UX Strategy: How to Devise Innovative Digital Products that People Want

UX Strategy: How to Devise Innovative Digital Products That People Want Jaime Levy Beijing • Cambridge • Farnham • Köln • Sebastopol • Tokyo

Special Upgrade Offer If you purchased this ebook directly from oreilly.com, you have the following benefits: DRM-free ebooks — use your ebooks across devices without restrictions or limitations Multiple formats — use on your laptop, tablet, or phone Lifetime access, with free updates Dropbox syncing — your files, anywhere If you purchased this ebook from another retailer, you can upgrade your ebook to take advantage of all these benefits for just $4.99. Click here to access your ebook upgrade. Please note that upgrade offers are not available from sample content.

Foreword When I was 21 years old and taking the train into Manhattan from Brooklyn to fix laser printers and dream of a career in “multimedia,” I would read about Jaime Levy’s work hoping that one day I would get to meet her. In the early 90s, we didn’t have the Web, but we did have bulletin board systems (BBS), and new media was evolving fast. Computers had just begun offering built-in modems and CD-ROM drives, but we were a couple of years away from web browsers and broadband. Jaime got to the digital revolution before all of us, having made a floppy-disk magazine series from 1990 to 1992 — WIRED debuted its print magazine in 1993. That same year, she did this crazy interactive press kit for Billy Idol that he distributed with his album Cyberpunk. At that time, I started a “zine” called CyberSurfer, my screenname online, and published five issues. The folks at PAPER Magazine gave me a gig writing a column for them called “CyberSurfer’s Sillycon Alley,” and I would cover Jaime’s work often — primarily because she was the only person actually doing work! She never got rich, but she made great art and followed her vision of what the interactive world should be. In fact, she turned down her chance at being a billionaire as the third co-founder of Razorfish. In 1996, I hosted a pitching contest called “Ready, Set... Pitch!” at Josh Harris’ famous loft for Pseudo.com. Jaime pitched Electronic Hollywood, a studio that would make cartoons and interactive experiences for the Web. She saw casual games and YouTube a decade before they hit, and before anyone used the terms “UX” and “IA,” she was teaching all of us about “experience” and “flows.” I’ve been lucky enough to build or invest in over 100 Internet businesses, from Uber to Engadget, and I can tell you that if you want to build a product that changes the world, the first place you should begin is where you are right now — in Jaime’s hands. Listen and consider what she says in this book deeply. This is the “missing manual” for the Lean Startup and Lean UX techniques that you’ve always wanted.

Nondesigners especially should continue reading, because Jaime takes the time to explain the oftentimes intimidating jargon and processes that designers throw around, effortlessly and clearly for you, the reader. Late one night, when we were kids in our 20s dreaming about the Internet and what it might become and how to be successful with it, Jaime explained it to me concisely: “It’s all about the experience.” There is not better advice for building product, or living your life. It’s all about the experience. JASON MCCABE CALACANIS APRIL 2015

Preface STRATEGY IS ABOUT CONNECTING THE DOTS. IT REQUIRES YOU TO LOOK at what’s happened in the past and what’s going on in the present to make better guesses about the future. People who do strategy need to be inquisitive, objective, and fearless. They need to be risk takers who stalk and kill their prey by going for the throat. User experience (UX) strategy lies at the intersection of UX design and business strategy. It is a practice that, when done empirically, provides a much better chance of a successful digital product than just crossing your fingers, designing some wireframes, and then writing a bunch of code. This book presents a solid framework on the practice of UX strategy. It is geared specifically for crafting innovative products and takes you through numerous lightweight techniques that you can use regardless of your work environment. The basic principles of business strategy do not need to be a mystery requiring somebody with an MBA to understand. Strategy, just like design, is something that you can master only by practicing it.

Who Should Read This Book? This book addresses the large knowledge gap between UX design and business strategy. It was written with the following types of product makers in mind: Entrepreneurs, digital product managers, and intrapreneurial teams You want to lead your team — visual and UX designers, developers, marketers, and so on — to craft a successful product with a killer UX. However, there are limitations on your time, cash, and other resources, and that means focusing your team’s efforts on techniques of applied simplicity, or putting the most essential and affordable tools into practice. You understand Lean Startup principles and want to cut corners on research and evaluation, but you also know that you need to make decisions based on a sound strategy. This book will provide you and your team with the necessary lightweight tools for testing value propositions, finding opportunities for creating value in the marketplace, and designing for conversion. UX/Interaction/UI Designers You’re frustrated. You feel like you are a cog in the wheel making design deliverables. You want your work to be more innovative and strategically sound, but you aren’t involved with product definition at a strategic level. You fear that you are hitting a career wall because you don’t have a business degree or marketing expertise. This book will teach you how to push back when you find yourself in the following situations: You’re assigned to create a site map and wireframes for a product that you believe is just a rip-off of an existing one. You don’t want to spend the next six months reinventing the wheel. This book will show you how to be innovative by systematically cherry-picking from your competitors. You have a stakeholder who is 100 percent certain that his product vision is right, and you are told to implement it as is. You want to do user research to help him deviate from his original vision, but he won’t give you the budget. This book will demonstrate different options for being intrapreneurial with or without buy-in. You get handed a massive requirements document for a transactional product and are told to come up with a design that will increase conversion. This book will show you how to break down the stages of engagement and map desired actions to metrics.

Why I Wrote This Book What has kept me on my toes while being a software designer and practitioner is being a part-time teacher of the evolving discipline of user interface (UI) design and product strategy. Since 1993, I have taught everything from graduate-level courses for engineering students to adult education courses for working professionals who wanted to reposition their career tracks with more marketable skill sets. But there was never a perfect book in any of those situations that gave my students everything they needed. Instead, I was constantly hounded to share my presentation decks, sample documents, and templates. I wrote this book to finally consolidate into one resource everything I know about the practice of UX strategy, which I learned from my work with startups, agencies, and enterprises. I also hope that designers and product makers who are aspiring strategists will gain from my years of professional experience. I’ve had a lot of ups and downs in my professional and personal life, and they have informed my attitude toward trial and error. This is why even from the beginning I didn’t want to write a dry business or technology book. I wanted to write a book that chronicles the vitality and fluidity of what we actually experience in the real world of product design. I wanted to depict the entrepreneurial spirit, which isn’t just about success or techniques that always work. I wanted to share that journey with the hope that you won’t get as scuffed up as I did along the way.

How This Book Is Organized I organized this book based on how I have fine-tuned my teaching method over the years. Therefore, the first way to read this book is as it was originally intended — as a how-to guide to making an innovative digital product. If that’s how you choose to read it, you’ll want to begin with an idea or problem you hope to solve through a digital interface, because the only way to learn how to swim first is to get in the pool and become comfortable with freezing your butt off. As you and your team move through the chapters, you’ll unlock techniques in a linear order. Then, when you’re acquainted with all the techniques, you’ll be able to practice them in the future in whatever order works best. The book has 11 chapters. Chapter 1 establishes what UX strategy is and is not. Chapter 2 introduces the UX strategy framework that will shape all the tools and techniques in this book. Chapter 3 through Chapter 9 teach you how to perform those UX strategy techniques. Chapter 10 includes four interviews with top strategists around the globe to give you some insight to their different perspectives on the subject. And finally, Chapter 11 wraps everything up in a brief conclusion.

What Is the UX Strategy Toolkit? This book comes with a complimentary toolkit so that you and your teams can begin using it immediately for nailing a stellar UX strategy for your product. I’ve been refining these tools for years with clients, using them both for collaboration and as an output deliverable. They might seem unwieldy at first, but they are a crucial starting place to learn how to conduct efficient UX strategy. As you read, you’ll come across in-depth explanations of how each tool works and the benefits that each one provides. To access the free UX Strategy Toolkit, go to the following URL: http://userexperiencestrategy.com After you download the toolkit — an Excel (.xlsx) file — simply import it into Google Drive as a spreadsheet. You will have full editing and sharing privileges; so, by all means, share it with your team. There are tabs at the bottom of the spreadsheet with which you can switch among the different tools. UX strategy requires collaboration among team members and stakeholders. It doesn’t matter whether you’re a student in a classroom, a fledging startup, or a cross-functional team at an enterprise. The tactics don’t work unless you all work together. The best way to collaborate in this digital age is through cloud- based tools, and the cloud-based toolkit for this book will help you to align your onsite and remote teams to a product vision. It’s also great because you can work together in real time on the same document, virtually chat with teammates, or leave contextual notes for later.

Comments and Questions Please address comments and questions concerning this book to the publisher: O’Reilly Media, Inc. 1005 Gravenstein Highway North Sebastopol, CA 95472 (800) 998-9938 (in the United States or Canada) (707) 829-0515 (international or local) (707) 829-0104 (fax) We have a web page for this book, where we list errata, examples, and any additional information. You can access this page at: http://bit.ly/ux_strategy To comment or ask technical questions about this book, send email to: bookquestions@oreilly.com For more information about our books, courses, conferences, and news, see our website at http://www.oreilly.com. Find us on Facebook: http://facebook.com/oreilly Follow us on Twitter: http://twitter.com/oreillymedia Watch us on YouTube: http://www.youtube.com/oreillymedia

® Safari Books Online Safari Books Online (www.safaribooksonline.com) is an on-demand digital library that delivers expert content in both book and video form from the world’s leading authors in technology and business. Technology professionals, software developers, web designers, and business and creative professionals use Safari Books Online as their primary resource for research, problem solving, learning, and certification training. Safari Books Online offers a range of product mixes and pricing programs for organizations, government agencies, and individuals. Subscribers have access to thousands of books, training videos, and prepublication manuscripts in one fully searchable database from publishers like O’Reilly Media, Prentice Hall Professional, Addison-Wesley Professional, Microsoft Press, Sams, Que, Peachpit Press, Focal Press, Cisco Press, John Wiley & Sons, Syngress, Morgan Kaufmann, IBM Redbooks, Packt, Adobe Press, FT Press, Apress, Manning, New Riders, McGraw-Hill, Jones & Bartlett, Course Technology, and dozens more. For more information about Safari Books Online, please visit us online.

Acknowledgements This book would not be in front of your eyes without my constant collaboration with Sarah Dzida. I first met Sarah in my UX design class while she was pursuing a master’s degree in writing. We eventually worked on a number of UX strategy and design projects together, which gave her firsthand insights into helping me tell the stories behind my business cases. In the end, she did everything from helping me write the book proposal to serving as my writing coach from sample chapter to final draft, acting as the lead editor and applying her genius talents to structurally weave all of the crazy narratives together across the chapters into a seamless epic. I’m forever grateful to her for sticking with me throughout my entire quest of becoming an author. I also want to extend my thanks and gratitude to the following people: Big thanks go to Lane Halley, my “Number 1” UX Guru and Lean Startup Queen, who has been my sounding board for this project since the first time it was presented as a lecture in Los Angeles. Thanks to the contributors including Chaim Diesto, Miles Frank (portraits of strategists), Ena De Guzman, Geoff Katz, Jared Krause, Zhan Li, Paul Lumsdaine, Peter Merholz, Holly North, Bita Sheibani, Michael Sigal, Milana Sobol, Michael Sueoka, Eric Swenson, and Laurel Wetzork. Thanks to O’Reilly Media and my editing team, Mary Treseler and Angela Rufino. Thanks to my awesome son Terry for giving me that special raison d’ être to keep my eyes on the prize. I dedicate this book to him and the rest of my family. Thanks to all my ballet teachers for teaching me an art form and a practice that kept me sane throughout this project. Thank you, Los Angeles, for being my home.

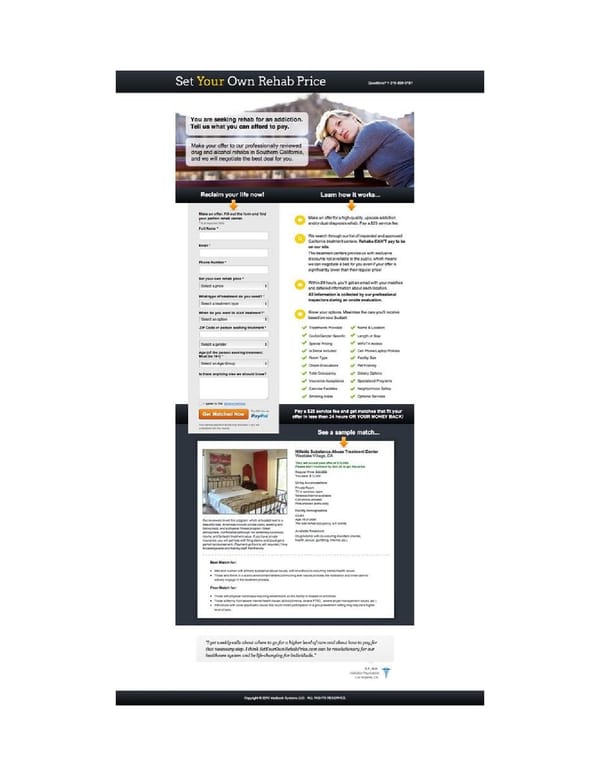

Chapter 1. What Is UX Strategy? I’ve seen the needle and the damage done, a little part of it in everyone. — NEIL YOUNG (1972) A FEW YEARS AGO, A HIGHLY SUCCESSFUL SOFTWARE ENGINEER BECAME an entrepreneur because he had a problem — someone he loved needed treatment for a drug addiction. He embarked on a daunting journey that millions of Americans face each year — to find appropriate care at a reputable facility. However, the road was filled with uncertainty and pain points; there was no price transparency, no centralized place to research the facilities with unbiased reviews, and scads of liars running overpriced facilities while preying on desperate people just like him. But during the course of his research, he discovered that reputable treatment centers also struggled with certain things: they constantly had empty beds; they had difficulty sifting through referrals for appropriate patients; and it was a hassle to collect payments from insurance companies. At the end of his journey, the software engineer saw the opportunity to embark on a different kind of adventure. He could solve a market problem and at the same time help people with a personal problem about which he was very passionate. That’s how his startup was born; his idea to connect the right patients with the right kind of treatment centers through an online interface. [1] Because his product had the potential to disrupt the marketplace, he was able to gather a solid team and get investment capital. He developed relationships with reputable rehabilitation facilities. He developed a database for matching [2] empty beds with the people who needed them. He developed a way to vet each facility to ensure that only the best were included in the database. And, of course, he and his team developed a consumer-facing website for customer acquisition. They didn’t leave anything to chance. They also conducted a couple of online surveys with people who had looked for treatment in the past. They hired public relations, marketing, and search-engine optimization (SEO) firms. They bought advertising in print and online publications; talked to industry experts; and found many business-side partners interested in their value proposition and who wanted to be a part of it. When the site went live, they ran numerous online advertising campaigns using Facebook and Google to promote the financial savings and data-rich reviews that customers could get by using their service. From these campaigns, only a small

amount of traffic trickled to their home page and then bounced away. Sometimes, a user registered with the service. Sometimes, they even came back. But over the course of 18 months, no one booked a treatment center through their website. The software engineer’s team knew that whatever they were doing, it wasn’t working. They had the proof: millions of dollars spent building a product that hadn’t gained them one customer. Their investors and business partners were getting anxious. Their publicist continued to find media that were interested in the concept, but the outlets wouldn’t run the story without some activity on the site. Still, they had a lot of features and functionality built in to their interface to help users make the best decision possible. “It must be the user experience,” the team hypothesized, which is when and why they came to me. Like many product makers before them, they asked my user experience (UX) team to just redesign the “look and feel” of the site, ASAP. After all, they needed to meet the growing concerns of their business partners, and because they had a lot of entrenched functionality, they felt it would be easy for my team to just build off of it. But we refused, because they didn’t just need a new UX design. They needed a new UX strategy.

Misinterpretations About UX Strategy UX is an umbrella term that encompasses a lot of disciplines, and UX strategy lies somewhere at the intersection of UX design and business strategy. But the lines don’t exist in a vacuum. Instead, they exist in an elaborate anatomical structure with a lot of dots to connect. This is why there are so many different interpretations floating around UX strategy. I first came across the term “UX strategy” in 2008 in an advanced-level UX [3] book called Mental Models by Indi Young. At the time of its writing, Young was attempting to help UX design ascend to the next level. As such, she offered her readers a mini-manifesto, which you can see in Figure 1-1. Figure 1-1. Sidebar from the book Mental Models © 2008 Rosenfeld Media, LLC I really wanted to understand what UX strategy meant, but aside from the fact that the difference between “experience” strategy and “user experience” strategy just seems to be one word, the book didn’t delve any deeper into this abstract equation. Over the course of my career from working with big interactive agencies to enterprises, I’ve heard many other theoretical concepts about the intention of UX strategy. And that’s something I want to sidestep in this book: the entirely semantic disputes about what “strategy” means or whether a theoretical framework has practical application. It’s important that we avoid battles that boil down to these kinds of debates. They only confuse our clients

and stakeholders, and this is ultimately what happened in the early 2000s when there was so much debate about the differences between the practices of “user experience design” versus “interaction design.” But misinterpretations, if they can do anything, can be useful in providing a grounding point for contrast. So, let’s get the big ones out of the way. Misinterpretation 1: UX strategy is about identifying a “North Star” Reality: the North Star is not the brightest star in the galaxy, but it has been used [4] for navigation throughout history because of its “fixed” location in the sky. In the context of the digital age, a team identifies that fixed point as the goal of their game plan and then sets course for it. This traditional business-strategy approach can work to galvanize a team in a large slow-moving enterprise. But what if your solution is an innovative digital product about to be launched in a fast-moving consumer market full of uncertainties? This requires an agile process — one that is variable and iterative with continuous feedback loops at several points along the way. You don’t want a North Star to guide your UX strategy; instead, you want a goal or point toward which to steer every time you pivot. Misinterpretation 2: UX strategy is a “strategic way” to perform UX design Reality: I guess the opposite of this would be, what, doing nonstrategic UX design? UX design and UX strategy are two different things. When you are doing design, you are creating something. When you are doing strategy, you are coming up with a game plan before creating something. One way to explain it is to just substitute the word “product” for “user experience.” A product strategist thinks about all the possibilities for the product and defines it after researching the potential customers and existing competitors. She thinks about how much the product will cost to make and be priced to sell at, and how it will be distributed to different customer segments. In contrast, a product designer actually fabricates the thing. They are two separate disciplines. Too often, I have seen UX designers work on products without being informed of the overall business strategy. They are blind beyond what they’ve received in the business requirements document. This disconnect is why the Lean UX movement is so popular; it advocates that UX designers take on a bigger leadership role (“getting a seat at the strategy table”) by becoming the glue that holds cross-functional teams together.

Misinterpretation 3: UX strategy is just product strategy Reality: Misinterpretation 2 points out the similarities between a product strategist and UX strategist. However, that doesn’t mean that you can easily substitute one for the other (even if my parents think my little brother [a product director/manager type] and I do the same thing for a living). The people who design the real-world shopping experience of a brick-and-mortar Target as well as the products in that store are thinking about a very different set of issues than the people designing Target.com. But UX strategy goes beyond just one digital product or online experience. It spans dozens of different digital products, services, and platforms; it interconnects all members of a digital interface family. Here are just a few examples to consider: Apple iMac, iPod, the physical Mac Store, iTunes, iCloud, and so on LinkedIn Desktop, mobile, and Premium Adobe Photoshop, Illustrator, and in the cloud Amazon Prime, AWS, Kindle, as a content creator, and so on The UX strategy makes a case for all touch points and weaves them into a seamless ecosystem between buyer and seller through the UX design. It accounts for the user’s entire journey down the funnel. (For more on this, see Chapter 9.) Misinterpretation 4: UX strategy is closely tied to brand strategy Reality: brand strategy is how, what, where, when, and to whom you plan on communicating and delivering your brand messages through your distribution channels. Aspects of brand strategy can help define aspects of your product’s UX design, and vice versa. But it’s easy to confuse these branding efforts and goals with a UX strategy. A poor UX can actually decrease the “brand value” of a product, but not so much the other way around. Even the brandiest of brands can’t overcome the poor UX of a product. [5] In their book Lean Entrepreneur, Brant Cooper and Patrick Vlaskovits say,

“Marketing can increase awareness for the product, but if the product sucks, that’s what the buzz will be.” Apply this thinking to Google. It has a fantastic brand. Now, think about products like Google+, Buzz, and Wave. These products were consistent with the Google brand strategy, but they failed to stand up to public scrutiny on their own. When these products debuted, they baffled users and failed to acquire them. They bombed at the “Big Picture,” which was to solve the user’s dilemma over how to communicate to different networks of people through multiple products. Another important thing to remember is that a solid UX design no longer differentiates brands. For companies such as Google, users assume the UX will be good. Google doesn’t have to announce it anymore, and when it’s bad, it’s all the more jarring. That’s why a UX strategy becomes even more potent. As the company grows and expands its digital properties, you need to constantly pivot and shift your game plan, baking your strategy into all online services effectively, reliably, and without friction. A product needs a good UX no matter what.

So What the Hell Is UX Strategy? UX strategy is the process that should be started first, before the design or development of a digital product begins. It’s the vision of a solution that needs to be validated with real potential customers to prove that it’s desired in the marketplace. Although UX design encompasses numerous details such as visual design, content messaging, and how easy it is for a user to accomplish a task, UX strategy is the “Big Picture.” It is the high-level plan to achieve one or more business goals under conditions of uncertainty. The purpose of any strategy is to create a game plan that looks at your current position and then helps you get to where you actually want to be. Your strategy should play to your strengths and be mindful of your weaknesses. It should rely on empirical, lightweight tactics that quickly move you and your team (because let’s face it, you’re probably not doing this alone) toward your desired destination. A solid strategy is the difference between success and failure. In the digital-product world, chaos — time delays, increased costs, and bad user experiences — get exacerbated when there is no shared product vision among team members. Like any good general, you need to develop that strategy. That’s why we convinced the beleaguered startup of our software engineer to step back and reformulate their game plan. Here’s what our hands-on UX strategy achieved for them in about a month: We questioned all the current research and found a lot of it was based on business assumptions rather than factual user data. This is why the client allowed my team to put the redesign on pause. We conducted guerrilla user research using a Minimum Viable Product (MVP) prototype with the clients sitting at the table. By hearing firsthand from their presumed customer, the clients acknowledged that their customer segment actually wasn’t “everybody” who was getting ripped off by bad treatment centers. Instead, they had built a business model that needed a direct marketing channel targeted at an affluent customer segment. We experimented on new value propositions by testing customer acquisition with landing pages. This helped open the clients’ minds to other possible business models, such as a business-to-business (B2B) solution. Sure, many of the findings were super depressing for the clients. They had spent a lot of time and money building a product that didn’t work. Initially they blamed their site’s “user experience.” But by looking at the big picture, we

showed them how a lot of their UX was actually getting hamstrung by other things that went beyond the digital interface.

Why a UX Strategy Is Crucial A mental model is the conceptual model in a person’s mind about how a thing works. For instance, when I was 10 years old, I believed the way my mom got cash was by going to a bank, signing a slip of paper, and then receiving the funds from the teller. When I was 20, I believed I needed to take a bank card and key code to access an ATM to get cash. But if you were to ask my 10-year-old son how to get cash, he would tell you to go to the supermarket and ask the cashier to give you some when you pay for your groceries. The 2015 mental model for getting cash is very different from the 1976 mental model. That’s because new technologies and new business processes come together to offer a more efficient way for people to accomplish tasks. Stale mental models are overturned. Life is disrupted for the better! This is why I love working with startups, because entrepreneurs are the biggest risk takers of them all. They quit their day jobs and go all in on one big idea that they are passionate about. Our software engineer was just that type of person — after a difficult personal experience, he wanted to solve a problem so that others would not have to experience his pain. He wanted to change a mental model. Even though envisioning innovative products is fun, it’s hard to get people to change their behavior. Customers have to see the value in the new way before they’ll consider abandoning the old. Devising new products to solve serious dilemmas is not for the faint of heart. You must be passionate and at least a little crazy to run headlong into all the obstacles that inevitably will get in the way. Yet, it’s the passion to solve a problem, change the world, and make it an easier place to live in that makes for game-changing products. And this passion is not limited to entrepreneurs who quit their day jobs. It also emboldens people who have titles like product manager, UX designer, or developer. These are people who also are passionate about using technology to devise products that customers want. When you bring these types of people together, you have the necessary means to potentially make magic happen and destroy outdated mental models. Because time on earth is finite, why else would you want to build anything else? My goal in this book is to demystify the practice of UX strategy so that you can do just that. You’ll be able to immediately apply UX strategy techniques to your projects in a variety of work settings to keep you and your team from getting overwhelmed no matter what limitations you face.

I’ll show you how it can happen through a variety of business cases. You’ll meet some of my former clients — our aforementioned software engineer, a Hollywood producer, and an entrepreneur named Jared who wants to eliminate the need for currency with his transactional online platform. You’ll meet two of my students — Bita and Ena — who participated in a UX apprenticeship in which they chased a made-up value proposition in order to document my UX strategy process. I’ll even reach back into my family ancestry, because I know I was incentivized to be entrepreneurial from watching and learning from my parents. You’ll see how the journey is a reward, no matter if you’re the teacher, student, or maker. You’ll also see that no matter the project or the circumstances, devising products is like being on a rollercoaster, and the only way to keep the product on the rails is to use empirical, cost-efficient strategy techniques. As a UX strategist, I am paid to help my clients face dilemmas and chase dreams. This is why solid problem-solving skills are absolutely critical to mastering UX strategy. Strategy goes beyond the abstract nature of design and into the land of critical thinking. Critical thinking is disciplined thinking that is [6] clear, rational, open-minded, and informed by evidence. Product stakeholders and entrepreneurs use the critical thinking in a UX strategy to help them connect the dots among all the points — the customers, their needs, and the solution they all want to solve using technology. It is in this way that UX strategists need to be equally passionate about technology, because the Internet continues to offer consumers an endless supply of digital options. Every click, swipe, and hover is a decision that users are able to make. They have choices — a gazillion of them — to buy or not buy, like or deride, share or forget, complete or cancel. You need to know what features to offer and how people actually use them. You need to understand all of the latest and upcoming devices, platforms, and apps so that you can consider their application for your solutions. You and your team need to do everything you can to ensure that Alice will fall down the rabbit hole and into Wonderland. Are you ready to jump? [1] “Priceline Type Bed Auction Service Has Potential to Radically Transform Addictions Biz.” Treatment Magazine, January 12, 2012. http://tinyurl.com/8lj5wqa. [2] “Making a Treatment Match.” Behavioral Healthcare, February 25, 2013. http://tinyurl.com/mv5gq8u. [3] Definition of Experience Strategy by Jesse James Garrett in Indi Young’s book Mental Models, Rosenfeld Media, 2008; p 20. [4] http://www.space.com/15567-north-star-polaris.html

[5] Vlaskovits, Patrick and Brant Cooper. Lean Entrepreneur. Wiley, 2013. [6] http://en.wikipedia.org/wiki/Critical_thinking

Chapter 2. The Four Tenets of UX Strategy “In war, let your great object be victory, not lengthy campaigns.” [7] — SUN TZU, ART OF WAR A STELLAR UX STRATEGY IS A MEANS TO ACHIEVING DISRUPTION IN the marketplace through mental-model innovation. And to keep me from forgetting this, I have the sticker shown in Figure 2-1 on my laptop lid. Figure 2-1. The sticker on my laptop lid Because what’s the point in spending time and energy crafting a digital product that isn’t unique? Or, at the very least, is a much better alternative to current solutions found in the online marketplace? To achieve that disruption, we need a framework in which to connect all the dots

that will build a cohesive UX strategy. In this chapter, I’m going to break down the most important tenets that you need to understand in order to successfully implement the tools and techniques in this book. Think of it as a primer to get you and your team thinking like a UX strategist.

How I Discovered My UX Strategy Framework In the digital world, strategy usually begins in the discovery phase. This is when teams dig deep into research to reveal key information about the product they want to build. I’ve always liked to think of the discovery phase as similar to the pretrial discovery process used by attorneys in the United States. To avoid a “trial by ambush,” lawyers can request to see the evidence of the opposing counsel in order to prepare sufficient counter-evidence. In this way, the attorneys try to avoid surprises, and you, as a product maker, should also want to strategically do just that. My first chance to practice UX strategy occurred in 2007. At the time, I was the UX lead at Schematic (now Possible) for the website redesign of Oprah.com. Along with the other team leads, I flew into Chicago to kick off our discovery phase. Before that moment, my 15 years of professional experience focused on interface design and integrating new technologies (such as Flash) into interfaces to create “cutting-edge” products. Often, I was handed a massive requirements document that listed hundreds of “essential” features. Or, I was given a flimsy project brief with pretty comps that stated what the final product should accomplish. From there, I made a site or application map that catered to a specific set of user scenarios that enabled those interactions. Based on these documents, I could only infer whether my creation solved the problem or not because it was typically too late at that point to challenge the rationale behind the product vision. I was just supposed to design it on time and on budget. But in 2007, it was so fascinating to watch our UX director, Mark Sloan, get a dozen contentious stakeholders — no, Oprah wasn’t there — on the same page. Mark used consensus-building techniques such as affinity maps, dot voting, and forced [8] ranking to help us understand all the different parts — content and critical functionality — that would make up the system we had to digitize. This discovery opportunity helped us (the stakeholders and product team) in examining our goals to make a better platform for the millions of devoted Oprah fans in the world. One week later, after all the workshops, the product team and I presented the discovery brief defining the product vision. The brief contained typical deliverables such as user personas, concept map analyses, and a recommended feature list. Because the stakeholders were anxious to get started, they immediately approved it. Our digital team was off and running on the

implementation phase, which took over six months of emotionally fueled hand- offs. There were hundreds of pages of wireframes and functional specifications traded between stakeholders, designers, and developers. But the discovery brief was never referenced again. The personas and proposed solution were never validated by existing customers. The stakeholders went back to fighting for whatever prime real estate they could grab for their particular business units. Yet, there was something good that came out of that discovery phase for me: I was a UX designer who finally got a taste of what a UX strategy could potentially be. I was ruined. I couldn’t imagine just being a wireframe monkey anymore. A full year later, the redesigned site launched. I never looked at it because I had moved onto to another interactive agency (HUGE) with other high-profile clients. In my new position, I was able to focus my energy more directly on the discovery phase of projects in which user research and business strategy were given more weight. I also had a seat at the table to help shape the UX strategy and decide how a product vision should be implemented. I no longer had to feel fraudulent for spending so many waking hours building products for which I lacked a deep understanding of the customer segment and the business model. Today, I run my own practice that specializes in UX strategy, and since my first discovery phase, I’ve learned a lot about how to make it an iterative, lightweight, and empirical process of intense collaboration among stakeholders, designers, developers, and so on. Because when everyone shares a product vision, you and your team really have a chance at changing the rules of the game for your product, company, and future customers. However, I do want to acknowledge that my methodology is my version of UX strategy and might be different from other strategists’. That’s precisely why I included Chapter 10, which contains profiles of people I respect who have been practicing UX strategy and design as well. However, you’ll also see that we align on a lot of things. That’s what happens when a new discipline or methodology arises: people will find their own approach, but even within those differences, there are connective tissues that bind them together to make UX strategy identifiable and unique. So, with all that said, cue the drum roll to introduce my UX strategy framework, as presented in Figure 2-2.

Figure 2-2. The four tenets of UX strategy represented as plates at the dinner table My formula is this: UX Strategy = Business Strategy + Value Innovation + Validated User Research + Killer UX Design. These are the four tenets that make up my framework. I have seen them in play every day since my first discovery phase. It’s not enough to understand your marketplace if you don’t talk directly to your customers. It’s not enough to validate that your product works if you’re not creating something unique. Good enough just isn’t good enough, and just identifying these tenets won’t be enough to get your team flying. You’ll need to understand how they interact and affect one another. Then, the real trick will be to keep all four of these tenet “plates” spinning in the air while you move through the techniques and tools in the subsequent chapters. LESSONS LEARNED The discovery phase is where UX strategy begins. UX strategy is based on four tenets: business strategy, value innovation, validated user research, and killer UX design. The output of the discovery phase should be based on empirical data, such as getting direct input

from target users before going straight from an idea to wireframes and development. How a team executes a discovery phase can be the deciding factor between how a product will ultimately deliver real value through a killer UX and create real value for the stakeholders.

Tenet 1: Business Strategy Business strategy is the top-line vision of the company. It is why the company exists. It ensures the long-term growth and sustainability of the organization. It is the basis for the core competencies and offerings, which are the products. In this book, I will use the term “products” to refer to both digital products and digital services. The business strategy is what gives product makers the direction to grow in the marketplace while beating the competition. The business strategy identifies the company’s guiding principles for how it will position itself and still achieve its objectives. For this to happen, the business must continually identify and utilize a competitive advantage. A competitive advantage is essential to the company’s long-term existence. [9] In his classic book, Competitive Advantage, Michael E. Porter lays out the two most common ways to achieve a competitive advantage: cost leadership and differentiation. The advantage behind cost leadership comes from offering the lowest price for products in a particular industry. Whether it is the cheapest car, television, or hamburger, this was the traditional way that companies achieved dominance in the marketplace. After all, allowing the private sector to compete without government regulation is what free market economy is all about! I mean, look at the rampant success of stores such as Walmart and Target. They can offer consumers the best prices and widest selection of merchandise. But what happens when prices hit rock bottom? Then, the battle needs to be about what makes the product better. This brings us to Porter’s second type of competitive advantage: differentiation. Because we are product inventors planning to build disruptive technologies, this is where our actual power lies. With differentiation, the advantage is based on a new or unique product or a unique aspect of the product for which customers will pay a premium because of its perceived value. As consumers, we choose one product over another based on the things we personally value, ranging from the product’s usefulness to how much pleasure we derive from it. That perceived value is what transforms a simple little café and cup o’ joe into the crazy success story of Seattle-based Starbucks. There’s a reason why people pay $5 for a cafe latté — it’s the experience that’s also wrapped into the product. It starts the moment a customer steps into the store and ends when that person tosses his cup and sleeve into the trash.

Today, a UX differentiation is the digital-product game changer. Differentiated user experiences have completely revolutionized the way we communicate with the world. Consider what the world was like before microblogging. When it was released in 2006, Twitter confounded users with its 140-character limit. But the limit turned out to be a valuable perk, especially with respect to updates. Today, users don’t check traditional news outlets for instant updates; they instead check Twitter. When Hurricane Sandy pounded the East Coast in 2012, the power went out, but more than 20 million Tweets occurred among users, residents in the [10] storm, and media and government outlets. I know I spent some time on Twitter, tweeting to friends in New York about the hurricane updates I saw on TV from my home on the West Coast. Another tool that has distinguished itself from the competition with a UX differentiation is the map app Waze. It combines social traffic with GPS navigation, thereby allowing users to find the quickest route of the moment to their destination. By merely driving around with Waze open, users passively contribute traffic and other road data to the network. Users also can take a more active role by sharing road reports on accidents, police traps, or any other hazards along the way, helping to give other users in the area a heads-up about what surprises might ahead of them. In June of 2013, Waze (an Israeli startup) was acquired by Google for $1.1 billion. Now, Waze still offers its distinct UX to [11] its users, but its data is also channeled into Google Maps. Clearly, Google recognized the competitive advantage of UX collaboration and chose to adopt Waze for what it could add to its product rather than compete against it. A UX competitive advantage is important to understand in this brave new world of technology. Traditionally, the purpose of a competitive advantage was to make a product that was self-sufficient through a revenue stream. A revenue stream is how the company gets paid. And when a customer pays more for the product than what it costs to make, value is created for the stakeholders. To many people, this is the heart of a product’s business model. Today, though, a UX differentiation doesn’t necessarily mean big bucks when your product hits the market. Instead, the goal of many entrepreneurs is mass adoption. Products such as Facebook didn’t kick the collective asses of competitors like MySpace or Friendster’s because it was a cheaper alternative. Facebook won the field because, a) it offered a differentiated UX that was perceived by users as more valuable, and b) everyone adopted it. From that point, Facebook innovated a new kind of business model that relied on monetizing its user data for selling targeted [12] advertising. In 2013, Waze did a similar thing when Google bought it. Waze made a lot of money by selling access to its devoted users, and Google will make

a lot of money because so many users continue to use both the Waze and Google Maps apps. The two companies essentially turned their users into customers because they were able to monetize them, and because of this, from here on out, I am going to use the terms “user” and “customer” interchangeably. Still, a good business model doesn’t just define the revenue stream of a product. Nor does it just rely on a ridiculous number of users adopting it. This is something often lost on young tech entrepreneurs. Because they grew up in a world in which products like Facebook became solvent and conquered the world without an obvious business model, they don’t realize what an uphill battle they have ahead of them to acquire users. They also forget that the megasuccessful digital products that continue to define our everyday lives didn’t just stumble onto their business models. These game-changing companies experimented, tested, and failed before they hit on and innovated the right one. And if, like me, you worked on the Web when the dot-com bubble burst in the 1990s, you have firsthand experience of all of the risks involved in creating products without proven business models. When the investment money runs out, and there isn’t any more coming in, life is bleak. The process of business-model construction is foundational to a business strategy. As Steve Blank writes, a business model describes the “flow between [13] key components of the company.” This quote comes from Blank’s Customer Development manifesto, in which he challenges product founders to stop writing static business plans. Instead, he encourages them to adopt a flexible business model that requires all of the key components to be validated using empirical, customer-facing discovery methods. To get a sense of these key components, let’s take a look at a tool called the Business Model Canvas. [14] In their seminal book Business Model Generation, authors Alexander Osterwalder and Yves Pigneur deconstruct each of the nine essential building blocks of a business model so that visionaries can systematically think through the logic of how the company will eventually make money. Blank also refers to this tool in his own work on business-model creation. What’s relevant to us in this book is how many of these components align with the UX strategy for a digital product. They are as follows (see also Figure 2-3): Customer segments Who are the customers? What are their behaviors? What are their needs and goals? Value propositions

What value (either qualitative or quantitative) do we promise to deliver? Channels How will we reach our customer segment? Is it online or offline? Customer relationships How are we going to acquire and retain our customers? Revenue streams How does the business earn revenue from the value proposition? Are the customers going to pay for it? Or are there other options? Key resources What unique strategic assets must the business have to make the product work? Is it content, capital, or patents? Is this something we must develop? Key activities What uniquely strategic things does the business do to deliver its proposition? Are we optimizing an outdated business process? Are we creating a platform to bring customers together to transact? Key partnerships What partnerships and suppliers do we need in order to deliver our value proposition? Cost structure What are the major costs that will be incurred to make our business model work? Are we trying to cut costs by throwing out the thrills? Are there fixed costs that won’t go away?

Figure 2-3. Business Model Canvas showing the nine essential building blocks of a business model By using the canvas, product makers collect all their hypotheses about their product into one place. They then revise it as they move through the discovery phase, and it’s something you’ll see as we develop all the techniques in this book. For this tenet, however, it is another place in which we can see how business strategy and UX strategy really intersect. So many of the concerns of the Business Model Canvas — customer segments, value propositions, revenue streams, and customer acquisition and retention — are elements that are essential to creating a product’s user experience, which as you’ve learned, is key to our competitive advantage. When you don’t see these connections, you can potentially end up in the same position as our software engineer in Chapter 1. His business model relied on an affluent customer segment to provide the company’s revenue stream, but he had not correctly identified that segment before he built his product. If he had not come in contact with that user during my team’s customer discovery, he might have pushed ahead with a lengthy and expensive campaign to blitz media and online advertising outlets. This, as my team’s UX strategy proved, would have

been very problematic because the campaigns wouldn’t have reached out to the user segment actually interested in the value proposition. This leads us to how the Business Model Canvas also calls out the importance of collaboration among stakeholders and team members in the discovery phase. Categories such as key resources and partnerships aren’t something that a digital product manager or UX designer should think up in a vacuum. Rather, these categories are where the stakeholders can offer a wealth of information and leads. Other categories, such as key activities, customer segments, and value propositions, will more likely rely on the guidance of the digital team to lead the stakeholders to the best product. But the digital product team must also recognize that these same categories need input from actual users before a hypothesis can be changed to a fact, which is what our UX strategy research demonstrated to the software engineer. We need to recognize that building a business strategy isn’t about formulating and executing a perfect plan. Instead, it’s about being able to research what’s out there, analyze the opportunities, run structured experiments, fail, learn, and iterate until we devise something of value that people truly want. Also, as the product scales and the market evolves, the business strategy must be nimble. For a new product, a strategy probably revolves around just getting enough product/market fit to raise financing, or grabbing enough market share so that its customer base is the competitive advantage. But, for a more mature company, the strategy is about building out the company’s core value proposition while trying to keep the company’s infrastructure and internal processes in place. It is in this way that what might have been the business model or competitive advantage in the early life cycle of the product might not be the same in later phases. Nevertheless, in chasing this moving target, companies must continue to experiment with varied offerings so that they can scale, remain competitive, and continue to offer value to users in an ever-changing marketplace.

Tenet 2: Value Innovation As digital product inventors, we must be hyperaware of all the changing digital market dynamics. We must understand how and why people use their digital devices and what defines a successful and a failed UX. This is because a user’s first contact with the interface generally determines success or failure. It provides the user with their first impression of your value innovation, and it is value innovation that disrupts or creates new mental models for people. We definitely want to do that. Before we dig into value innovation, let’s discuss the word “value.” The word is used everywhere. It’s found in almost all traditional and contemporary business [15] books since the 1970s. In Management: Tasks, Responsibilities, Practices, Peter Drucker discusses how customer values shift over time. He gives an example of how a teenage girl will buy a shoe for its fashion, but when she becomes a working mother, she will probably buy a shoe for its comfort and price. In 1984, Michael Lanning first coined the term “value proposition” to explain how a firm proposes to deliver a valuable customer experience. For a business to generate wealth, it needs to offer a superior product to that of its competitors but at a manufacturing cost below what customers pay for it. That same year, Michael Porter defined the term “value chain” as the chain of activities that a firm operating in a specific industry performs in order to deliver a valuable product. Figure 2-4 illustrates a traditional value chain for a physical product manufacturer. Figure 2-4. The value chain That is the business process that Toyota uses to make vehicles and that Apple uses to make computers and devices. During each of the activities in this value chain of events, opportunities exist for firms to outperform their competitors. But, all those terms apply to physical products. By contrast, virtual products allow for a value chain to have faster repeat loops and in some cases for the activities to happen in parallel. This is part of why traditional business-strategy principles do not perfectly map to digital product strategy. When producing digital products, we must continuously research, redesign, and remarket to keep up with the rapidly evolving online marketplace, customer values, and value chains that are required to keep our products in production.

This brings us to another challenge of designing digital products: the software, apps, and other things that users find on the Internet and use every day. As mentioned, a product needs to be valuable to customers to entice them use it. It also needs to be valuable to the business so that the business can sustain itself. However, the Internet is full of digital products for which the users don’t have to pay for the privilege of using them. If a business model is supposed to help a company achieve sustainability, how can you do that when the online marketplace is overrun with free products? [16] Value innovation is the key. In the book Blue Ocean Strategy, authors W. Chan Kim and Renée Mauborgne describe value innovation as “the simultaneous pursuit of differentiation and low cost, creating a leap in value for both buyers and the company.” What this means is that value innovation occurs when companies align newness with utility and price (see Figure 2-5). Companies pursue both differentiation and cost leadership to create high-value and low-cost products for the customers and stakeholders. Consider how Waze found a sustainable business model — sharing its crowd-sourced data made it lucrative to other companies such as Google. Yet, to get the data, it had to provide a new kind of value to customers for mass adoption, and that value was based entirely on taking advantage of a disruptive innovation through the UX and business model.

Figure 2-5. Value Innovation = The simultaneous pursuit of differentiation and low cost Disruptive innovation is a term that was coined by Clayton M. Christensen in the mid-1990s. In his book The Innovator’s Dilemma, he analyzed the value chain of high-tech companies and drew a distinction between those just doing sustaining innovation versus disruptive innovation. A sustaining innovation he described as any innovation that enables industry leaders to do something better for their [17] existing customers. A disruptive innovation is a product that a company’s best customer potentially can’t use and therefore has substantially lower profit margins than the business might be willing to support. However, this is where disruptive innovation can blindside established competitors. Christensen says that disruptive innovation usually is “a process by which a product or service takes root initially in simple applications at the bottom of a market and then [18] relentlessly moves up market, eventually displacing established competitors.” Innovative means doing something that is new, original, and important enough to shake up a market, and this leads us right back to the book Blue Ocean Strategy.

In the book, the authors discuss their studies of 150 strategic moves spanning more than a 100 years and 30 industries. They explain how the companies behind the Ford Model T, Cirque du Soleil, and the iPod won because of how they entered blue-ocean markets instead of red-ocean markets. The sea of other competitors with similar products is known as a red ocean. Red oceans are full of sharks that compete for the same customer by offering lower prices and eventually turning a product into a commodity. In contrast, a blue ocean is uncontested territory; it is free for the taking. In the corporate world, the impulse to compete by destroying your rivals is rooted in military strategy. In war, the fight typically plays out over a specific terrain. The battle gets bloody when one side wants what the other side has — whether it be oil, land, shelf space, or eyeballs. In a blue ocean, the opportunity is not constrained by traditional boundaries. It’s about breaking a few rules that aren’t quite rules yet or even inventing your own game that creates an uncontested new marketplace and space for users to roam. When we transpose Blue Ocean Strategy to the world of digital products, we must admit that there are bigger opportunities in unknown market spaces. A perfect example of a company that took advantage of a blue-ocean market is Airbnb. Airbnb is a “community marketplace” for people to list, discover, and book sublets of practically anything from a tree house in Los Angeles to a castle in France. What’s amazing about this is that its value proposition has completely [19] disrupted the travel and housing industry (see Figure 2-6). Its value proposition is so addictive that as soon as customers try it, it’s hard to go back to the old way of booking a place to stay or subletting a property. Figure 2-6. Airbnb in the news Airbnb achieves this value innovation by coupling a killer UX design with a tantalizing value proposition. And, as I mentioned earlier, true value innovation occurs when the UX and business model intersect. In this case, they intersected

in a blue ocean because of how Airbnb broke and reinvented some rules. For example, Craig’s List was a primary means for users to sublet before Airbnb, but it was a generally creepy endeavor. There were no user profiles. There was no way to verify anything about the host or guest in the transaction. Yet, that was the norm! Airbnb enabled a free-market sub-economy in which quality and trust were given high value in the UX, much like in Amazon, Yelp, and eBay. Airbnb’s entire UX was built around the idea of ensuring that each guest and host was a good customer. It required its users to change their mental models. Formerly unwritten social etiquette now had to come into play if users were to host strangers or stay in a stranger’s home and for both parties to feel good about it. For instance, I just came back from a weekend in San Francisco with my family. Instead of booking a hotel that would have cost us upward of $1,200 (two rooms for two nights at a 3.5 star hotel), we used Airbnb and spent half of that. For us, though, it wasn’t just about saving money. It was about being in a gorgeous and spacious two-bedroom home closer to the locals and their foodie restaurants. The [20] six percent commission fee we paid to Airbnb was negligible. Interestingly, the corporate lawyer who owned this San Francisco home was off in Paris with her family. She was also staying at an Airbnb, which could have been paid for using some of the revenue ($550-plus) from her transaction with us. Everybody won! Except, of course, the hotels that lost our business. Airbnb’s business strategy is that they cater to both sides of their two-sided market — the people who list their homes and those who book places to stay. They offer incredible value through feature sets like easy calendaring tools, map integration for browsing, and, most crucially, a seamless transactional system that had not been previously offered by other competitiors like VRBO, Homeaway, or Craig’s List. Ultimately Airbnb offered a more usable platform that minimized the risk of dealing with scary people coupled with fair-market value pricing. All of this added up to serious disruption through value innovation for all customers and stakeholders in the online and offline experience. That’s why it is winning so decisively. There are many other products causing widespread disruption to the status quo through their combined value innovation of cost leadership and differentiation in blue-ocean marketplaces. And through their UX strategies, they are ultimately making people’s lives easier, bringing together customers in new ways and smashing mental models. Companies such as Airbnb, Kickstarter, and Eventbrite have completely upended how people rent homes, fund business ventures, and

organize events, respectively. In fact, Eventbrite is how I tested my hypothesis that there were people out there with a thirst for knowledge about UX strategy. Using its interface, I quickly set up a 60-seat lecture at the price of $40 per person, and sold it out. If I didn’t have Eventbrite to experiment with as a promotional platform, there might have been no book for Jaime Levy. Thank you Eventbrite for enabling the one value innovation that other platforms like Meetup failed to offer: the ability to host paid ticketed events.

Tenet 3: Validated User Research Not realizing a product’s value is one of the primary reasons why that product will fail. Stakeholders are dreamers in that they assume what is valuable to their customers instead of verifying it. Much like Kevin Costner in the movie Field of Dreams, these entrepreneurs believe that if they build it, they [the users] will come. But the truth is that any product is a risk. Remember our software engineer at the beginning of this book? His assumptions about what his customers wanted turned out to be wrong. His heart was in the right place. His idea was timely, different, very innovative, and even had a unique and sustainable business model. Nonetheless, the users didn’t come. And when my team eventually went out and asked his target users, we discovered that they wouldn’t pay for the product as it was being positioned. User research is how you verify that you’re on the right track with your value proposition. There are lots of ways to do it — ethnographic field studies, contextual inquiries, focus groups, diaries and journals, card sorting, eye- tracking, personas, and more. I don’t want to talk about any of these traditional methods. Instead, I want to talk about Lean Startup. [21] It’s weird to admit, but before 2011 when Eric Ries’ Lean Startup (which you must read) went critical mass, founders didn’t make it their mission to confront customers “early and often.” The empirical, fast-moving, and transparent nature of Lean Startup riffed on ideas from Steve Blank’s customer development [22] methodology and the highly theoretical Design Thinking approach. Sure, organizations had UX designers around to do “user-centric” design (as opposed to engineer-centric), but Lean Startup made conducting validated user research a make-or-break aspect of moving forward on a product. Lean Startup forced user research to become measurable. This leads us to our third tenet — validated user research. “Validation” is the secret sauce of the Lean Startup business approach. Validation is the process of confirming that a specific customer segment finds value in your product. Without validation, you are simply assuming that customers will find use for your product. Validated user research goes beyond just observing and establishing empathy for potential users. It is a process based on a reality-check that focuses on direct feedback from interaction with users. It helps your team to determine if the vision of your product is a dream or a potential nightmare. Eric Ries popularized the term Minimum Viable Product (MVP). It simply means learning if potential customers want your product by building just the

core features of your value proposition. This is far different from traditional product development in which building a prototype was often a simulation to show potential investors the future product. By getting customer buy-in on your value proposition early, you are de-risking your product. And if users don’t like what they see, we need to either “pivot” to a different customer segment or pivot to a different problem that our value proposition can address. Iterations like the MVP require your team to conduct research and gain validation before developing a solution. It helps verify that your team is targeting the right customer (something our startup in Chapter 1 failed to do) and not just a general persona. When you’ve validated a specific pain point that needs addressing, you can continue to add features and then test those features using the same research methods. This is known as the Lean Startup feedback loop of build-measure-learn. Use your research to validate your decisions and ensure that the product vision is aligned with the end user’s needs. Validated user research is a collaborative process that should involve as many members of the product team as possible. Collaboration will actually help organically build consensus on the value proposition and any pivots that follow. Now, this might sound naïve, given that we are all working in different environments with a range of folks with dynamic personalities who are in various positions of power. In an enterprise environment, there are typically many stakeholders who each have a say on the product requirements based on their personal agenda or preference. When I work for agencies, the product requirements are typically locked in stone during a requirements-gathering phase that I’m not involved in. For me to suggest doing validated user research or creating an MVP to test during the design phase is blasphemy because it’s counterintuitive to the agency model. The last thing an account executive wants to hear from his UX resources are ways to cut the project fee down for his client. If you happen to find yourself in this familiar position, that’s the exact moment that you need to become intrapreneurial. Intrapreneurship is the act of behaving like an entrepreneur while working within a large organization. You need to decide to take the fate of the product into your own hands through assertive risk- taking and innovation. Stand up and ask for the extra week or two to conduct validated user research. If you get a “no” or are too afraid to ask, it’s time to start working off-hours. The worst thing that can happen is that you will discover something about yourself and/or start looking for ways to improve your own work process. The bottom line is that confronting your target customers is nonnegotiable. We

must learn as quickly as possible if the idea we are working on is stupid and worthless. We need to have an open mind to experiment and to fail. That’s right, we are betting. And the odds are against us. In the end, though, this approach is more cost-effective and efficient.

Tenet 4: Killer UX Design [23] In Lean Entrepreneur Patrick Vlaskovits and Brant Cooper advocate, “If you are doing best practices, you are not innovating.” This is a provocative statement, because established interaction design patterns help make consistent user experiences. Then again, there is no harm in breaking a rule or two through experimentation to make a killer user experience. The “user experience” (UX) is how a human feels when using the interface of a digital product while attempting to accomplish a task or goal. Yes, we can say a door handle is an interface and go off the nondigital highway into the world of 100 percent physical products. But in practice, the term “user experience” refers to whether a person has a good or bad time trying to utilize a digital product. Traditionally (if I dare use that word for a discipline barely two decades old), UX design is associated with deliverables for development and design execution — site maps, wireframes, process/task flows, and functional specifications. Recruiters for enterprises and agencies identify UX design with the job titles that create these deliverables, including interaction designer, information architect, and UX designers. These definitions are used by large enterprises and agencies and are pretty much how UX design is currently practiced. Yet, what ultimately happens in this “traditional” system is that the UX designer and therefore the UX design are often more focused on the issues of user engagement and design rather than customer development and business-model generation. The common problem that many product makers don’t realize is how much their UX decisions are tied to customer acquisition. Just think about any transactional website or even a simple sign-up process. The UX design should be very concerned with barriers to entry, which can prevent validated leads who have previously engaged with the product from converting to customers. We’ll talk more about this in Chapter 9. Interfaces and user flows should be geared toward the desired response of the user. It’s all about engagement. This is what distinguishes a novice UX designer from a killer UX designer. Killer UX designers know now to guide the value innovation of a product in the following ways: They work collaboratively with stakeholders and teammates at the idea’s inception. Then, the UX designer can be involved in designing structured experiments for validation. These experiments need to be focused on how successful the value proposition can be communicated to the customer from

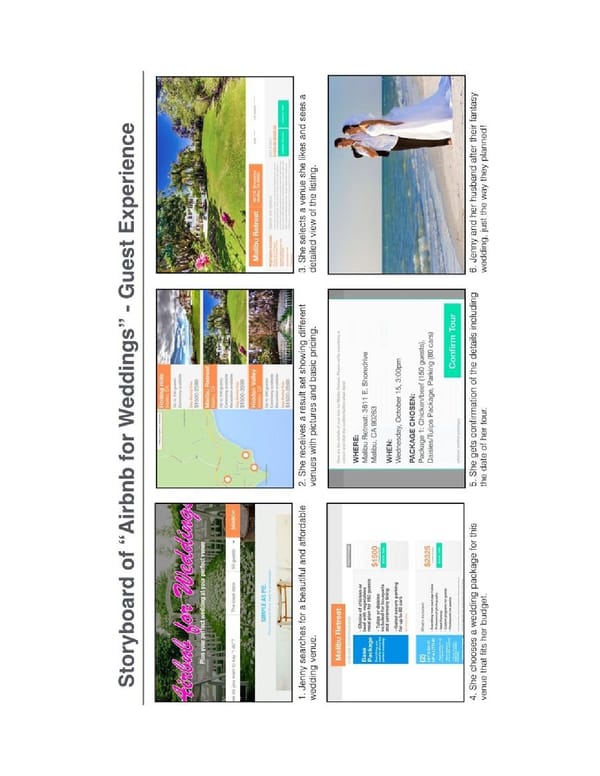

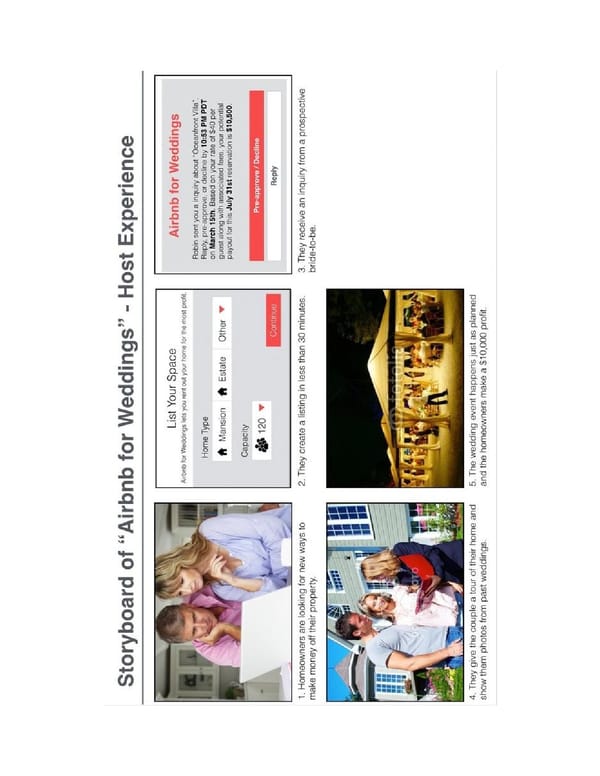

the moment the customer opens the landing page. Using measurable results, design decisions can be made based on real evidence rather than hunches. They help determine the key moments and features that are absolutely critical to your product. Chapter 6 focuses on tactics for helping you discover value innovations, concentrating on the primary utility of the product. We explore techniques such as storyboarding that will weave key experiences together in simple and elegant ways. We look at ways to poach and cherry-pick features from both competitors and noncompetitors so that we can put them together in new ways. They learn everything about the existing market space to identify UX opportunities that can be exploited. This allows your team to find ways to create a leap in value by offering something that makes peoples lives more efficient. They talk directly to potential users or existing power users of the product to discover and validate its primary utility with respect to the problem that must be solved. They weave the UX through all touch points — online and offline — enabling an experience that is frictionless. This is especially relevant in products such as Airbnb and Uber in which the transaction begins on the Internet, is fulfilled in the real world, but then loops the user back to the interface to write reviews. You can’t merely “design think” your way to a killer UX design. It’s only when the UX is informed by and affects the other three tenets that mental models are broken. Disruption erupts! Over the course of the book, I will discuss several case studies of products that have killer user experiences. These are UX designs that didn’t just “happen” through good luck or “genius design.” They’re killer through the manifestation of the tenets. It’s only with practice and mindfulness that we will come to understand the product as a sum of both its tangible and intangible parts. The examples include the following companies. Airbnb The listing service that is disrupting the travel industry (Figure 2-7).

Figure 2-7. Airbnb’s killer UX Uber The ridesharing application that is disrupting the taxi-service industry (Figure 2-8). Figure 2-8. Uber’s killer UX

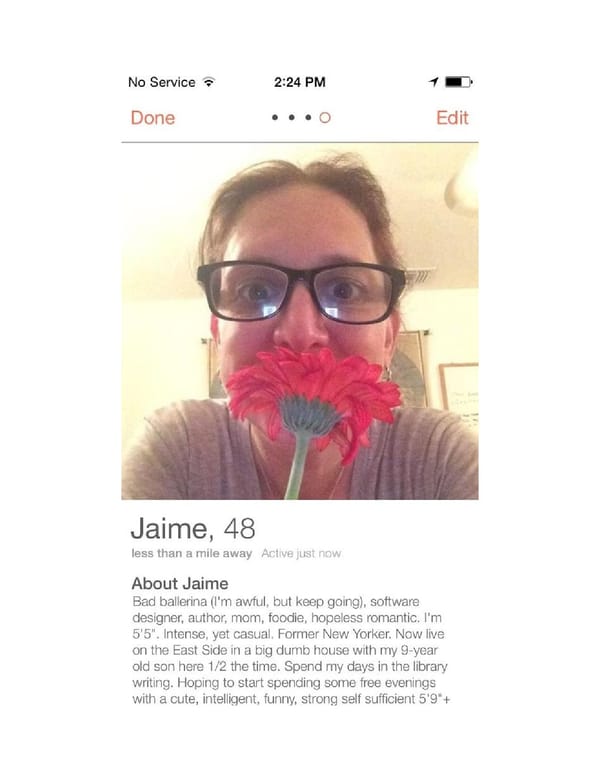

Waze The map application that is disrupting how people get from Point A to Point B in their cars (Figure 2-9). Figure 2-9. Waze’s killer UX Tinder The dating app that is threatening former dating-site disruptors such as OkCupid and Eharmony (Figure 2-10).

Figure 2-10. Tinder’s killer UX These products all got to where they are not by execution of a static business plan or a two-week UX discovery phase, but through experiments, failure, and iterations over months and sometimes years. It was the insights born out of structured strategic meanderings that blossomed into awe-inspiring product interfaces. It’s how the founders and teams behind-the-scenes took risks while assembling the building blocks of their products’ business models. They fine- tuned their value innovation and acquired fervent customers, which led to a competitive advantage such that they now swim in a blue ocean. TOP 10 NOT-UX STRATEGIES! 1. A killer idea for a new product! 2. A laundry list of features! 3. A thoroughly researched game plan for which all possible scenarios have been considered and is ready for implementation. No need for customer feedback because you are 100 percent certain you have nailed it! 4. A creative permutation of trending buzzwords that were just used by another startup that raised financing (for instance, peer-to-peer sharing economies). 5. A generic set of motivational statements (such as Go Team Challenge Conquer). 6. An arrogant statement from some expert — “Our product sprung from the genius of Professor I.M. Awesome, the visionary of Social Lean Disruption.” 7. A hypothesis that has nonvalidated risky assumptions — “Well, all women do like pink.” 8. A grandiose vision that doesn’t align with its core values that your company has no capability of delivering (for instance, a patent-pending, new-method-of-discovery dream). 9. A vague affirmation that sounds like a good Hallmark card — “You, too, can achieve Social Lean

Disruption.” 10. The North Star.

Recap UX strategy is a way of thinking. It’s not a means of formulating and executing a perfect plan; rather, it’s about being able to research what’s out there, analyze the opportunities, run structured experiments, fail, learn, and iterate until you devise something of value that people truly want. While devising a UX strategy, you will need to take risks and accept failure. You’ll learn how to fail smartly by doing small-structured experiments to validate that your strategy is moving your team in the right direction. [7] Sun Tzu, Art of War. first published by Lionel Giles in 1910. [8] Gray, David, Sunni Brown, Jamews Macanufo. Gamestorming: A Playbook for Innovators, Rulebreakers, and Changemakers. O’Reilly, 2010. [9] Porter, Michael. Competitive Advantage. New York: The Free Press, 1985. [10] http://www.journalism.org/2012/11/06/hurricane-sandy-and-twitter/ [11] “New features ahead: Google Maps and Waze apps better than ever.” Google Maps Blog, August 20, 2013, http://tinyurl.com/lx9sq8c. [12] Kirkpatrick, David. The Facebook Effect: The Inside Story of the Company That Is Connecting the World. Simon & Schuster, 2011. [13] Blank, Steve and Bob Dorf. The Startup Owner’s Manual. Wiley, 2012. [14] Oswerwalder, Alexander and Yves Pigneur. Business Model Generation. Wiley, 2010. [15] Drucker, Peter. Management: Tasks, Responsibilities, Practices. HarperBusiness, 1973. [16] Kim, W. Chan and Renée Mauborgne. Blue Ocean Strategy. Harvard Business School Press, 2005. [17] http://www.strategy-business.com/article/14501?pg=all [18] http://www.claytonchristensen.com/key-concepts/#sthash.47B9F4IW.dpuf [19] “NY official: Airbnb stay illegal; host fined $2,400.” C|Net, May 20, 2013. http://tinyurl.com/k7oyx3j. [20] The service fee that guests pay on AirBnb varies from 6 to 18 percent, based on the subtotal. [21] Ries, Eric. Lean Startup. HarperBusiness, 2011. [22] Blank, Steve. The Four Steps to the Epiphany. K&S Ranch Press, 2005. [23] Vlaskovits, Patrick and Brant Cooper. Lean Entrepreneur. Wiley, 2013.

Chapter 3. Validating the Value Proposition “To know what a business is we must start with its purpose. Its purpose must lie outside of the business itself. In fact, it must lie in society since business enterprise is the organ of the society. There is only [24] one valid definition of business purpose: to create a customer.” — PETER DRUCKER, 1973 AT THE BEGINNING, YOU DON’T JUST DEFINE YOUR PRODUCT VISION. Rather, you first need to figure out what problem you’re going to solve and what kind of customer needs it solved the most. That’s a lot to figure out, and getting one part wrong could turn your vision into a delusion. So, to stay grounded, you’re going to really dig into Tenet 1, Business Strategy, and Tenet 3, Validated User Research (see Figure 3-1 and refer to Chapter 2 if you need a refresher on the four tenets of UX strategy). In this chapter, you will learn how to create a value proposition, which is the magical thing that you must make tangible for customers. Then, you will go over how to validate it through experiments to prove whether that hypothesis is correct. Figure 3-1. Tenet 1 and Tenet 3: Business Strategy and Validated User Research