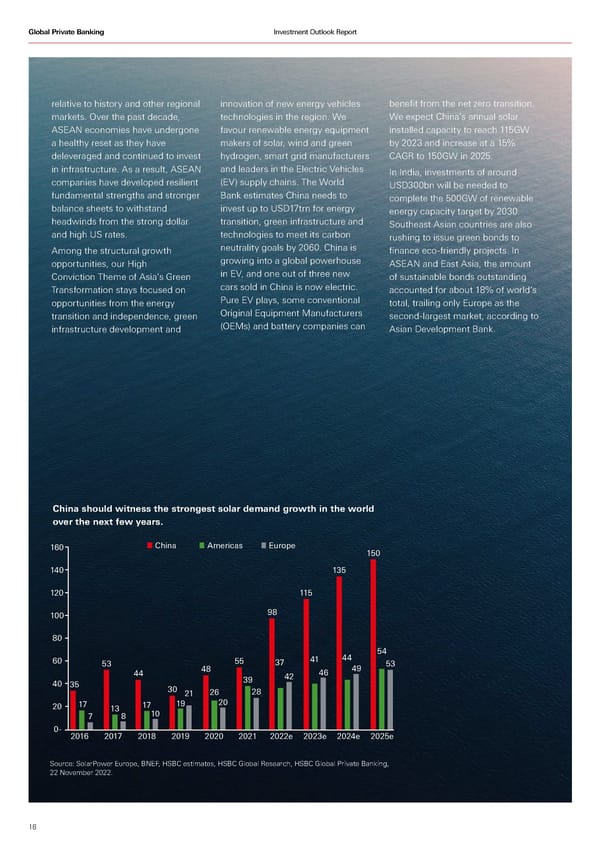

Global Private Banking Investment Outlook Report relative to history and other regional innovation of new energy vehicles benefit from the net zero transition. markets. Over the past decade, technologies in the region. We We expect China’s annual solar ASEAN economies have undergone favour renewable energy equipment installed capacity to reach 115GW a healthy reset as they have makers of solar, wind and green by 2023 and increase at a 15% deleveraged and continued to invest hydrogen, smart grid manufacturers CAGR to 150GW in 2025. in infrastructure. As a result, ASEAN and leaders in the Electric Vehicles In India, investments of around companies have developed resilient (EV) supply chains. The World USD300bn will be needed to fundamental strengths and stronger Bank estimates China needs to complete the 500GW of renewable balance sheets to withstand invest up to USD17trn for energy energy capacity target by 2030. headwinds from the strong dollar transition, green infrastructure and Southeast Asian countries are also and high US rates. technologies to meet its carbon rushing to issue green bonds to Among the structural growth neutrality goals by 2060. China is finance eco-friendly projects. In opportunities, our High growing into a global powerhouse ASEAN and East Asia, the amount Conviction Theme of Asia’s Green in EV, and one out of three new of sustainable bonds outstanding Transformation stays focused on cars sold in China is now electric. accounted for about 18% of world’s opportunities from the energy Pure EV plays, some conventional total, trailing only Europe as the transition and independence, green Original Equipment Manufacturers second-largest market, according to infrastructure development and (OEMs) and battery companies can Asian Development Bank. China should witness the strongest solar demand growth in the world over the next few years. 160 China Americas Europe 150 140 135 120 115 100 98 80 44 54 60 53 55 37 41 53 44 48 46 49 40 39 42 35 30 28 21 26 20 17 13 17 19 20 7 8 10 0- 2016 2017 2018 2019 2020 2021 2022e 2023e 2024e 2025e Source: SolarPower Europe, BNEF, HSBC estimates, HSBC Global Research, HSBC Global Private Banking, 22 November 2022. 16

HSBC Investment Outlook Q1 2023 Page 15 Page 17

HSBC Investment Outlook Q1 2023 Page 15 Page 17