Kaiser Permanente WA SoundChoice SBC (2024)

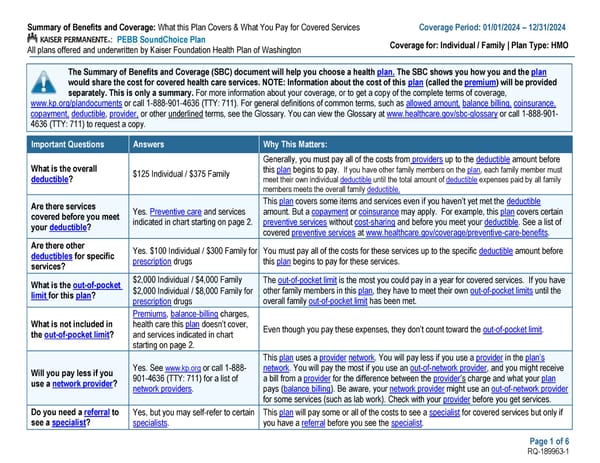

Summary of Benefits and Coverage: What this Plan Covers & What You Pay for Covered Services Coverage Period: 01/01/2024 – 12/31/2024 : PEBB SoundChoice Plan Coverage for: Individual / Family | Plan Type: HMO All plans offered and underwritten by Kaiser Foundation Health Plan of Washington The Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan would share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately. This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, www.kp.org/plandocuments or call 1-888-901-4636 (TTY: 711). For general definitions of common terms, such as allowed amount, balance billing, coinsurance, copayment, deductible, provider, or other underlined terms, see the Glossary. You can view the Glossary at www.healthcare.gov/sbc-glossary or call 1-888-901- 4636 (TTY: 711) to request a copy. Important Questions Answers Why This Matters: What is the overall Generally, you must pay all of the costs from providers up to the deductible amount before deductible? $125 Individual / $375 Family this plan begins to pay. If you have other family members on the plan, each family member must meet their own individual deductible until the total amount of deductible expenses paid by all family members meets the overall family deductible. Are there services This plan covers some items and services even if you haven’t yet met the deductible covered before you meet Yes. Preventive care and services amount. But a copayment or coinsurance may apply. For example, this plan covers certain your deductible? indicated in chart starting on page 2. preventive services without cost-sharing and before you meet your deductible. See a list of covered preventive services at www.healthcare.gov/coverage/preventive-care-benefits. Are there other Yes. $100 Individual / $300 Family for You must pay all of the costs for these services up to the specific deductible amount before deductibles for specific prescription drugs this plan begins to pay for these services. services? What is the out-of-pocket $2,000 Individual / $4,000 Family The out-of-pocket limit is the most you could pay in a year for covered services. If you have limit for this plan? $2,000 Individual / $8,000 Family for other family members in this plan, they have to meet their own out-of-pocket limits until the prescription drugs overall family out-of-pocket limit has been met. Premiums, balance-billing charges, What is not included in health care this plan doesn’t cover, Even though you pay these expenses, they don’t count toward the out-of-pocket limit. the out-of-pocket limit? and services indicated in chart starting on page 2. This plan uses a provider network. You will pay less if you use a provider in the plan’s Will you pay less if you Yes. See www.kp.org or call 1-888- network. You will pay the most if you use an out-of-network provider, and you might receive use a network provider? 901-4636 (TTY: 711) for a list of a bill from a provider for the difference between the provider’s charge and what your plan network providers. pays (balance billing). Be aware, your network provider might use an out-of-network provider for some services (such as lab work). Check with your provider before you get services. Do you need a referral to Yes, but you may self-refer to certain This plan will pay some or all of the costs to see a specialist for covered services but only if see a specialist? specialists. you have a referral before you see the specialist. Page 1 of 6 RQ-189963-1

Kaiser Permanente WA SoundChoice SBC (2024) Page 2

Kaiser Permanente WA SoundChoice SBC (2024) Page 2