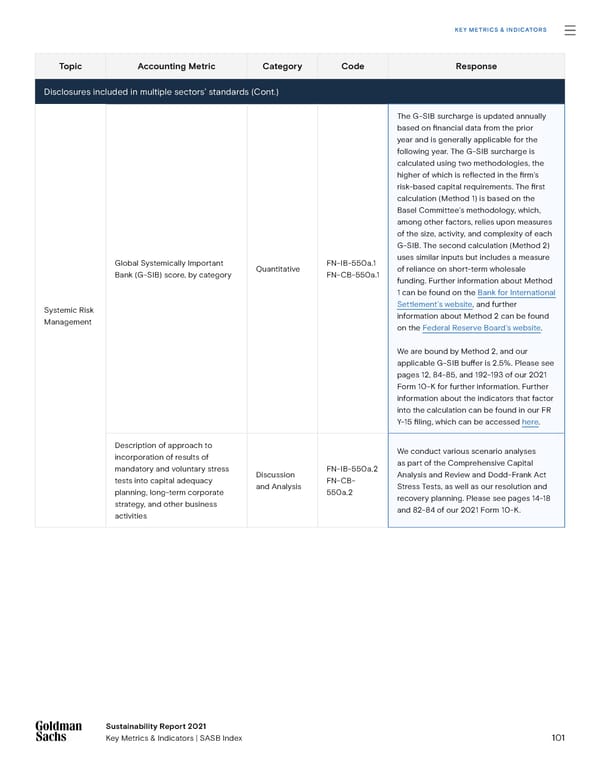

KEY METRICS & INDICATORS Topic Accounting Metric Category Code Response Disclosures included in multiple sectors’ standards (Cont.) The G-SIB surcharge is updated annually based on 昀椀nancial data from the prior year and is generally applicable for the following year. The G-SIB surcharge is calculated using two methodologies, the higher of which is re昀氀ected in the 昀椀rm’s risk-based capital requirements. The 昀椀rst calculation (Method 1) is based on the Basel Committee’s methodology, which, among other factors, relies upon measures of the size, activity, and complexity of each G-SIB. The second calculation (Method 2) Global Systemically Important FN-IB-550a.1 uses similar inputs but includes a measure Bank (G-SIB) score, by category Quantitative FN-CB-550a.1 of reliance on short-term wholesale funding. Further information about Method 1 can be found on the Bank for International Systemic Risk Settlement’s website, and further Management information about Method 2 can be found on the Federal Reserve Board’s website. We are bound by Method 2, and our applicable G-SIB bu昀昀er is 2.5%. Please see pages 12, 84-85, and 192-193 of our 2021 Form 10-K for further information. Further information about the indicators that factor into the calculation can be found in our FR Y-15 昀椀ling, which can be accessed here. Description of approach to We conduct various scenario analyses incorporation of results of as part of the Comprehensive Capital mandatory and voluntary stress Discussion FN-IB-550a.2 Analysis and Review and Dodd-Frank Act tests into capital adequacy and Analysis FN-CB- Stress Tests, as well as our resolution and planning, long-term corporate 550a.2 recovery planning. Please see pages 14-18 strategy, and other business and 82-84 of our 2021 Form 10-K. activities SSuussttaaiinnaabbiilliittyy Re Reppoorrtt 2 2002121 KKeey My Meettrriiccs & Is & Innddiiccatatoorrs | Ss ASB Index 101

Goldman Sachs sustainability report Page 100 Page 102

Goldman Sachs sustainability report Page 100 Page 102