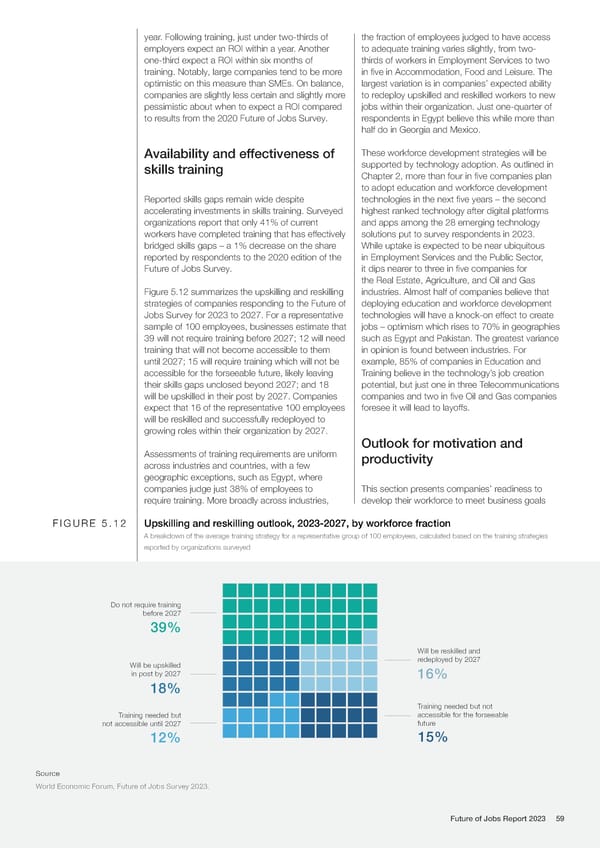

year. Following training, just under two-thirds of the fraction of employees judged to have access employers expect an ROI within a year. Another to adequate training varies slightly, from two- one-third expect a ROI within six months of thirds of workers in Employment Services to two training. Notably, large companies tend to be more in five in Accommodation, Food and Leisure. The optimistic on this measure than SMEs. On balance, largest variation is in companies’ expected ability companies are slightly less certain and slightly more to redeploy upskilled and reskilled workers to new pessimistic about when to expect a ROI compared jobs within their organization. Just one-quarter of to results from the 2020 Future of Jobs Survey. respondents in Egypt believe this while more than half do in Georgia and Mexico. Availability and effectiveness of These workforce development strategies will be skills training supported by technology adoption. As outlined in Chapter 2, more than four in five companies plan to adopt education and workforce development Reported skills gaps remain wide despite technologies in the next five years – the second accelerating investments in skills training. Surveyed highest ranked technology after digital platforms organizations report that only 41% of current and apps among the 28 emerging technology workers have completed training that has effectively solutions put to survey respondents in 2023. bridged skills gaps – a 1% decrease on the share While uptake is expected to be near ubiquitous reported by respondents to the 2020 edition of the in Employment Services and the Public Sector, Future of Jobs Survey. it dips nearer to three in five companies for the Real Estate, Agriculture, and Oil and Gas Figure 5.12 summarizes the upskilling and reskilling industries. Almost half of companies believe that strategies of companies responding to the Future of deploying education and workforce development Jobs Survey for 2023 to 2027. For a representative technologies will have a knock-on effect to create sample of 100 employees, businesses estimate that jobs – optimism which rises to 70% in geographies 39 will not require training before 2027; 12 will need such as Egypt and Pakistan. The greatest variance training that will not become accessible to them in opinion is found between industries. For until 2027; 15 will require training which will not be example, 85% of companies in Education and accessible for the forseeable future, likely leaving Training believe in the technology’s job creation their skills gaps unclosed beyond 2027; and 18 potential, but just one in three Telecommunications will be upskilled in their post by 2027. Companies companies and two in five Oil and Gas companies expect that 16 of the representative 100 employees foresee it will lead to layoffs. will be reskilled and successfully redeployed to growing roles within their organization by 2027. Outlook for motivation and Assessments of training requirements are uniform productivity across industries and countries, with a few geographic exceptions, such as Egypt, where companies judge just 38% of employees to This section presents companies’ readiness to require training. More broadly across industries, develop their workforce to meet business goals FIGURE 5.12 Upskilling and reskilling outlook, 2023-2027, by workforce fraction A breakdown of the average training strategy for a representative group of 100 employees, calculated based on the training strategies reported by organizations surveyed Do not require training before 2027 39% Will be reskilled and Will be upskilled redeployed by 2027 in post by 2027 16% 18% Training needed but not Training needed but accessible for the forseeable not accessible until 2027 future 12% 15% Source World Economic Forum, Future of Jobs Survey 2023. Future of Jobs Report 2023 59

The Future of Jobs Report 2023 Page 58 Page 60

The Future of Jobs Report 2023 Page 58 Page 60