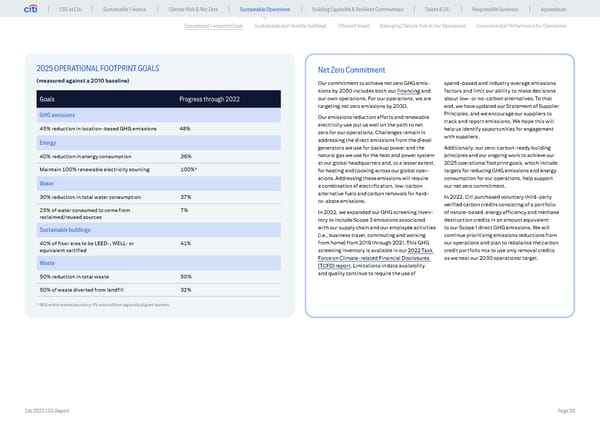

ESG at Citi Sustainable Finance Climate Risk & Net Zero Sustainable Operations Building Equitable & Resilient Communities Talent & DEI Responsible Business Appendices Operational Footprint Goals Sustainable and Healthy Buildings Efficient Travel Managing Climate Risk in Our Operations Environmental Performance for Operations 2025 OPERATIONAL FOOTPRINT GOALS Net Zero Commitment (measured against a 2010 baseline) Our commitment to achieve net zero GHG emis- spend-based and industry average emissions sions by 2050 includes both our financing and factors and limit our ability to make decisions Goals Progress through 2022 our own operations. For our operations, we are about low- or no-carbon alternatives. To that targeting net zero emissions by 2030. end, we have updated our Statement of Supplier GHG emissions Our emissions reduction efforts and renewable Principles, and we encourage our suppliers to electricity use put us well on the path to net track and report emissions. We hope this will 45% reduction in location-based GHG emissions 48% zero for our operations. Challenges remain in help us identify opportunities for engagement addressing the direct emissions from the diesel with suppliers. Energy generators we use for backup power and the Additionally, our zero-carbon-ready building 40% reduction in energy consumption 36% natural gas we use for the heat and power system principles and our ongoing work to achieve our at our global headquarters and, to a lesser extent, 2025 operational footprint goals, which include Maintain 100% renewable electricity sourcing 100%* for heating and cooking across our global oper- targets for reducing GHG emissions and energy ations. Addressing these emissions will require consumption for our operations, help support Water a combination of electrification, low-carbon our net zero commitment. 30% reduction in total water consumption 37% alternative fuels and carbon removals for hard- In 2022, Citi purchased voluntary third-party to-abate emissions. verified carbon credits consisting of a portfolio 25% of water consumed to come from 7% In 2022, we expanded our GHG screening inven- of nature-based, energy efficiency and methane reclaimed/reused sources tory to include Scope 3 emissions associated destruction credits in an amount equivalent Sustainable buildings with our supply chain and our employee activities to our Scope 1 direct GHG emissions. We will (i.e., business travel, commuting and working continue prioritizing emissions reductions from 40% of floor area to be LEED-, WELL- or 41% from home) from 2019 through 2021. This GHG our operations and plan to rebalance the carbon equivalent certified screening inventory is available in our 2022 Task credit portfolio mix to use only removal credits Waste Force on Climate-related Financial Disclosures as we near our 2030 operational target. (TCFD) report. Limitations in data availability 50% reduction in total waste 50% and quality continue to require the use of 50% of waste diverted from landfill 32% * 96% within market boundary; 4% sourced from regionally aligned markets. Citi 2022 ESG Report Page 35

Global ESG Report 2022 Citi Bookmarked Page 34 Page 36

Global ESG Report 2022 Citi Bookmarked Page 34 Page 36