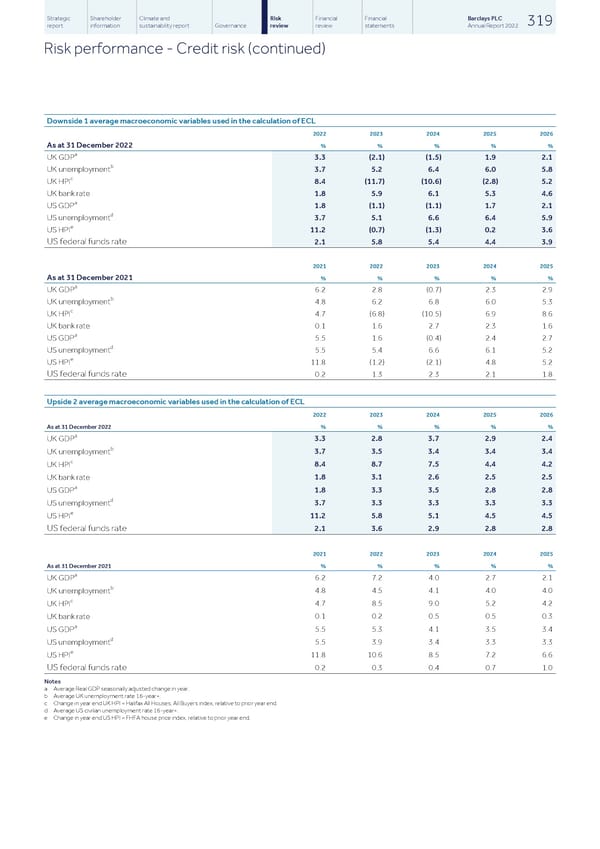

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 319 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Credit risk (continued) Downside 1 average macroeconomic variables used in the calculation of ECL 2022 2023 2024 2025 2026 As at 31 December 2022 % % % % % a UK GDP 3.3 (2.1) (1.5) 1.9 2.1 b UK unemployment 3.7 5.2 6.4 6.0 5.8 c UK HPI 8.4 (11.7) (10.6) (2.8) 5.2 UK bank rate 1.8 5.9 6.1 5.3 4.6 a US GDP 1.8 (1.1) (1.1) 1.7 2.1 d US unemployment 3.7 5.1 6.6 6.4 5.9 e US HPI 11.2 (0.7) (1.3) 0.2 3.6 US federal funds rate 2.1 5.8 5.4 4.4 3.9 2021 2022 2023 2024 2025 As at 31 December 2021 % % % % % a UK GDP 6.2 2.8 (0.7) 2.3 2.9 b UK unemployment 4.8 6.2 6.8 6.0 5.3 c UK HPI 4.7 (6.8) (10.5) 6.9 8.6 UK bank rate 0.1 1.6 2.7 2.3 1.6 a US GDP 5.5 1.6 (0.4) 2.4 2.7 d US unemployment 5.5 5.4 6.6 6.1 5.2 e US HPI 11.8 (1.2) (2.1) 4.8 5.2 US federal funds rate 0.2 1.3 2.3 2.1 1.8 Upside 2 average macroeconomic variables used in the calculation of ECL 2022 2023 2024 2025 2026 As at 31 December 2022 % % % % % a 3.3 2.8 3.7 2.9 2.4 UK GDP b 3.7 3.5 3.4 3.4 3.4 UK unemployment c 8.4 8.7 7.5 4.4 4.2 UK HPI 1.8 3.1 2.6 2.5 2.5 UK bank rate a 1.8 3.3 3.5 2.8 2.8 US GDP d 3.7 3.3 3.3 3.3 3.3 US unemployment e 11.2 5.8 5.1 4.5 4.5 US HPI 2.1 3.6 2.9 2.8 2.8 US federal funds rate 2021 2022 2023 2024 2025 As at 31 December 2021 % % % % % a 6.2 7.2 4.0 2.7 2.1 UK GDP b 4.8 4.5 4.1 4.0 4.0 UK unemployment c 4.7 8.5 9.0 5.2 4.2 UK HPI 0.1 0.2 0.5 0.5 0.3 UK bank rate a 5.5 5.3 4.1 3.5 3.4 US GDP d 5.5 3.9 3.4 3.3 3.3 US unemployment e 11.8 10.6 8.5 7.2 6.6 US HPI 0.2 0.3 0.4 0.7 1.0 US federal funds rate Notes a Average Real GDP seasonally adjusted change in year. b Average UK unemployment rate 16-year+. c Change in year end UK HPI = Halifax All Houses, All Buyers index, relative to prior year end. d Average US civilian unemployment rate 16-year+. e Change in year end US HPI = FHFA house price index, relative to prior year end.

Barclays PLC - Annual Report - 2022 Page 320 Page 322

Barclays PLC - Annual Report - 2022 Page 320 Page 322