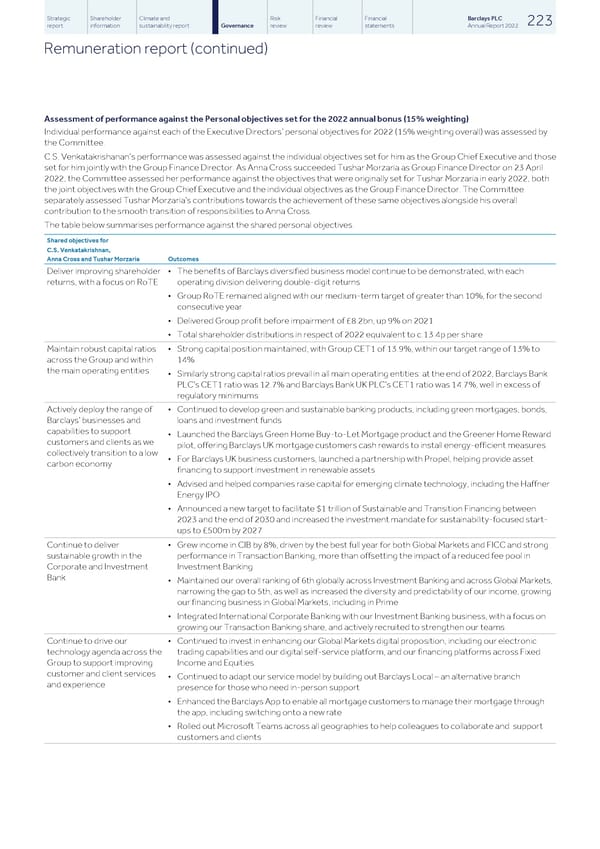

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 223 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) Assessment of performance against the Personal objectives set for the 2022 annual bonus (15% weighting) Individual performance against each of the Executive Directors’ personal objectives for 2022 (15% weighting overall) was assessed by the Committee. C.S. Venkatakrishanan’s performance was assessed against the individual objectives set for him as the Group Chief Executive and those set for him jointly with the Group Finance Director. As Anna Cross succeeded Tushar Morzaria as Group Finance Director on 23 April 2022, the Committee assessed her performance against the objectives that were originally set for Tushar Morzaria in early 2022, both the joint objectives with the Group Chief Executive and the individual objectives as the Group Finance Director. The Committee separately assessed Tushar Morzaria’s contributions towards the achievement of these same objectives alongside his overall contribution to the smooth transition of responsibilities to Anna Cross. The table below summarises performance against the shared personal objectives. Shared objectives for C.S. Venkatakrishnan, Anna Cross and Tushar Morzaria Outcomes Deliver improving shareholder • The benefits of Barclays diversified business model continue to be demonstrated, with each returns, with a focus on RoTE operating division delivering double-digit returns • Group RoTE remained aligned with our medium-term target of greater than 10%, for the second consecutive year • Delivered Group profit before impairment of £8.2bn, up 9% on 2021 • Total shareholder distributions in respect of 2022 equivalent to c.13.4p per share Maintain robust capital ratios • Strong capital position maintained, with Group CET1 of 13.9%, within our target range of 13% to across the Group and within 14% the main operating entities • Similarly strong capital ratios prevail in all main operating entities: at the end of 2022, Barclays Bank PLC’s CET1 ratio was 12.7% and Barclays Bank UK PLC’s CET1 ratio was 14.7%, well in excess of regulatory minimums Actively deploy the range of • Continued to develop green and sustainable banking products, including green mortgages, bonds, Barclays’ businesses and loans and investment funds capabilities to support • Launched the Barclays Green Home Buy-to-Let Mortgage product and the Greener Home Reward customers and clients as we pilot, offering Barclays UK mortgage customers cash rewards to install energy-efficient measures collectively transition to a low • For Barclays UK business customers, launched a partnership with Propel, helping provide asset carbon economy financing to support investment in renewable assets • Advised and helped companies raise capital for emerging climate technology, including the Haffner Energy IPO • Announced a new target to facilitate $1 trillion of Sustainable and Transition Financing between 2023 and the end of 2030 and increased the investment mandate for sustainability-focused start- ups to £500m by 2027 Continue to deliver • Grew income in CIB by 8%, driven by the best full year for both Global Markets and FICC and strong sustainable growth in the performance in Transaction Banking, more than offsetting the impact of a reduced fee pool in Corporate and Investment Investment Banking Bank • Maintained our overall ranking of 6th globally across Investment Banking and across Global Markets, narrowing the gap to 5th, as well as increased the diversity and predictability of our income, growing our financing business in Global Markets, including in Prime • Integrated International Corporate Banking with our Investment Banking business, with a focus on growing our Transaction Banking share, and actively recruited to strengthen our teams Continue to drive our • Continued to invest in enhancing our Global Markets digital proposition, including our electronic technology agenda across the trading capabilities and our digital self-service platform, and our financing platforms across Fixed Group to support improving Income and Equities customer and client services • Continued to adapt our service model by building out Barclays Local – an alternative branch and experience presence for those who need in-person support • Enhanced the Barclays App to enable all mortgage customers to manage their mortgage through the app, including switching onto a new rate • Rolled out Microsoft Teams across all geographies to help colleagues to collaborate and support customers and clients

Barclays PLC - Annual Report - 2022 Page 224 Page 226

Barclays PLC - Annual Report - 2022 Page 224 Page 226