ESG Report | Starbucks

021 REPORT STARBUCKS 2021 2 2 0 ORT 21 R E P REP Global 1 OR 20 T 2 T 02 RO 12 PE PER Environmental R 120TRO 2 && Social Impact Report PEOPLE PLANET GOVERNANCE

Introduction Twenty years ago, in our first As we report on the company’s Corporate Social Responsibility environmental and social impact in Together, with direct, open and transparent report, we shared, “Starbucks has FY21, we are proud of the progress the opportunity to lead by example. we have made and we remain conversation and collaboration we will Our responsibility starts with rooted in the belief that we can restore trust in each other, reimagine being accountable to Starbucks lead through the lens of humanity, stakeholders – our partners, far beyond the pursuit of profit. Starbucks and co-create our future. customers, shareholders, suppliers, This report outlines the goals we community members and others – have set and highlights the impact A future where our people and our communicating openly about our we can have together – when communities are never left behind, business practices and performance.” we uplift our partners, when we but always propelled forward. connect with our customers and our A future where our planet is cared Starbucks has always been a communities, and when we remain for and we create value not only for different kind of company – accountable to each other. our company, but for the collective one deep with purpose, where success of all our stakeholders. we work together to create a Our company, like many, is also positive impact in the world. facing new realities in a changed It is our role and our responsibility, We pursue ambitious goals for world – the continued effects of together. our partners, our communities COVID-19, heightened social and and our planet with intention, political unrest, efforts to unionize transparency and accountability. and stakeholders who seek new accountability from businesses. At times, we have fallen short of our ambitions. But we remain transparent about our missteps, while still rising to meet the opportunities ahead of us through our Mission and Values – and always with the aspiration to exceed the expectations of our partners and customers.

CONTENTS OF THIS REPORT 4 People 5 Opportunity 14 Inclusion 20 Community 24 Navigating a Global Pandemic 26 The Starbucks Foundation 29 FY22 Highlights 30 Planet 31 2030 Goals & Progress 34 Strategies for Change 41 FY22 Highlights 42 Governance Supporting documents, scorecard and tables begin on page 48

People At Starbucks, we put people at the center of our work. We have always believed that our success should be shared, and we remain committed to providing an elevated experience for our partners. We know that our success can be built upon to help our partners achieve their biggest dreams and to help our communities thrive. We are committed to being people positive— a bold effort to enhance the well-being of all who connect with Starbucks, through actions and programs rooted in opportunity, inclusion and community.

People 021 REPORT 2 T 2 02 OR 1 R EP E 1 R PO 20 TR 2T 02 OPPORTUNITY RO 12 PER PER 1202TRO We believe in creating meaningful opportunities for our partners and farmers — investing in their health, well-being and success.

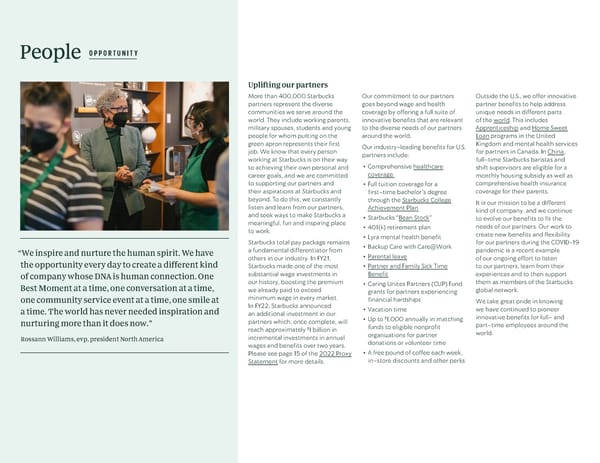

People OPPORTUNITY Uplifting our partners More than 400,000 Starbucks Our commitment to our partners Outside the U.S., we offer innovative partners represent the diverse goes beyond wage and health partner benefits to help address communities we serve around the coverage by offering a full suite of unique needs in different parts world. They include working parents, innovative benefits that are relevant of the world. This includes military spouses, students and young to the diverse needs of our partners Apprenticeship and Home Sweet people for whom putting on the around the world. Loan programs in the United green apron represents their first Our industry-leading benefits for U.S. Kingdom and mental health services job. We know that every person partners include: for partners in Canada. In China, working at Starbucks is on their way full-time Starbucks baristas and to achieving their own personal and • Comprehensive healthcare shift supervisors are eligible for a career goals, and we are committed coverage monthly housing subsidy as well as to supporting our partners and • Full tuition coverage for a comprehensive health insurance their aspirations at Starbucks and first-time bachelor’s degree coverage for their parents. beyond. To do this, we constantly through the Starbucks College It is our mission to be a different listen and learn from our partners, Achievement Plan kind of company, and we continue and seek ways to make Starbucks a • Starbucks “Bean Stock” to evolve our benefits to fit the meaningful, fun and inspiring place • 401(k) retirement plan needs of our partners. Our work to to work. create new benefits and flexibility Starbucks total pay package remains • Lyra mental health benefit for our partners during the COVID-19 “We inspire and nurture the human spirit. We have a fundamental differentiator from • Backup Care with Care@Work pandemic is a recent example others in our industry. In FY21, • Parental leave of our ongoing effort to listen the opportunity every day to create a different kind Starbucks made one of the most • Partner and Family Sick Time to our partners, learn from their of company whose DNA is human connection. One substantial wage investments in Benefit experiences and to then support Best Moment at a time, one conversation at a time, our history, boosting the premium • Caring Unites Partners (CUP) Fund them as members of the Starbucks we already paid to exceed grants for partners experiencing global network. one community service event at a time, one smile at minimum wage in every market. financial hardships We take great pride in knowing a time. The world has never needed inspiration and In FY22, Starbucks announced • Vacation time we have continued to pioneer an additional investment in our $ innovative benefits for full- and nurturing more than it does now.” partners which, once complete, will • Up to 1,000 annually in matching $ funds to eligible nonprofit part-time employees around the reach approximately 1 billion in organizations for partner world. Rossann Williams, evp, president North America incremental investments in annual donations or volunteer time wages and benefits over two years. Please see page 15 of the 2022 Proxy • A free pound of coffee each week, Statement for more details. in-store discounts and other perks

People OPPORTUNITY Our Commitment to Partners Innovative, Inclusive Healthcare Total Compensation & Retirement 100% College Tuition Coverage Partner & Family Support More Partner Perks • Comprehensive and affordable • Competitive wages • The Starbucks College • A welcoming and inclusive place • A po und of coffee each week choices in health insurance • Added pay for tenure at 2+ and Achievement Plan provides 100% to work • Disc ounts coverage with personalized 5+ years tuition coverage for a bachelor’s • Flexible hours to match partner support degree through a partnership with needs • F ree food and beverages on shift • Health insurance coverage that is • Opportunity to grow your career — Arizona State University • F ree Spotify Premium inclusive of transgender medical Barista Trainer, Shift Supervior and • Starbucks also extends this benefit • Professional networking and beyond career development through • F ree Headspace Premium needs to a spouse or child of partners Partner Networks • Fertility services including IVF • A robust 401(k) plan with match who are current members of the • Plus mor e • “Bean Stock” — partners share U.S. Armed Forces and Veterans • Paid Parental Leave for birth and • 20 free mental health sessions in our financial success through • Starbucks Global Academy offers non-birth parents each year grants of Starbucks stock access to courses for personal and • Partner and Family Sick Time professional development at no • Family Expansion Reimbursement cost • Partners can apply on day one • Childcare benefits • Vacation and other time off Partners who work 20 hours or more in the U.S. are benefits-eligible with health and college tuition benefits requiring eligibility. Around the world we have innovative benefits to address unique needs: • U.K.: Apprenticeship and Home Sweet Loan Programs • Canada: Mental health coverage and interest-free housing loans • China: Housing subsidy and health insurance for parents of partners

People OPPORTUNITY Training and Educational Resources Third Place Development Series We are investing Starbucks success back into our partners. Training and FY21 Results: 22 Pour Over sessions have been designed and implemented educational resources are designed to recruit and retain the best people and to date. affirm Starbucks as one of the very best jobs in retail globally. The way we hire, Since the beginning, we have worked to build and provide a third place develop and advance our partners is critical to our journey toward inclusion, where everyone is welcomed and respected. The Third Place Development diversity and equity at Starbucks. Series empowers partners to create an atmosphere of warmth and belonging We believe in sharing our educational resources with those outside of in Starbucks cafés. Building on the 2020 model, Starbucks engaged its Starbucks as part of our commitment to lifelong learning and providing partners in early 2021 to propose and vote on topic ideas through an internal many pathways to opportunity. Starbucks Global Academy is a platform for crowdsourcing platform. More than 175 ideas were submitted, and 2,500 Starbucks partners, customers, suppliers and community members around partners voted on their preferences. The four partner-generated Pour Over the world to access world-class, open-scale learning content without barriers topics selected for 2021–2022 modules include: biases related to age; and at no cost. Operated in partnership with Arizona State University (ASU), biases related to weight; non-apparent disabilities, like multiple sclerosis, Starbucks Global Academy learners deepen their knowledge on key Starbucks chronic fatigue and chronic pain; and bridging the political divide through initiatives and advance their personal and professional goals from a library of conversation. Each Pour Over session averages 10,000 unique views. over 100 curated courses including our To Be Welcoming curriculum, Greener Apron and Starbucks Coffee Academy. To Be Welcoming Barista Basics and Continuous Learning FY21 Results: Over 87,000 course enrollments in To Be Welcoming courses 1 globally and nearly 37,000 course completions since launch. $ FY21 Results: 1.2 billion invested in onboarding, immersion and continuing Our commitment to equal opportunity means cultivating an environment education training programs for our retail partners. where differences are embraced and building a culture that fosters a sense We invest in key training and learning programs to ensure that store partners of belonging. In 2018, we worked with ASU to create the To Be Welcoming are equipped with the knowledge, skills and ability to provide a great anti-bias curriculum for our partners. In 2020, we opened this 15-course $ curriculum to the public, free of cost. Now, we are working to meet our goal experience for Starbucks customers. In FY21, Starbucks invested 1.2 billion in training programs for our new and existing retail partners to foster smart of enrolling 100,000 learners – partners, customers and communities – in onboarding and continuous learning. the program to help more people engage with difficult topics through The Barista Basics Training Program provides the initial training for a newly academically robust, objective and research-based content. hired barista on essential skills and knowledge required for the role. Using simple and intuitive tools, skills are taught through one-to-one delivery and on-the-job training. It is a highly effective learning experience for a new barista that quickly enhances confidence and competence in delivering customer service. Starbucks is redesigning Barista Basics to include additional training time for all roles as well as practice shifts. We are also working to expand beyond our 40 highly successful training stores in the U.S. that are dedicated entirely to training partners in this area. 1 The geographic scope of this data point includes all company- owned and operated markets globally.

People OPPORTUNITY Greener Apron Starbucks Coffee Academy Starbucks College FY21 Results: Over 38,000 course FY21 Results: Over 136,000 course Achievement Plan enrollments in Greener Apron enrollments in Starbucks Coffee FY21 Results: 2,500 partners globally and more than 15,000 Academy globally and more than earned their college degree in FY21 2 course completions since launch. 55,000 course completions since through the Starbucks College Starbucks iconic green aprons launch.2 Achievement Plan. take on an even deeper meaning The Starbucks Coffee Academy is The Starbucks College Achievement through our work to give more than designed to explore the many facets Plan (SCAP) was created to help we take from our planet. We offer of the coffee industry and Starbucks more Starbucks partners realize every partner the opportunity to role as a leader in ethical sourcing, the dream of a college education. access the Greener Apron course. roasting, blending, brewing and craft. Partners who enroll in the SCAP The course is designed to give all The modular learning experience program receive 100% tuition partners the tools they need to allows anyone to choose their coffee coverage towards their bachelor’s champion sustainability in their learning adventure and to join us degree at ASU from Starbucks. stores, homes and communities. in our everlasting love for coffee. In The program connects Starbucks It covers a range of sustainability FY21, beyond the core curriculum, we partners with more than 100 topics and offers practical steps added ongoing learning assets that bachelor’s degree programs, all toward taking better care of the include video libraries, discussion offered fully online. This flexibility planet. guides, podcasts, brew guides and makes the SCAP program a game- origin maps. changer for many of our partners. Since the program began in 2014, “When I started working at Starbucks, I had no idea nearly 7,000 partners have earned that it would open so many doors for me.” their college degrees, and we are working towards our ambitious goal Gigi, an aspiring musician and daughter of immigrants from the of graduating 25,000 Starbucks Philippines who will be the first in her family to graduate college, partners from ASU by 2025. never thought she would be able to even attend college. Born and raised in the Bay Area, Gigi, now 24, grew up immersed in the arts. But creativity was just a hobby and the plan was to go to a four-year school and study business and hospitality. Until she couldn’t come up with the money. Through her hard work in the Starbucks College Achievement Plan with ASU, her life has changed. She is studying film and media and was even cast in the Starbucks 50th Anniversary national television commercial. And last spring quarter, Gigi earned a 4.0 grade point average. The future is bright for Gigi and the 20,000 Starbucks partners enrolled in SCAP. 2 The geographic scope of this data point includes all company- owned and operated markets globally.

People OPPORTUNITY Partner Networks FY21 Results: 12 Partner Networks EMEA Partner Networks: with 77 active chapters across the • Black Partner Network U.S. and an additional 19 partner (Est. 2020) 3 networks globally. • Pride Network Starbucks Partner Networks are (Est. 2020) partner-led groups that bring • Women’s Impact Network together people with shared (Est. 2020) identities and experiences, along Welcome, engage and empower Starbucks Share the heritage of the African diaspora Foster a community of awareness, with their allies, to promote a Veterans, military spouses and advocate to develop partners, advise our business inclusion and accessibility for partners Asia-Pacific Partner Networks: culture of inclusion and contribute partners in cultivating a strong community and enrich Starbucks contribution to our with apparent and non-apparent • Culture Club to the success of our partners and that embraces Veterans in the workplace customers and communities. (Est. 2007) disabilities. (Est. 2006) and enriches the Starbucks Experience. (Est. 2020, Hong Kong) our business. Our partners are (Est. 2007) • Disability Advocacy Network thoughtful advocates and powerful (Est. 2020, Hong Kong) voices to help promote change and • Partners for Sustainability understanding within the company (Est. 2020, Hong Kong) and beyond. Since the launch of the • Pride Alliance LGBTQ (now Pride Alliance) Partner (Est. 2020, Hong Kong) Network in 1996, partners across • Social Impact the global Starbucks community Celebrate the Latinx culture, develop Develop a global community contributing Preserve and celebrate Indigenous cultural (Est. 2020, Hong Kong) have created 12 networks with 99 partners and positively impact our to the growth of the India market, values, we will interweave communities by • Women’s Impact Network active chapters across the U.S. and customers and communities. (Est. 2006) celebrate Indian culture and support the teaching and understanding our heritage. (Est. 2018, India; est. 2020, 19 partner networks globally as of growth of partners from the region. Together, we will unite and continuously Hong Kong) February 2022. (Est. 2013) Walk in Beauty. (Est. 2020) Latin America and Caribbean Partner Networks: • Diversity Network (Est. 2021, Chile) • Ethical Diversity Network (Est. 2021, Brazil) Support and empower the next generation Foster meaningful connections and elevate Educate, engage and empower Starbucks • Partners with Disabilities of Starbucks leadership. (Est. 2015) the impact of Pan-Asian partners and partners to drive sustainable change. (Est. 2022, Brazil) allies within Starbucks and the community. (Est. 2021) (Est. 2007) • Pride Network (Est. 2019 in Argentina and Uruguay; est. 2021 in Chile and Colombia) • Refugee Network (Est. 2021, Costa Rica) • Sustainability Network (Est. 2021, Chile) 3 Strive to cultivate an equitable, dynamic Welcome, empower and advocate Ignite the power of women to make The geographic scope of this data point and supportive environment for LGBTQ for refugee partners and allies while an impact through partners, allies and includes all company-owned and partners, allies and customers. (Est. 1996) strengthening and enriching their global community. (Est. 2008) operated markets globally. Starbucks Experience. (Est. 2018)

People OPPORTUNITY Supporting Farmers Around Coffee and Farmer Equity (C.A.F.E.) Practices the World FY21 Results: Nearly 95% of Starbucks coffee was ethically sourced and Today’s farmers face numerous verified through C.A.F.E. Practices. challenges to their long-term future. The cornerstone of our ethical sourcing approach to buying coffee is Coffee We believe that it is Starbucks Farmer and Equity (C.A.F.E.) Practices, which was one of the coffee industry’s responsibility to work alongside first set of ethical sourcing standards when it launched in 2004. Developed coffee farmers to improve their in collaboration with Conservation International, C.A.F.E. Practices is a livelihoods – whether they sell to verification program that measures farms against economic, social and us or not. Together, we hope to help environmental criteria, designed to promote transparent, profitable and farmers increase their productivity, sustainable coffee growing practices while protecting the well-being of quality of life and profitability by coffee farmers and workers, their families and their communities. Evidence driving solutions that support both shows that farmers participating in the program have higher productivity people and our planet. than country averages, which has helped Starbucks create a long-term supply of high-quality coffee while positively impacting the lives of coffee farmers and their communities. Our goal is to ethically source and verify 100% of Starbucks coffee through C.A.F.E. Practices. In FY21, due to restrictions caused by COVID-19, auditing teams were unable to complete all the necessary in-person, on-farm audits to renew their active status in the program. As a result, 94.86% of our coffee in FY21 was sourced from C.A.F.E. Practice- verified farms. “We must be brave, and we must lead, and set out aspirations that are bold to take the path that can create a better future for those that grow coffee and their families, and to ensure that the beauty and art and ritual that’s coffee remains in all of our cultures, for decades and decades to come.” Michelle Burns, evp, Global Coffee, Tea and Cocoa

People OPPORTUNITY Responsible Sourcing for Tea Responsible Sourcing for Traceability FY21 Results: 99.9% of tea sourced Cocoa FY21 Results: More than 33,000 by Global Coffee, Tea & Cocoa, the FY21 Results: Global Coffee, Tea bags of coffee were traced using company’s global coffee sourcing and Cocoa, the company’s global our online tool. team, verified as responsibly coffee sourcing team, purchased In 2020, the Starbucks Digital sourced. 10 million kilograms of Traceability tool was launched in Sourcing certified tea is a key aspect segregated cocoa beans. North American retail stores to of our ethical sourcing approach. In Like coffee and tea, we are dedicated transform each bag of coffee beans FY21, Global Coffee, Tea & Cocoa, the to sourcing cocoa responsibly, for into a digital passport, launching company’s global coffee sourcing the betterment of people and planet. coffee lovers on a virtual expedition team, sourced 99.9% of tea from In FY21, Global Coffee, Tea and to meet farmers, roasters and Rainforest Alliance Certified farms. Cocoa, the company’s global coffee baristas and to explore coffee- Farms, forest communities, and sourcing team, purchased 10 million growing regions around the world. businesses that participate in kilograms of segregated cocoa beans In FY21, more than 33,000 bags Rainforest Alliance’s certification from the Ivory Coast through our Tier of coffee were traced using the program are audited against 1 supplier, Cargill.4 traceability tool online, and the tool We continue to rigorous sustainability standards source Rainforest Alliance Certified was accessed by nearly 170,000 based on the triple bottom line: cocoa and to work in partnership unique visitors, raising awareness environmental, economic and social with the Rainforest Alliance to for farmers, C.A.F.E. Practices and well-being. leverage their expertise and increase Starbucks ongoing commitment to In addition to our global coffee our due diligence and transparency transparency. sourcing team, Starbucks regional in our cocoa supply chains. We teams also purchase tea. Moving are a member of the World Cocoa forward, we are working with Foundation and continue to work regional markets to verify their with others across the industry to purchases using a consistent set evolve and strengthen our approach of ethical sourcing guidelines and to responsibly sourced cocoa. expect to provide reporting on those In addition to our global sourcing efforts in coming years. team, Starbucks regional teams also purchase cocoa. Moving forward, we are working to provide additional transparency across all cocoa- based products sourced across the company globally. 4More on Cargill’s approach to Cocoa procurement can be found here.

People OPPORTUNITY Global Farmer Fund Farmer Support Centers Childcare Centers FY21 Results: Starbucks doubled the FY21 Results: Opened our 10th FY21 Results: Five new centers $ Global Farmer Fund to 100 million. Farmer Support Center globally. opened in Guatemala to support $ More than 30,000 people farming families during harvest. Since FY18, 54.8 million in loans has been deployed. trained with advanced agronomy Through co-investments with The Starbucks Global Farmer Fund techniques.5 Starbucks suppliers, we opened an was created to improve supply chain Starbucks operates Farmer Support additional five childcare centers resiliency and ensure a long-term Centers in coffee-producing in Guatemala for the 2021-2022 supply of coffee by addressing the countries around the world and harvest season bringing the total unmet business financing needs of in FY21 opened our tenth Farmer operating in this harvest to ten. The farmers. Too often, farmers cannot Support Center. These centers centers provide safe spaces for local turn to traditional banks for business provided free direct-to-farmer and migrant workers’ children to lending because of high interest training along with training to continue their education during the rates. The loans provided through technical experts in a train- coffee harvest season. the fund allow farmers to plant new the-trainer model to more than trees, improve their infrastructure 30,000 people globally. In 2020, and build financial resiliency in the we achieved our goal of training face of shifts in climate and markets. 200,000 people with the latest In FY21, Starbucks committed findings of Starbucks agronomists $ an additional 50 million dollars including advances like new varietals to double the fund. Since FY18, of disease-resistant coffee trees Carlos Mario Rodriguez, director and global head of coffee research $ and advanced soil management Starbucks has deployed 54.8 million and development, was part of the very first Farmer Support Center to coffee businesses and farmers techniques. agronomy team. He drove his pickup truck over countless miles through loans. of narrow roads to visit farmers and help them with a range of sustainability issues and ensure a long-term supply of quality coffee. Carlos helped farmers set up their own test plots, showed them how to space trees correctly and offered suggestions to manage erosion and reduce the use of pesticides. “I think it’s very important for customers to know how difficult it is to produce high-quality coffee,” he said. “It’s critical that we support the farmers.” For Carlos, Starbucks progress in supporting farming communities is best measured one farm, one farmer at a time. “To me, as a professional, as a partner, it’s the best part really when you start working with a particular farmer and see that they are improving their living conditions and being able to keep producing coffee as a 5 good business,” he said. “That’s the best. It’s really something that The geographic scope of this data point includes all company- owned and operated markets globally. motivates us.”

People 021 REPORT 2 T 2 02 INCLUSION OR 1 R EP E 1 R PO 20 TR We believe it is our responsibility to advance 2T 02 racial and social equity, and we are committed RO 12 PER PER to furthering that work with intention, 12 02 T RO transparency and accountability.

People INCLUSION Racial & Social Equity Goals & Representation At Starbucks, we are on a journey to advance racial and social equity for our partners, our community and our society. Our work to advance inclusion, diversity and equity has already led to important policies, programs and initiatives. We are building on the work in our prior Civil Rights Assessments, conducted by Covington & Burling, including the recommendation to hire a chief inclusion & diversity officer and to set and meet representation goals for Black, 6 Indigenous and People of Color (BIPOC) partners and women partners across the company. Starbucks continues its efforts to achieve 2025 representation goals, including achieving at least 30% BIPOC representation at all corporate levels and at least 40% in all retail and manufacturing roles. We also aim to achieve 55% women in all retail roles, 50% women in corporate roles and 30% women in manufacturing roles by 2025. We are working to ensure that our partners represent the communities they are part of and serve. Use our interactive tool to view additional demographic data of Starbucks partners. FY21 Results: Diversity in Retail Stores FY21 Results: Diversity in Corporate Roles FY21 Results: Diversity in Manufacturing Roles Goal: Our partner base will include 40% BIPOC partners and at Goal: We aim to achieve at least 30% BIPOC representation and Goal: We will achieve 40% BIPOC representation and 30% least 55% women partners in all retail roles in the U.S. by 2025. 50% representation of women for all enterprise roles by 2025. representation of women for manufacturing roles in the U.S. by 2025. ROLE BIPOC WOMEN ROLE BIPOC WOMEN ROLE BIPOC WOMEN Regional Vice President 20% 65% Senior Vice President+ 22% 59% Director 13% 13% Regional Director 30% 52% Vice President 32% 49% Manager 24% 28% District Manager 32% 60% Director 29% 56% Individual Contributor 49% 34% Store Manager 37% 69% Manager 30% 54% Shift Supervisor 45% 70% Individual Contributor 38% 54% Barista 50% 73% Board Diversity FY21 Results: Our Board of Directors has 55% BIPOC representation (6 out of 11 members) and 36% representation of women (4 out of 11 members). In FY21, Starbucks announced that Mellody Hobson would build on her experience since joining the Starbucks board of directors in 2005 by serving as the company’s non-executive chair. At the time of this groundbreaking announcement, only 15 companies where the director is not also the CEO among the S&P 500 had a female chair, and none of the women represented identified as Black. Starbucks joined the Board Diversity Action Alliance to act alongside peer companies as part of our commitment to representation of racially and ethnically diverse directors on Starbucks corporate boards of directors. The Board Diversity Action Alliance works to increase the representation of racially and ethnically diverse directors on corporate boards of directors, beginning with Black directors. Our full disclosure is in the 6Demographic percentages represented in this section have been rounded. 2022 Proxy Statement on page 26.

People INCLUSION Global Equity in Pay Civil Rights Assessment FY21 Results: Starbucks has achieved and maintained 100% pay equity for FY21 Results: Starbucks published women and men and people of all races performing similar work in the its third annual Civil Rights U.S. and achieved and maintained gender equity in pay in global company- Assessment. 7 operated markets Canada and Great Britain. Since 2019, Starbucks has Since announcing in 2018 that Starbucks had achieved 100 percent pay equity commissioned an annual, objective for women and men and people of all races performing similar work in the assessment of our company’s United States, we have committed to maintaining that standard annually commitment to civil rights. In FY21, and reaching 100% gender pay equity for all partners in Starbucks company- we published our third Civil Rights operated markets globally. Assessment. This assessment, In FY21, Starbucks once again maintained 100% pay equity for women and conducted by Covington & Burling men and people of all races performing similar work in the U.S. As of the end LLP under the leadership of former of FY21, median pay ratio in the U.S. was 100% for women and BIPOC partners. U.S. Attorney General Eric Holder, Jr., addresses our progress over time Globally, in FY21 the median pay for women was 100% of the median for and provides recommendations men. We once again maintained gender equity in pay in company-operated for how we can better advance markets Canada and Great Britain. inclusion, diversity and equity on In FY20, our licensed partners in Singapore, the Philippines and India achieved behalf of our partners, customers 100% pay equity for women and men. In FY21, eight additional markets in and communities. To promote Asia-Pacific and the Hong Kong Support Center achieved 100% gender pay transparency, we publish these equity, and we continue to work with licensed partners to prioritize gender assessments online. pay equity in all markets. We continue to leverage our experience in achieving gender equity in pay in the U.S. and other markets by sharing our pay-equity principles — equal footing, transparency and accountability — with other employers to help address known, systemic barriers to global pay equity. Starbucks Inclusion & Diversity Mentorship Program We continue to be intentional in cultivating a culture of inclusion, with a focus on partner retention and development by launching a mentorship program. Beginning with our BIPOC partners, the program is designed to connect partners to senior leaders with the goal of creating continuous learning opportunities for the mentor and the mentee. In FY22, the first cohort of participants graduated, and survey results show that 100% of program participants “feel a sense of belonging at Starbucks since the launch of the program.” All mentors and mentees surveyed agreed that they achieved a deeper understanding of partners’ experience with inclusion and diversity. 7 Our goal is to reach 100% pay equity in all global company-owned and operated markets.

People INCLUSION Supporting LGBTQ+ Partners Before joining Starbucks as a store manager in Southern California, FY21 Results: Starbucks scored 100% on the Human Rights Campaign Joe spent 15 years in the restaurant business, eight of them as a Corporate Equality Index. chef. When COVID-19 became a pandemic and everyone started For more than three decades, Starbucks has been committed to building wearing masks, Joe realized he was suddenly deprived of his primary a culture where everyone is welcome. We stand as an ally to the lesbian, communication tool: reading lips. gay, bisexual, transgender and queer community – affirming every way Joe, 28, was born in Guam, unable to fully hear sounds — especially people may choose to identify. In FY21, Starbucks received a 100% score on whispers or anything said behind him. Doctors eventually diagnosed the Human Rights Campaign Corporate Equality Index based on corporate him with otosclerosis, a condition caused by the abnormal growth of the policies and practices for LGBTQ equality for the 11th year. Starbucks also $ tiny bones inside the ears that commonly contributes to hearing loss. donated 50,000 to the Lavender Rights Project to support providing low- cost legal services for transgender and queer low-income people and other “Growing up, I was classified as Deaf,” Joe says. “I was very ashamed $ marginalized communities in Washington state and 50,000 to the National of my hearing. I was embarrassed. I thought if people found out, they Center for Transgender Equality to increase understanding and acceptance of wouldn’t want to be my friend, wouldn’t want to talk to me, wouldn’t trans people across the United States. want to hire me. So I taught myself how to read lips, read the room. I taught myself things to be and feel normal. I wore hearing aids as a little kid, but after a while I would take them off when I got to school... I saw how other kids would act toward kids with disabilities.” Recently, his twin girls — with the help of his wife and father-in-law — gifted him with a new pair of hearing aids. They were an unexpected blessing. They also gave him the confidence to seek out community and a career outside his comfort zone, which led him to Starbucks. “I started to embrace my Deafness and decided I want to learn more about it and inspire other people with Deafness,” Joe says. “Who knows, maybe there’s a handful of partners out there who are afraid or embarrassed to share. I want to let them know it’s all right. We’re all just people at the end of the day.”

People INCLUSION Disability Inclusion Inclusive & Accessible Design Starbucks Signing Stores FY21 Results: Starbucks received FY21 Results: Began offering FY21 Results: Operating 11 Signing 9 100% score on the Disability free Aira service, which provides Stores globally. Equality Index. visual interpreter service for blind Signing Starbucks stores are led by Starbucks is committed to and low-vision customers and store partners who are proficient enhancing accessibility of the introduced new large-print Braille in sign language, whether they are Starbucks Experience for partners menus in all stores in the U.S. and hearing, hard of hearing or Deaf. 8 and customers. We are proud to be Canada. Starbucks operates 11 signing stores recognized for our inclusion policies Starting from the early stages of globally that provide a space for the and practices related to people with design, we strive to create accessible Deaf and hard of hearing community disabilities. In 2015, 2016, 2017, environments in our stores by to connect through sign language 2019 and 2021, Starbucks scored employing universal design principles and celebrate Deaf culture. 100 out of 100 on the Disability and in our digital world through Equality Index and was recognized the Starbucks app and accessible as a “Best Place to Work.” We are a websites. In FY21, we began offering member of Disability:IN’s Inclusion free Aira service, which provides Works program, a national forum for visual interpreter service for blind peer institutions to share best and and low-vision customers and evolving practices on Access and introduced new large-print Braille Disability Inclusion, and have signed menus in all stores in the U.S. and on to Disability:IN’s pledge, Are You Canada. In, committing to advance disability inclusion in the workplace. 8 The geographic scope of this data point includes all company- owned and operated stores in the U.S. and Canada. 9 The geographic scope of this data point includes all company- owned and operated stores globally.

People INCLUSION Refugee Support Veterans and Military Families FY21 Results: Starbucks hired 339 partners who self-identified as refugees FY21 Results: 78 Military Family Stores are now open, and we have hired 10 in the U.S., Canada and EMEA, bringing our cumulative total to 2,959. 7,720 Veterans and military spouses across Starbucks roles in the U.S. Starbucks has a longstanding history of creating opportunity and investing We are dedicated to serving Veterans, military service members and military in the people who are part of the communities we serve. That includes our spouses, whose leadership and sacrifice inspire us each day. Our goal is to commitment to hire refugees across the company, with a goal of hiring hire 5,000 military Veterans and military spouses annually, and in FY21 we 10,000 refugees globally by 2022. In FY21, Starbucks hired 339 refugees have hired more than 7,700 Veterans and military spouses across Starbucks globally, bringing our cumulative total of partners who have self-identified as roles in the U.S. refugees to 2,959. In the U.S., our efforts include a focus on hiring interpreters, Starbucks Military Family Stores have become a hub for active service personnel and their families who served alongside U.S. troops overseas to members, Veterans, families and communities all over the country. Because champion their talent, experience and resilience. Since announcing our military families often live far from family and friends, Military Family Stores commitment, we have built partnerships with organizations around the world are located near major military bases to serve as a place of connection and like International Rescue Committee, LIRS and Upwardly Global. Additionally, support. Each store also works with Veterans Service Organizations to help in FY21, Starbucks joined coalition efforts dedicated to welcoming Afghan connect local Veterans and their families to services and resources. By the refugees in the U.S. such as Mobilizing America for Refugees Fund and end of FY21, Starbucks 78 Military Family Stores were open across the United Welcome.US. States, with the goal to open 132 Military Family Stores by the end of 2022. The Starbucks Foundation, a 501(c)(3) charitable organization with a mission Starbucks is also dedicated to teaming up with service organizations that help to strengthen humanity by transforming lives across the world, awarded Veterans transition to civilian life, develop as leaders and leverage their skills $ more than 350,000 in grants to No One Left Behind, International Rescue and passion to positively change communities. Committee Seattle, ACCES Employment and Refugee Council U.K. - nonprofit organizations supporting the resettlement of Afghans in the United States, • Starbucks has partnered with Team RWB since 2017 to support their Canada and the United Kingdom in FY21. work in building a sense of belonging, camaraderie and inclusiveness for hundreds of thousands of Veterans. • Headstrong helps Veterans and their families heal the hidden wounds of war with confidential, free and effective mental health treatment. With an investment of $ 150,000, Starbucks catalyzed the Headstrong clinical counseling network in the Pacific Northwest. 10 The geographic scope of this data point includes globally company- owned and operated markets and licensed markets in EMEA.

People COMMUNITY We recognize a responsibility to strengthen the REP communities where we live, work and grow. 021 ORT 2 Starbucks impact in communities is most T 2 02 meaningful when our efforts begin with our OR 1 R EP E partners, who know their neighbors best. 1 R PO 20 TR 2T 02 RO 12 PER PER 120 2 TR O

People COMMUNITY Community Stores Hunger Relief FY21 Results: Starbucks dedicated FY21 Results: FoodShare food donation program is available at 100% of its 21st company operated stores in the U.S. and Canada. In FY21, 10.4 million meals Community Store in the th were donated in the U.S. and 1.2 million meals were donated in Canada.11 U.S., and its 13 Community Store in Asia. Since 2016, Starbucks has been committed to the fight against hunger Starbucks Community Stores are through its innovative FoodShare food donation program in partnership ® dedicated to providing economic with Feeding America , Second Harvest Canada and other hunger-relief opportunity in rural and urban organizations. In FY21, FoodShare was scaled to 100% of company-operated communities across the U.S. These stores in the U.S. and Canada, resulting in 10.4 million meals donated and stores are focused on hiring locally, 12 13.8 million pounds of food diverted from waste streams in the U.S., and 1.2 creating dedicated space for million meals donated and 1.4 million pounds of food diverted from waste communities to come together for streams in Canada. Since FoodShare was launched in U.S. in 2016, 39.4 million events, featuring local artists and meals have been donated while we have diverted 47.3 million pounds of food working with diverse contractors from waste streams. FoodShare in Canada launched in 2019, and through the for store construction and remodels. end of FY21, 3 million meals have been donated, along with 3.3 million pounds In FY21, Starbucks dedicated its 21st of food diverted from waste streams. Starbucks hunger relief programs also “When you’re on the receiving end, every bit counts,” Community Store in the U.S. and the expanded to international markets, including the United Kingdom, Japan and th Mexico. 13 Community Store in Asia on the says Antonio Flores Sanchez. journey to opening 100 Community Since 2016, Starbucks has invested $ Stores by the end of 2025. 45 million into hunger relief efforts in It’s 10:30 p.m. on a recent Tuesday night, and the cars are still stop- $ the U.S., and in FY21 made a commitment to reinvest 100 million by 2030. and-go in the drive-thru line at the Starbucks Community Store in Additionally, in FY21, we announced a new $ 1.7 million donation to Feeding Watts. Inside, Antonio, the store manager, is checking his inventory of America to advance equitable access to nutritious food, building on $ 2.69 perishable food. Sandwiches, salads, pastries, wraps. Various protein million invested in food bank mobile pantry programs since 2019. The equitable food access grants were distributed to 16 local Feeding America boxes filled with vegetables, eggs, cheese and chicken. He rifles member food banks located near Starbucks Community Stores. The grants through them all, filling an orange tote with unsold products. are designed to help food banks provide nutritious food to households with He walks the box to a refrigerator in the back and putting it inside. individuals who are BIPOC and residing in communities experiencing high On Wednesday, a delivery truck will stop at one of the Los Angeles rates of food insecurity. Regional Food Bank’s warehouses, a 90,000-square foot storage and distribution center that processes four million pounds of food donations every week. Starbucks uses an innovative backhaul model, which means the same drivers who drop off the supplies at each Starbucks store also pick up the donation boxes, unlocking efficiencies and possibilities that didn’t exist before. Nearly 700 smaller, local agencies work with the Los Angeles Regional Food Bank to get food free of charge for their own programs, whether it’s a larger sub-angency or a kids’ backpack program or a senior- citizen home delivery service. Starbucks helps support mobile food banks and refrigerated vans to ensure that fresh food is delivered 11 The geographic scope of this data point includes all company-owned and operated safely and on time. It’s a story that happens thousands of times over, stores in the U.S. and Canada. at every company-operated Starbucks in the United States. 12 According to the USDA, 1.2 pounds of food is the equivalent to one meal.

People COMMUNITY Community Resilience Fund Supplier Diversity and $ Inclusion FY21 Results: Starbucks committed to invest 100 million in a Community $ $ Resilience Fund; Starbucks deployed 10 million into Chicago Community FY21 Results: Nearly 800 million Development Financial Institutions (CDFIs) to support small businesses. 13 14 spent with Tier 1 diverse suppliers. Too often, entrepreneurs of color can’t thrive because they don’t get the The Starbucks Supplier Diversity and capital and support they need to succeed. In FY21, Starbucks executed its Inclusion program drives inclusion of FY20 commitment to partner with CDFIs to invest $ 10 million in small- qualified businesses with a focus on business development loans for Chicago’s underserved communities. suppliers of all sizes and categories. $ Building on this initiative, Starbucks committed to invest 100 million in In FY21, Starbucks spent nearly the Starbucks Community Resilience Fund. The Fund aims to advance racial $ 800 million with diverse suppliers, equity and environmental resilience by supporting small business growth and supporting more than 6,400 jobs community development projects in BIPOC communities with historically $ and contributing to 1.2 billion in total limited access to capital with a goal to have the total fund invested by 2025. direct, indirect and induced economic The investments will initially focus on 12 U.S. metropolitan areas and impact nationwide. Starbucks has $ their surrounding regions: Atlanta, Detroit, Houston, Los Angeles, Miami, spent more than 8 billion with Tier 1 Minneapolis, New Orleans, New York City, Philadelphia, San Francisco diverse suppliers since 2000. Bay Area, Seattle and Washington, D.C. In partnership with community leaders, CDFIs and other impact-focused financial institutions, the Fund will help provide access to capital intended to support small businesses and neighborhood projects, including those addressing the inequitable impacts of climate change. 13 Tier 1 refers to those suppliers from whom Starbucks directly purchases a given product. 14 The geographic scope of this data point includes all company-owned and operated stores in the U.S. and Canada.

People COMMUNITY Civic Engagement Resources Outreach Worker Program FY21 Results: In FY21, nearly 85,000 people – including customers and FY21 Results: Outreach workers partners – accessed voter registration and election information (via Fuel across six cities connected with Our Democracy) while more than 12,500 partners used civic education over 6,000 customers, helping to resources (via Starbucks Partners Vote). enroll more than 1,600 people in As part of Starbucks commitment to civic engagement, we continued to stabilizing programs. provide tools and resources for partners to ensure their voice is heard in each The Outreach Worker pilot program and every election. We provide partners with voter education and resources launched in FY20 in service to to make a plan to vote and support conversations between managers and support partners in high-complexity partners to ensure partners don’t have to choose between work and voting. stores by connecting them with In July 2021, Starbucks joined the Business for Voting Rights Coalition in hyperlocal street outreach and calling on Congress to update the Voting Rights Act, to help ensure protection social workers that have expertise in of the right to vote for all. connecting individuals to stabilizing programs and resources. The program initially launched in partnership with Community Champions United Way Worldwide and has since FY21 Results: More than 18,000 partners globally engaged as Community and partnered with local nonprofit Champions, participating in over 2,900 community events and donating organizations that specialize in street more than 45,000 volunteer hours to local nonprofit organizations.15 outreach and connect in individuals experiencing homelessness, mental Our vision is to empower every partner to be a Community Champion, and health and substance abuse to we provide the resources, tools and recognition for the many ways partners existing city-specific resources. can make a positive impact in the community. For some partners, being a During FY21, Starbucks scaled the Community Champion may mean donating unused food nightly as part of program to New York City, in addition their store’s FoodShare program. F or other partners it may include planning to continuing operations in its initial and participating in community service events, hosting donation drives in pilot cities (Philadelphia, Washington store, nominating community nonprofits for Neighborhood Grants, donating D.C., Seattle, Los Angeles and to nonprofit organizations or inspiring others to become Community Chicago). $ Champions. Starbucks matches up to 1,000 annually for both full-time and part-time partners’ eligible contributions to nonprofits, including a dollar- for-dollar match on financial donations and, with recent improvements in the program, a match for every hour of volunteer time donated to an eligible nonprofit organization . In support and recognition of U.S. and Canada Starbucks Partners’ Community Champion efforts, Starbucks donated over $ 1 million to more than 2,000 nonprofit organizations. 15 The geographic scope of this data point includes company-owned and operated markets in the U.S. and Canada, and licensed operations in the Bahamas, Indonesia, and Mexico.

People 021 REPORT 2 T 2 02 OR 1 R EP E 1 R PO 20 TR 2 T 02 RO 12 NAVIGATING A GLOBAL PANDEMIC PE R PE R 1 2 0 2 T R O Throughout the COVID-19 pandemic, Starbucks has remained committed to three guiding principles: 1 Prioritizing the health and well-being of our partners, 2 Playing a constructive role in supporting health and government officials, and 3 Showing up in positive and responsible ways to serve our community.

People NAVIGATING A GLOBAL PANDEMIC Our partners are the backbone of our business and they have continued to Support for Front-Line show up for their communities in the face of extraordinary circumstances. Responders Since the start of the COVID-19 pandemic and through FY21, we provided benefits to support our partners that included service pay, catastrophe pay, FY21 Results: Starbucks provided benefits continuation, expanded mental health support, expanded backup 1 million cups of coffee to first childcare support and food and beverage allowances. Additionally, we have and frontline responders through continued to strongly encourage all partners to get fully vaccinated and a partnership with Operation boosted against COVID-19, providing up to two hours of paid time off for Gratitude. partners to receive the vaccine, up to three doses, as well as up to 4 hours of Starbucks has served more than paid time off if partners experience vaccine-related side effects and miss a one million cups of free coffee scheduled shift within 48 hours of receiving the COVID-19 vaccine or booster. to first responders and front- We also created online tools for partners - along with their friends and family line responders supporting the - to create a vaccine plan and easily access state-specific information about healthcare industry. We continue to vaccine availability. And because our partners are known for giving back, we applaud and support our front-line continue to share volunteer opportunities for partners who want to support responder communities through safe and equitable vaccine access in their communities. donations to local organizations. A key part of our COVID-19 action plan is to stay informed and communicative about recommendations from national, state and local health authorities. Since the onset of COVID-19, Starbucks aligned with national, state and local health recommendations to ensure our business decisions are anchored to and guided by facts and science. In addition, Starbucks believes In January, Starbucks and other companies joined Washington State that businesses have a role and a responsibility to support our communities Governor Inslee and Challenge Seattle in a first-of-its-kind public- with safe and equitable vaccine access. In FY21, Starbucks shared educational private partnership (the COVID-19 Vaccine Action Command and information and resources about the COVID-19 vaccine and supported our Coordination System (VACCS) Center), to help optimize accelerated, safe communities in equitable vaccine access and distribution. and equitable access to the COVID-19 vaccines across Washington State. • Starbucks hosted scientists from • I n coffee and tea growing Utilizing the company’s Tryer Center Innovation Lab, Starbucks the Fred Hutchinson Cancer communities, The Starbucks contributed expertise in operational efficiency, scalable modeling and Research Center for virtual Foundation continued to human-centered design to Washington State’s vaccine distribution conversations with thousands of support urgent needs related to efforts. The Starbucks team used this work to inform three different partners to discuss the current COVID-19 of vulnerable families models: vaccination clinics, drive-through clinics and mobile pop- state of COVID-19 and facilitate in Brazil, Colombia, Costa Rica, ups to go to people in more rural or underserved areas. Starbucks, answers to partner questions Ethiopia, Guatemala, India, in partnership with Challenge Seattle and VACCS, also released a on vaccine effectiveness, virus Indonesia and Kenya. Working Playbook of best practices from this partnership, so that other states variants and antibodies and with nonprofit organizations and government leaders may leverage the findings and efficiencies for addressing fears about vaccines. such as Mercy Corps and Bean other mass vaccination sites across the country. • Starbucks and other companies Voyage, these efforts addressed joined a first-of-its-kind food insecurity, expanded access This partnership helped Washington State successfully accelerate public-private partnership, the to clean water and promoted vaccine distribution to meet Washington State’s 45,000 vaccinations Washington State Vaccine Action resilience building. per day goal. Command and Coordination • St arbucks and The Starbucks Systems (VACCS) Center, to help Foundation together contributed optimize accelerated, safe and $ nearly 500,000 to innovative equitable access to the COVID-19 programs designed to increase vaccine across Washington. equitable vaccine access.

People 021 REPORT 2 T 2 02 OR 1 R EP E 1 R PO 20 TR 2T 02 RO 12 PER PER THE STARBUCKS FOUNDATION 12 02 T RO The Starbucks Foundation is a U.S. 501(c)(3) charitable organization with a mission to strengthen humanity by transforming lives across the world. It is focused on enabling community resiliency and prosperity, and uplifting communities affected by disaster. In FY21, the Foundation provided more than $ 23 million in grants to nonprofit organizations across the U.S. and around the world.

People THE STARBUCKS FOUNDATION Origin Grants for Women & Girls $ FY21 Results: 15 unique grants totaling 5 million awarded in support of 16 women and girls in Origin communities. Since International Women’s Day 2018, the Foundation has been working toward a goal to empower 250,000 women and girls in coffee, tea and cocoa growing communities by 2025. Women play key roles for their households, farms and communities, and women are often most disproportionately impacted by evolving challenges, such as the climate crisis. We believe that investing in women and girls in coffee, tea and cocoa-growing regions significantly impacts both families and broader communities. The Starbucks Foundation’s Origin Grants help these communities continue to break down barriers to education, promote clean water, sanitation and hygiene (WASH) and create economic opportunities for women and girls. Through FY21, this effort has made a difference in the lives of more than 125,000 women in coffee- and tea- For Frank, a barista in Texas, volunteering is a way of paying it forward. growing front-line communities across Africa, Asia and Latin America. “When good things started happening to me, I felt I Neighborhood Grants needed to find something to give back to.” $ FY21 Results: 2 million awarded to more than 1,300 local nonprofits 17 Frank, 49, has been volunteering for Resource Center in Dallas for more nominated by Starbucks partners. than 20 years. As a young gay man, he first sought out Resource Center’s The Starbucks Foundation’s Neighborhood Grants are investments in nonprofit HIV education and prevention services when he moved to Dallas. It’s organizations – nominated by Starbucks partners – to help build sustained now one of the largest LGBTQ+ community centers in the country. local impact and inspire increased partner volunteerism in our communities. Frank volunteers at the center in a number of ways, but his heart lies Since 2019, more than 15,000 Starbucks partners have participated, resulting with the food service program. For the last decade, he’s organized in Neighborhood Grants to more than 3,000 organizations across the U.S. and $ Canada totaling more than 5 million. a Thanksgiving meal that has grown to serving over 400 people. In November 2020, the event was cancelled due to the pandemic. But his longtime volunteers still wanted to contribute. Frank also had help from his Starbucks partners. “It wasn’t what we normally did, but it was the next best thing to do. And to see my fellow partners come out to represent Starbucks…They knew it wasn’t going to be glamorous. It was going to be cold. It was going to be outside. They did it with grace and smiles.” Frank’s enthusiasm for Resource Center prompted his manager to nominate it for a Neighborhood Grant from The Starbucks Foundation. These grants are awarded to community nonprofits, all nominated by partners. 16 The geographic scope of this data point includes all company-owned and operated markets globally. “I’m hoping I can bring my experience with philanthropy and 17 The geographic scope of this data point includes all company-owned and operated community outreach to do more under the Starbucks umbrella.” stores in the U.S. and Canada.

People THE STARBUCKS FOUNDATION Youth Equity Grants International Grants Disaster Response $ $ FY21 Results: More than 4 million FY21 Results: More than 40 grants FY21 Results: Nearly 4 million $ in grants awarded to organizations totaling 8 million awarded to awarded to promote resilience and serving BIPOC youth. impact communities that we serve uplift communities impacted by 18 disaster.18 In 2020, The Starbucks Foundation outside of the United States. committed to invest $ 5 million in The Starbucks Foundation supports Throughout FY21, The Starbucks nonprofits that serve BIPOC youth. communities around the world, Foundation continued to uplift In FY21, The Starbucks Foundation including in close partnership with communities affected by disaster $ finalized its grant recipients: Big our Starbucks partners and business by investing nearly 4 million Brothers Big Sisters of America, partners in local markets. In 2018, in preparedness, response and Boys & Girls Clubs of America, The Starbucks Foundation committed resilience programs around the world, City Year, Covenant House, Junior to invest in social impact programs including to support communities Achievement USA, MENTOR, Public in China and in FY21, achieved the disproportionately impacted by the $ Allies and YWCA USA. These grants milestone of 12 million in grants to increased frequency and intensity will support diversity, equity China nonprofit organizations. For of disasters due to climate change. and inclusion initiatives, youth example, the Foundation provided In addition to national support of mentorship and leadership and life a grant to the China Foundation the American Red Cross and global skills for youth through national- and for Poverty Alleviation to promote support of World Central Kitchen’s local-level programs in communities sustainable livelihoods for farmers chef relief efforts, the Foundation across the United States. As of in Yunnan through vocational provided quick support to impacted January 2022, programs supported training and expansion of economic communities, from Hurricane Eta by the Foundation’s grants have opportunities. In FY21, The Starbucks and the Texas winter storms to the impacted more than 100,000 youth. Foundation also expanded its Miami building collapse and volcano partnership with Planet Water eruption in the Democratic Republic Foundation, engaging Starbucks of Congo. partners as volunteers to provide clean water access and hygiene education programs to communities in seven different countries. 18 The geographic scope of this data point includes all company-owned and operated markets globally.

People FY22 HIGHLIGHTS TO DATE At Starbucks, inclusion and belonging Advancing Equity Inclusive and Accessible Physical Positively Impacting Women and must be everyday realities - on both Diversity Across the Supply Chain and Digital Spaces Girls at Origin sides of the counter, in our Starbucks The Starbucks Supplier Diversity and With the recognition that one in four In FY22, The Starbucks Foundation Support Center, across our supply Inclusion program drives inclusion of American adults has a disability and met its commitment to empower chains and in farming communities qualified businesses with a focus on all people experience changes to 250,000 women and girls in origin around the world. Our work to suppliers of all sizes and categories. their physical or mental health, communities by 2025, ahead of enhance the well-being of all who In FY22, we announced our work Starbucks is working to extend schedule. In service of our ambition connect with Starbucks continues to increase the annual spend with disability inclusion and accessibility. to be people positive, The Starbucks in FY22. $ In FY22, Starbucks committed to Foundation committed to expand its diverse suppliers to 1.5 billion by commitment – seeking to positively 2030. design, test and scale more inclusive impact 1 million women and girls in Partner Investments Reaching More People design standards and experiences coffee-, tea- and cocoa- growing Every decision and every investment At Starbucks, we listen and learn across its store portfolio, with the communities by 2030. we make is to ensure our partners from our partners, our customers goal of ensuring that every physical are supported. To do this, we and our communities. To ensure and digital Starbucks environment Addressing the Root Causes of take bold actions with intention, we’re reaching diverse audiences, will meet a bolder, more accessible Chronic Homelessness in Seattle transparency and accountability. we committed to allotting 15% of our standard by 2030. Building on the company’s 50- In FY22 we built upon our work to advertising budget with minority- year legacy of work to strengthen increase pay for partners during the owned and targeted media Community Impact and uplift its hometown, in FY22, COVID-19 pandemic by announcing companies. Starbucks announced nearly a half new wage increases: Global Community Impact Grants a million dollars of investments Small Business Support The Starbucks Foundation, in that will take place throughout $ FY22, announced a $ • At least a 10% pay increase for In 2021, Starbucks created a 100 30 million 2022 to advance solutions that baristas, shift supervisors and million Community Resilience investment by 2030 in a new support those experiencing chronic café attendants hired on or Fund that is designed to support Global Community Impact Grants homelessness in the greater Seattle before September 14, 2020. small business growth and portfolio designed to drive locally region. These efforts include • At least an 11% pay increase for community development projects relevant impact in the communities partnering with the We Are In tenured partners with three in BIPOC communities. The initial where Starbucks operates around Coalition to support Partnership for years of continued service. investments are focused on 12 U.S. the world. To scale the initiative, Zero, led by the King County Regional metropolitan areas and surrounding The Starbucks Foundation invited Homelessness Authority (KCRHA), • A continued investment in shift regions: Atlanta, Detroit, Houston, partner companies (licensees) which expanding support for nonprofits supervisor pay to recognize Los Angeles, Miami, Minneapolis, operate the Starbucks brand across providing dignified access to basic this critical leadership role and New Orleans, New York City, its three international regions – Asia needs including bathrooms, showers attract the best talent. Philadelphia, San Francisco Bay Area, Pacific; Europe, Middle East & Africa; and laundry services for individuals • At least a 5% increase to all Seattle and Washington, D.C. As of and Latin America & the Caribbean experiencing chronic homelessness, starting pay rates to support January 2022, Starbucks has issued – to nominate local nonprofit expanding its commitments to the $ organizations for grants. These grants store managers in continuing to 21 million in funding to seven CDFIs chronically homeless population attract and retain new talent. through the Starbucks Community are intended to fund programs by supporting Plymouth Housing Resilience Fund. that create meaningful local or and extending its investment regional impact and expands on the in Northwest Harvest as part of company’s people positive ambition its FoodShare program. to enhance the well-being of all who connect with Starbucks.

Planet Starbucks is committed to being resource positive — giving back more than we take from the planet. Over the course of our 50 years, with the help of our partners, we have looked for ways to help protect our planet consistent with the belief that we can build a great business that scales for good — driving innovation, ensuring a sustainable future for coffee and caring for people. We have set a bold commitment to reduce our carbon, water and waste footprints in half by 2030, and we continue to work to ensure that our 2030 targets remain ambitious as science and measurement capabilities evolve.

Planet 2030 GOALS & PROGRESS Our aspiration to become resource-positive means we will give more than we take from the planet: storing more carbon than we emit, R E P O providing more clean freshwater than we use 021 RT 2 and eliminating waste. T 2 02 OR 1 R EP E 1 R PO 20 TR 2T 02 RO 12 PER PER 1202TRO

Planet 2030 GOALS & PROGRESS 2030 Planet Goals Carbon Water Waste 50% absolute reduction in scope 1, 50% of water withdrawals will be 50% reduction in waste sent to 2 and 3 greenhouse (GHG) emissions conserved or replenished across landfill from stores (including representing all of Starbucks direct Starbucks direct operations, stores, packaging that leaves stores) operations and value chain. packaging and agricultural supply and direct operations, driven by chain, prioritizing action in high- a broader shift toward a circular risk water basins while supporting economy. watershed health, ecosystem resilience and water equity. CO 2 We are governing our sustainability commitments through our Global “Starbucks sustainability journey has been driven Environmental Council, which is comprised of senior leaders across Starbucks by bold aspirations and a comprehensive approach. whose compensation is tied to performance against our goals. We also formally review and seek counsel from our Board of Directors Nominating Today, our goal is to become resource-positive, and Corporate Governance Committee, along with informal advisors who are storing more carbon than we emit, replenishing more experts and influencers in the sustainability sector. We can only achieve this ambition by working together with, and receiving freshwater than we use and eliminating waste. We set feedback from, our stakeholders — partners, suppliers, non-profit targets to cut our carbon, water and waste footprints organizations, industry partners, government, farmers and customers are all in half by 2030.” part of our journey to store more carbon than we emit, eliminate waste and replenish more freshwater than we use. In FY21, rooted in science, grounded in Starbucks Mission and Values and Michael Kobori, chief sustainability officer informed by comprehensive market research and trials, Starbucks finalized 2030 environmental goals to cut our carbon, water and waste footprints by half, working from a FY19 baseline.

2030 GOALS & PROGRESS Planet Since that time, Starbucks carbon goal has been validated as science-based from the Science Based Targets Initiative (“SBTi”). The SBTi has confirmed that the scope 1 and scope 2 portions of our 2030 carbon target are aligned with a 1.5°C pathway, the most ambitious level they validate. In FY20, we joined the newly established Transform to Net Zero (TONZ) initiative as a founding member. Comprised of nine founding members, the Initiative’s objective is to accelerate the transition to a net zero global economy no later than 2050 by developing and delivering research, guidance and roadmaps to guide businesses in achieving net zero emissions. Starbucks also expanded its goal to conserve or replenish 50% of water used in green coffee production in our direct operations to include global operations, agricultural supply chain and packaging, increasing the projected water conserved or replenished and addressing some of the biggest impacts on Starbucks water footprint. To achieve this, we will focus on expanding water conservation and replenishment efforts to include agricultural supply chains, global operations and packaging; catalyzing holistic watershed health improvements in highest risk basins; and by promoting equity and resiliency for communities through WASH. Starbucks endorsed the United Nations’ Water Resilience Coalition (WRC) to help preserve freshwater resources globally. Coalition members commit to collective action in water-stressed basins, to develop and implement resilient practices across their industry, and to provide leadership and advocacy in the field of water stewardship. Similar to last year, our progress against our 2030 commitments in FY21 was influenced by external factors, including COVID-19. Compared to FY19, GHG 19 emissions increased one percent and water withdrawals decreased by 11% 20 in FY21 . Starbucks diverted 32% of operational waste and 24% of packaging 21 was reusable, recyclable or compostable in FY21 . We are continuously improving data availability and quality as we improve our environmental impact measurement process. 19 At this stage in our journey toward significant reductions, an increase in GHG emissions is expected. We are identifying, testing and scaling innovative solutions across our global operations and engaging with our value chain while improving our measurement systems. 20 Water withdrawals decreased compared to FY19 because of shifts in agricultural commodities purchased due to changing customer preferences, continued impacts from COVID-19 and improvements to data quality and measurement processes. 21 In FY21, data reporting for waste diversion and packaging was changed to increase accuracy in measurement and better aligned to industry standards. We are reviewing our goal going forward.

Planet 021 REPORT 2 T 2 02 OR 1 R EP E 1 R PO 20 TR 2T 02 STRATEGIES FOR CHANGE RO 12 PER PER 1202TRO To meet our 2030 goals, we have set five key strategies rooted in science, grounded in Starbucks Mission and Values and informed by comprehensive research and trials: • Expand plant-based menu options • Shift away from single use to reusable packaging • I nvest in regenerative agriculture, reforestation, forest conservation and water replenishment in our supply chain • Invest in better ways to manage our waste • I nnovate to develop more sustainable stores, operations, manufacturing and delivery

Planet STRATEGIES FOR CHANGE Greener Stores Framework FY21 Results: 2,779 Greener Stores are certified globally. Announced in 2018, the Greener Stores Framework, co-developed with World Wildlife Fund, is designed to accelerate the transformation of retail towards lower-impact stores that achieve reductions in carbon emissions, water usage and landfill waste. With performance-based standards that incorporate design and extend throughout the life of a store, Starbucks Greener Stores in North America have reduced energy consumption by 30% compared with the company’s prior store designs. Additionally, state-of- the-art technologies treat and conserve water, reducing annual water use by more than 30%, saving more than 1.3 billion gallons of water annually. Meanwhile, 90% of company operated stores have adopted waste diversion and circular practices, including recycling, composting, Grounds for Your Garden and Starbucks FoodShare. In FY21, 2,779 Starbucks stores were certified Greener Stores and we Susan, a partner in Shanghai, is excited to be part of the first Greener expanded the framework to international markets, opening the first Greener Store outside of North America. “I feel very lucky to be store manager Store outside of North America in Shanghai with a focus on circularity. The at this very important store. As the first store in China to be certified Shanghai Greener Store has been designed and built to reduce waste, under the ‘Starbucks Greener Store’ standard, this store sets new repurpose goods and serve as a platform for future innovation. In FY22, benchmarks for green retail,” Susan says. Starbucks will continue the international expansion of this program with The Shanghai Greener Store is unique in that it will focus on Greener Stores opening in Japan, the U.K. and Chile. We aim to build and circularity, which means it was designed and built to reduce waste operate 10,000 Greener Stores globally by 2025. and repurpose goods. “[Greener Stores] lead sustainability solutions in store design, construction and operations, with [our Shanghai store] focusing on waste reduction. With the opening of this store, we invite customers and communities to adopt greener lifestyles,” Susan says. The store is designed to bring eco-friendly practices to life for customers. From using wood reclaimed from renovations at other Starbucks stores, to Starbucks green aprons made from recycled cups, to a Circular Lifestyle Lab that showcases sustainability-themed exhibitions featuring emerging young artists and advocates, the store promises to be an immersive learning experience for all. “Protecting the planet is everyone’s responsibility. We are all in this together for a better future. I would like to invite everyone to the store, joining us [in a] greener lifestyle,” Susan says.