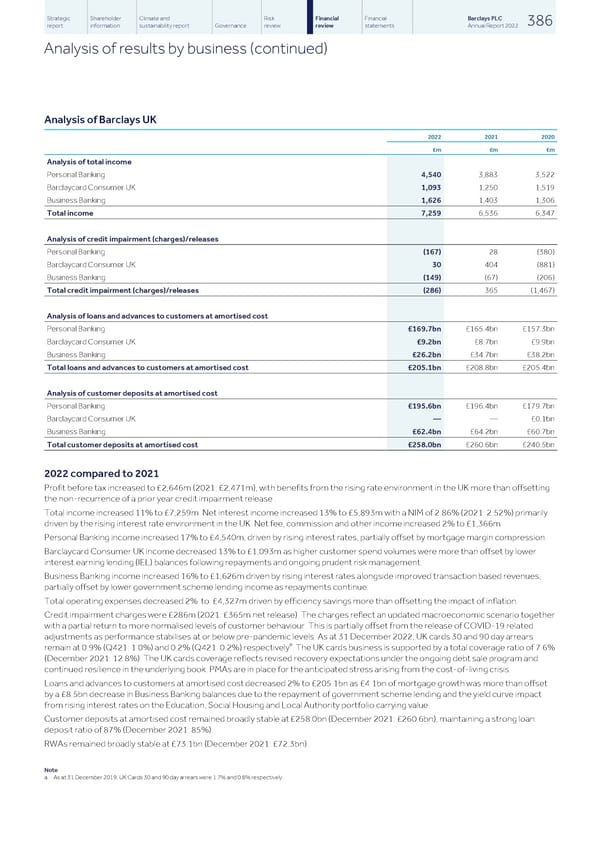

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 386 report information sustainability report Governance review review statements Annual Report 2022 Analysis of results by business (continued) Analysis of Barclays UK 2022 2021 2020 £m £m £m Analysis of total income Personal Banking 4,540 3,883 3,522 Barclaycard Consumer UK 1,093 1,250 1,519 Business Banking 1,626 1,403 1,306 Total income 7,259 6,536 6,347 Analysis of credit impairment (charges)/releases Personal Banking (167) 28 (380) Barclaycard Consumer UK 30 404 (881) Business Banking (149) (67) (206) Total credit impairment (charges)/releases (286) 365 (1,467) Analysis of loans and advances to customers at amortised cost Personal Banking £169.7bn £165.4bn £157.3bn Barclaycard Consumer UK £9.2bn £8.7bn £9.9bn Business Banking £26.2bn £34.7bn £38.2bn Total loans and advances to customers at amortised cost £205.1bn £208.8bn £205.4bn Analysis of customer deposits at amortised cost Personal Banking £195.6bn £196.4bn £179.7bn Barclaycard Consumer UK — — £0.1bn Business Banking £62.4bn £64.2bn £60.7bn Total customer deposits at amortised cost £258.0bn £260.6bn £240.5bn 2022 compared to 2021 Profit before tax increased to £2,646m (2021: £2,471m), with benefits from the rising rate environment in the UK more than offsetting the non-recurrence of a prior year credit impairment release . Total income increased 11% to £7,259m. Net interest income increased 13% to £5,893m with a NIM of 2.86% (2021: 2.52%) primarily driven by the rising interest rate environment in the UK. Net fee, commission and other income increased 2% to £1,366m. Personal Banking income increased 17% to £4,540m, driven by rising interest rates, partially offset by mortgage margin compression. Barclaycard Consumer UK income decreased 13% to £1,093m as higher customer spend volumes were more than offset by lower interest earning lending (IEL) balances following repayments and ongoing prudent risk management. Business Banking income increased 16% to £1,626m driven by rising interest rates alongside improved transaction based revenues, partially offset by lower government scheme lending income as repayments continue. Total operating expenses decreased 2% to £4,327m driven by efficiency savings more than offsetting the impact of inflation. Credit impairment charges were £286m (2021: £365m net release). The charges reflect an updated macroeconomic scenario together with a partial return to more normalised levels of customer behaviour. This is partially offset from the release of COVID-19 related adjustments as performance stabilises at or below pre-pandemic levels. As at 31 December 2022, UK cards 30 and 90 day arrears a remain at 0.9% (Q421: 1.0%) and 0.2% (Q421: 0.2%) respectively . The UK cards business is supported by a total coverage ratio of 7.6% (December 2021: 12.8%). The UK cards coverage reflects revised recovery expectations under the ongoing debt sale program and continued resilience in the underlying book. PMAs are in place for the anticipated stress arising from the cost-of-living crisis. Loans and advances to customers at amortised cost decreased 2% to £205.1bn as £4.1bn of mortgage growth was more than offset by a £8.5bn decrease in Business Banking balances due to the repayment of government scheme lending and the yield curve impact from rising interest rates on the Education, Social Housing and Local Authority portfolio carrying value. Customer deposits at amortised cost remained broadly stable at £258.0bn (December 2021: £260.6bn), maintaining a strong loan: deposit ratio of 87% (December 2021: 85%). RWAs remained broadly stable at £73.1bn (December 2021: £72.3bn). Note a As at 31 December 2019, UK Cards 30 and 90 day arrears were 1.7% and 0.8% respectively.

Barclays PLC - Annual Report - 2022 Page 387 Page 389

Barclays PLC - Annual Report - 2022 Page 387 Page 389