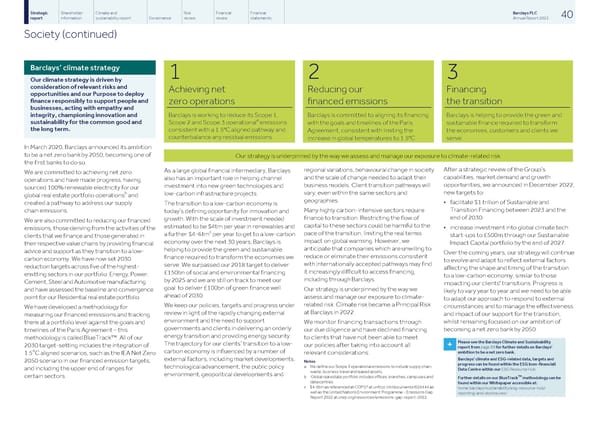

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 40 report information sustainability report Governance review review statements Annual Report 2022 Society (continued) Barclays’ climate strategy 1 2 3 Our climate strategy is driven by consideration of relevant risks and Achieving net Reducing our Financing opportunities and our Purpose to deploy finance responsibly to support people and zero operations financed emissions the transition businesses, acting with empathy and integrity, championing innovation and Barclays is working to reduce its Scope 1, Barclays is committed to aligning its financing Barclays is helping to provide the green and a sustainability for the common good and Scope 2 and Scope 3 operational emissions with the goals and timelines of the Paris sustainable finance required to transform the long term. consistent with a 1.5°C aligned pathway and Agreement, consistent with limiting the the economies, customers and clients we counterbalance any residual emissions. increase in global temperatures to 1.5°C. serve. In March 2020, Barclays announced its ambition to be a net zero bank by 2050, becoming one of Our strategy is underpinned by the way we assess and manage our exposure to climate-related risk. the first banks to do so. After a strategic review of the Group’s regional variations, behavioural change in society As a large global financial intermediary, Barclays We are committed to achieving net zero capabilities, market demand and growth and the scale of change needed to adapt their also has an important role in helping channel operations and have made progress, having opportunities, we announced in December 2022, business models. Client transition pathways will investment into new green technologies and sourced 100% renewable electricity for our b new targets to: vary, even within the same sectors and low-carbon infrastructure projects. global real estate portfolio operations and geographies. • facilitate $1 trillion of Sustainable and created a pathway to address our supply The transition to a low-carbon economy is Transition Financing between 2023 and the Many highly carbon-intensive sectors require chain emissions. today’s defining opportunity for innovation and end of 2030. finance to transition. Restricting the flow of growth. With the scale of investment needed We are also committed to reducing our financed capital to these sectors could be harmful to the estimated to be $4trn per year in renewables and • increase investment into global climate tech emissions, those deriving from the activities of the c pace of the transition, limiting the real terms a further $4-6trn per year to get to a low-carbon start-ups to £500m through our Sustainable clients that we finance and those generated in impact on global warming. However, we economy over the next 30 years, Barclays is Impact Capital portfolio by the end of 2027. their respective value chains by providing financial anticipate that companies which are unwilling to helping to provide the green and sustainable advice and support as they transition to a low- Over the coming years, our strategy will continue reduce or eliminate their emissions consistent finance required to transform the economies we carbon economy. We have now set 2030 to evolve and adapt to reflect external factors with internationally accepted pathways may find serve. We surpassed our 2018 target to deliver reduction targets across five of the highest- affecting the shape and timing of the transition it increasingly difficult to access financing, £150bn of social and environmental financing emitting sectors in our portfolio: Energy, Power, to a low-carbon economy, similar to those including through Barclays. by 2025 and we are still on track to meet our Cement, Steel and Automotive manufacturing impacting our clients' transitions. Progress is goal to deliver £100bn of green finance well Our strategy is underpinned by the way we and have assessed the baseline and convergence likely to vary year to year and we need to be able ahead of 2030. assess and manage our exposure to climate- point for our Residential real estate portfolio. to adapt our approach to respond to external related risk. Climate risk became a Principal Risk We keep our policies, targets and progress under circumstances and to manage the effectiveness We have developed a methodology for at Barclays in 2022. review in light of the rapidly changing external and impact of our support for the transition, measuring our financed emissions and tracking environment and the need to support whilst remaining focused on our ambition of We monitor financing transactions through them at a portfolio level against the goals and governments and clients in delivering an orderly becoming a net zero bank by 2050. our due diligence and have declined financing timelines of the Paris Agreement – this energy transition and providing energy security. to clients that have not been able to meet methodology is called BlueTrack™. All of our Please see the Barclays Climate and Sustainability The trajectory for our clients’ transition to a low- our policies after taking into account all 2030 target-setting includes the integration of + report from page 69 for further details on Barclays' o carbon economy is influenced by a number of ambition to be a net zero bank. relevant considerations. 1.5 C aligned scenarios, such as the IEA Net Zero Barclays' climate and ESG-related data, targets and external factors, including market developments, 2050 scenario in our financed emission targets, Notes progress can be found within the ESG (non-financial) a We define our Scope 3 operational emissions to include supply chain, technological advancement, the public policy and including the upper end of ranges for Data Centre within our ESG Resource Hub waste, business travel and leased assets. environment, geopolitical developments and TM certain sectors. b Global real estate portfolio includes offices, branches, campuses and Further details on our BlueTrack methodology can be data centres. found within our Whitepaper accessible at: c $4-6trn as referenced at COP27 at unfccc.int/documents/624444 as home.barclays/sustainability/esg-resource-hub/ well as the United Nations Environment Programme - Emissions Gap reporting-and-disclosures/ Report 2022 at unep.org/resources/emissions-gap-report-2022.

Barclays PLC - Annual Report - 2022 Page 41 Page 43

Barclays PLC - Annual Report - 2022 Page 41 Page 43