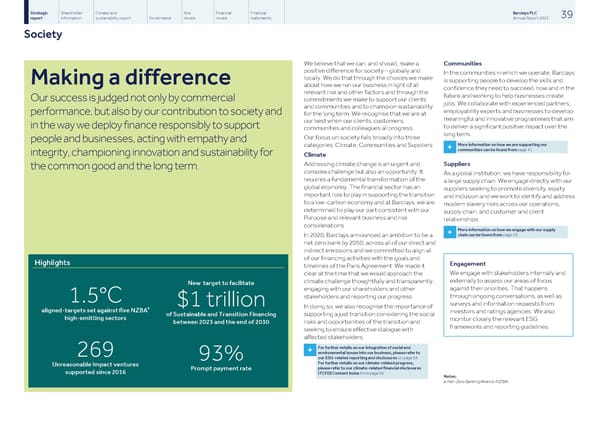

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 39 report information sustainability report Governance review review statements Annual Report 2022 Society We believe that we can, and should, make a Communities positive difference for society – globally and In the communities in which we operate, Barclays locally. We do that through the choices we make is supporting people to develop the skills and Making a difference about how we run our business in light of all confidence they need to succeed, now and in the relevant risk and other factors and through the future and working to help businesses create Our success is judged not only by commercial commitments we make to support our clients jobs. We collaborate with experienced partners, and communities and to champion sustainability employability experts and businesses to develop performance, but also by our contribution to society and for the long term. We recognise that we are at meaningful and innovative programmes that aim our best when our clients, customers, to deliver a significant positive impact over the in the way we deploy finance responsibly to support communities and colleagues all progress. long term. Our focus on society falls broadly into three people and businesses, acting with empathy and More information on how we are supporting our categories: Climate, Communities and Suppliers. + communities can be found from page 41 integrity, championing innovation and sustainability for Climate Addressing climate change is an urgent and Suppliers the common good and the long term. complex challenge but also an opportunity. It As a global institution, we have responsibility for requires a fundamental transformation of the a large supply chain. We engage directly with our global economy. The financial sector has an suppliers seeking to promote diversity, equity important role to play in supporting the transition and inclusion and we work to identify and address to a low-carbon economy and at Barclays, we are modern slavery risks across our operations, determined to play our part consistent with our supply chain, and customer and client Purpose and relevant business and risk relationships. considerations. More information on how we engage with our supply + chain can be found from page 43 In 2020, Barclays announced an ambition to be a net zero bank by 2050, across all of our direct and indirect emissions and we committed to align all of our financing activities with the goals and Highlights Engagement timelines of the Paris Agreement. We made it We engage with stakeholders internally and clear at the time that we would approach the externally to assess our areas of focus climate challenge thoughtfully and transparently, New target to facilitate against their priorities. That happens engaging with our shareholders and other through ongoing conversations, as well as stakeholders and reporting our progress. 1.5°C surveys and information requests from $1 trillion In doing so, we also recognise the importance of a aligned-targets set against five NZBA investors and ratings agencies. We also supporting a just transition considering the social of Sustainable and Transition Financing high-emitting sectors monitor closely the relevant ESG risks and opportunities of the transition and between 2023 and the end of 2030 frameworks and reporting guidelines. seeking to ensure effective dialogue with affected stakeholders. For further details on our integration of social and + environmental issues into our business, please refer to 269 our ESG-related reporting and disclosures on page 64 93% For further details on our climate-related progress, Unreasonable Impact ventures please refer to our climate-related financial disclosures Prompt payment rate supported since 2016 (TCFD) Content Index from page 65 Notes: a Net-Zero Banking Alliance (NZBA)

Barclays PLC - Annual Report - 2022 Page 40 Page 42

Barclays PLC - Annual Report - 2022 Page 40 Page 42