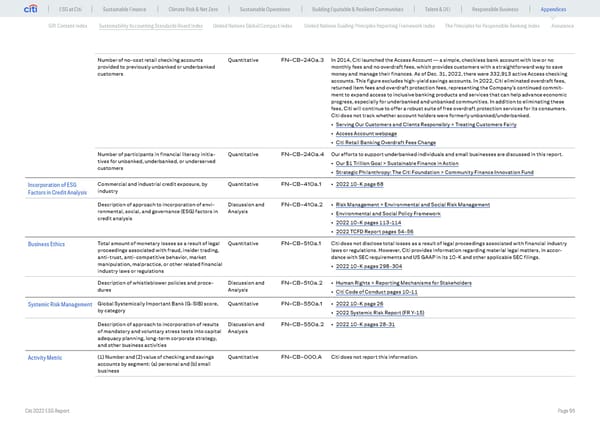

ESG at Citi Sustainable Finance Climate Risk & Net Zero Sustainable Operations Building Equitable & Resilient Communities Talent & DEI Responsible Business Appendices GRI Content Index Sustainability Accounting Standards Board Index United Nations Global Compact Index United Nations Guiding Principles Reporting Framework Index The Principles for Responsible Banking Index Assurance Number of no-cost retail checking accounts Quantitative FN-CB-240a.3 In 2014, Citi launched the Access Account — a simple, checkless bank account with low or no provided to previously unbanked or underbanked monthly fees and no overdraft fees, which provides customers with a straightforward way to save customers money and manage their finances. As of Dec. 31, 2022, there were 332,913 active Access checking accounts. This figure excludes high-yield savings accounts. In 2022, Citi eliminated overdraft fees, returned item fees and overdraft protection fees, representing the Company’s continued commit- ment to expand access to inclusive banking products and services that can help advance economic progress, especially for underbanked and unbanked communities. In addition to eliminating these fees, Citi will continue to offer a robust suite of free overdraft protection services for its consumers. Citi does not track whether account holders were formerly unbanked/underbanked. • Serving Our Customers and Clients Responsibly > Treating Customers Fairly • Access Account webpage • Citi Retail Banking Overdraft Fees Change Number of participants in financial literacy initia- Quantitative FN-CB-240a.4 Our efforts to support underbanked individuals and small businesses are discussed in this report. tives for unbanked, underbanked, or underserved • Our $1 Trillion Goal > Sustainable Finance in Action customers • Strategic Philanthropy: The Citi Foundation > Community Finance Innovation Fund Incorporation of ESG Commercial and industrial credit exposure, by Quantitative FN-CB-410a.1 • 2022 10-K page 68 Factors in Credit Analysis industry Description of approach to incorporation of envi- Discussion and FN-CB-410a.2 • Risk Management > Environmental and Social Risk Management ronmental, social, and governance (ESG) factors in Analysis • Environmental and Social Policy Framework credit analysis • 2022 10-K pages 113-114 • 2022 TCFD Report pages 54-56 Business Ethics Total amount of monetary losses as a result of legal Quantitative FN-CB-510a.1 Citi does not disclose total losses as a result of legal proceedings associated with financial industry proceedings associated with fraud, insider trading, laws or regulations. However, Citi provides information regarding material legal matters, in accor- anti-trust, anti-competitive behavior, market dance with SEC requirements and US GAAP in its 10-K and other applicable SEC filings. manipulation, malpractice, or other related financial • 2022 10-K pages 298-304 industry laws or regulations Description of whistleblower policies and proce- Discussion and FN-CB-510a.2 • Human Rights > Reporting Mechanisms for Stakeholders dures Analysis • Citi Code of Conduct pages 10-11 Systemic Risk Management Global Systemically Important Bank (G-SIB) score, Quantitative FN-CB-550a.1 • 2022 10-K page 26 by category • 2022 Systemic Risk Report (FR Y-15) Description of approach to incorporation of results Discussion and FN-CB-550a.2 • 2022 10-K pages 28-31 of mandatory and voluntary stress tests into capital Analysis adequacy planning, long-term corporate strategy, and other business activities Activity Metric (1) Number and (2) value of checking and savings Quantitative FN-CB-000.A Citi does not report this information. accounts by segment: (a) personal and (b) small business Citi 2022 ESG Report Page 95

Global ESG Report 2022 Citi Bookmarked Page 94 Page 96

Global ESG Report 2022 Citi Bookmarked Page 94 Page 96