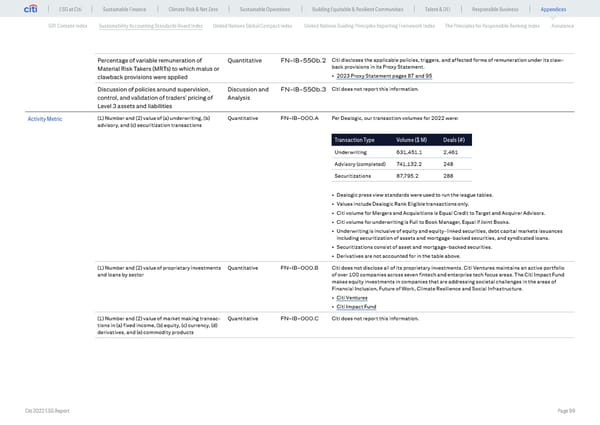

ESG at Citi Sustainable Finance Climate Risk & Net Zero Sustainable Operations Building Equitable & Resilient Communities Talent & DEI Responsible Business Appendices GRI Content Index Sustainability Accounting Standards Board Index United Nations Global Compact Index United Nations Guiding Principles Reporting Framework Index The Principles for Responsible Banking Index Assurance Percentage of variable remuneration of Quantitative FN-IB-550b.2 Citi discloses the applicable policies, triggers, and affected forms of remuneration under its claw- Material Risk Takers (MRTs) to which malus or back provisions in its Proxy Statement. clawback provisions were applied • 2023 Proxy Statement pages 87 and 95 Discussion of policies around supervision, Discussion and FN-IB-550b.3 Citi does not report this information. control, and validation of traders’ pricing of Analysis Level 3 assets and liabilities Activity Metric (1) Number and (2) value of (a) underwriting, (b) Quantitative FN-IB-000.A Per Dealogic, our transaction volumes for 2022 were: advisory, and (c) securitization transactions Transaction Type Volume ($ M) Deals (#) Underwriting 631,451.1 2,461 Advisory (completed) 741,132.2 248 Securitizations 87,795.2 288 • Dealogic press view standards were used to run the league tables. • Values include Dealogic Rank Eligible transactions only. • Citi volume for Mergers and Acquisitions is Equal Credit to Target and Acquirer Advisors. • Citi volume for underwriting is Full to Book Manager, Equal if Joint Books. • Underwriting is inclusive of equity and equity-linked securities, debt capital markets issuances including securitization of assets and mortgage-backed securities, and syndicated loans. • Securitizations consist of asset and mortgage-backed securities. • Derivatives are not accounted for in the table above. (1) Number and (2) value of proprietary investments Quantitative FN-IB-000.B Citi does not disclose all of its proprietary investments. Citi Ventures maintains an active portfolio and loans by sector of over 100 companies across seven fintech and enterprise tech focus areas. The Citi Impact Fund makes equity investments in companies that are addressing societal challenges in the areas of Financial Inclusion, Future of Work, Climate Resilience and Social Infrastructure. • Citi Ventures • Citi Impact Fund (1) Number and (2) value of market making transac- Quantitative FN-IB-000.C Citi does not report this information. tions in (a) fixed income, (b) equity, (c) currency, (d) derivatives, and (e) commodity products Citi 2022 ESG Report Page 99

Global ESG Report 2022 Citi Bookmarked Page 98 Page 100

Global ESG Report 2022 Citi Bookmarked Page 98 Page 100