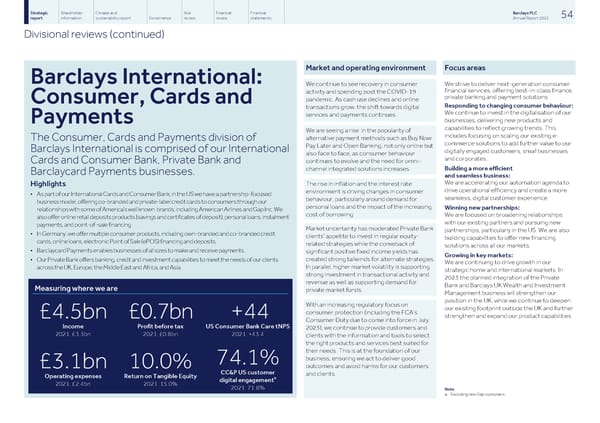

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 54 report information sustainability report Governance review review statements Annual Report 2022 Divisional reviews (continued) Market and operating environment Focus areas Barclays International: We continue to see recovery in consumer We strive to deliver next-generation consumer financial services, offering best-in-class finance, activity and spending post the COVID-19 private banking and payment solutions. pandemic. As cash use declines and online Consumer, Cards and Responding to changing consumer behaviour: transactions grow, the shift towards digital We continue to invest in the digitalisation of our services and payments continues. businesses, delivering new products and Payments capabilities to reflect growing trends. This We are seeing a rise in the popularity of includes focusing on scaling our existing e- alternative payment methods such as Buy Now The Consumer, Cards and Payments division of commerce solutions to add further value to our Pay Later and Open Banking, not only online but Barclays International is comprised of our International digitally engaged customers, small businesses also face to face, as consumer behaviour and corporates. continues to evolve and the need for omni- Cards and Consumer Bank, Private Bank and Building a more efficient channel integrated solutions increases. Barclaycard Payments businesses. and seamless business: We are accelerating our automation agenda to The rise in inflation and the interest rate Highlights drive operational efficiency and create a more environment is driving changes in consumer • As part of our International Cards and Consumer Bank, in the US we have a partnership-focused seamless, digital customer experience. behaviour, particularly around demand for business model, offering co-branded and private-label credit cards to consumers through our personal loans and the impact of the increasing Winning new partnerships: relationships with some of America’s well known brands, including American Airlines and Gap Inc. We cost of borrowing. We are focused on broadening relationships also offer online retail deposits products (savings and certificates of deposit), personal loans, instalment with our existing partners and pursuing new payments, and point-of-sale financing. Market uncertainty has moderated Private Bank partnerships, particularly in the US. We are also • In Germany, we offer multiple consumer products, including own-branded and co-branded credit clients' appetite to invest in regular equity- building capabilities to offer new financing cards, online loans, electronic Point of Sale (ePOS) financing and deposits. related strategies while the comeback of solutions across all our markets. • Barclaycard Payments enables businesses of all sizes to make and receive payments. significant positive fixed income yields has Growing in key markets: created strong tailwinds for alternate strategies. • Our Private Bank offers banking, credit and investment capabilities to meet the needs of our clients We are continuing to drive growth in our In parallel, higher market volatility is supporting across the UK, Europe, the Middle East and Africa, and Asia. strategic home and international markets. In strong investment in transactional activity and 2023 the planned integration of the Private revenue as well as supporting demand for Bank and Barclays UK Wealth and Investment Measuring where we are private market funds. Management business will strengthen our position in the UK, while we continue to deepen With an increasing regulatory focus on our existing footprint outside the UK and further consumer protection (including the FCA’s strengthen and expand our product capabilities. £4.5bn £0.7bn +44 Consumer Duty due to come into force in July Income Profit before tax US Consumer Bank Care tNPS 2023), we continue to provide customers and 2021: £3.3bn 2021: £0.8bn 2021: +43.4 clients with the information and tools to select the right products and services best suited for their needs. This is at the foundation of our business, ensuring we act to deliver good 74.1% outcomes and avoid harms for our customers £3.1bn 10.0% CC&P US customer and clients. Operating expenses Return on Tangible Equity a digital engagement 2021: £2.4bn 2021: 15.0% 2021: 71.8% Note a Excluding new Gap customers.

Barclays PLC - Annual Report - 2022 Page 55 Page 57

Barclays PLC - Annual Report - 2022 Page 55 Page 57