drive the 101% increase in total revenue growth over the same period in 2018. The increased sales and marketing efforts have also increased committed revenue backlog from approximately $0.5 billion as of December 31, 2017 to approximately $4.0 billion as of June 30, 2019. As a percentage of total revenue, sales and marketing expenses increased to 21% for the six months ended June 30, 2019 as compared to 18% for the six months ended June 30, 2018. Sales and marketing employee compensation and benefits expenses increased $87.1 million primarily due to our investment in additional sales and marketing personnel to support the continued expansion of our platform. Stock-based compensation increased by $9.5 million, including $6.8 million driven by the 2019 tender offer. Additionally, we made new stock-based grants to new and existing employees and the fair value of our capital stock increased, which also contributed to the increase in stock-based compensation. The increase in sales and marketing expense was also driven by a $39.8 million increase in member referral fees, a $36.5 million increase in advertising expenses, and a $16.6 million increase in various other costs, all associated with our investment in the growth in our business. These increases are offset by a decrease in sales and marketing expenses relating to the Creator Awards of $9.3 million. 102

S1 - WeWork Prospectus Page 106 Page 108

S1 - WeWork Prospectus Page 106 Page 108