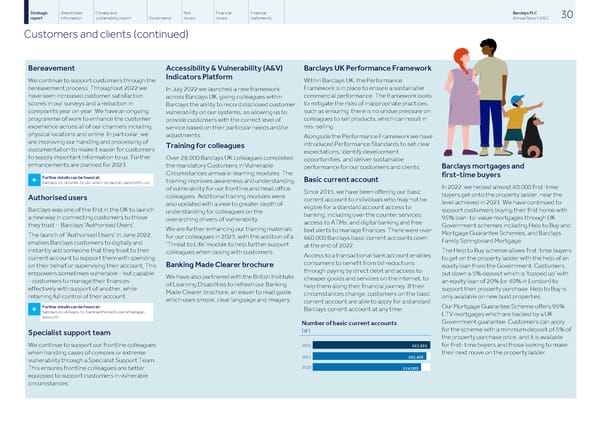

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 30 report information sustainability report Governance review review statements Annual Report 2022 Customers and clients (continued) Bereavement Accessibility & Vulnerability (A&V) Barclays UK Performance Framework Indicators Platform We continue to support customers through the Within Barclays UK, the Performance bereavement process. Throughout 2022 we Framework is in place to ensure a sustainable In July 2022 we launched a new framework have seen increased customer satisfaction commercial performance. The framework looks across Barclays UK, giving colleagues within scores in our surveys and a reduction in to mitigate the risks of inappropriate practices, Barclays the ability to record disclosed customer complaints year on year. We have an ongoing such as ensuring there is no undue pressure on vulnerability on our systems, so allowing us to programme of work to enhance the customer colleagues to sell products, which can result in provide customers with the correct level of experience across all of our channels including mis-selling. service based on their particular needs and/or physical locations and online. In particular, we adjustments. Alongside the Performance Framework we have are improving our handling and processing of introduced Performance Standards to set clear Training for colleagues documentation to make it easier for customers expectations, identify development to supply important information to us. Further Over 28,000 Barclays UK colleagues completed opportunities, and deliver sustainable enhancements are planned for 2023. the mandatory Customers in Vulnerable Barclays mortgages and performance for our customers and clients. Circumstances annual e-learning modules. The first-time buyers Further details can be found at: Basic current account training improves awareness and understanding + barclays.co.uk/what-to-do-when-someone-dies/notify-us/ In 2022, we helped almost 40,000 first-time of vulnerability for our frontline and head office Since 2015, we have been offering our basic buyers get onto the property ladder, near the colleagues. Additional training modules were Authorised users current account to individuals who may not be level achieved in 2021. We have continued to also updated with a view to greater depth of eligible for a standard account access to Barclays was one of the first in the UK to launch support customers buying their first home with understanding for colleagues on the banking, including over the counter services, a new way in connecting customers to those 95% loan-to-value mortgages through UK overarching drivers of vulnerability. access to ATMs, and digital banking and free they trust - Barclays 'Authorised Users’. Government schemes including Help to Buy and We are further enhancing our training materials text alerts to manage finances. There were over Mortgage Guarantee Schemes, and Barclays The launch of ‘Authorised Users’ in June 2022, for our colleagues in 2023, with the addition of a 660,000 Barclays basic current accounts open Family Springboard Mortgage. enables Barclays customers to digitally and ‘Threat to Life’ module to help further support at the end of 2022. instantly add someone that they trust to their The Help to Buy scheme allows first-time buyers colleagues when liaising with customers. Access to a transactional bank account enables current account to support them with spending to get on the property ladder with the help of an consumers to benefit from bill reductions Banking Made Clearer brochure on their behalf or supervising their account, This equity loan from the Government. Customers through paying by direct debit and access to empowers sometimes vulnerable - but capable put down a 5% deposit which is ‘topped up’ with We have also partnered with the British Institute cheaper goods and services on the internet, to - customers to manage their finances an equity loan of 20% (or 40% in London) to of Learning Disabilities to refresh our Banking help them along their financial journey. If their effectively with support of another, while support their property purchase. Help to Buy is Made Clearer brochure; an easier to read guide circumstances change, customers on the basic retaining full control of their account. only available on new build properties. which uses simple, clear language and imagery. current account are able to apply for a standard Further details can be found at: Our Mortgage Guarantee Scheme offers 95% Barclays current account at any time. + barclays.co.uk/ways-to-bank/authorised-users/manage- LTV mortgages which are backed by a UK account/ Government guarantee. Customers can apply Number of basic current accounts for the scheme with a minimum deposit of 5% of (#) Specialist support team the property purchase price, and it is available for first-time buyers and those looking to make We continue to support our frontline colleagues 2022 661,991 their next move on the property ladder. when handling cases of complex or extreme 642,468 2021 vulnerability through a Specialist Support Team. 2020 614,000 This ensures frontline colleagues are better equipped to support customers in vulnerable circumstances.

Barclays PLC - Annual Report - 2022 Page 31 Page 33

Barclays PLC - Annual Report - 2022 Page 31 Page 33