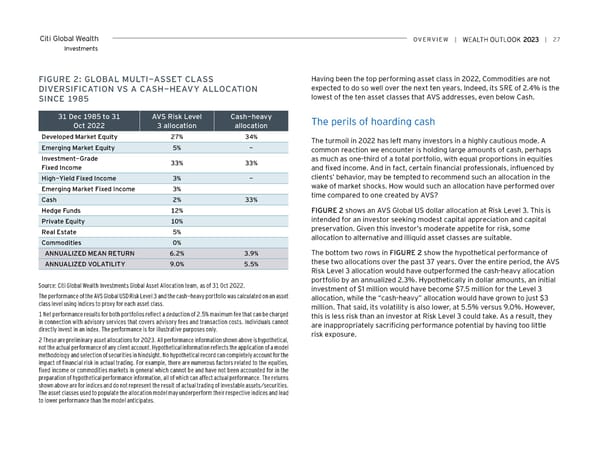

Citi Global Wealth overview | | 27 Investments FiGUre 2: GLoBAL MULTi-ASSeT CLASS Having been the top performing asset class in 2022, Commodities are not DiverSiFiCATioN vS A CASH-HeAvY ALLoCATioN expected to do so well over the next ten years. Indeed, its SRE of 2.4% is the SiNCe 1985 lowest of the ten asset classes that AVS addresses, even below Cash. 31 Dec 1985 to 31 AvS risk Level Cash-heavy The perils of hoarding cash oct 2022 3 allocation allocation Developed Market equity 27% 34% The turmoil in 2022 has left many investors in a highly cautious mode. A emerging Market equity 5% - common reaction we encounter is holding large amounts of cash, perhaps investment-Grade 33% 33% as much as one-third of a total portfolio, with equal proportions in equities Fixed income and fixed income. And in fact, certain financial professionals, influenced by High-Yield Fixed income 3% - clients’ behavior, may be tempted to recommend such an allocation in the emerging Market Fixed income 3% wake of market shocks. How would such an allocation have performed over Cash 2% 33% time compared to one created by AVS? Hedge Funds 12% FIGURE 2 shows an AVS Global US dollar allocation at Risk Level 3. This is Private equity 10% intended for an investor seeking modest capital appreciation and capital real estate 5% preservation. Given this investor’s moderate appetite for risk, some Commodities 0% allocation to alternative and illiquid asset classes are suitable. ANNUALiZeD MeAN reTUrN 6.2% 3.9% The bottom two rows in FIGURE 2 show the hypothetical performance of ANNUALiZeD voLATiLiTY 9.0% 5.5% these two allocations over the past 37 years. Over the entire period, the AVS Risk Level 3 allocation would have outperformed the cash-heavy allocation portfolio by an annualized 2.3%. Hypothetically in dollar amounts, an initial Source: Citi Global Wealth Investments Global Asset Allocation team, as of 31 Oct 2022. investment of $1 million would have become $7.5 million for the Level 3 The performance of the AVS Global USD Risk Level 3 and the cash-heavy portfolio was calculated on an asset allocation, while the “cash-heavy” allocation would have grown to just $3 class level using indices to proxy for each asset class. million. That said, its volatility is also lower, at 5.5% versus 9.0%. However, 1 Net performance results for both portfolios reflect a deduction of 2.5% maximum fee that can be charged this is less risk than an investor at Risk Level 3 could take. As a result, they in connection with advisory services that covers advisory fees and transaction costs. Individuals cannot are inappropriately sacrificing performance potential by having too little directly invest in an index. The performance is for illustrative purposes only. risk exposure. 2 These are preliminary asset allocations for 2023. All performance information shown above is hypothetical, not the actual performance of any client account. Hypothetical information reflects the application of a model methodology and selection of securities in hindsight. No hypothetical record can completely account for the impact of financial risk in actual trading. For example, there are numerous factors related to the equities, fixed income or commodities markets in general which cannot be and have not been accounted for in the preparation of hypothetical performance information, all of which can affect actual performance. The returns shown above are for indices and do not represent the result of actual trading of investable assets/securities. The asset classes used to populate the allocation model may underperform their respective indices and lead to lower performance than the model anticipates.

Citi Wealth Outlook 2023 Page 26 Page 28

Citi Wealth Outlook 2023 Page 26 Page 28