The Procter & Gamble Annual Report

2022 Annual Report

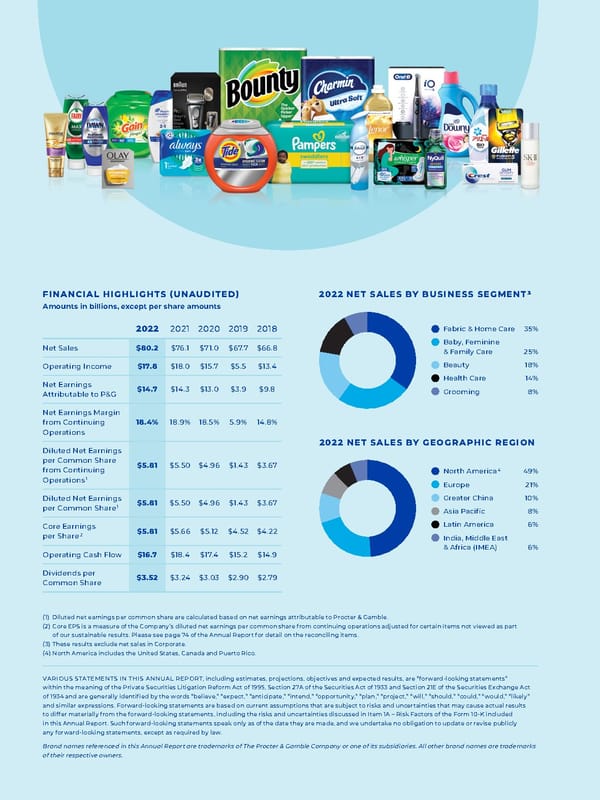

FINANCIAL HIGHLIGHTS (UNAUDITED) Amounts in billions, except per share amounts N/A 2022 2021 2020 2019 2018 Net Sales $80.2 $76.1 $71.0 $67.7 $66.8 Operating Income $17.8 $18.0 $15.7 $5.5 $13.4 Net Earnings Attributable to P&G $14.7 $14.3 $13.0 $3.9 $9.8 Net Earnings Margin from Continuing Operations 18.4% 18.9% 18.5% 5.9% 14.8% Diluted Net Earnings per Common Share from Continuing Operations 1 $5.81 $5.50 $4.96 $1.43 $3.67 Diluted Net Earnings per Common Share 1 $5.81 $5.50 $4.96 $1.43 $3.67 Core Earnings per Share 2 $5.81 $5.66 $5.12 $4.52 $4.22 Operating Cash Flow $16.7 $18.4 $ 17.4 $15.2 $14.9 Dividends per Common Share $3.52 $3.24 $3.03 $2.90 $2.79 2022 NET SALES BY BUSINESS SEGMENT 3 Fabric & Home Care 35% Baby, Feminine & Family Care 25% Beauty 18% Health Care 14% Grooming 8% 2022 NET SALES BY GEOGRAPHIC REGION North America 4 49% Europe 21% Greater China 10% Asia Pacific 8% Latin America 6% India, Middle East & Africa (IMEA) 6% (1) Diluted net earnings per common share are calculated based on net earnings attributable to Procter & Gamble. (2) Core EPS is a measure of the Company’s diluted net earnings per common share from continuing operations adjusted for certain items not viewed as part of our sustainable results. Please see page 74 of the Annual Report for detail on the reconciling items. (3) These results exclude net sales in Corporate. (4) North America includes the United States, Canada and Puerto Rico. VARIOUS STATEMENTS IN THIS ANNUAL REPORT , including estimates, projections, objectives and expected results, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and are generally identified by the words “believe,” “expect,” “anticipate,” “intend,” “opportunity,” “plan,” “project,” “will,” “should,” “could,” “would,” “likely” and similar expressions. Forward-looking statements are based on current assumptions that are subject to risks and uncertainties that may cause actual results to differ materially from the forward-looking statements, including the risks and uncertainties discussed in Item 1A – Risk Factors of the Form 10-K included in this Annual Report. Such forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise publicly any forward-looking statements, except as required by law. Brand names referenced in this Annual Report are trademarks of The Procter & Gamble Company or one of its subsidiaries. All other brand names are trademarks of their respective owners.

Dear Shareowners, Fiscal 2022 was another very strong year as the execution of our integrated strategies continued to yield strong sales, earnings and cash results in an incredibly difficult operating environment. Your Company delivered broad-based and strong top-line growth across our categories and regions, earnings growth in the face of significant cost headwinds, and continued strong cash return to you, P&G’s shareowners. For the fiscal year, organic sales grew 7%, core earnings per share grew 3%, currency-neutral core earnings per share were up 5%, and adjusted free cash flow productivity was 93%. Organic sales growth of 7% continues our strong top- line momentum, which is up 13% on a two-year stack (across fiscal years 2021 and 2022) and up 19% on a three-year stack (across fiscal years 2020, 2021 and 2022). Growth this fiscal year was broad-based across business units, with all 10 of our categories growing organic sales. Personal Health Care grew 20%. Fabric Care and Feminine Care grew double digits. Baby Care was up high single digits. Oral Care and Grooming were up mid-single digits. Hair Care, Home Care, Skin & Personal Care and Family Care each grew low single digits. Focus markets grew 5% and Enterprise markets w ere up 10%. We delivered strong results in our largest and most profitable market, the United States, with organic sales growing 8%. E-commerce sales increased 11%, representing 14% o f total Company sales. Global aggregate market share increased 50 basis points, and 38 of our top 50 category/country combinations held or grew share for the year. Importantly, this share growth is broad based. Nine o f 10 product categories grew share globally over the past year. Our bottom-line results include over $3 billion of earnings headwinds from commodities, freight and foreign exchange. Despite this, we delivered core EPS growth within our initial guidance range for the year. We returned nearly $19 billion of value to shareowners through $8.8 billion in dividends and $10 billion in share repurchase. In April, we announced a 5% increase in our dividend. This is the 66th consecutive annual dividend increase, and the 132nd consecutive year in which P&G has paid a dividend. Only seven U.S. publicly traded companies have paid a dividend in more consecutive years than P&G, and only three are recognized to have increased their dividend in more consecutive years than P&G. In summary, we met or exceeded each of our going-in target ranges for the fiscal year — organic sales growth, core EPS growth, free cash flow productivity and cash returned to shareowners. This is strong performance in very difficult operating conditions. +7% +3% 93% Organic Sales Growth Core EPS Growth Adjusted Free C ash Flow Productivity JON R. MOELLER Chairman of the Board, President and Chief Executive Officer Integrated Strategic Choices P&G employees have delivered great results over the past four years in a very challenging macro environment against very capable competition. In those four years, P&G people have added more than $13 billion in annual sales and roughly $5 billion in after-tax profit — executing our integrated strategies with excellence. The progress we have made, and our collective commitment to our strategies, give me confidence we can manage through the challenges we will continue

to face. Still, we are clear-eyed about the trials ahead. The operational, cost and currency challenges we dealt with over the last two years will continue in fiscal year 2023, and we begin the new fiscal year with consumers facing inflation levels not seen in the last 40 years. The best response to the uncertainties and challenges — double down on the integrated set of strategies that are delivering very strong results. We are focused on delighting and serving consumers, customers, society and shareowners through five strategic and integrated choices: a portfolio of daily- use products in categories where performance drives brand choice; superiority across product, package, brand communication, retail execution and value; productivity in everything we do; constructive disruption across the value chain; and an agile, accountable and empowered organization. These are not independent strategic choices. They reinforce and build on each other, and when executed well, they lead to balanced top- and bottom-line growth and value creation. There is still meaningful opportunity for improvement and leverage in every facet of this strategy, and we continue to work to strengthen our execution of these choices. A Portfolio of Superior, Da ily-Use Products P&G has a focused portfolio of daily-use products — many providing cleaning, health and hygiene benefits — in 10 categories where performance drives brand choice: Fabric Care, Home Care, Baby Care, Feminine Care, Family Care, Hair Care, Skin & Personal Care, Oral Care, Personal Health Care and Grooming. We know how to win in these categories — by delivering irresistibly superior propositions to our consumers and retail partners across product performance, packaging, brand communication, retail execution and value. Continued investment in these five vectors of superiority is critical to drive sustainable business growth. Even when our costs are rising sharply, we will not diverge from this strategy, especially when consumers are ever more focused on the performance and value of the brands they choose. Superiority to Win wit h Consumers We continue to raise the bar on all aspects of superiority — product, package, brand communication, retail execution and value — in all price tiers where we compete. INTEGRA TED GR OWTH STRATEGY PORTFOLIO performance drives br and choice SUPERIORITY to win with consumers PRODUCTIVITY to fuel investments CONSTRUCTIVE DISRUPTION across our business ORGANIZATION empowered, agile, accountable ii • The Procter & Gamble Company

We are leveraging this superiority to grow markets, and P&G’s share in them, as a way to sustainably build the business. Creating new business is powerful with our retail partners as we work to jointly create value. Superiority is especially critical in an inflationary environment. As consumers face increased pressure on nearly every aspect of their household budgets, we invest to deliver truly superior value through a combination of price and product performance to earn their loyalty every day. We are committed to keep investing to strengthen the superiority of our brands across innovation, supply chains and brand equity to deliver superior value for consumers. Ongoing Productivity The strategic need for investment to strengthen the long-term health and competitiveness of our brands, the short-term need to manage through significant cost increases, and the ongoing need to drive balanced top- and bottom-line growth, including margin expansion, underscore the importance of productivity. We have developed a strong productivity muscle over the last decade as we delivered two $10 billion savings programs. Productivity is part of our DNA now, which will help us address some of the challenges we face. We remain fully committed to cost and cash productivity in all facets of our business. No area of cost is left untouched. For example, as COVID-19 supply chain challenges ease and we reach a better balance of supply and demand, we will have an increased opportunity to implement cost savings projects in our manufacturing operations. As we leverage digital tools and automation, there will be more opportunities to focus employees on the higher-order work of serving consumers. And, as we continue to integrate data and analytics and artificial intelligence, brand teams will be working to make our marketing investments even more efficient and effective to deliver improved demand creation at equal or lower cost. Each business is driving productivity up and down their income statement and across their balance sheet, and we remain fully committed to productivity as a core driver of balanced top- and bottom-line growth and strong cash generation. We cannot let up here. Productivity will remain a significant part of our work, especially now. Measures of Superiority PRODUCT Products so good, consumers recognize the difference. Superior products raise expectations for performance in t he category. PACKAGING Packaging that attracts consumers, conveys brand eq uity, helps consumers select the best product for th eir needs, and delights consumers during use. BRAND COMMUNICATION Product and packaging benefits communicated with exceptional advertising th at makes you think, talk, laugh, cry, smile, act and buy — and that drives category and brand growth. RETAIL EXECUTION In-store: with the right store coverage, product forms, sizes, pr ice points, shelving and merchandising. Online: with the right content, assortment, ratings, reviews, search and subscription offerings. CONSUMER & CUSTOMER VALUE For consumers: all these elements presented in a clear and shoppable way at a compelling price. For customers: margin, penny profit, trip generation, ba sket size, and category growth.

PRODUCT An upgraded formula and unique packaging made Dawn EZ-Squeeze in the U.S. and Fairy Max Power in Europe stand- out products in fiscal 2022. The inverted bottle, no-flip cap and self-sealing valve allow for easy one-handed use of every drop of soap. These products contributed to mid-single digit hand dish global category growth and enabled additional distribution and shelf space across multiple markets and retailers. During fiscal 2022, they contributed to Dawn’s mid-single digit organic sales growth and grew the brand’s global value share by nearly one point. PACKAGING We have now introduced a plastic-free package for many Gillette and Venus products in every P&G region globally. It delights consumers as it is easier to open, read and select at shelf, and fully recyclable. We estimate this superior package could save the plastic equivalent of 85 million water bottles per year when fully launched.* In North America, one of the first regions where we launched, this innovation contributed to high single digit organic sales growth for P&G’s Grooming category in fiscal 2022, and globally helped to grow Grooming’s value share by over one point. *Based on FY20 sales RETAIL EXECUTION Nervive is a nerve care product launched in North America in fiscal 2022, helping to establish the nerve care category in that region after many successful years in Europe with Neurobion, a brand acquired with Merck in 2018. Eye-level brand blocks on-shelf and displays at top retailers grew sales by more than 40% where executed, and strong online content and search strategy supported e-commerce growth. As a result, Nervive contributed to Personal Health Care organic sales growth of 20% in fiscal 2022. CONSUMER & CUSTOMER VALUE Tide and Ariel offer a superior value equation. For consumers, our enhanced formula enables superior cleaning performance in cold water, creating energy savings and avoiding rewashing which may be necessary with less effective detergents. By reducing the energy required to heat water in the laundry process and improving garment life spans, consumers also see sustainability benefits. For customers, innovations like Tide Power PODS help drive category growth. In fiscal 2022, unit dose detergent grew organic sales in the low teens globally, with growth in every region, contributing to P&G’s double digit growth in the Fabric Care category.

BRAND COMMUNICATION A witty ‘edu-tainment’ campaign with celebrities and influencers reached millions of consumers across a range of digital and broadcast platforms. The campaign delivered a humorous approach to tampon and period education appealing to Gen Z and Millennial audiences. This campaign contributed to double digit organic sales growth for global Feminine Care in fiscal 2022, with value share up over one point. Read more about superiority at pg.com/ annualreport2022 A Constructive Disruption Mindset Success in our highly competitive industry also requires agility that comes with a mindset of constructive disruption — a willingness to change, adapt and create new trends and technologies that will shape our industry for the future. A mindset of constructive disruption is even more important in this challenging environment. A good example of constructive disruption in a category is Dawn Powerwash Dish Spray, which addresses the changing habit of washing dishes as you go instead of waiting until the end of a meal. The product enables direct application of activated suds to dishes to speed up the entire process, saving people not only time but also water. Another example is how we continue to reinvent brand building, including how we reach consumers more effectively and efficiently. Pampers, our largest and most global brand, is relatively unique in that its primary audience is narrow: parents of children at diapering age. To reach these parents more precisely, Pampers created the Pampers Rewards app so parents can receive helpful information, tips, deals and rewards. With this app, Pampers was able to build smart audiences to reach parents at different stages — like newborns, crawling and potty training — with more precise advertising specifically designed for each media platform, increasing the brand’s reach, effectiveness and efficiency, while driving cost savings. Success in our highly competitive industry re q uires the agility that comes with a mindset of constructive disruption — Lean Innovation Brand Building Supply Chain Digitization & Data Analytics The Procter & Gamble Company • v

An Empowered, Agile and Accountable Organization We strive for an empowered, agile and accountable organization with little overlap or redundancy — flowing to new demands and seamlessly supporting each other, through a culture of equality and inclusion, to de liver against our priorities around the world. P&G is organized around five industry-based sector business units (SBUs). These five sectors manage our 10 product categories, with full sales, profit, cash and value creation responsibility for our largest and most profitable markets — called Focus Markets — accounting for about 80% of Company sales and about 90% of after-tax profit. Enterprise Markets, which represent the rest of the world, are a separate unit with sales, profit and value creation responsibility. Over the last several years, we have been growing both top and bottom line in nearly all of these markets, which are important to the future of P&G. The best proof that this organization design is working is the growth of our largest and most profitable market, North America, whose growth has accelerated since we put this design in place. Organic sales in North America have increased from an average of +2% the three years prior to the design change to +8% in the three years since. This structure, and its resulting organizational speed and focus, has also allowed us to manage through the challenges and headwinds we are experiencing. We continue to believe that this structure — with the SBUs squarely concentrated on Focus Markets and managing Enterprise Markets as a separate operating unit — is the best way to navigate successfully through the increasingly dynamic world in which we live. Operating through five industry- based Sector Business Units Prov iding greater clarity on responsibilities and reporting lines Strengthening leadership accountability Enabling P&G people to accelerate growth and value creation Strengthening Our Strategy One of the most important things about our strategy — portfolio, superiority, productivity, constructive disruption, and an empowered, agile and accountable organization — is that it is inherently dynamic, not static. It requires being responsive to changing consumer needs and habits. It demands we serve evolving customer needs in rapidly transforming channels. Going forward, we have identified four areas to be even more deliberate and intentional about pursuing to further strengthen the execution of our strategy. The first is Supply. We are improving our supply chain capacity, agility, cost efficiency and resilience for a new reality and a new age. The capability investments we made prior to COVID-19 to improve our manufacturing and distribution networks in the U.S. and Europe helped us to manage through the last few years with relatively few prolonged issues. We are already making the next round of investments needed to ensure we have multiple qualified suppliers for key inputs, sufficient manufacturing capacity to satisfy growing demand and flexibility to meet the changing needs of all types of retailers. The second area is Environmental Sustainability. We are integrating sustainability into our product, packaging and supply chain innovation work to develop irresistibly superior offerings for consumers that are better for the environment. For example, our new cardboard packaging on Gillette razors reduces plastic packaging and offers a noticeably superior experience for consumers at the first and second moments of truth. Another example is our new fully recyclable paper packaging on our premium Always Cotton Protection pads recently launched in Germany. One more example is cold-water washing with Tide and Ariel. When people turn their wash cycles to cold, they can save up to 90% of the energy used on every load of laundry, while saving money. They also get greater satisfaction because their colors look brighter, and their clothes look newer longer. Better for the consumer, better for our planet. Third, we are increasing our Digital Acumen to drive consumer and customer preference, reduce cost and enable rapid and efficient decision making. Increased vi • The Procter & Gamble Company

digitization of our manufacturing lines, more use of artificial intelligence and more use of blockchain technology are not ends unto themselves. They are tools we can use to delight consumers and customers. Fourth, a Superior Employee Value Equation for all gender identities, races, ethnicities, sexual orientations, ages, and abilities — for all roles — to ensure we continue to attract, retain and develop the best talent. By definition, this must include equality. To deliver a superior employee value equation, there must be something in it for everyone. These are not new or separate strategies. They are necessary elements of focus in continuing to build superiority, in reducing cost to enable investment and value creation, and in strengthening our organization. They are part of the constructive disruption we must continue to lead. Meeting Consumer, Customer, Employee, Societal and Investor Needs In the ever more complex world we live in, it is not just top and bottom line that must be delivered and balanced. We must endeavor to deliver against the needs of an increasing number of constituents. This is especially true in our efforts in Environmental, Social and Governance (ESG), where consumer, customer, employee, society and shareowner expectations are growing. As I shared earlier, our consumers increasingly rely on us to deliver superior solutions that are sustainable. Our world requires that we do our part in this regard. This challenge is also an opportunity to extend our margin of superiority, further grow categories, and create more value, all while improving our own environmental impact, enabling consumers to reduce their footprint, and helping society solve some of the most pressing global challenges. Citizenship Community Impact Equality & Inclusion Environmental Sustainability Ethics & Corporate Responsibility For more about our work in all these areas, visit our ESG for Investors website at pginvestor.com/esg and read our latest Citizenship report at pg.com/citizenship . At P&G, we aim to be a force for growth and a force for good. The Procter & Gamble Company • vii

Our Community Impact work helps improve lives for people in difficult times by providing clean water and donations of product, time and money to those affected by natural disasters and crises around the world. It is also part of what employees are proud of and value in P&G. The ability to do good for the communities we live and work in also helps us attract and retain the best talent. We know we increase our chances of winning when we have an equal, diverse and inclusive culture that gives life to the best thoughts and ideas — a culture where everyone can succeed and is able to be their best. Externally, we support equality and inclusion efforts with our business partners and in the communities where we live and work because it is not only the right thing to do, but it also can improve income and wealth equity for more people, creating more purchasing power, which drives market growth. Our foundation is our Purpose, Values and Principles, which set a high standard for each P&G person. High standards are good. They require that we hold ourselves and each other accountable for results and, equally important, for how we achieve those results. Last year, we added an ESG factor to our annual incentive compensation program for our senior executives as a demonstration of our commitment to near-term progress toward our long-term ESG goals. Serving and balancing the needs of consumers, customers, employees, society and shareowners will not be easy, but it is necessary — and those that do it best, as I expect we will, should thrive. Looking Forward The integrated strategies we have outlined here were delivering strong results before the pandemic. They served us well during the more recent volatile times. They remain the right strategic choices to drive balanced growth and value creation. We endeavor to step forward into the challenges we face, not back, growing through near-term challenges, while serving consumers and communities. We are doing this in our interest, in society’s interest and in the interest of our long-term shareowners. Confidence in our future success is rooted in my confidence in P&G people. Every day, P&G people demonstrate their commitment to our Purpose, Values and Principles, their high motivation to win, their personal accountability to winning results, and their strong focus on sustained excellence in everything they do — serving consumers, serving customers and delivering for shareowners. JON R. MOELLER Chairman of the Board, President and Chief Executive Officer viii • The Procter & Gamble Company

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10 - K (Mark one) [x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 TRUE For the Fiscal Year Ended June 30, 2022 OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 False For the transition perio d from to Commission File No. 1 - 434 Cin cin nati THE PROCTER & GAMBLE COMPANY OH One Pro cter & Ga mbl e Pla za One Procter & Gamble Plaza, Cincinnati, Ohio 45202 452 02 513 Telephone (513) 983 - 1100 983 - 110 0 IRS Employer Identification No. 31 - 0411980 31 - 041 198 0 State of Incorporation: Ohio OH Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange on which registered Common Stock, without Par Value PG New York Stock Exchange 2.000% Notes due 2022 PG22B New York Stock Exchange 1.125% Notes due 2023 PG23A New York Stock Exchange 0.500% Notes due 2024 PG24A New York Stock Exchange 0.625% Notes due 2024 PG24B New York Stock Exchange 1.375% Notes due 2025 PG25 New York Stock Exchange 0.110% Notes due 2026 PG26D New York Stock Exchange 4.875% EUR Notes due May 2027 PG27A New York Stock Exchange 1.200% Notes due 2028 PG28 New York Stock Exchange 1.250% Notes due 2029 PG29B New York Stock Exchange 1.800% Notes due 2029 PG29A New York Stock Exchange 6.250% GBP Notes due January 2030 PG30 New York Stock Exchange 0.350% Notes due 2030 PG30C New York Stock Exchange 0.230% Notes due 2031 PG31A New York Stock Exchange 5.250% GBP Notes due January 2033 PG33 New York Stock Exchange 1.875% Notes due 2038 PG38 New York Stock Exchange 0.900% Notes due 2041 PG41 New York Stock Exchange Indicate by check mark if the registrant is a well - known seasoned issuer, as defined in Rule 40 5 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No Indicate by chec k mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to R ule 405 of Regulation S - T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes No Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non - accelerated filer, smaller reporting company, or an emerging growth company. See the def initions of "large accelerated filed," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rul e 12b - 2 of the Exchange Act. Large accelerated filer Accelerated filer Non - accelerated filer Smaller reporting company FALSE Emerging growth company FALSE If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b - 2 of the Exchange Act). Yes No False Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes - Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes No TR UE The aggregate market va lue of the voting stock held by non - affiliates amounted to $392 billion on December 31, 2021. There were 2,389,553,883 shares of Common Stock outstanding as of July 31, 2022. Documents Incorporated by Reference Portions of the Proxy Statement for the 2022 Annual Meeting of Shareholders, which will be filed within one hundred and twenty days of the fiscal year ended June 30, 2022 (2022 Proxy Statement), are incorporated by reference into Part III of this report to the extent described herein.

FORM 10 - K TABLE OF CONTENTS Page PART I Item 1. Business 1 Item 1A. Risk Factors 3 Item 1B. Unresolved Staff Comments 9 Item 2. Properties 9 Item 3. Legal Proceedings 9 Item 4. Mine Safety Disclosure 9 Information about our Executive Officers 10 PART II Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities 11 Item 6. Intentionally Omitted 12 Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations 13 Item 7A. Quantitative and Qualitative Disclosures about Market Risk 32 Item 8. Financial Statements and Supplementary Data 33 Management's Report and Reports of Independent Registered Public Accounting Firm 33 Consolidated Statements of Earnings 37 Consolidated Statements of Comprehensive Income 38 Consolidated Balance Sheets 39 Consolidated Statements of Shareholders' Equity 40 Consolidated Statements of Cash Flows 41 Notes to Consolidated Financial Statements 42 Note 1: Summary of Significant Accounting Policies 42 Note 2: Segment Information 44 Note 3: Supplemental Financial Information 46 Note 4: Goodwill and Intangible Assets 47 Note 5: Income Taxes 48 Note 6: Earnings Per Share 50 Note 7: Stock - based Compensation 50 Note 8: Postretirement Benefits and Employee Stock Ownership Plan 51 Note 9: Risk Management Activities and Fair Value Measurements 57 Note 10: Short - term and Long - term Debt 60 Note 11: Accumulated Other Comprehensive Income/(Loss) 61 Note 12: Leases 62 Note 13: Commitments and Contingencies 63 Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure 63 Item 9A. Controls and Procedures 63 Item 9B. Other Information 63 Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections 63 PART III Item 10. Directors, Executive Officers and Corporate Governance 64 Item 11. Executive Compensation 64 Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters 64 Item 13. Certain Relationships and Related Transactions and Director Independence 64 Item 14. Principal Accountant Fees and Services 64 PART IV Item 15. Exhibits and Financial Statement Schedules 65 Item 16. Form 10 - K Summary 67 Signatures 68 Exhibit Index 69

PART I Item 1. Business . The Procter & Gamble Company (the Company) is focused on providing branded products of superior quality and value to improve the lives of the world's consumers, now and for generations to come. The Company was incorporated in Ohio in 1905, having first been established as a New Jersey corporation in 1890, and was built from a bu siness founded in Cincinnati in 1837 by William Procter and James Gamble. Today, our products are sold in approximately 180 countries and territories. Additional information required by this item is incorporated herein by reference to Management's Discuss ion and Analysis (MD&A); and Notes 1 and 2 to our Consolidated Financial Statements. Unless the context indicates otherwise, the terms the "Company," "P&G," "we," "our" or "us" as used herein refer to The Procter & Gamble Company (the registrant) and its subsidiaries. Throughout this Form 10 - K, we incorporate by reference information from other documents filed with the Securities and Exchange Commission (SEC). The Company's Annual Report on Form 10 - K, quarterly reports on Form 10 - Q and current reports on F orm 8 - K, and amendments thereto, are filed electronically with the SEC. The SEC maintains an internet site that contains these reports at: www.sec.gov. Reports can also be accessed through links from our website at: www.pginvestor.com. P&G includes the website link solely as a textual reference. The information contained on our website is not incorporated by reference into this report. Copies of these reports are also available, without charge, by contacting EQ Shareowner Services, 1100 Centre Pointe Cu rve, Suite 101, Mendota, MN 55120 - 4100. Financial Information about Segments Information about our reportable segments can be found in the MD&A and Note 2 to our Consolidated Financial Statements. Narrative Description of Business Business Model . Our busi ness model relies on the continued growth and success of existing brands and products, as well as the creation of new innovative products and brands. The markets and industry segments in which we offer our products are highly competitive. Our products ar e sold in approximately 180 countries and territories through numerous channels as well as direct - to - consumer. Our growth strategy is to deliver meaningful and noticeable superiority across five key vectors of our consumer proposition - product performanc e, packaging, brand communication, retail execution and consumer and customer value. We use our research and development (R&D) and consumer insights to provide superior products and packaging. We utilize our marketing and online presence to deliver super ior brand messaging to our consumers. We work collaboratively with our customers to deliver superior retail execution, both in - store and online. In conjunction with the above vectors, we provide superior value to consumers and our retail customers in eac h price tier in which we compete. Productivity improvement is also critical to delivering our objectives of balanced top and bottom - line growth and value creation. Key Product Categories . Information on key product categories can be found in the MD&A an d Note 2 to our Consolidated Financial Statements. Key Customers . Our customers include mass merchandisers, e - commerce (including social commerce) channels, grocery stores, membership club stores, drug stores, department stores, distributors, wholesalers, specialty beauty stores (including airport duty - free stores), high - frequency stores, pharmacies, electronics stores and professional channels. We also sell direct to consumers. Sales to Walmart Inc. and its affiliates represent approximately 15% of our total sales in 2022, 2021 and 2020. No other customer represents more than 10% of our total sales. Our top ten customers accounted for approximately 39% of our total sales in 2022, 39% in 2021 and 38% in 2020. Sources and Availability of Materials . Al most all of the raw and packaging materials used by the Company are purchased from third parties, some of whom are single - source suppliers. We produce certain raw materials, primarily chemicals, for further use in the manufacturing process. In addition, fuel, natural gas and derivative products are important commodities consumed in our manufacturing processes and in the transportation of input materials and finished products. The prices we pay for materials and other commodities are subject to fluctuatio n. When prices for these items change, we may or may not pass the change to our customers. The Company purchases a substantial variety of other raw and packaging materials, none of which are material to our business taken as a whole. Trademarks and Paten ts . We own or have licenses under patents and registered trademarks, which are used in connection with our activity in all businesses. Some of these patents or licenses cover significant product formulation and processes used to manufacture our products. The trademarks are important to the overall marketing and branding of our products. All major trademarks in each business are registered. In part, our success can be attributed to the existence and continued protection of these trademarks, patents and licenses. Competitive Condition . The markets in which our products are sold are highly competitive. Our products compete against similar products of many large and small companies, including well - known global competitors. In many of the markets and indu stry segments in which we sell our products, we compete against other branded products as well as retailers' private - label brands. We are well positioned in the industry segments and markets in which we operate, often holding a leadership or significant m arket share position. We support our products with advertising, promotions and other marketing vehicles to build awareness The Procter & Gamble Company 1

and trial of our brands and products in conjunction with our sales force. We believe this combination provides the most efficient method of marketing for these types of products. Product quality, performance, value and packaging are also important differentiating factors. Government Regulation . Our Company is subject to a wide variety of laws and regulations across the countries in which we do business. In the United States, many of our products and manufacturing operations are subject to one or more federal or state regulatory agencies, including the U.S. Food and Drug Administration (FDA), the Environmental Protection Agency (EPA ), the Occupational Safety and Health Administration (OSHA), the Federal Trade Commission (FTC) and the Consumer Product Safety Commission (CPSC). We are also subject to anti - corruption laws and regulations, such as the U.S. Foreign Corrupt Practices Act, and antitrust and competition laws and regulations that govern our dealings with suppliers, customers, competitors and government officials. In addition, many foreign jurisdictions in which we do business have regulations and regulatory bodies that gove rn similar aspects of our operations and products, in some cases to an even more significant degree. We are also subject to expanding laws and regulations related to environmental protection and other sustainability - related matters, non - financial reportin g and diligence, labor and employment, trade, taxation and data privacy and protection, including the European Union’s General Data Protection Regulation (GDPR) and similar regulations in states within the United States and in countries around the world. For additional information on the potential impacts of global legal and regulatory requirements on our business, see “Item 1A. Risk Factors” herein. The Company has in place compliance programs and internal and external experts to help guide our business i n complying with these and other existing laws and regulations that apply to us around the globe; and we have made, and plan to continue making, necessary expenditures for compliance with these laws and regulations. We also expect that our many suppliers, consultants and other third parties working on our behalf share our commitment to compliance, and we have policies and procedures in place to manage these relationships, though they inherently involve a lesser degree of control over operations and governa nce. We do not expect that the Company’s expenditures for compliance with current government regulations, including current environmental regulations, will have a material effect on our total capital expenditures, earnings or competitive position in fisca l year 2023 as compared to prior periods. Human Capital . Our employees are a key source of competitive advantage. Their actions, guided by our Purpose, Values and Principles (PVPs), are critical to the long - term success of our business. We aim to retain our talented employees by offering competitive compens ation and benefits, strong career development and a respectful and inclusive culture that provides equal opportunity for all. Our Board of Directors, through the Compensation and Leadership Development Committee (C&LD Committee), provides oversight of th e Company’s policies and strategies relating to talent including diversity, equality and inclusion as well as the Company’s compensation principles and practices. The C&LD Committee also evaluates and approves the Company’s compensation plans, policies an d programs applicable to our senior executives. Employees As of June 30, 2022, the Company had approximately 106,000 employees, an increase of five percent versus the prior year due primarily to business growth. The total number of employees is an estimate of total Company employees excluding interns, co - ops, contractors and employees of joint ventures. 49% of our employees are in manufacturing roles and 26% of our employees are located in the United States. 41% of our global employees are women. As of June 30, 2022, 28% of our U.S. employees identify as multicultural. Training and Development We focus on attracting, developing and retaining skilled and diverse talent, both from universities and the broader market. We recruit from among the best universities across markets in which we compete and are generally able to select from the top talent. We focus on developing our employees by providing a variety of job experiences, training programs and skill development opportunities. Given our develop - from - within model for staffing most of our senior leadership positions, it is particularly important for us to ensure holistic growth and full engagement of our employees. Diversity, Equality and Inclusion As a consumer products company, we believe that it is important for our workforce to reflect the diversity of our consumers worldwide. We also seek to foster an inclusive work environment where each individual can bring their authentic self, which helps drive innovation and enables us to better serve o ur consumers. We aspire to achieve equal gender representation globally and at key management and leadership levels. Within the U.S. workforce, our aspiration is to achieve 40% multicultural representation overall as well as at management and leadership levels. Compensation and Benefits Our compensation plans are based on the principles of paying for performance, paying competitively versus peer companies that we compete with for talent and in the marketplace and focusing on long - term success through a c ombination of short - term and long - term incentive programs. We also offer competitive benefit programs, including retirement plans and health insurance in line with local country practices with flexibility to accommodate the needs of a diverse workforce. S ustainability . Environmental sustainability is a key focus area and integrated into P&G’s business strategies. The Company has declared its focus on developing irresistibly superior products and packages that are sustainable. The Company announced an am bition to reduce greenhouse gas emissions, purchase renewable electricity for our operations, reduce our use of virgin petroleum - based plastic in our packaging, increase the recyclability or reusability of our packaging and increase responsible sourcing of key forest - based commodities such as wood pulp and palm oil. 2 The Procter & Gamble Company

Additional detailed information on our sustainability efforts including our TCFD (Task Force on Climate - Related Financial Disclosures), SASB (Sustainability Accounting Standards Board) and CDP (Carbon Disclosure Project) reports can be found on our website at https://pginvestor.com/esg. References to our sustainability reports and website are for informational purposes only and neither the sustainability reports nor the other information on our website is incorporated by reference into this Annual Report on Form 10 - K. Item 1A. Risk Factors. We discuss our expectations regarding future performance, events and outcomes, such as our business outlook and objectives in this Form 10 - K, as well as in our quarterly and annual reports, current reports on Form 8 - K, press releases and other written and oral communications. All statements, except for historical and present factual information, are “forward - looking statements” and are based on financial data and business plans available only as of the time the statements are made, which may become outdated or incomplete. We assume no obligation to update any forward - looking statements as a result of new information, future events or other factors, except to the extent required by law. Forward - looking statements are inherently uncertain, and investors must recognize that events could significantly differ from our expectations. The following discussion of “risk factors” identifies significant factors that may adversely affect our business, operations, financial position or future financial performance. This information should be read in conjunction with Management's Discussion and Analysis and the Consolidated Financial Statements and related Notes incorpo rated in this report. The following discussion of risks is not all inclusive but is designed to highlight what we believe are important factors to consider when evaluating our expectations. These and other factors could cause our future results to differ from those in the forward - looking statements and from historical trends, perhaps materially. MACROECONOMIC CONDITIONS AND RELATED FINANCIAL RISKS Our business is subject to numerous risks as a result of having significant operations and sales in interna tional markets, including foreign currency fluctuations, currency exchange or pricing controls and localized volatility. We are a global company, with operations in approximately 70 countries and products sold in approximately 180 countries and territories around the world. We hold assets, incur liabilities, generate sales and pay expenses in a variety of currencies other than the U.S. dollar, and our operations outside the U.S. generate more than fifty percent of our annual net sales. Fluctuations in exc hange rates for foreign currencies have and could continue to reduce the U.S. dollar value of sales, earnings and cash flows we receive from non - U.S. markets, increase our supply costs (as measured in U.S. dollars) in those markets, negatively impact our c ompetitiveness in those markets or otherwise adversely impact our business results or financial condition. Further, we have a significant amount of foreign currency debt and derivatives as part of our capital markets activities. The maturity cash outflow s of these instruments could be adversely impacted by significant appreciation of foreign currency exchange rates (particularly the Euro), which could adversely impact our overall cash flows. Moreover, discriminatory or conflicting fiscal or trade policie s in different countries, including changes to tariffs and existing trade policies and agreements, could adversely affect our results. See also the Results of Operations and Cash Flow, Financial Condition and Liquidity sections of the MD&A and the Consoli dated Financial Statements and related Notes. We also have businesses and maintain local currency cash balances in a number of countries with currency exchange, import authorization, pricing or other controls or restrictions, such as Nigeria, Turkey, Argen tina and Egypt. Our results of operations, financial condition and cash flows could be adversely impacted if we are unable to successfully manage such controls and restrictions, continue existing business operations and repatriate earnings from overseas, or if new or increased tariffs, quotas, exchange or price controls, trade barriers or similar restrictions are imposed on our business. Additionally, our business, operations or employees have been and could continue to be adversely affected (including by the need to de - consolidate or even exit certain businesses in particular countries) by political volatility, labor market disruptions or other crises or vulnerabilities in individual countries or regions, including political instability or upheaval or acts of war (such as the Russia - Ukraine War) and the related government and other entity responses, broad economic instability or sovereign risk related to a default by or deterioration in the creditworthiness of local governments, particularly in emerging mar kets. Uncertain economic or social conditions may adversely impact demand for our products or cause our customers and other business partners to suffer financial hardship, which could adversely impact our business. Our business could be negatively impacted by reduced demand for our products related to one or more significant local, regional or global economic or social disruptions. These disruptions have included and may in the future include: a slow - down, recession or inflationary press ures in the general economy; reduced market growth rates; tighter credit markets for our suppliers, vendors or customers; a significant shift in government policies; significant social unrest; the deterioration of economic relations between countries or re gions, including potential negative consumer sentiment toward non - local products or sources; or the inability to conduct day - to - day transactions through our financial intermediaries to pay funds to or collect funds from our customers, vendors and suppliers . Additionally, these and other economic conditions may cause our suppliers, distributors, contractors or other third - party partners to suffer financial or operational difficulties that they cannot overcome, resulting in their inability to provide us with the materials and services we need, in which case our business and results of operations could be adversely affected. The Procter & Gamble Company 3

Customers may also suffer financial hardships due to economic conditions such that their accounts become uncollectible or are subject to longer collection cycles. In addition, if we are unable to generate sufficient sales, income and cash flow, it could affect the Company’s ability to achieve expected share repurchase and dividend payments. Disruptions in credit markets or to our banking p artners or changes to our credit ratings may reduce our access to credit or overall liquidity. A disruption in the credit markets or a downgrade of our current credit rating could increase our future borrowing costs and impair our ability to access capital and credit markets on terms commercially acceptable to us, which could adversely affect our liquidity and capital resources or significantly increase our cost of capital. In addition, we rely on top - tier banking partners in key markets around the world, who themselves face economic, societal, political and other risks, for access to credit and to facilitate collection, payment and supply chain finance programs. A disruption to one or more of these top - tier partners could impact our ability to draw on exi sting credit facilities or otherwise adversely affect our cash flows or the cash flows of our customers and vendors. Changing political conditions could adversely impact our business and financial results. Changes in the political conditions in markets in which we manufacture, sell or distribute our products may be difficult to predict and may adversely affect our business and financial results. Results of elections, referendums, sanctions or other political processes in certain markets in which our produc ts are manufactured, sold or distributed could create uncertainty regarding how existing governmental policies, laws and regulations may change, including with respect to sanctions, taxes, tariffs, import and export controls and the general movement of goo ds, services, capital and people between countries and other matters. The potential implications of such uncertainty, which include, among others, exchange rate fluctuations, new or increased tariffs, trade barriers and market contraction, could adversely affect the Company’s results of operations and cash flows. The war between Russia and Ukraine has adversely impacted and could continue to adversely impact our business and financial results. The war between Russia and Ukraine has negatively impacted, and the situation it generates may continue to negatively impact, our operations. Beginning in March 2022, the Company reduced its product portfolio, discontinued new capital investments and suspended media, advertising and promotional activity in Russia. F uture impacts to the Company are difficult to predict due to the high level of uncertainty as to how the overall situation will evolve. Within Ukraine, there is a possibility of physical damage and destruction of our two manufacturing facilities, our dist ribution centers or those of our customers. We may not be able to operate our manufacturing sites and source raw materials from our suppliers or ship finished products to our customers. Within Russia, we may reduce further or discontinue our operations d ue to sanctions and export controls and counter - sanctions, monetary, currency or payment controls, restrictions on access to financial institutions, supply and transportation challenges or other circumstances and considerations. Ultimately, these could re sult in loss of assets or impairments of our manufacturing plants and fixed assets or write - downs of other operating assets and working capital. The war between Russia and Ukraine could also amplify or affect the other risk factors set forth in this Part I, Item 1A, including, but not limited to, foreign exchange volatility, disruptions to the financial and credit markets, energy supply and supply chain disruptions, increased risks of an information security or operational technology incident, cost fluctu ations and commodity cost increases and increased costs to ensure compliance with global and local laws and regulations. The occurrence of any of these risks, combined with the increased impact from the war between Russia and Ukraine, could adversely impa ct our business and financial results. More broadly, there could be additional negative impacts to our net sales, earnings and cash flows should the situation worsen, including, among other potential impacts, economic recessions in certain neighboring cou ntries or globally due to inflationary pressures, energy and supply chain cost increases or the geographic proximity of the war relative to the rest of Europe. BUSINESS OPERATIONS RISKS Our business results depend on our ability to manage disruptions in our global supply chain. Our ability to meet our customers’ needs and achieve cost targets depends on our ability to maintain key manufacturing and supply arrangements, including execution of supply chain optimizations and certain sole supplier or sole man ufacturing plant arrangements. The loss or disruption of such manufacturing and supply arrangements, including for issues such as labor disputes or controversies, loss or impairment of key manufacturing sites, discontinuity or disruptions in our internal information and data systems or those of our suppliers, inability to procure sufficient raw or input materials (including water, recycled materials and materials that meet our labor standards), significant changes in trade policy, natural disasters, increa sing severity or frequency of extreme weather events due to climate change or otherwise, acts of war or terrorism, disease outbreaks or other external factors over which we have no control, have at times interrupted and could, in the future, interrupt prod uct supply and, if not effectively managed and remedied, could have an adverse impact on our business, financial condition, results of operations or cash flows. Our businesses face cost fluctuations and pressures that could affect our business results. Our costs are subject to fluctuations, particularly due to changes in the prices of commodities (including certain petroleum - derived materials like resins and paper - based 4 The Procter & Gamble Company

materials like pulp) and raw and packaging materials and the costs of labor, transportat ion (including trucks and containers), energy, pension and healthcare. Inflation pressures could also result in increases in these input costs. Therefore, our business results depend, in part, on our continued ability to manage these fluctuations through pricing actions, cost saving projects and sourcing decisions, while maintaining and improving margins and market share. Failure to manage these fluctuations could adversely impact our results of operations or cash flows. The ability to achieve our busine ss objectives depends on how well we can compete with our local and global competitors in new and existing markets and channels. The consumer products industry is highly competitive. Across all of our categories, we compete against a wide variety of globa l and local competitors. As a result, we experience ongoing competitive pressures in the environments in which we operate, which may result in challenges in maintaining sales and profit margins. To address these challenges, we must be able to successfull y respond to competitive factors and emerging retail trends, including pricing, promotional incentives, product delivery windows and trade terms. In addition, evolving sales channels and business models may affect customer and consumer preferences as well as market dynamics, which, for example, may be seen in the growing consumer preference for shopping online, ease of competitive entry into certain categories and growth in hard discounter channels. Failure to successfully respond to competitive factors a nd emerging retail trends and effectively compete in growing sales channels and business models, particularly e - commerce and mobile or social commerce applications, could negatively impact our results of operations or cash flows. A significant change in cu stomer relationships or in customer demand for our products could have a significant impact on our business. We sell most of our products via retail customers, which include mass merchandisers, e - commerce (including social commerce) channels, grocery store s, membership club stores, drug stores, department stores, distributors, wholesalers, specialty beauty stores (including airport duty - free stores), high - frequency stores, pharmacies, electronics stores and professional channels. Our success depends on our ability to successfully manage relationships with our retail trade customers, which includes our ability to offer trade terms that are mutually acceptable and are aligned with our pricing and profitability targets. Continued concentration among our retai l customers could create significant cost and margin pressure on our business, and our business performance could suffer if we cannot reach agreement with a key customer on trade terms and principles. Our business could also be negatively impacted if a ke y customer were to significantly reduce the inventory level of or shelf space allocated to our products as a result of increased offerings of other branded manufacturers, private label brands and generic non - branded products or for other reasons, significa ntly tighten product delivery windows or experience a significant business disruption. If the reputation of the Company or one or more of our brands erodes significantly, it could have a material impact on our financial results. The Company's reputation, a nd the reputation of our brands, form the foundation of our relationships with key stakeholders and other constituencies, including consumers, customers and suppliers. The quality and safety of our products are critical to our business. Many of our brand s have worldwide recognition and our financial success directly depends on the success of our brands. The success of our brands can suffer if our marketing plans or product initiatives do not have the desired impact on a brand's image or its ability to at tract consumers. Our results of operations or cash flows could also be negatively impacted if the Company or one of our brands suffers substantial harm to its reputation due to a significant product recall, product - related litigation, defects or impuritie s in our products, product misuse, changing consumer perceptions of certain ingredients, negative perceptions of packaging (such as plastic and other petroleum - based materials), lack of recyclability or other environmental impacts, concerns about actual o r alleged labor or equality and inclusion practices, privacy lapses or data breaches, allegations of product tampering or the distribution and sale of counterfeit products. Additionally, negative or inaccurate postings or comments on social media or netwo rking websites about the Company or one of its brands could generate adverse publicity that could damage the reputation of our brands or the Company. If we are unable to effectively manage real or perceived issues, including concerns about safety, quality , ingredients, efficacy, environmental or social impacts or similar matters, sentiments toward the Company or our products could be negatively impacted, and our results of operations or cash flows could suffer. Our Company also devotes time and resources to citizenship efforts that are consistent with our corporate values and are designed to strengthen our business and protect and preserve our reputation, including programs driving ethics and corporate responsibility, strong communities, equality and inclu sion and environmental sustainability. While the Company has many programs and initiatives to further these goals, our ability to achieve these goals is impacted in part by the actions and efforts of third parties including local and other governmental au thorities, suppliers, vendors and customers. If these programs are not executed as planned or suffer negative publicity, the Company's reputation and results of operations or cash flows could be adversely impacted. We rely on third parties in many aspects of our business, which creates additional risk. Due to the scale and scope of our business, we must rely on relationships with third parties, including our suppliers, contract manufacturers, distributors, contractors, commercial banks, joint ventur e partners and external business partners, for certain functions. If we are unable to effectively manage our third - party relationships and the agreements under which our third - party partners operate, our results of operations and cash flows could be adver sely impacted. Further, failure of these third parties to meet their obligations to the Company or substantial disruptions in the relationships between the The Procter & Gamble Company 5

Company and these third parties could adversely impact our operations and financial results. Addi tionally, while we have policies and procedures for managing these relationships, they inherently involve a lesser degree of control over business operations, governance and compliance, thereby potentially increasing our financial, legal, reputational and operational risk. A significant information security or operational technology incident, including a cybersecurity breach, or the failure of one or more key information or operations technology systems, networks, hardware, processes and/or associated sites owned or operated by the Company or one of its service providers could have a material adverse impact on our business or reputation. We rely extensively on information and operational technology (IT/OT) systems, networks and services, including internet a nd intranet sites, data hosting and processing facilities and technologies, physical security systems and other hardware, software and technical applications and platforms, many of which are managed, hosted, provided and/or used by third parties or their v endors, to assist in conducting our business. The various uses of these IT/OT systems, networks and services include, but are not limited to: • ordering and managing materials from suppliers; • converting materials to finished products; • shipping products to customers; • marketing and selling products to consumers; • collecting, transferring, storing and/or processing customer, consumer, employee, vendor, investor and other stakeholder information and personal data, including such data from persons cov ered by an expanding landscape of privacy and data regulations, such as citizens of the European Union who are covered by the General Data Protection Regulation (GDPR), residents of California covered by the California Consumer Privacy Act (CCPA), citizen s of China covered by the Personal Information Protection Law (PIPL) and citizens of Brazil covered by the General Personal Data Protection Law (LGPD); • summarizing and reporting results of operations, including financial reporting; • managing our banking and other cash liquidity systems and platforms; • hosting, processing and sharing, as appropriate, confidential and proprietary research, business plans and financial information; • collaborating via an online and efficient means of global business com munications; • complying with regulatory, legal and tax requirements; • providing data security; and • handling other processes necessary to manage our business. Numerous and evolving information security threats, including advanced persistent cybersecurity thre ats, pose a risk to the security of our services, systems, networks and supply chain, as well as to the confidentiality, availability and integrity of our data and of our critical business operations. In addition, because the techniques, tools and tactics used in cyber - attacks frequently change and may be difficult to detect for periods of time, we may face difficulties in anticipating and implementing adequate preventative measures or fully mitigating harms after such an attack. Our IT/OT databases and s ystems and our third - party providers’ databases and systems have been, and will likely continue to be, subject to advanced computer viruses or other malicious codes, ransomware, unauthorized access attempts, denial of service attacks, phishing, social engi neering, hacking and other cyber - attacks. Such attacks may originate from outside parties, hackers, criminal organizations or other threat actors, including nation states. In addition, insider actors - malicious or otherwise - could cause technical disruptio ns and/or confidential data leakage. We cannot guarantee that our security efforts or the security efforts of our third - party providers will prevent material breaches, operational incidents or other breakdowns to our or our third - party providers’ IT/OT da tabases or systems. A breach of our data security systems or failure of our IT/OT databases and systems may have a material adverse impact on our business operations and financial results. If the IT/OT systems, networks or service providers we rely upon f ail to function properly or cause operational outages or aberrations, or if we or one of our third - party providers suffer significant unavailability of key operations, or inadvertent disclosure of, lack of integrity of, or loss of our sensitive business or stakeholder information, due to any number of causes, including catastrophic events, natural disasters, power outages, computer and telecommunications failures, improper data handling, viruses, phishing attempts, cyber - attacks, malware and ransomware atta cks, security breaches, security incidents or employee error or malfeasance, and our business continuity plans do not effectively address these failures on a timely basis, we may suffer interruptions in our ability to manage operations and be exposed to re putational, competitive, operational, financial and business harm as well as litigation and regulatory action. If our critical IT systems or back - up systems or those of our third - party vendors are damaged or cease to function properly, we may have to make a significant investment to repair or replace them. In addition, if a ransomware attack or other cybersecurity incident occurs, either internally or at our third - party technology service providers, we could be prevented from accessing our data or systems, which may cause interruptions or delays in our business operations, cause us to incur remediation costs, subject us to demands to pay a ransom or damage our reputation. In addition, such events could result in unauthorized disclosure of confidential info rmation, and we may suffer financial and reputational damage because of lost or misappropriated confidential information belonging to us or to our partners, our employees, customers and suppliers. Additionally, we could 6 The Procter & Gamble Company

be exposed to potential liability, litigation, governmental inquiries, investigations or regulatory enforcement actions; and we could be subject to payment of fines or other penalties, legal claims by our suppliers, customers or employees and significant remediation costs. Periodically, we also upgrade our IT/OT systems or adopt new technologies. If such a new system or technology does not function properly or otherwise exposes us to increased cybersecurity breaches and failures, it could affect our ability to order materials, make and ship orders and process payments in addition to other operational and information integrity and loss issues. The costs and operational consequences of responding to the above items and implementing remediation measures could be significant and could adversely impact our results of operations and cash flows. We must successfully manage the demand, supply and operational challenges associated with the effects of a disease outbreak, including epidemics, pandemics or similar widespread public health concerns. Our business may be negatively impacted by the fear of exposure to or actual effects of a disease outbreak, epidemic, pandemic or similar widespread public health concern, such as travel restrictions or recommendations or mandates from governmental authorities as a result of the COVID - 19 virus, the threat of the virus or the emergence of any variants. These impacts include, but are not limited to: • Significant reductions in demand or significant volatility in demand for one or more of our products, which may be caused by, among other things: the temporary inability of consumers to purchase our products due to illness, quarantine or other travel restrictions or financial hardship, shifts in demand away from one or more of our more discretionary or higher priced products to lower priced products, or stockpiling or similar pantry - loading activity. If prolonged, such impacts can further increase the difficulty of business or operations planning and may adversely impact our results of operations and cash flows; • Ina bility to meet our customers’ needs and achieve cost targets due to disruptions in our manufacturing and supply arrangements caused by constrained workforce capacity or the loss or disruption of other essential manufacturing and supply elements such as raw materials or other finished product components, transportation, or other manufacturing and distribution capability; • Failure of third parties on which we rely, including our suppliers, contract manufacturers, distributors, contractors, commercial banks, j oint venture partners and external business partners, to meet their obligations to the Company, or significant disruptions in their ability to do so, which may be caused by their own financial or operational difficulties and may adversely impact our operat ions; • Periods of disruption that limit the ability to access the financial markets or which increase the cost of liquidity; or • Significant changes in the political conditions in markets in which we manufacture, sell or distribute our products, including qu arantines, import/export restrictions, price controls, or governmental or regulatory actions, closures or other restrictions that limit or close our operating and manufacturing facilities, restrict our employees’ ability to travel or perform necessary busi ness functions, or otherwise prevent our third - party partners, suppliers or customers from sufficiently staffing operations, including operations necessary for the production, distribution, sale and support of our products, which could adversely impact our results of operations and cash flows. Despite our efforts to manage and remedy these impacts to the Company, their ultimate impact also depends on factors beyond our knowledge or control, including the duration and severity of any such outbreak as well as third - party actions taken to contain its spread and mitigate its public health effects. In the case of COVID - 19, the emergence of variants may continue to occur across regions and countries where we operate, leading to varied government responses and the potential for decreased vaccine effectiveness, resulting in further volatility and disparity in our results and operations across geographies. BUSINESS STRATEGY & ORGANIZATIONAL RISKS Our ability to meet our growth targets depends on successful product, marketing and operations innovation and successful responses to competitive innovation, evolving digital marketing and selling platforms and changing consumer habits. We are a consumer products company that relies on continued global demand for our brands and products. Achieving our business results depends, in part, on successfully developing, introducing and marketing new products and on making significant improvements to our equipment and manufacturing processes. The success of such innovation depends on our ability to correctly anticipate customer and consumer acceptance and trends, to obtain, maintain and enforce necessary intellectual property protections and to avoid infringing upon the intellectual property rights of others and to continue to deli ver efficient and effective marketing across evolving media and mobile platforms with dynamic and increasingly more restrictive privacy requirements. We must also successfully respond to technological advances made by, and intellectual property rights gra nted to, competitors, customers and vendors. Failure to continually innovate, improve and respond to competitive moves, platform evolution and changing consumer habits could compromise our competitive position and adversely impact our financial condition, results of operations or cash flows. We must successfully manage ongoing acquisition, joint venture and divestiture activities. The Procter & Gamble Company 7