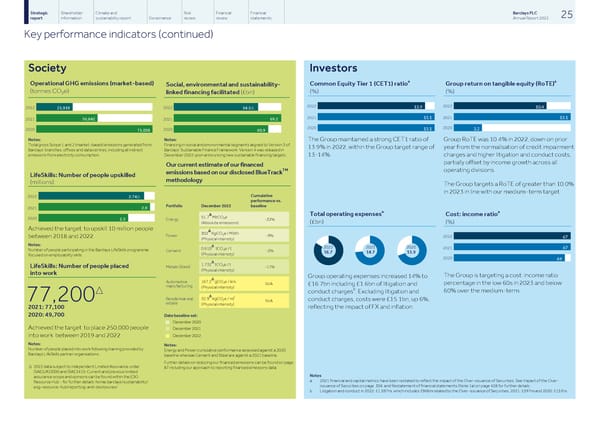

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 25 report information sustainability report Governance review review statements Annual Report 2022 Key performance indicators (continued) Society Investors a a Operational GHG emissions (market-based) Group return on tangible equity (RoTE) Common Equity Tier 1 (CET1) ratio Social, environmental and sustainability- (tonnes CO e) (%) (%) linked financing facilitated (£bn) 2 2022 2022 2.7 1.2 13.9 10.4 2022 2022 21,919 54.3△ 14.9△ 2021 2021 15.1 13.1 36,842 69.2 2021 2021 2020 2020 15.1 3.2 9.9 2020 2020 8.3 71,038 60.9 Notes: Notes: The Group maintained a strong CET1 ratio of Group RoTE was 10.4% in 2022, down on prior Total gross Scope 1 and 2 (market-based) emissions generated from Financing in social and environmental segments aligned to Version 3 of 13.9% in 2022, within the Group target range of year from the normalisation of credit impairment Barclays’ branches, offices and data centres, including all indirect Barclays’ Sustainable Finance Framework. Version 4 was released in emissions from electricity consumption. December 2022 upon announcing new sustainable financing targets. 13-14%. charges and higher litigation and conduct costs, partially offset by income growth across all Our current estimate of our financed TM operating divisions. emissions based on our disclosed BlueTrack LifeSkills: Number of people upskilled methodology (millions) The Group targets a RoTE of greater than 10.0% in 2023 in line with our medium-term target. Cumulative 2022 2.74△ performance vs. Portfolio December 2022 baseline 2.9 2021 a a Δ Total operating expenses Cost: income ratio 51.7 MtCO e 2 2020 2.3 Energy -32% (£bn) (%) (Absolute emissions) Achieved the target to upskill 10 million people Δ 302 KgCO e / MWh 2 Power -9% 2022 between 2018 and 2022. 67 (Physical intensity) Notes: Δ 67 2021 0.610 tCO e / t 2 Number of people participating in the Barclays LifeSkills programme Cement -2% (Physical intensity) focused on employability skills. 2020 64 3 Δ 1.732 tCO e / t 2 LifeSkills: Number of people placed Metals (Steel) -11% (Physical intensity) into work The Group is targeting a cost: income ratio Group operating expenses increased 14% to Δ 167.2 gCO e / km Automotive 2 percentage in the low 60s in 2023 and below N/A £16.7bn including £1.6bn of litigation and manufacturing (Physical intensity) b 60% over the medium-term. conduct charges . Excluding litigation and △ Δ 2 32.9 kgCO e / m Residential real 2 conduct charges, costs were £15.1bn, up 6%, 77,200 N/A estate (Physical intensity) reflecting the impact of FX and inflation. 2021: 77,100 2020: 49,700 Date baseline set: December 2020 n Achieved the target to place 250,000 people December 2021 n December 2022 into work between 2019 and 2022. n Notes: Notes: Number of people placed into work following training provided by Energy and Power cumulative performance assessed against a 2020 Barclays LifeSkills partner organisations. baseline whereas Cement and Steel are against a 2021 baseline. Further details on reducing our financed emissions can be found on page Δ 2022 data subject to independent Limited Assurance under 87 including our approach to reporting financed emissions data. ISAE(UK)3000 and ISAE3410. Current and previous limited Notes assurance scope and opinions can be found within the ESG a 2021 financial and capital metrics have been restated to reflect the impact of the Over-issuance of Securities. See Impact of the Over- Resource Hub - for further details: home.barclays/sustainability/ issuance of Securities on page 356 and Restatement of financial statements (Note 1a) on page 428 for further details. esg-resource-hub/reporting-and-disclosures/ b Litigation and conduct in 2022: £1,597m, which includes £966m related to the Over-issuance of Securities, 2021: £397m and 2020: £153m.

Barclays PLC - Annual Report - 2022 Page 26 Page 28

Barclays PLC - Annual Report - 2022 Page 26 Page 28