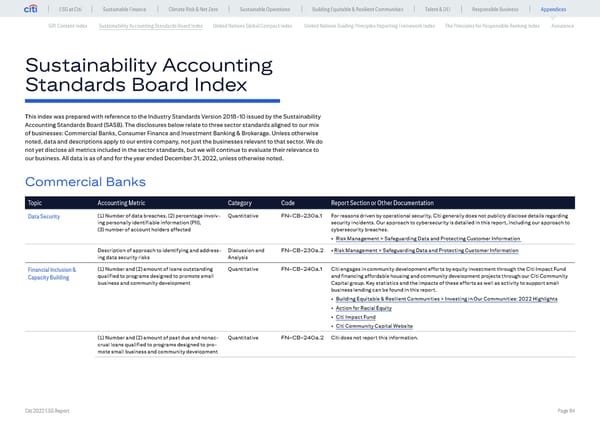

ESG at Citi Sustainable Finance Climate Risk & Net Zero Sustainable Operations Building Equitable & Resilient Communities Talent & DEI Responsible Business Appendices GRI Content Index Sustainability Accounting Standards Board Index United Nations Global Compact Index United Nations Guiding Principles Reporting Framework Index The Principles for Responsible Banking Index Assurance Sustainability Accounting Standards Board Index This index was prepared with reference to the Industry Standards Version 2018-10 issued by the Sustainability Accounting Standards Board (SASB). The disclosures below relate to three sector standards aligned to our mix of businesses: Commercial Banks, Consumer Finance and Investment Banking & Brokerage. Unless otherwise noted, data and descriptions apply to our entire company, not just the businesses relevant to that sector. We do not yet disclose all metrics included in the sector standards, but we will continue to evaluate their relevance to our business. All data is as of and for the year ended December 31, 2022, unless otherwise noted. Commercial Banks Topic Accounting Metric Category Code Report Section or Other Documentation Data Security (1) Number of data breaches, (2) percentage involv- Quantitative FN-CB-230a.1 For reasons driven by operational security, Citi generally does not publicly disclose details regarding ing personally identifiable information (PII), security incidents. Our approach to cybersecurity is detailed in this report, including our approach to (3) number of account holders affected cybersecurity breaches. • Risk Management > Safeguarding Data and Protecting Customer Information Description of approach to identifying and address- Discussion and FN-CB-230a.2 • Risk Management > Safeguarding Data and Protecting Customer Information ing data security risks Analysis Financial Inclusion & (1) Number and (2) amount of loans outstanding Quantitative FN-CB-240a.1 Citi engages in community development efforts by equity investment through the Citi Impact Fund Capacity Building qualified to programs designed to promote small and financing affordable housing and community development projects through our Citi Community business and community development Capital group. Key statistics and the impacts of these efforts as well as activity to support small business lending can be found in this report. • Building Equitable & Resilient Communities > Investing in Our Communities: 2022 Highlights • Action for Racial Equity • Citi Impact Fund • Citi Community Capital Website (1) Number and (2) amount of past due and nonac- Quantitative FN-CB-240a.2 Citi does not report this information. crual loans qualified to programs designed to pro- mote small business and community development Citi 2022 ESG Report Page 94

Global ESG Report 2022 Citi Bookmarked Page 93 Page 95

Global ESG Report 2022 Citi Bookmarked Page 93 Page 95