StartUp Tools: Advice on Starting and Running a StartUp

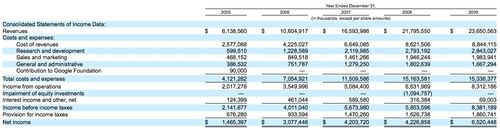

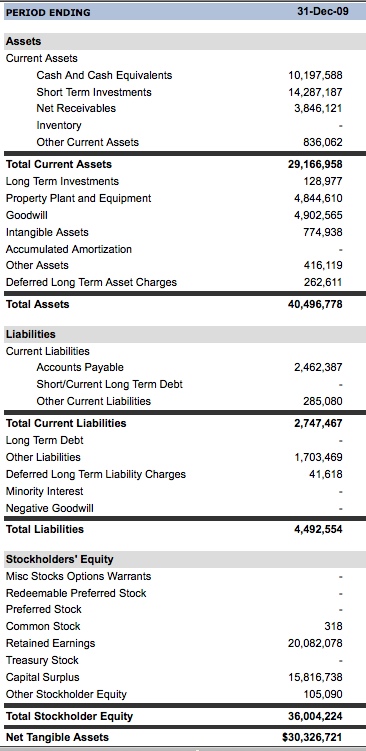

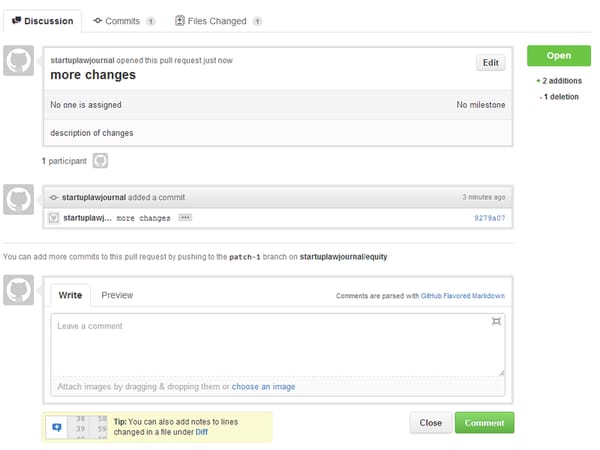

We have five weeks (including today) before we start the sustainability course. It's not enough time to start a new series. So I've decided to rerun five posts on accounting and financial statements that I did early on in MBA Mondays. This is core stuff. If you want to start a business, run a business, and/or operate a business, you need to know the basics of accounting and finance.

So today we will rerun the post on accounting. The next three weeks we will go through the three main financial statements. And we will end with a post on understanding financial statements.

--------------

Accounting is keeping track of the money in a company. It's critical to keep good books and records for a business, no matter how small it is. I'm not going to lay out exactly how to do that, but I am going to discuss a few important principles.

The first important principal is every financial transaction of a company needs to be recorded. This process has been made much easier with the advent of accounting software. For most startups, Quickbooks will do in the beginning. As the company grows, the choice of accounting software will become more complicated, but by then you will have hired a financial team that can make those choices.

The recording of financial transactions is not an art. It is a science and a well understood science. It revolves around the twin concepts of a "chart of accounts" and "double entry accounting." Let's start with the chart of accounts.

The accounting books of a company start with a chart of accounts. There are two kinds of accounts; income/expense accounts and asset/liability accounts. The chart of accounts includes all of them. Income and expense accounts represent money coming into and out of a business. Asset and liability accounts represent money that is contained in the business or owed by the business.

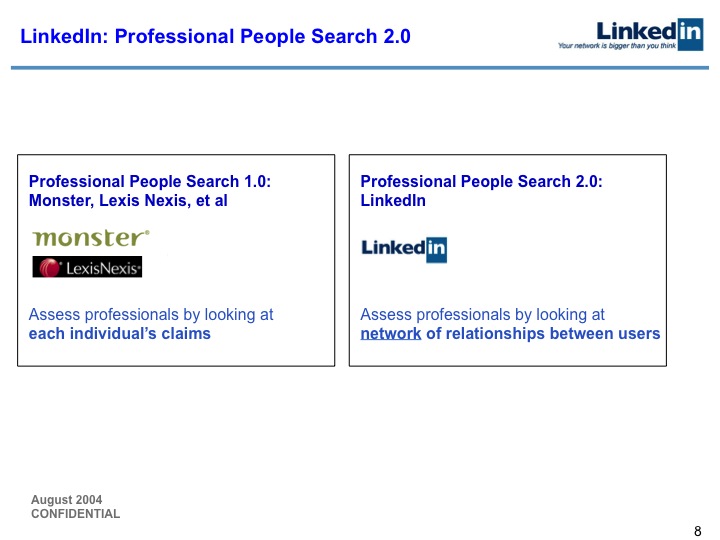

Advertising revenue that you receive from Google Adsense would be an income account. The salary expense of a developer you hire would be an expense account. Your cash in your bank account would be an asset account. The money you owe on your company credit card would be called "accounts payable" and would be a liability.

When you initially set up your chart of accounts, the balance in each and every account is zero. As you start entering financial transactions in your accounting software, the balances of the accounts goes up or possibly down.

The concept of double entry accounting is important to understand. Each financial transaction has two sides to it and you need both of them to record the transaction. Let's go back to that Adsense revenue example. You receive a check in the mail from Google. You deposit the check at the bank. The accounting double entry is you record an increase in the cash asset account on the balance sheet and a corresponding equal increase in the advertising revenue account. When you pay the credit card bill, you would record a decrease in the cash asset account on the balance sheet and a decrease in the "accounts payable" account on the balance sheet.

These accounting entries can get very complicated with many accounts involved in a single recorded transaction, but no matter how complicated the entries get the two sides of the financial transaction always have to add up to the same amount. The entry must balance out. That is the science of accounting.

Since the objective of MBA Mondays is not to turn you all into accountants, I'll stop there, but I hope everyone understands what a chart of accounts and an accounting entry is now.

Once you have a chart of accounts and have recorded financial transactions in it, you can produce reports. These reports are simply the balances in various accounts or alternatively the changes in the balances over a period of time.

The next three posts are going to be about the three most common reports;

* the profit and loss statement which is a report of the changes in the income and expense accounts over a certain period of time (month and year being the most common)

* the balance sheet which is a report of the balances all all asset and liability accounts at a certain point in time

* the cash flow statement which is report of the changes in all of the accounts (income/expense and asset/liability) in order to determine how much cash the business is producing or consuming over a certain period of time (month and year being the most common)

If you have a company, you must have financial records for it. And they must be accurate and up to date. I do not recommend doing this yourself. I recommend hiring a part-time bookkeeper to maintain your financial records at the start. A good one will save you all sorts of headaches. As your company grows, eventually you will need a full time accounting person, then several, and at some point your finance organization could be quite large.

There is always a temptation to skimp on this part of the business. It's not a core part of most startup businesses and is often not valued by tech entrepreneurs. But please don't skimp on this. Do it right and well. And hire good people to do the accounting work for your company. It will pay huge dividends in the long run.

For Books on Silicon Valley History see here

Free Harvard Business Review article here

Entrepreneurial Management Stack

Over the last few years we've discovered that startups are not smaller versions of large companies. The skills founders need are not covered by traditional books for MBA's and large company managers. There are now a few books that specifically address founders needs. Alexander Osterwalder's Business Model Generation is the first book that allows you to answer "What's your business model?" intelligently and with precision. Make sure this one is on your shelf.

Eric Ries was the best student I ever had. He took the Customer Development process, combined it with Agile Engineering, and actually did the first implementation in a startup. His insights about the combined Customer Development/Agile process and its implications past startups into large corporations is a sea change in thinking. His book, The Lean Startup is a "must have" for your shelf.

It's impossible to implement any of this if you don't understand Agile Development. Extreme Programming Explained by one of the pioneers of Agile, Kent Beck, is a great tutorial. If you don't understand Values, Principles and Practices in XP it makes Customer Development almost impossible.

Order Here

Order Here

If you're in a large company, T he Other Side of Innovation makes sense of how to actually insert innovation into an execution organization. If you're starting a medical device company Biodesign:The Process of Innovating Medical Technologies is a must have. It has a great customer discovery process.

And my newest book, The Startup Owners Manual

The Founders Workbook - The Checklist Companion to the Startup Owners Manual

Must Read Books

The other side of innovation is the closest recipe I've read for getting entrepreneurship right in large companies. Innovator's Dilemma and Innovator's Solution helped me refine the notion of the Four types of Startup Markets. I read these books as the handbook for startups trying to disrupt an established company. The Innovators DNA rings true about the skills founders need to have. Crossing the Chasm made me understand that there are repeatable patterns in early stage companies. It started my search for the repeatable set of patterns that preceded the chasm. The Tipping Point has made me realize that marketing communications strategies for companies in New Markets often follow the Tipping Point. Blue Ocean Strategy is a great way to look at what I've called "market type."

Strategy Books for Startups

How large companies can stay innovative and entrepreneurial has been the Holy Grail for authors of business books, business schools, consulting firms, etc. There's some great work from lots of authors in this area but I'd start by reading the other side of innovation. Next I'd read The Future of Mangement and consider its implications. Then I'd read the short Harvard Business Review articles. Eric Von Hippel work on new product introduction methodologies and the notion of "Lead Users" offer many parallels with Customer Discovery and Validation. But like most books on the subject it's written from the point of view of a large company. Von Hippel's four steps of 1) goal generation and team formation, 2) trend research, 3) lead user pyramid networking and 4) Lead User workshop and idea improvement is a more rigorous and disciplined approach then suggested in our book, the Four Steps to the Epiphany. Harvard Business Review ArticlesThe Marketing Playbook gives marketers five strategy options, teaches you gap analysis and offer tactical marketing campaign advice. Do More Fasteridentifies issues that first-time entrepreneurs encounter and offer useful advice. Getting Real is web-focussed. Wasserman's Founders Dilemma is essential reading to building a great startup team.

The metaphor that business is war is both a cliché and points to a deeper truth. Many basic business concepts; competition, leadership, strategy versus tactics, logistics, etc. have their roots in military affairs. The difference is that in business no one dies. At some time in your business life you need to study war or become a casualty. Sun Tzu covered all the basics of strategy in The Art of War until the advent of technology temporarily superseded him. Also, in the same vein try The Book of Five Rings by Miyamoto Musashi. These two books have unfortunately turned into business clichés but they are still timeless reading. Carl Von Clausewitz's On War is a 19th century western attempt to understand war. The "Boyd" book, The Fighter Pilot Who Changed the Art of War is a biography and may seem out of place here, but John Boyd's OODA loop is at the core of Customer Development and the Pivot. Read it and then look at all the web sites for Boyd papers, particularly Patterns of Conflict. The New Lanchester Strategy is so offbeat that it tends to be ignored. Its ratios of what you require to attack or defend a market keep coming up so often in real life, that I've found it hard to ignore.These books are classics but timeless. The Entrepreneurial Mindset articulates the critically important idea that there are different types of startup opportunities. The notion of three Market Types springs from here and Christensen's work. The book provides a framework for the early marketing/sales strategies essential in a startup. Delivering Profitable Value talks more about value propositions and value delivery systems than you ever want to hear again. However, this is one of the books you struggle through and then realize you learned something valuable. Schumpeter's book Theory of Economic Development is famous for his phrase "creative destruction" and its relevance to entrepreneurship. Peter Drucker's Concept of the Corporation was the first insiders view of how a decentralized company (GM) works. His Practice of Management defined "management by objective" and Innovation and Entrepreneurship is a classic. While written for a corporate audience, read it for the sources of innovation. If you write software you already know about Fred Brooks classic text the Mythical Man Month. If you manage a software company you need to read it so you don't act like Dilbert's pointy-haired boss. Peppers and Rogers, The One to One Future opened my eyes to concepts of lifetime value, most profitable customers and the entire customer lifecycle of "get, keep and grow." Bill Davidow's Marketing High Technology introduced me to the concept of "whole product" and the unique needs of mainstream customers. Michael Porter is the father of competitive strategy. His books Competitive Strategy, Competitive Advantage, and On Competition are still the standards.

Ries and Trout positioning books can be read in a plane ride, yet after all these years they are still a smack on the side of the head. Regis McKenna has always been a favorite of mine. However, as you read Relationship Marketing separate out the examples Regis uses into either startups or large sustainable businesses. What worked in one, won't necessarily work in another. Read these books first before you dive into the 21st century stuff like Seth Godin.Innovation and Entrepreneurship in the Enterprise

"War as Strategy" Books

Predictable Revenue is one of those short, smart, tactical books that you need to read if you have a direct sales force. Thomas Freese is the master of consultative selling. Both his books are a great start in understanding how a pro sells. Jeff Thull's Mastering the Complex Sale has a lot of elements of Customer Discovery and Validation, but skip the first 50 pages. Many of the ideas of Customer Validation are based on the principles articulated by Bosworth, Heiman and Rackham. Bostworth's Solution Selling and it's successor, The New Solution Selling are must reads for any executive launching a new product. Its articulation of the hierarchy of buyers needs as well its description of how to get customers to articulate their needs, makes this a "must read", particularly those selling to businesses. Yet in his new book What Great Salespeople Do he says, ignore those books follow this advice. Heiman's books are a bit more tactical and are part of a comprehensive sales training program from his company Miller-Heiman. If you are in sales or have a sales background you can skip these. But if you aren't they are all worth reading for the basic "blocking and tackling" advice. The only bad news is that Heiman writes like a loud salesman - but the advice is sound. Rackham's Spin Selling is another series of books about major account, large ticket item sales, with again the emphasis on selling the solution, not features. Lets Get Real is of the Sandler School of selling (another school of business to business sales methodology.) Jill Konrath has great strategies and insights for large sales. Baseline Selling uses baseball metaphors but it's an effective explanation of how to do consultative selling. I sure could have used the Complete Idiots Guide to Cold Calling when it was just me and the telephone. The Strategy and Tactics of Pricing provides a great framework for thinking about "how much should I charge for this?"Marketing Communications Books

Seth Godin "gets deeply" the profound changes the internet is having in the way we think about customers and communicating with them. Godin's All Marketers are Liars talks about the power of storytelling in marketing. His Permission Marketing book crystallized a direct marketing technique (permission marketing), which was simply impossible to achieve pre-internet. Read his Ideavirus after you've read Permission Marketing. Made to Stick gives you the tools to make your messages "sticky." I put Sway here because great marketers know how to find these irrational behaviors Lakoff's book, Don't Think of an Elephant! while written for a political audience has some valuable insights on framing communications.

Sales

Startup Law and Finance

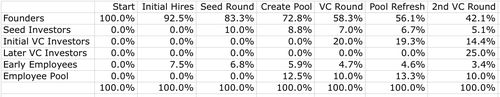

If you don't pay attention to the law from the day you start your company it can kill you. But most books (and lawyers) speak in their own arcane language. David Weekly's An Introduction to Stock and Options should be your first read (unfortunately its Kindle only.) The Entrepreneurs Guide to Business Law is the one book you ought to have on your shelf. While not written explicitly for Silicon Valley startups it demystifies the most common areas you need to know. Term Sheets and Valuations is a great read if you're faced with a term sheet and staring at words like "liquidation preferences and conversion rights" and don't have a clue what they mean. Read this and you can act like you almost understand what you are giving away.

Silicon Valley/Regional Clusters

Venture Capital HistoryBrad Feld's Startup Communities posits a big idea: startup communities are driven by entrepreneurs who are the leaders and everyone else is a feeder. Essential reading if you're trying to build your own cluster. Anna Lee Saxenian's Regional Advantage is the definitive text of why Silicon Valley beat Boston as the hub of U.S. entrepreneurship. Startup Nation is the story of how the Israeli government engineered the country into becoming the hottest cluster outside the U.S. for startups. In contrast, Josh Lerner's Boulevard of Broken Dreams describes the multiple ways governments can screw up a cluster. Jessica Livingston's Founders At Work are the best case studies/vignettes without a PR rewrite of how founders really start companies. The Startup Playbook also does a good job of offering founders advice. An Engineer's Guide to Silicon Valley Startups is one of those quirky books that perfectly match Silicon Valley culture. If you're an engineer in the valley or coming out, this is a useful read. It describes what types of startups are there, how to get a job at one, negotiating your salary, stock options, etc. Geek Silicon Valley is part history and part travel guide. Also useful.

Venture Capital

If you buy one book to understand how VC's and fund raising works, Venture Deals is the one. Wish I had it when I did startups. Same for Mastering the VC Game. If you read two books about how to deal with VC's start here. The rest of the books are personal stories. Bill Draper's book is both history and advice from a VC pioneer. If you have never experienced a startup first hand, Jerry Kaplan's book Startup and Michael Wolff's book Burn Rate are good reads of a founder's adventure with the venture capitalists. Eboys is the story of Benchmark Capital during the Internet Bubble. Ferguson's book is a great read for the first time entrepreneur. His personality and views of the venture capitalists and "suits" are a Rorschach ink blot test for the reader.

These books tell the story of the formation of the Venture Capital Industry.

Startup Nuts & Bolts

Nesheim's book High Tech Startup is the gold standard of the nuts and bolts of all the financing stages from venture capital to IPO's. If you promise to ignore the marketing advice he gives you, Baird's book, Engineering Your Startup is the cliff notes version in explaining the basics of financing, valuation, stock options, etc. Gordon Bells' book High-Tech Venturesis incomprehensible on the first, second or third read. Yet it is simply the best "operating manual" for startups that has been written. (The only glaring flaw is Bell's assumption that a market exists for the product and that marketing's job is data sheets and trade shows.) Read it in doses for insight and revelation and make notes, (think of reading the bible) rather than reading it straight through.

Startup Textbooks

If you take an entrepreneurship class in a Business School or University you'll probably encounter one of these textbooks.The reason you don't see them on the desks of working entrepreneurs is that at $100-$150+ they're all priced for a captive student audience. (Some do have paperback versions for $50-$85.) The other uncomfortable fact is that most startups in Silicon Valley ignore these textbooks once they leave school. In the real-world startups are now built using the business model/customer development/agile engineering stack. Not one of these textbooks teach that.

I've yet to meet a manufacturing person that does not reference The Goal when talking about lean manufacturing principles first. It's a book inside a novel - so it humanizes the manufacturing experience. Lean Thinking is the best over all summary of the lean manufacturing genre. Toyota Production System is the father of all lean manufacturing - it's simple tone is refreshing.Of all the texts, Technology Ventures is "the gold standard" of entrepreneurship textbooks. Jeff Timmons' New Venture Creation has too much great stuff in it to ignore. At first read it is simply overwhelming but tackle it a bit a time and use it to test your business plan for completeness. Business Plans that Work summarizes the relevant part of Timmons' New Venture Creation book and teaches how to write a document (the business plan) that no one ever reads. However, both books are worth having if you're in a large company thinking about introducing follow-on products.

Nancy Duarte's two books, Slid:eology and Resonate are about presentation design. These are the two books I refer entrepreneurs to who want to build a killer customer presentation. The advice may not work for all audiences but it's a great place to start. Cooper's book, The Inmates are Running the Asylum, is about product design. It had the same impact on me as Moore's Crossing the Chasm - "why of course, that's what's wrong." It's important and articulate.

- Technology Ventures - Tom Byers, Richard Dorf, Andrew Nelson

- New Venture Creation Entrepreneurship for the 21st Century and Business Plans That Work by Jeffry A. Timmons

- Entrepreneurship: Strategy and Resources - Marc J. Dollinger

- Launching New Ventures: An Entrepreneurial Approach - Kathleen R. Allen

- Entrepreneurship - Robert Hisrich, Michael Peters, Dean Shepherd

- Entrepreneurship - William D. Bygrave , Andrew Zacharakis

- Entrepreneurship: An Innovator's Guide to Startups and Corporate Ventures - Marc H. Meyer, Frederick G. Crane

- Entrepreneurship: Successfully Launching New Ventures - Bruce R. Barringer

- Entrepreneurial Small Business - Jerome Katz

- Entrepreneurship: In a European Perspective - C.K. Volkmann, K.O. Tokarski and M. Granhagen

- Patterns of Entrepreneurship Management - Jack M. Kaplan, Anthony Warren

- Technology Entrepreneurship: Creating, Capturing and Protecting Value -Thomas N. Duening, Robert A. Hisrich, Michael A. Lechter

- Nurturing Science-based Ventures: An International Case Perspective - Ralf W. Seifert, Benoît F. Leleux, Chris L. Tucci

- Venture Capital and Private Equity: A Casebook - Josh Lerner, Felda Hardymon, Ann Leamon

- Biodesign: The Process of Innovating Medical Technologies - Zenios, Makower, Yock,Brinton, Kumar, Denend, Krummel

Manufacturing

Presentation and Product Design

Culture/Human Resources

What I Wish I Knew When I Was 20 and InGenious are the books I give all young entrepreneurs.If you are in a large company and wondering why your company isn't going anywhere your answers might be found in Good to Great. Written by Jim Collins, the same author who wrote Built to Last, both are books that "you should be so lucky" to read. What differentiates good companies versus great? How do you institutionalize core values into a company that enable it to create value when the current management is long gone? When I first read these, I thought they were only for companies that were lucky enough to get big. Upon reflection, these books were the inspiration for the "Mission-Oriented Culture." Read these two books together.

Alfred Sloan's My Years with General Motors is a great read, but not for the traditional reasons. Read it from the point of view of an entrepreneur (Durant) who's built a great company by gut and instinct, got it to $200M and is replaced by the board. Then watches as a world-class bureaucrat grows into one of the largest and best run companies in the world. Make sure you read it in conjunction with Sloan Rules and A Ghost's Memoir. If you're an entrepreneur the one founder you probably never heard of but should is William Durant. Read Madsen's biography. The Nudist on the Late Shift is a book you send to someone who lives outside of Silicon Valley who wants to know what life is like in a startup. If you want to understand how the modern corporation formed Chandlers' Strategy and Structure is the "Ur text." Silicon Valley HistoryIronically, the best HR stuff for anyone in a startup to read is not a book. It is the work James Baron at Stanford has done. Download his slides on the Stanford Project on Emerging Companies. Baron's book, Strategic Human Resources - is a classic HR textbook. Finally, if you are working at a startup and wondering why the founder is nuts, The Founder Factor helps explain a few things.

I'm not sure how to characterize The Checklist Manifesto so I stuck it here. It's a quick read with some insights that match why Business Model strategy need to be translated into Customer Development checklists.

Business History (See here for Silicon Valley History)

My friend, Stephen Spinelli President of Philadelphia University offered this great reading list on the activity of the university in tech transfer/collaborations with business, community and government. The list also covers the activity/behavior/leadership of the university president.

All of the following four chapters are in the: Journal of the Programme on Institutional Management in Higher Education, Higher Education Management. Vol. 13, No. 2, 2001. Organisation for Economic Co-operation and Development.

Also see Tom Eisenmann's Reading list from his Harvard Lean Startup class.

The Prendismo Collection offers:

- Over 16,000 2-minute clips from experts.

- 200 topics on business, leadership and entrepreneurship.

- Subscriptions for individuals and schools.

- Video Clips available to license for your company or personal use.

Find insights you can add to your presentations or simply expand your personal knowledge by searching our collection today.

Warning: Illegal string offset 'keywords_time' in /home/chubbybrain/public_html/blog/wp-content/plugins/internal_link_building.php_/internal_link_building.php on line 103

After the " What is a super angel?" question we get from founders going through the Funding Recommendation Engine, the next question is, "Who are the super angels?"

Ask and you shall receive. Below is the best list out there of super angel investors in alphabetical order along with some analysis of their investment industries and geographies of focus.

Note: Since a clear definition of super angel has not surfaced yet, we've used what seems to be the more popular definition which is that Super Angels are those that who were angel investors and who have have subsequently raised small funds with which to invest in emerging, young companies. To those that feel strongly that calling these folks Super Angels is a misnomer and that they are actually micro venture capital funds, our headline attempts to assuage your concerns. Rich Aberman of WePay has a good post explaining why these types of issues probably don't matter to founders and entrepreneurs anyways.

- Key People: Dave McClure

- Fund Size: $30M

- Average Investment Size: $25k - $250

- Number of Portfolio Companies / Investments: 31 (This doesn't include angel investment Dave McClure had previously made on his own)

- What does 500 Hats invest in? Over 80% of 500 Startups' portfolio is internet companies. A bit more than 10% is in mobile & telecom companies. (note: this is based on actual investment portfolio company data)

- Geographies that 500 Hats invests in? All but one of 500 Startups' companies are based in the US. The vast majority are in California. (note: this is based on actual investment portfolio company data)

- Related entities: Dave McClure (his individual angel investor profile)

- Key People: Aydin Senkut

- Fund Size: $40M

- Average Investment Size: $25k - $150k

- Number of Portfolio Companies / Investments: 68

- What does Felicis Ventures invest in? Over 80% of Felicis Ventures' portfolio is in internet companies. A little less than 9% is in mobile & telecom companies. (note: this is based on actual investment portfolio company data)

- Geographies that Felicis Ventures invests in? All but two of Felicis Ventures' companies are based in the US. Over 75% are based in California. (note: this is based on actual investment portfolio company data)

- Related entities: Aydin Senkut

- Fund Size: $70M+

- Average Investment Size: $150,000 to $1 million

- Number of Portfolio Companies / Investments: 56

- What industries does Floodgate invest in? Almost 3/4 of Floodgate's portfolio is internet companies. The remaining 25% is a mix of mobile, software, computer hardware & services and business products & services companies. (note: this is based on actual investment portfolio company data)

- What geographies does Floodgate invest in? With the exception of a single China-based investment, Floodgate invests in the US only. The vast majority of their portfolio is California-based companies followed by Texas. They have also invested occasionally in Massachusetts, Illinois and Pennsylvania but these are in the small minority of their investments. (note: this is based on actual investment portfolio company data)

- Related entities: Floodgate was formerly known as Maples Investments

- Key People: Bill Trenchard, Caterina Fake, Chris Dixon, David Frankel, Eric Paley, Mark Gerson, Micah Rosenbloom, Zach Klein

- Fund Size: ~$40 million

- Number of Portfolio Companies / Investments: 25

- What does Founder Collective invest in? Almost 80% of Founder Collective's portfolio is in internet companies. A bit less than 9% is in mobile & telecom companies. (note: this is based on actual investment portfolio company data)

- What geographies does Founder Collective invest in? 100% of Founder Collective's companies are based in the US. The vast majority are in California or New York although they have invested in Massachusetts-based companies as well. (note: this is based on actual investment portfolio company data)

- Related entities: Many of the investors and founders of Founder Collective formerly made and continue to make angel investments outside of the fund. Here are links to their individual angel investor profiles: Caterina Fake, Chris Dixon, Zach Klein, Bill Trenchard, Eric Paley

- Fund Size: $2.5M (raised in 2008)

- Average Investment Size: $50k - $250

- Number of Portfolio Companies / Investments: 12

- What does Founders Co-op invest in? Over 80% of Founders Co-op's portfolio is in internet companies. (note: this is based on actual investment portfolio company data)

- Geographies that Founders Co-op invests in? 100% of Founders Co-op's companies are based in the US. The vast majority of companies are Washington State. (note: this is based on actual investment portfolio company data)

- Number of Portfolio Companies / Investments: 29

- What does Harrison Metal invest in? Over 80% of Harrison Metal's portfolio is comprised of Internet companies and 10% is Mobile. (note: this is based on actual investment portfolio company data)

- Geographies that Harrison Metal invests in? Harrison Metal's investments are currently based exclusively in the United States, with the vast majority in California. The firm also has limited investment in New York, Massachusetts and Pennsylvania-based companies. (note: this is based on actual investment portfolio company data)

- Fund Size: ~$25 million

- Average Investment Size: $150,000 to $1 million

- Number of Portfolio Companies / Investments: 12

- What does IA Ventures invest in? Over 80% of IA Ventures portfolio is in internet companies. A bit less than 9% is in both mobile & telecom and software companies. (note: this is based on actual investment portfolio company data)

- What geographies does IA Ventures invest in? The majority of IA Ventures' portfolio are in California or New York although they have invested in Massachusetts-based companies as well. (note: this is based on actual investment portfolio company data)

- Average Investment Size: $100,000 to $1M

- Number of Portfolio Companies / Investments: 7

- What does K9 Ventures invest in? Over 80% of K9 Ventures' portfolio is in internet companies with the remainder being focused on mobile software & telecom. (note: this is based on actual investment portfolio company data)

- Geographies that K9 Ventures invests in? 100% of K9 Ventures' portfolio companies are based in the United States, and more specifically within the San Francisco / Bay area. (note: this is based on actual investment portfolio company data)

- Related links: K9 Ventures portfolio

- Fund Size: ~$7 million

- Number of Portfolio Companies / Investments: 15

- Average Investment Size: $150,000 to $1 million

- What does Lerer Media Ventures invest in? Over 90% of Lerer Media Ventures' portfolio is in internet companies. (note: this is based on actual investment portfolio company data)

- What geographies does Lerer Media Ventures invest in? The vast majority of Lerer Media's investments are NYC-based companies. They have a few investments outside of New York in California and Texas. (note: this is based on actual investment portfolio company data)

- Key People: Chris Sacca

- Fund Size: $28M+

- Number of Portfolio Companies / Investments: 40

- What does Lowercase Capital invest in? 75% of Lowercase Capital's investments have been in Internet companies, followed by roughly 20% in Mobile, 5% in Software. (note: this is based on actual investment portfolio company data)

- Geographies that Lowercase Capital invests in? 92% of Lowercase Capital's investments have been in the United States, followed by 5% in the UK and 3% in Canada. (note: this is based on actual investment portfolio company data)

- Related links: Lowercase Capital's portfolio

- Related entities: Chris Sacca's angel investment portfolio

- Key People: Howard Lindzon

- Average Investment Size: $100,000 to $500,000

- Number of Portfolio Companies / Investments: 13

- What does Social Leverage invest in? Over 75% of Social Leverage's portfolio is in internet companies with the remainder being invested in software firms. (note: this is based on actual investment portfolio company data)

- What geographies does Social Leverage invest in? A majority of Social Leverage's investments are based in the US but they do invest overseas. Within the US, the fund invests primarily in New York and California but based on investment history is open to other US states as well.

- Key People: Jean-Francois "Jeff" Clavier

- Fund Size: $15M

- Average Investment Size: $100k - $500

- Number of Portfolio Companies / Investments: 42

- What does SofttechVC invest in? Over 90% of SofttechVC's portfolio is in internet companies. (note: this is based on actual investment portfolio company data)

- Geographies that SofttechVC invests in? All but two of SofttechVC's companies are based in the US. The vast majority of companies are based in California and almost 12% of the portfolio is based in New York. (note: this is based on actual investment portfolio company data)

- Related entities: Jean-Francois "Jeff" Clavier

- Key People: Ron Conway, David Lee, Mike Ghaffary, Kevin Carter and Topher Conway

- Fund Size: $20M+

- Number of Portfolio Companies / Investments: 33 (many of Ron Conway's historical investments were made by him personally or through Baseline Ventures. Links to those are below)

- What does SV Angel invest in? 86.5% of SV Angel's investments have been in Internet companies, followed by 13.5% in Mobile. (note: this is based on actual investment portfolio company data)

- Geographies that SV Angel invests in? 100% of SV Angel's portfolio companies are based in the United States, predominantly in California but also including New York, Massachusetts, Washington and Rhode Island. (note: this is based on actual investment portfolio company data)

- Related entities: SV Angel's founding partners include Ron Conway and David Lee who also maintain individual portfolios as angel investors. Conway also invested through Baseline Ventures in the past.

- Key People: Joshua Kushner

- Fund Size: $10M (launched summer 2010)

- Average Investment Size: $100k - $150k

- Number of Portfolio Companies / Investments: 15

- What does Thrive Capital invest in? 100% of Thrive Capital's portfolio is in internet companies. (note: this is based on actual investment portfolio company data)

- Geographies that Thrive Capital invests in? All Thrive Capital's companies are based in the US. The vast majority of companies are based in New York. (note: this is based on actual investment portfolio company data)

- Related links: Thrive Capital portfolio

- Related entities: Joshua Kushner

- Key People: Andrew Ogawa, Hiro Ogawa, Marcus Ogawa

- Fund Size: $20M

- Average Investment Size: $100k - $1.5M (typical $500k)

- Number of Portfolio Companies / Investments: 13

- What does Quest Venture Partners invest in? Over 70% of Quest Venture Partners' portfolio is in internet companies with another nearly 25% in mobile companies. (note: this is based on actual investment portfolio company data)

- Geographies that Quest Venture Partners invests in? Quest Venture Partners' companies are based in the US. The vast majority of companies Quest invests in are based in California. (note: this is based on actual investment portfolio company data)

- Related links: Quest Venture Partners portfolio

- Related entities: Marcus Ogawa

If we've missed your Super Angel Fund, leave a comment or email us at feedback(at)chubbybrain.com. It seems new Super Angel funds are emerging every day so we'll try to keep this updated over time as well.

If you're an entrepreneur whose read this far, you definitely should try out our Funding Recommendation Engine to get a list of investors that match with your business.

by Scott Edward Walker on February 17th, 2010

IntroductionThis post is part of a weekly series called "Ask the Attorney," which I am writing for VentureBeat (one of the most popular websites for entrepreneurs). As the VentureBeat Editor notes on the site: "Ask the Attorney is a new VentureBeat feature allowing start-up owners to get answers to their legal questions."

I have two goals here: (i) to encourage entrepreneurs to ask law-related questions regardless of how basic they may be; and (ii) to provide helpful responses in plain English (as opposed to legalese). Please give me your feedback in the comments section. Many thanks, Scott

Question

We launched our company about six months ago, and we have a couple of angel investors lined-up for about $300,000. We don't know if we should sell them common stock or preferred (they want preferred). I've been reading some stuff on the web that recommends issuing convertible notes. What do you recommend? Thanks!

AnswerThis issue comes-up all the time. In short, I recommend that you issue convertible notes. Below are the advantages and disadvantages of each choice from the founders' perspective.

1. Common Stock . The advantage of issuing common stock is that it is relatively quick, simple and inexpensive. All you need is a short subscription agreement and perhaps a stockholders agreement (if you don't already have one). In addition, from the founders' perspective, it puts the angels in the same boat as them.

There are four disadvantages: (i) you will need to value the company, which (as discussed below) can be difficult and may lead to the founders' substantial dilution; (ii) you're likely to get substantial push-back from sophisticated angels - who generally will not agree to common stock because they don't think their money should put them in the same boat as the founders; (iii) there may be tricky tax issues depending upon the timing of the investment - e.g., if you and your co-founders paid a nominal price for your shares of common stock and the angels pay substantially more for theirs shortly thereafter, the IRS may question how the value of the stock could have increased so much and may deem the shares issued to the founders a form of compensation; and (iv) it may cause potential problems with respect to stock option grants because the value of the shares of common stock will be established.

2. Preferred Stock . Preferred stock is extremely favorable to the angels. The only advantage from your perspective is that the interests of the founders and the angels are aligned. Specifically, there is no incentive on the angels part (unlike if they were holding convertible notes, as discussed below) to keep the valuation of the company low in the Series A round.

The disadvantages to issuing preferred stock are significant. First, it is relatively time-consuming, complicated and expensive. Indeed, legal fees can be in the neighborhood of $20,000 or more if the preferred stock has all the "bells" and "whistles." And second, as noted above, valuing the company at such an early stage is difficult and often leads to protracted negotiations and substantial dilution to the founders.

3. Convertible Notes . The issuance of convertible notes is often viewed as a reasonable compromise between issuing common stock and issuing preferred stock. In essence, it is a form of "bridge" financing - i.e., it is designed to provide the company with sufficient funds to get to the first professional (i.e., "Series A") round, at which point, the notes would automatically convert into preferred stock at a discount (e.g., 15%-35%).

The advantage of issuing convertible notes is that it is relatively quick, simple and inexpensive; all you arguably need is a short note. As discussed above, the other significant advantage is that it will defer the company's valuation (i.e., the pricing) until the Series A round. By issuing convertible notes, you "kick the can" to the Series A round when the valuation picture would be clearer.

The disadvantage of issuing convertible notes is that, as noted above, the founders' interests and the angels' interests may not be aligned because, again, it's in the angels' interest for the Series A valuation to be low. Indeed, angels who think they can make a significant contribution to your company (e.g., as a result of their introductions or domain expertise) want to share in the increase in value they are creating. Accordingly, if the angels do agree to the issuance of convertible notes, they will often push for a "cap" on the Series A valuation (which is obviously not in your interest).

ConclusionI hope the foregoing is helpful. If you would like a few tips with regard to angel financing generally, you can check-out these two posts: Angel Financings - Legal Tips for Entrepreneurs (Part I) and Angel Financings - Five Tips for Entrepreneurs (Part II).

Tags: angel, angel financing, common stock, convertible notes, dilution, founders, preferred stock, Series A, valuation

by Scott Edward Walker on December 2nd, 2009

IntroductionI am currently working with several smart, young entrepreneurs who are trying to raise capital from "angels" (i.e., wealthy individuals who invest in start-up companies). Indeed, since I moved to Los Angelesfrom New York City in 2005, I have been involved in a number of angel financings; and what's interesting from my perspective as a corporate attorney is that the deals run the gamut from an angel handing a check to an entrepreneur and instructing him to "send the paperwork when it's ready" - to an angel retaining a large, aggressive law firm and insisting on shares of preferred stock, with all the "bells and whistles." Below are five tips for entrepreneurs to help them through the angel financing process. (This is part one of a two-part series; I will provide five additional tips in my next post.)

Five Tips for Entrepreneurs1. Push for the Issuance of Convertible Notes . As noted above, angels will sometimes request shares of preferred stock for their investment; however, unless the start-up is raising at least approximately $750K, it generally is not in the entrepreneur's interest to issue such shares. Indeed, preferred stock financings are complicated, time-consuming and expensive. Moreover, the company would need to be valued, which is obviously difficult at such an early stage and could be extremely dilutive to the founders. Accordingly, entrepreneurs are better served by issuing convertible notes to angel investors, not equity - i.e., the angels would loan money to the company, which would automatically convert into equity in the first professional (the "Series A") round of financing; this approach will keep the financing relatively simple and inexpensive and will defer the company's valuation (i.e., the pricing) until the Series A round. If an angel insists on equity, the company should issue shares of common stock - which will place the angel in the same boat as the founders (though still requiring a valuation and causing potential problems with respect to stock option grants). Bill Reichert, Managing Director of Garage Technology Ventures, briefly discussed the "note vs. equity" issue on The Frank Peters Show (starting at the 22:51 mark) and expressly advised that: "If you're putting a few hundred thousand [dollars] in, it's just not worth all the brain damage to price the round. . . [and] it's not worth spending too much on lawyers."

2. Understand the Key Business Terms . Regardless of whether the company issues convertible notes or preferred stock, it is imperative that the entrepreneur understand all of the key business issues. In a convertible note financing, the key business issues include: (i) the amount of the discount on the conversion price (generally 20-35%); (ii) the terms of the warrant, if applicable; (iii) the interest rate on the note (generally 6-10% per annum); (iv) the definition of "event of default" and the related remedies; (v) the conversion rights of the noteholders; and (vi) whether the note will be subordinated to "senior indebtedness." In a preferred stock financing, the key business issues include: (i) the pre-money valuation; (ii) the terms of the liquidation preference; (iii) the terms of the anti-dilution provisions; (iv) the Board composition; (v) dividend-related issues; (vi) whether and to what extent vesting will be imposed on the founders' shares; and (vii) the protective provisions. Needless to say, an experienced corporate lawyer will help negotiate the foregoing issues; however, as Chris Dixon (co-founder of Hunch) aptly pointed out in a recent blog post: "you can't outsource the understanding of key financing and other legal documents to lawyers."

3. Diligence the Angel(s) . In the course of my 15+ years of practicing corporate law (including nearly eight years at two major law firms in New York City), the most common mistake I have seen entrepreneurs and inexperienced deal people make in any dealmaking context is the failure to investigate the guys (or gals) on the other side of the table. Indeed, in the angel financing context, the entrepreneur will, in effect, be married to the angel for a number of years. Accordingly, at a minimum, the entrepreneur should get references and speak with other entrepreneurs and founders who have done deals with the angel in order to make an informed judgment as to whether the angel is an appropriate individual with whom the entrepreneur should be partnering. Issues to consider include: What is the angel's motivation to invest? Is the angel a good guy or a jerk? Can the angel be counted-on and trusted? Will the angel add significant value (e.g., through his contacts, technical expertise, etc.)?

There is an outstanding video discussion on Mixergy.com of how the angel process works (and what could happen if you don't adequately diligence your angels) between Brandon Watson, a smart entrepreneur (currently at Microsoft), and Andrew Warner, the founder of Mixergy. Brandon is extremely candid and discusses how he got "bullied" by his Board. Moreover, he expressly notes in the comments section of the post (in response to my comment) that: "The diligence factor was that I knew them, but had never taken money from them." He also adds that: [O]ur legal counsel wasn't worth a damn, and they were the expensive Silicon Valley kind. My issue was that the partner would bill for a lot of stuff that I felt shouldn't have taken as long (my whole family are lawyers). I know that this could have been a partner specific issue, but my experience with the expensive SV lawyers has been a mixed bag at best." (I discuss the big firm problem in my recent post, " Behind the Big Law-Firm Curtain: The Good, The Bad, The Ugly.")

4. Never Subject Yourself to Personal Liability . It is self-evident that founders should not be personally liable to angel investors if their company fails (other than in connection with fraud). Indeed, that's one of the principal reasons for forming a corporation or limited liability company: to protect the entrepreneur against personal liability (see tip #1 of my post " Launching a Venture: Ten Tips for Entrepreneurs)." Unfortunately, there are angels and inexperienced business attorneys who will request that the founders personally make certain representations and warranties. In fact, I was involved in two separate angel financings in the past 18 months in which the angel's legal counsel insisted on just that; and in one deal, the angel requested a personal guarantee from the founder (but dropped the request when I pushed back very hard). My tip here for entrepreneurs is simple: Never agree to potential personal liability. Every sophisticated player understands that angel investing is a " high-risk, high reward " proposition, and there is no reason whatsoever that an entrepreneur should be sticking his neck out and subjecting himself to any personal liability if the deal sours. If an angel is pushing this issue, it's time to find a new angel.

5. Comply with Applicable Securities Laws . Whether the company issues convertible notes or shares of common stock or preferred stock, it will be issuing a "security" within the meaning of Section 2(a)(1) of the Securities Act of 1933, as amended (the "Securities Act"). Accordingly, such security must be registered with the Securities and Exchange Commission (the "SEC") and registered/qualified with applicable state commissions, or there must be an applicable exemption from registration. For startups, there are certain prescribed transaction exemptions which may be applicable in connection with an angel financing, the most common of which is the so-called "private placement" exemption under Section 4(2) of the Securities Act and Regulation D promulgated thereunder. The rule of thumb in connection with private placements is to sell securities only to "accredited investors" (as defined in Rule 501 of Regulation D) in reliance on Rule 506 thereof. There are two significant reasons for this: (1) Rule 506 preempts state-law registration requirements pursuant to the National Securities Markets Improvement Act of 1996 - which means, in general, that the issuer merely must file with the applicable state commissioners (i) a Form D (see my recent post regarding Form D), (ii) a consent to service and (iii) a filing fee; and (2) there is no prescribed written disclosure requirement if the investors are "accredited" - though it still may be prudent in certain cases to furnish investors with a private placement memorandum (or at least a summary and/or a set of risk factors).

There are eight categories of investors under the current definition of "accredited investor" - the most significant of which for entrepreneurs is an individual who has (i) a net worth (or joint net worth with his/her spouse) that exceeds $1 million at the time of the purchase or (ii) income exceeding $200,000 in each of the two most recent years (or joint income with a spouse exceeding $300,000 for those years) and a reasonable expectation of such income level in the current year. Indeed, if a company offers or sells securities to non-accredited investors, it opens a pandora's box of compliance and disclosure issues, under both federal and state law. Accordingly, the entrepreneur must ensure that the angel is an "accredited investor" and that he represents and warrants such in a subscription agreement or other applicable agreement/document. (Obviously, this should not be difficult based on the foregoing definition.) Non-compliance with applicable securities laws could result in serious adverse consequences, including a right of rescission for the securityholders (see my recent post " Rescission Offers: Five Tips for Entrepreneurs "), injunctive relief, fines and penalties, and possible criminal prosecution.

ConclusionIn part two of this series, I will provide five additional tips for entrepreneurs in connection with angel financings, including (i) how to work with angel groups (such as the Band of Angels, Tech Coast Angels, etc.); and (ii) why having a superstar angel as an investor (such as Ron Conway, Jeff Clavier or Kevin Rose in the San Francisco Bay area; or Matt Coffin, Kamran Pourzanjani or Jason Calacanis in the Los Angeles area) trumps all other tips.

Tags: angel, angel financings, angels, business attorneys, convertible notes, corporate attorney, entrepreneurs, liquidation preference, personal liability, Regulation D, rescission offers, SEC, securities laws, tips for entrepreneurs

by Scott Edward Walker on December 16th, 2009

IntroductionThis is part two of my two-part series on angel financings. In part one, I provided the following five tips for entrepreneurs: (i) push for the issuance of convertible notes; (ii) understand the key business terms; (iii) diligence the angel(s); (iv) never subject yourself to personal liability; and (v) comply with applicable securities laws. Below are five additional tips for entrepreneurs to help them through the angel financing process. Obviously, this is still a difficult environment in which to raise capital; however, I am confident that 2010 will bring greener pastures.

Tips for Entrepreneurs1. . Most angel investors will perform due diligence on the startup prior to any investment, including a legal due diligence investigation. Accordingly, it is imperative that all of the company's organizational documents and agreements are in order and that there are no significant potential problems. Indeed, I discuss this issue in the acquisition context in my post " Selling a Company: Ten Tips for Entrepreneurs " (see tip #3) and point out that: "An easy way to instill confidence in prospective buyers is for the selling entrepreneur to deliver (or make available) a complete, well-organized set of diligence documents." The same advice applies to angel financing.

Remember: angels may have hundreds of potential investment opportunities each year, but will only choose a select few. Thus, if the legal documentation demonstrates a lack of credibility, the angel(s) will more likely just move on. To demonstrate its credibility (and sophistication), the startup needs to button-down certain fundamental legal issues prior to approaching the angel, including (i) organizational matters (e.g., incorporating in Delaware); (ii) founders' stock issuances and vesting; (iii) IP issues; and (iv) compliance with applicable securities laws (all of which I discuss in detail in my post "Launching a Venture: Ten Tips for Entrepreneurs"). Needless to say, any red flags that are raised as part of the legal due diligence investigation will adversely affect the entrepreneur's chances of getting funding. (This is one of the primary reasons I warn entrepreneurs against playing lawyer and/or utilizing web services like LegalZoom to try to save money.)

2. Consider Angel Groups Carefully . There are a number of angel groups throughout the United States that invest in startups. As noted in a white paper from the Ewing Marion Kauffman Foundation (one of the world's largest foundation devoted to entrepreneurship), "[t]hese groups have several characteristics: loosely to well-defined legal structures; part-time or full-time management; standardized investment processes; a public face usually with a Web site and public relations activities; and, occasionally a traditionally structured venture capital/angel investing fund." Here, in California, two of the largest groups are the Band of Angels in Silicon Valley and Tech Coast Angels in Southern California. (Incidentally, I have attended a couple of Tech Coast Angels events, and they have some impressive members, including John Morris of GKM Ventures, the past Chairman.)

The good news with respect to these groups is that, generally speaking, they are a solid source of smart money for entrepreneurs, and they often have strong relationships with venture capitalists and other investors. The bad news is that each group has its own distinct set of policies, procedures and form documents, which can make the process onerous, slow and at times frustrating. Moreover, there are certain angel groups that are exploiting entrepreneurs by charging them excessive fees in connection with pitching and are otherwise taking advantage of them. Jason Calacanis, the founder and CEO of Mahalo.com, has done an extraordinary job of calling-out these groups - and he has recently launched his own angel group called " Open Angel Forum," which allows entrepreneurs to pitch for free.

Accordingly, my advice to entrepreneurs with respect to angel groups is two-fold: (i) do your due diligence (e.g., at a minimum, you need to talk to other entrepreneurs and founders who have dealt with the particular group in which you are interested) in order to obtain a deep understanding of the group's processes, including the timing and fees; and (ii) recognize that you will have little negotiating leverage in connection with their standard deal structure and forms - e.g., very few angel groups will agree to the issuance of convertible notes, in lieu of preferred stock (which I strongly recommended in tip #1 of part one of this post).

3. Try to Create a Competitive Environment . There is nothing that will give an entrepreneur more leverage in connection with any deal negotiation than a competitive environment (or the perception of same). Indeed, every investment banker worth his salt understands this simple proposition in connection with selling companies. Accordingly, if an entrepreneur is seeking angel financing, he will clearly have more negotiating leverage if the prospective angel investor thinks that other investors are interested in his startup. Competitors can be played-off of each other and, as a result, the entrepreneur will be able to strike the best possible deal. (I briefly discuss this issue in Lesson #3 of my video post " Lesson Learned in the Trenches of Two Big NYC Law Firms.")

Needless to say, this game must be played carefully and is better-handled by an experienced entrepreneur (or attorney). The last thing an entrepreneur wants in this difficult fundraising environment is to end-up with no investment at all. One final related point (which is the flip-side of this tip): do not appear desperate. Angel investors are often savvy deal guys who can spot desperation a mile away; and if they think you're desperate, they generally will either walk (thinking something must be wrong) or they will roll you.

4. . There are no "standard" deal terms or "standard" documents in an angel financing. Indeed, every deal is different - different players, different negotiating leverage, different risks, different timing. As I noted in the introduction to part one of this post, I have been involved in a number of angel financings, and they run the gamut: from an angel handing a check to an entrepreneur and instructing him to "send the paperwork when it's ready" - to an angel retaining a large, aggressive law firm and insisting on shares of preferred stock, with all the "bells and whistles."

It is thus imperative that the entrepreneur sit down with his transaction team (lawyer, accountant, co-founder, etc.) and strategize to develop a game plan in connection with the financing. The entrepreneur must communicate to the team, among other things, his deal-breakers, wish-list and potential problems. For example, maybe one of the deal-breakers is preferred stock, as opposed to convertible notes; or maybe the entrepreneur only wants angels who have industry contacts or operational experience; or maybe there are IP issues that need to be disclosed and a strategy must be devised regarding timing, etc. The bottom line is that entrepreneurs should treat angel financings like it would treat any other project: build a strong team, develop a game plan and then execute.

5. A Great Angel Trumps Every Tip . The final tip of this series is pretty simple: if a superstar angel is interested in investing in your company, don't worry about all of the other tips and take the money; a great partner trumps all rules. Indeed, as Roger Ehrenberg (a smart angel investor and the founder of IA Capital Partners) advises in his recent post on taking venture money: "[H]aving the right deal partner is critical, regardless of whether you are talking about the seed round, the A round, B round or beyond. A strong deal partner can help materially de-risk a business through sound mentoring, prudent board leadership and valuable connections." Mark Suster (another smart investor and a partner at GRP Partners), gives similar advice in his post " Raising Angel Money ":

"As an entrepreneur you should raise money from the most experienced people possible - period. If you have the opportunity to raise a small amount of money from a group of experienced investors who have a track record of helping companies get from that tricky idea stage to being a well-formed company with a good product and solid market-entry strategy[,] I would take the money - even if it were priced. Worrying about giving up an extra 10% of your company at this stage can be meaningless if the ultimate outcome is either success or failure. Even VC's think this way, which is why Fred Wilson when describing his decision to syndicate a portion of his invesment in GeoCities to another investor says, 'I learned that good partners are worth every penny of returns you give up to get them'."

VentureHacks, one of the best websites for entrepreneurs, recently put together a list of top angel investors, including such stars as Jeff Clavier, Dave McClure, Aaron Patzer, Matt Mullenweg, Peter Chane and others. In short, if any of them want to invest in your company, just roll-out the red carpet and take the money.

Tags: angel, angel financings, angel groups, angels, Band of Angels, convertible notes, diligence, entrepreneurs, preferred stock, Tech Coast Angels, tips, tips for entrepreneurs

Help for Startups! - A semi-complete list of startup accelerator programs

This is a post I've had a running draft of for some time. I'm happy to be getting it out of my draft bin and out onto the web!

Josh Kopelman of First Round Capital spoke at DreamIt Ventures this summer. During his talk, Josh mentioned how he expects to see an increasing number of DreamIt/TechStars/Y Combinator-style locally-focused "seed stage startup accelerator" programs in the coming years.

This is a topic that is near and dear to my heart. Between the research that led to the founding of the Lion Launch Pad at Penn State and my research into startup accelerator programs before joining DreamIt Ventures this summer, I've talked with / read about a number of programs.

But I wasn't really sure how many programs were out there, nor have I been able to find a comprehensive list anywhere else. The programs certainly don't all operate in the same fashion, so there is a lot of diversity as far as terms and offerings, but in general, I think everyone can agree that it's a good thing for startups that so many are taking an interest around the globe in helping early stage ventures get off the group and take flight.

So, here is the list I've been compiling - I'm sure I'm forgetting a few - what else is out there?

Global Seed-Stage Startup Accelerators

- Ann Arbor, MI - SPARK Business Accelerator - http://www.annarborusa.org/start-ups/spark-business-accelerator/

- Atlanta, GA - Shotput Ventures - http://www.shotputventures.com

- Athens, Greece - OpenFund - http://theopenfund.com

- Austin, TX - Capital Factory - http://www.capitalfactory.com

- Austin, TX - TechRanch Austin - http://techranchaustin.com

- Bangalore, India - iAccelerator - http://iaccelerator.org

- Bangalore, India - The Morpheus - http://www.themorpheus.com (formerly Morpheus Venture Partners - http://www.morpheusventure.com)

- Bangalore, India - Upstart.in - http://www.upstart.in/programs.html

- Barcelona, Spain - SeedRocket - http://www.seedrocket.com

- Belfast, Northern Ireland - StartVI (Start 6) - http://www.startvi.com

- Berkley, CA - Berkley Ventures - http://www.berkeleyventures.com

- Bloomington, IN - Sproutbox - http://www.sproutbox.com

- Boulder, CO / Boston, MA / Seattle, WA - TechStars - http://www.techstars.org

- Boston, MA and other cities - IBM Smartcamp - http://www.ibm.com/ie/smarterplanet/smartcamp/

- Boston, MA - Start@Spark - http://www.sparkcapital.com/start/

- Cambridge, UK - Springboard - http://springboard.red-gate.com

- Champaign, IL - iVentures10 - http://www.iventures10.com

- Chicago, IL - Excelerate Labs - http://www.exceleratelabs.com

- China - Innovation Works - http://en.innovation-works.com/

- Copenhagen, Denmark - Startupbootcamp - http://www.startupbootcamp.dk

- Dalian, China - China Accelerator - http://chinaccelerator.com

- Dallas, TX - Tech Wildcatters - http://techwildcatters.com

- Detroit, MI - Bizdom U - http://www.bizdom.com

- Dublin, Ireland - NDRC's Launch Pad - http://www.ndrc.ie/projects/entrepreneurial-internships/

- England - The Difference Engine - http://thedifferenceengine.eu

- Greenville, SC - NextStart - http://www.nextstart.org

- Hamburg, Germany - HackFwd - http://hackfwd.com

- Houston, TX - Houston Tech Center - http://www.houstontech.org

- Italy - H-Farm - http://www.h-farmventures.com

- Italy - Working Capital - http://www.workingcapital.telecomitalia.it/2010/03/koinup-selezionata/

- Jordan - Oasis 500 - http://arabcrunch.com/2010/06/oasis-500-a-startup-accelerator-to-launch-in-august.html (launching in August - no specific site yet)

- Lexington, MA / Menlo Park, CA - Summer@Highland Capital - http://www.hcp.com/summer/

- Lexington, KY - The Awesome Inc. Experience - http://awesomeinc.org/the-awesome-experience

- Limerick, Ireland - The Greenhouse - http://greenhouselimerick.com

- London, UK - Seedcamp - http://www.seedcamp.com

- Los Angeles, CA - LaunchPadLA - http://www.launchpad.la

- Madrid, Spain - Tetuan Valley Startup School - http://www.tetuanvalley.com

- Menlo Park, CA - Lightspeed Venture Partners Summer Grants - http://lightspeedvp.com/summergrants.aspx

- Montreal, Ca - BOLIDEA - http://blog.bolidea.com

- Montreal, Ca - Flow Ventures Accelerator Program - http://www.flowventures.com

- Montreal, Ca - Montreal Startup - http://montrealstartup.com

- Mountain View, CA - Y Combinator - http://www.ycombinator.com

- Nashville, TN - JumpStart Foundry - http://www.jumpstartfoundry.com

- New York, NY - FirstGrowth Venture Network - http://www.firstgrowthvn.com

- New York, NY - NYC SeedStart - http://www.nycseed.com/seedstart.html

- Orange County, CA - OCTANe LaunchPad - http://www.octaneoc.org

- Orem, Utah - BoomStartup - http://boomstartup.com

- Phoenix, AZ - Gangplank - http://gangplankhq.com

- Philadelphia, PA - DreamIt Ventures - http://www.dreamitventures.com

- Philadelphia, PA - Startl - partners with DreamIt Ventures - http://startl.org/apply/accelerator-apply/

- Pittsburgh, PA - AlphaLab - http://alphalab.org

- Portland, OR - The Portland Ten - http://www.portlandten.com

- Providence, RI - Betaspring - http://www.betaspring.com

- Redwood City, CA - Silicon Valley Association of Startup Entrepreneurs (SVASE) Seed Program - http://www.svase.org

- San Francisco, CA - The Start Project - http://thestartproject.com

- San Diego, CA - Springboard program at CONNECT.org - http://www.connect.org/springboard/

- Seattle, WA - Founders Co-op - http://www.founderscoop.com

- Silicon Valley - PayPal Startup Accelerator - http://www.x.com/community/ppx/xspaces/accelerator

- Singapore - Neoteny Labs - http://www.neotenylabs.com

- Sydney, Australia - SeedAccelerator - http://www.seedaccelerator.com

- Taipei, Taiwan - appWorks Ventures Incubator Program - http://appworks.tw/incubator/

- Toronto, Canada - Extreme Venture Partners University - http://www.extremevp.com/university/

- Tokyo, Japan - Open Network Lab - http://www.onlab.jp

- Utah - Startup Utah - http://startuputah.com

- Vancouver, Canada - BootupLabs - http://bootuplabs.com

- Washington, D.C. / Durham, NC - LaunchboxDigital - http://www.launchboxdigital.com

- Waterloo, Ontario, Canada - Impact Ventures - http://www.impact.org

- Zeeland, MI - Momentum - http://www.momentum-mi.com

- Unknown Location - Youniversity Ventures - http://www.youniversityventures.com

- Boulder, Colorado - Unreasonable Institute - http://www.unreasonableinstitute.org

- Philadelphia, PA - GoodCompany Ventures - http://www.goodcompanyventures.org

- India - Dasra Social-Impact - http://www.dasra.org/dasra-social-impact.htm

- Finland - Aalto University - Aalto Bootcamp - http://aaltoes.com/aaltoes-venture-track/bootcamp/

- Arizon State University - Edson Student Entrepreneur Initiative - http://studentventures.asu.edu

- Babson College - Summer Venture Program - http://www3.babson.edu/Newsroom/Releases/Summer-Venture-program.cfm (no specific site avail)

- Berkeley Entrepreneurship Laboratory - http://entrepreneurship.berkeley.edu/resources/bel.html

- College of the Atlantic - Sustainable Ventures Incubator - http://www.coa.edu/press-releases_pg1_724.htm

- Cornell University - eLabs - http://www.elabstartup.com

- Couri Hatchery at Syracuse University - http://whitman.syr.edu/eee/incubator/

- University of Michigan - RPM10 - http://www.rpmvc.com/rpm10/

- Penn State University - Lion Launch Pad - http://www.lionlaunchpad.org

- University of Pennsylvania - Wharton Venture Initiation Program - http://vip.wharton.upenn.edu

- RIT Student Business Development Lab - http://entrepreneurship.rit.edu/business_lab.php (part of the Venture Creations program at RIT http://www.venturecreations.org)

- Santa Clara University - Global Social Benefit Incubator - http://www.scu.edu/sts/gsbi/

- Stanford University - Student Startup Lab - http://sselabs.stanford.edu/

- Syracuse University - Start-Up Accelerator - http://accelerate.syr.edu/ForStudents/index.aspx

- Syracuse Student Sandbox at the Tech Garden - http://thetechgarden.com/studentsandbox

- Union College - U-Start - http://www.union.edu/resources/technology/u-start/index.php

- The University of Texas at Austin - Texas Venture Labs - http://www.texasventurelabs.net

- Virginia Tech - DayOne Ventures - http://dayoneventures.com

- Wayne State University - SmartStart Business Development Program - http://techtownwsu.org/business/smartstart.php

- Yale University - Yale Entrepreneurial Institute / Yale Startups - http://www.yalestartups.com

Social Entrepreneurship

University-Affiliated Startup Accelerator Programs

- Map of Seed Accelerator programs around the world: On Google Maps

- List of Application Deadlines for programs: here

Again, I'm sure this is not an exhaustive list and there are others out there. Let us know - where else can startups find help!

Sources: Numerous blog posts and tweets + Jed Christiansen's dissertation appendix + great tips in the comments! The New York student programs were listed at http://bianys.com/student_incubatorsEdited: From the comments below and the thread over on Hacker News, there have been some great suggestions for the list. I've updated the list with the applicable programs. Further programs added in April 2010. Added IBM Smartcamp. Updated April 22 with program from comments. Updated on April 24 to include deadpool. Updated May 14 to include the additional resources (count at 93). Updated June 11 with new programs (count at 102).

Deadlines and dates

Several times a year, we also hold offline Kickoffs (in select cities) for the Cofounder Network. It's a way for new members to meet and get introduced to the FounderDating community and values. There are deadlines by which to apply in order to be included in an upcoming Kickoff.

Remember Kickoffs are just an introduction, online is where it's at. Find your city for the dates and deadlines.

At Greylock, my partners and I are driven by one guiding mission: always help entrepreneurs. It doesn't matter whether an entrepreneur is in our portfolio, whether we're considering an investment, or whether we're casually meeting for the first time.

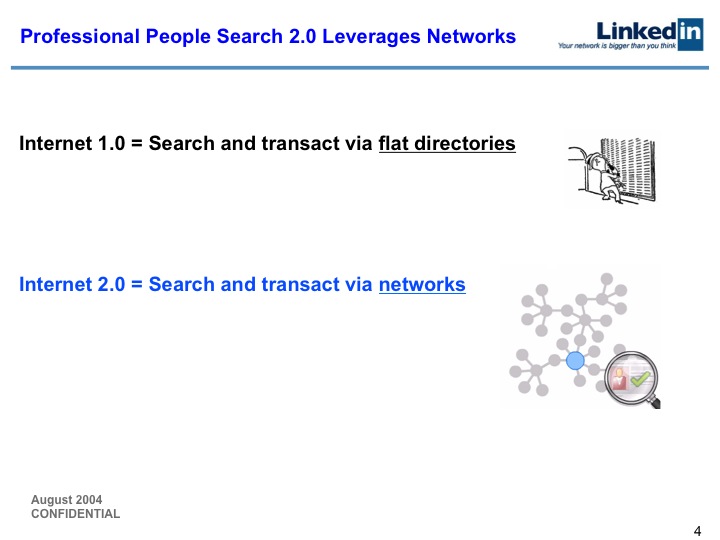

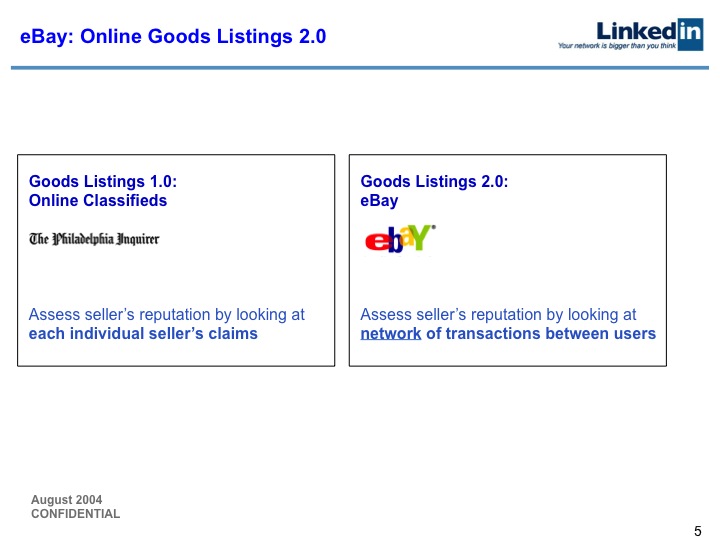

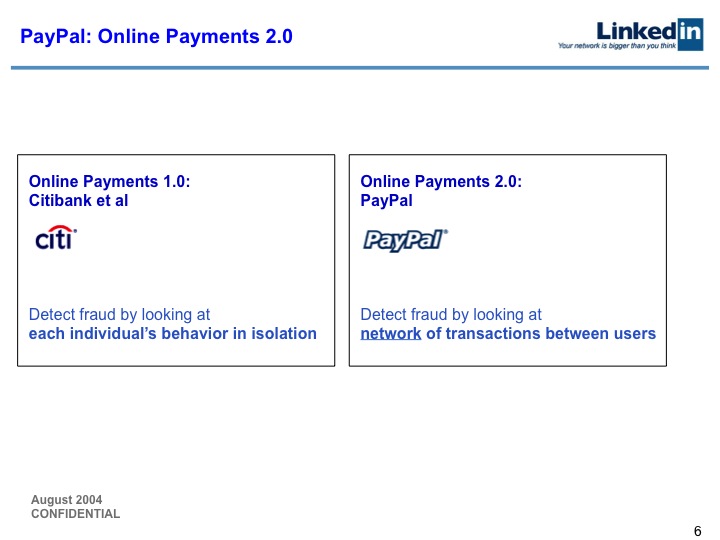

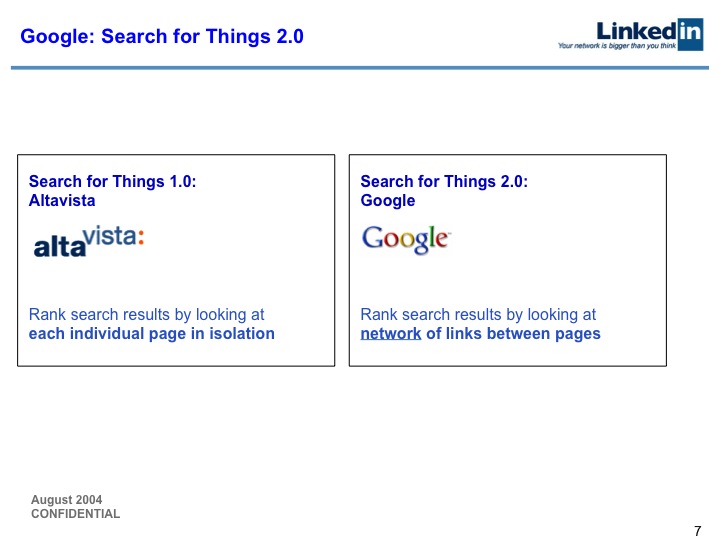

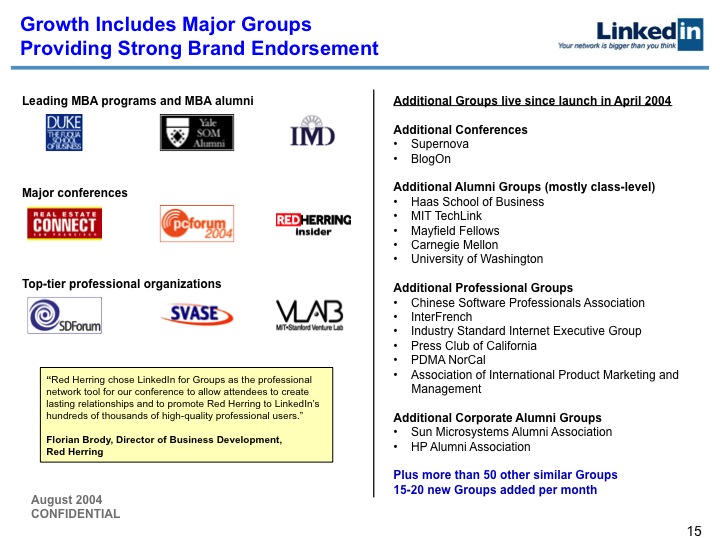

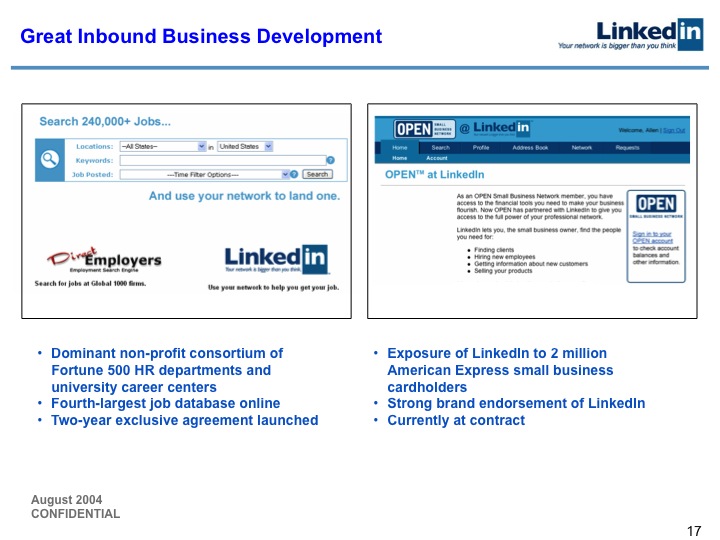

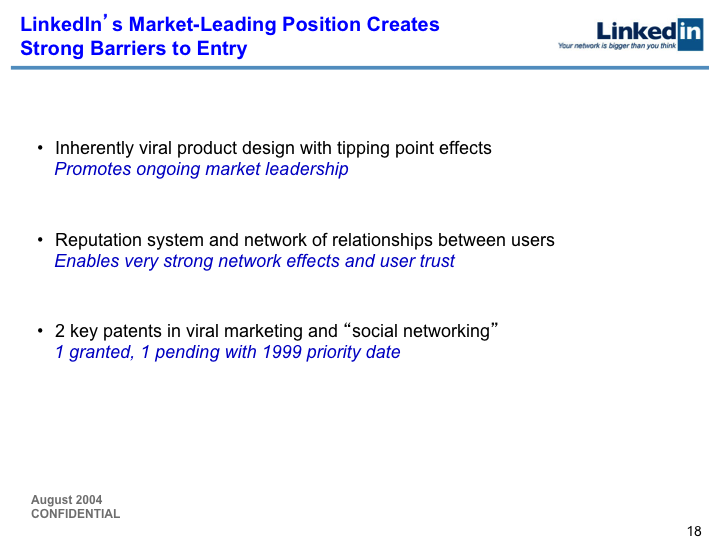

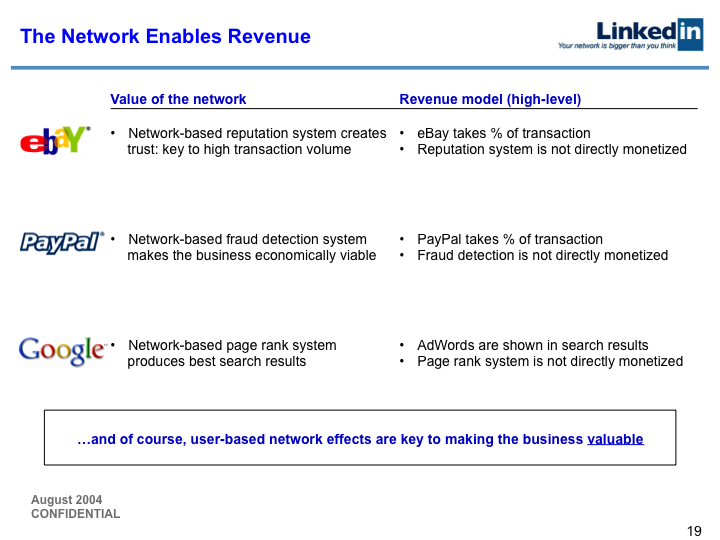

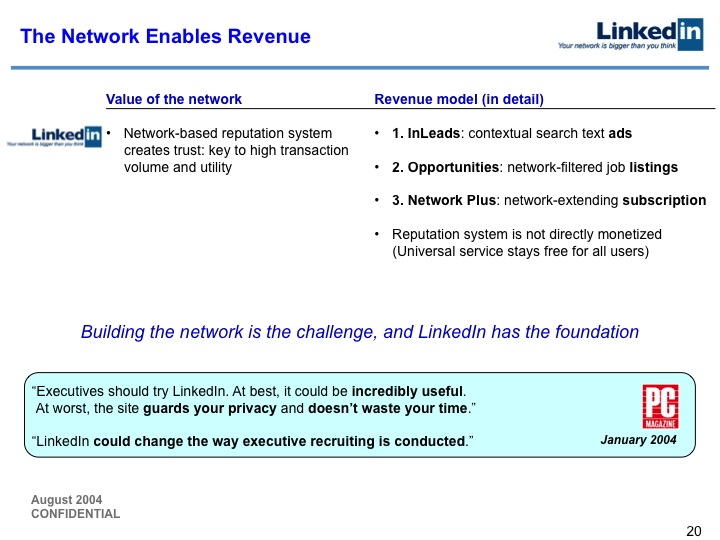

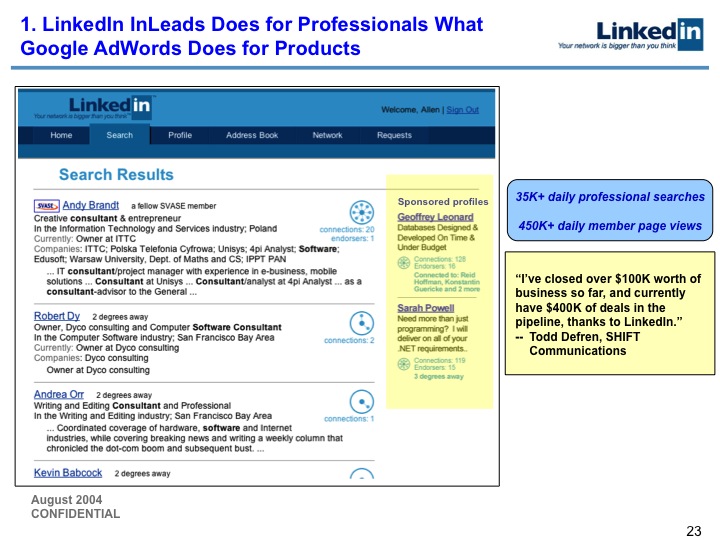

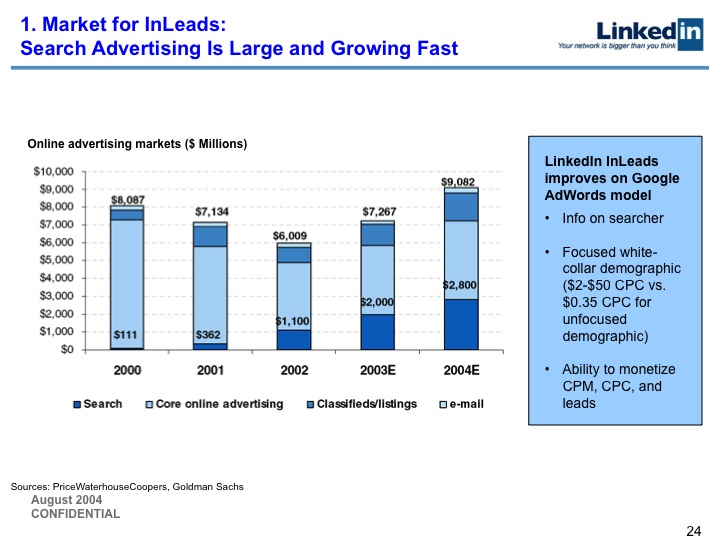

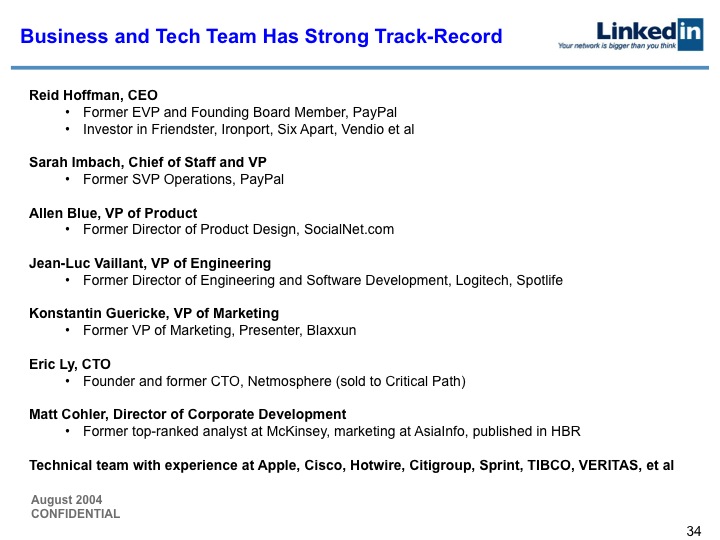

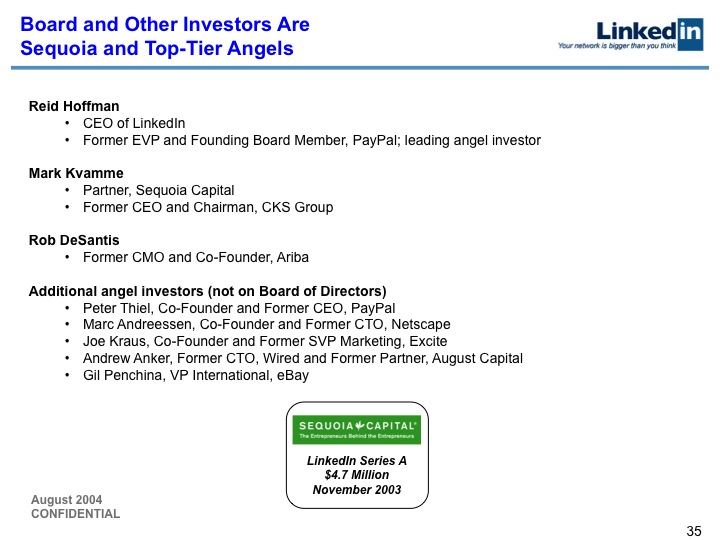

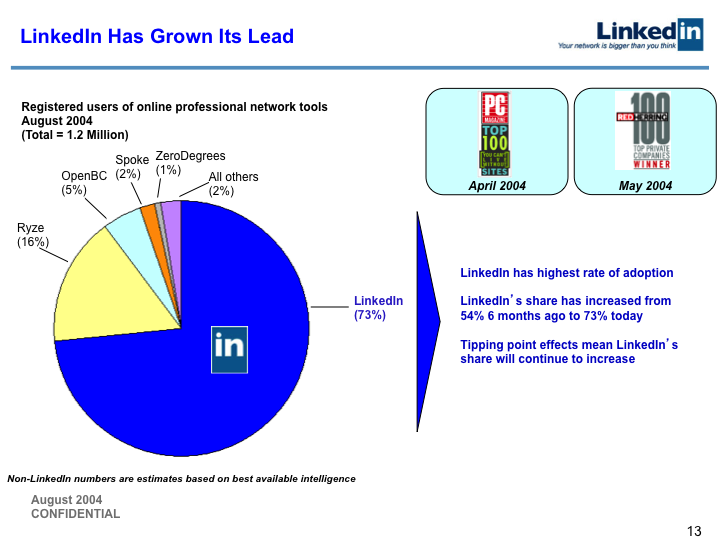

Entrepreneurs often ask me for help with their pitch decks. Because we value integrity and confidentiality at Greylock, we never share an entrepreneur's pitch deck with others. What I've honorably been able to do, however, is share the deck I used to pitch LinkedIn to Greylock for a Series B investment back in 2004.

This past May was the 10th anniversary of LinkedIn, and while reflecting on my entrepreneurial journey, I realized that no one gets to see the presentation decks for successful companies. This gave me an idea: I could help many more entrepreneurs by making the deck available not just to the Greylock network of entrepreneurs, but to everyone.

Today, I share the Series B deck with you, too. It has many stylistic errors - and a few substantive ones, too - that I would now change having learned more, but I realized that it still provides useful insights for entrepreneurs and startup participants outside of the Greylock network, particularly across three areas of interest:

- how entrepreneurs should approach the pitch process

- the evolution of LinkedIn as a company

- the consumer internet landscape in 2004 vs. today

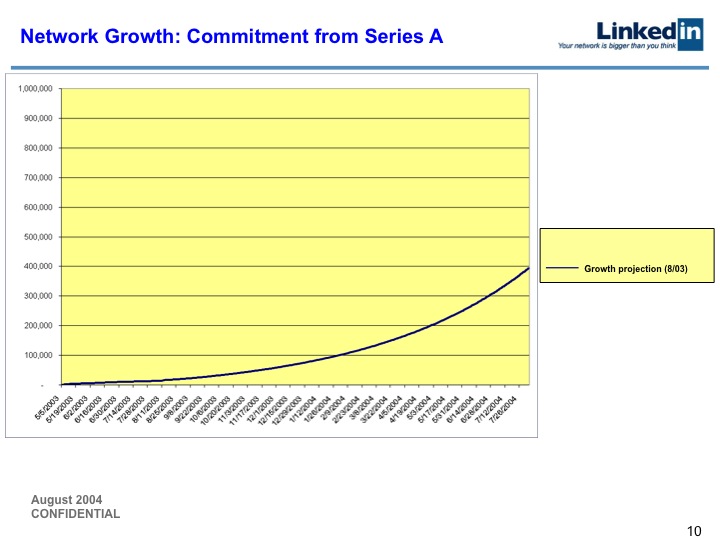

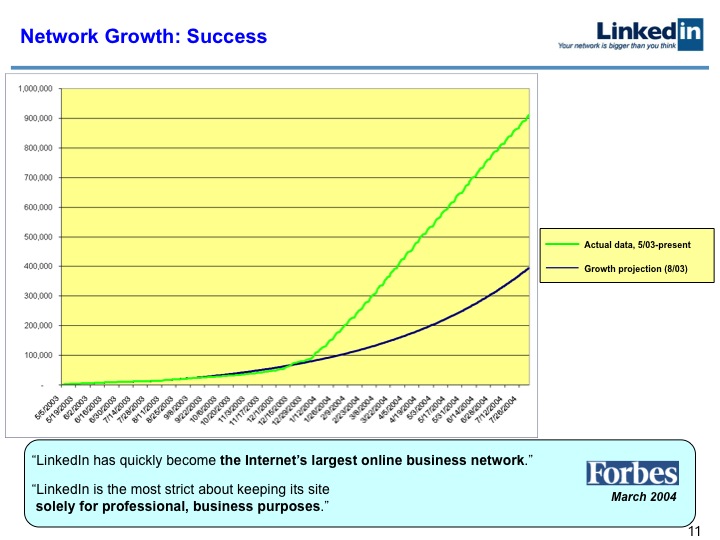

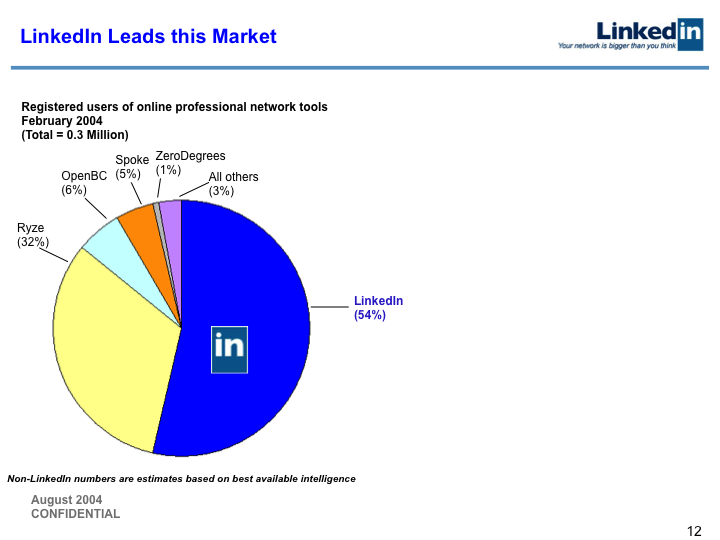

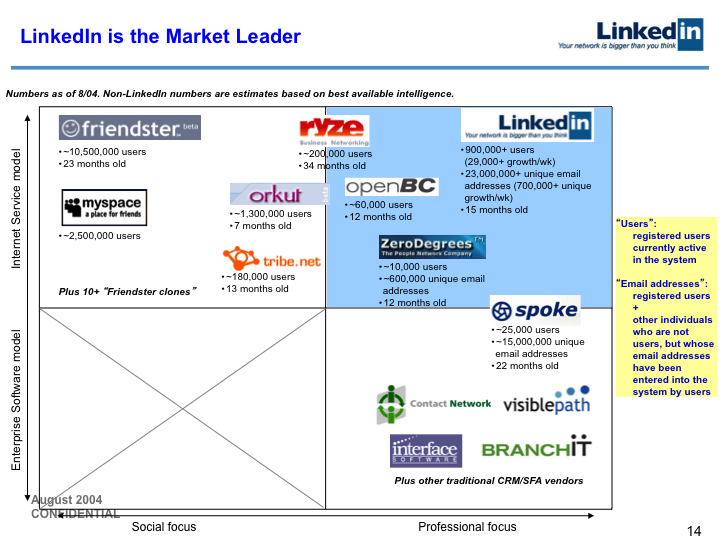

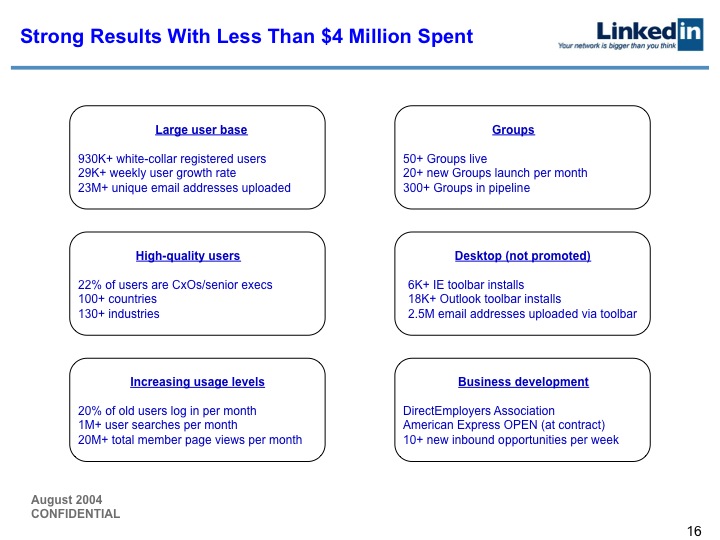

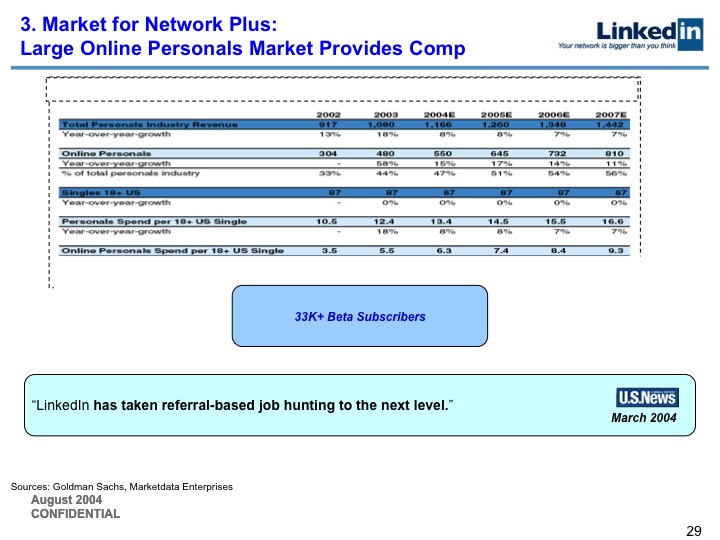

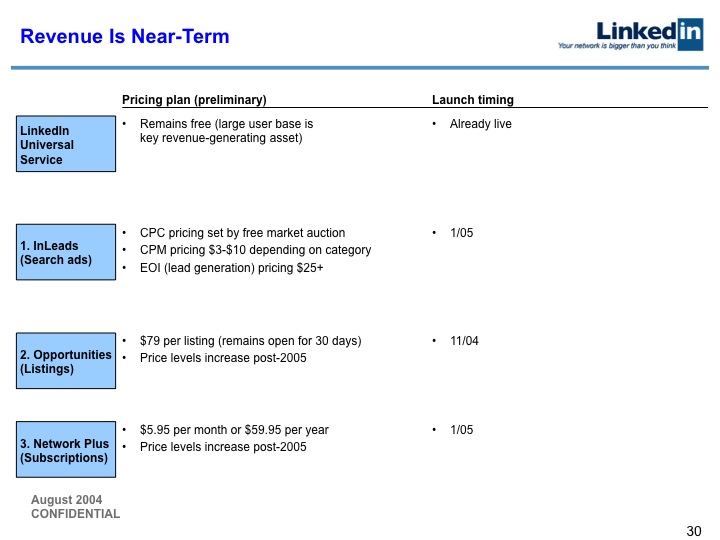

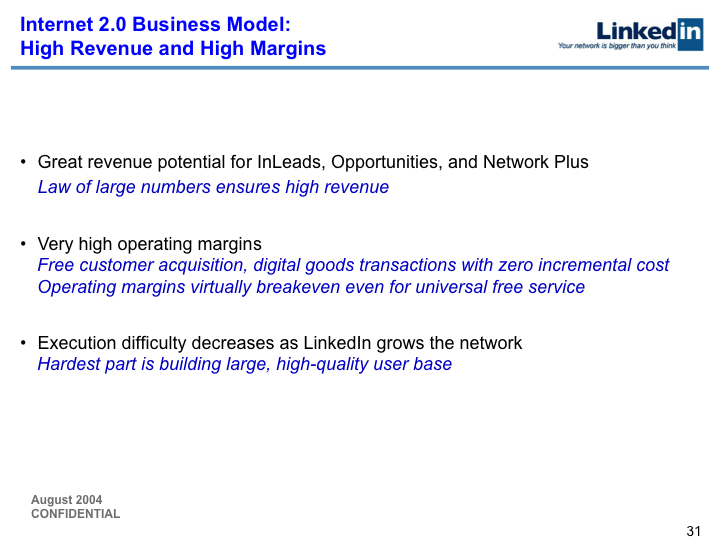

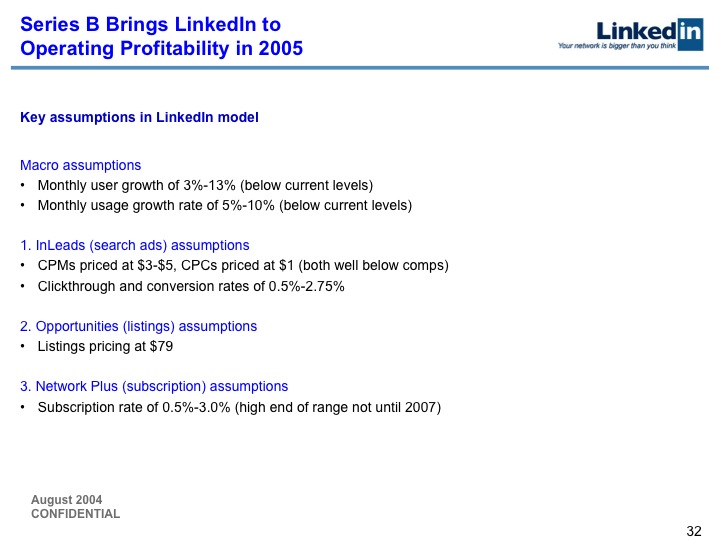

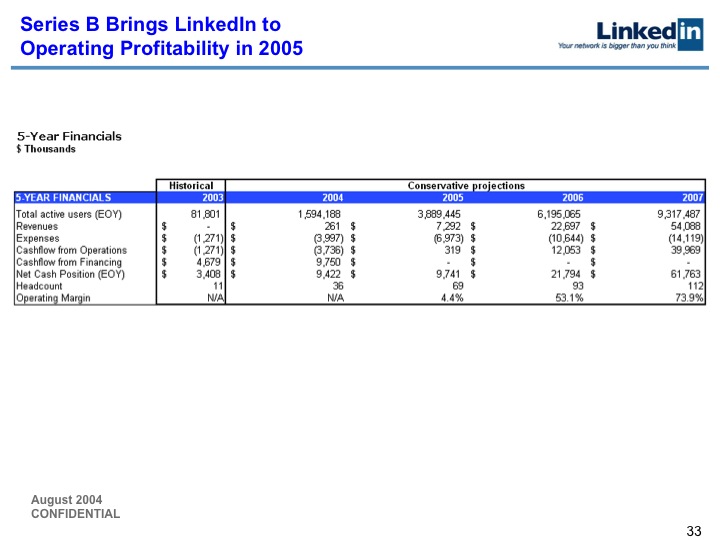

Today, LinkedIn seems like an obvious investment to have made in 2004. But at the time of the Series B financing, LinkedIn had spent its $4 million from Series A building a network that was much smaller than Friendster, MySpace, etc. We had no revenue, or even revenue-capable products.

The journey from founding, to multiple rounds of financing, to IPO, was not easy. All startups go through real Valley-of-the-Shadow moments, in which they wonder why they ever thought their business was a good idea. At LinkedIn, we had these moments. As an entrepreneur, I found David Sze and Greylock to be a tremendous ally through the process. And, David had the vision to invest in LinkedIn when it looked to most of the investing community like an odd niche.

We changed some of the text to be less hyperbolically ambitious on slides 9, 12-14, 18, 19, 31, and 36. A public company should avoid publishing forward-looking projections and ambitions - even if they're from 2004. As an entrepreneur pitching a private company, it is of course critical to be forward-looking and ambitious.Thanks to Ian Alas and Ben Casnocha, among others, for their help and feedback.

How did I get Greylock on board in the first place? It started with this pitch deck. A good pitch helps get great investors, because it builds a strong relationship through clear communication and vision.

So good fortune building your own pitch deck. And I hope it marks the start of an exciting entrepreneurial journey.

This article originally appeared on TechCrunch.

2 preamble issues having read the comments on TC today:

1: I know that the prices of startup companies is much great in Silicon Valley than in smaller towns / less tech focused areas in the US and the US prices higher than many foreign markets. I acknowledged this in the article. You can be pissed off, but I don't set prices. I'm just making the commentary.

2: As expected at least one person accused me of writing this post because I want to see lower valuations. That's stupid. I can't control the market. When prices are too high I just pass. Simple. I wrote this because over the last decade I've seen a destructive cycle where otherwise interesting companies have been screwed by raising too much money at too high of prices and gotten caught in a trap when the markets correct and they got ahead of themselves.

I said both in the article but felt compelled to provide a statement up front for the skimmers.

I have conversations with entrepreneurs and other VCs on a daily basis about fund raising, the prices of deals, how much companies should raise, etc. I've stopped talking about this as much publicly because it's such a heated, emotional topic where the points-of-view are strictly subjective and for which the answers will only be revealed in the future.

I've decided to take all of my private conversations and subjective points-of-view on the topic and make them public in a keynote speech at the Founder Showcase in San Francisco on June 15th.

I thought I'd post on one of the topics before hand. It's the one bit of advice I find myself giving most frequently these days, "raise money at the top end of normal."

Huh?

Here's what I mean. There is an inherent value that any company has. On a public stock market that is the value that investors place on future free cash flows of the business discounted to today's date to account for the time value of money. The more mature the company and industry, the easier it is to predict its future. When investors are feeling confident about the future they tend to bid up the value of public companies due to an increased perception that the future cash generated by the company will appreciate. The price of public stocks change instantly in reaction to news that is perceived to affect the future value of that company.

Every day shareholders vote on the value of the company by buying or selling shares. There is no price movement without one person agreeing to sell the stock and other agreeing to buy it. Stocks that have a lot of people trading are said to have a lot of liquidity, which basically means it's really easy to get into (buy) or get out of (sell) the stock.

Private markets for stocks are the opposite. They are pretty illiquid. If you invested in the first angel round of a startup company it is usually very hard to sell your stock - usually for many years if ever at all. So how exactly are prices determined?