ESG Report | Apple

Apple’s 2022 ESG Report Environmental Social Governance Report

Introduction 3 Letter from Tim Cook 4 Report highlights 6 Our approach 8 Our commitment to transparency 9 Advocating for change 10 Our commitment to human rights Environment 13 Our approach 13 Climate change 18 Resources 20 Smarter chemistry Our People 23 Our approach 23 Inclusion and diversity 26 Growth and development 27 Benefits 28 Compensation 29 Engagement 30 Workplace practices and policies 33 Health and safety at Apple Suppliers 37 Our approach 40 Labor and human rights in the supply chain 43 Health, safety, and wellness 44 Responsible materials sourcing 45 Education and professional development 46 Environment Customers 48 Our approach 48 Privacy 50 Accessibility 52 Inclusive design 53 Education 54 Health 55 Caring for customers Communities 59 Our approach 60 Racial Equity and Justice Initiative 62 Education 64 Affordable housing initiative 65 Corporate donations 67 Employee giving 68 Job creation Governance 70 Corporate governance 71 Ethics and compliance 72 Tax payments Appendix 74 Awards and recognition 75 United Nations Sustainable Development Goals 77 Stakeholder engagement 78 ESG data summary 84 About the report 85 Endnotes ESG Index ↗︎ This report contains forward-looking statements and actual results may differ. Numbers and percentages in this report include estimates or approximations and may be based on assumptions. For more information, see “About the report.” Contents Environmental Social Governance Apple’s 2022 ESG Report 2 Appendix Governance Communities Suppliers Customers Our People Environment Introduction

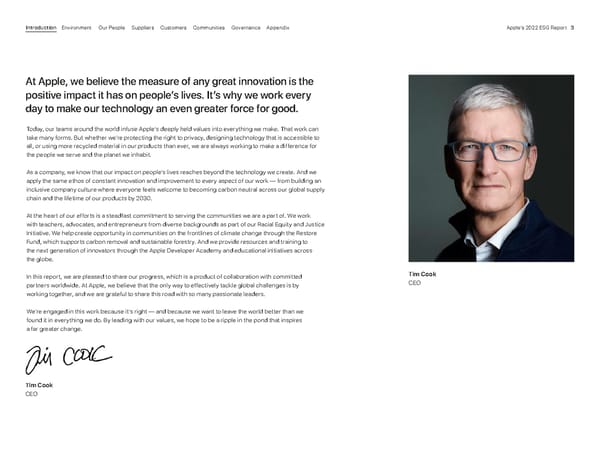

Today, our teams around the world infuse Apple’s deeply held values into everything we make. That work can take many forms. But whether we’re protecting the right to privacy, designing technology that is accessible to all, or using more recycled material in our products than ever, we are always working to make a difference for the people we serve and the planet we inhabit. As a company, we know that our impact on people’s lives reaches beyond the technology we create. And we apply the same ethos of constant innovation and improvement to every aspect of our work — from building an inclusive company culture where everyone feels welcome to becoming carbon neutral across our global supply chain and the lifetime of our products by 2030. At the heart of our efforts is a steadfast commitment to serving the communities we are a part of. We work with teachers, advocates, and entrepreneurs from diverse backgrounds as part of our Racial Equity and Justice Initiative. We help create opportunity in communities on the frontlines of climate change through the Restore Fund, which supports carbon removal and sustainable forestry. And we provide resources and training to the next generation of innovators through the Apple Developer Academy and educational initiatives across the globe. In this report, we are pleased to share our progress, which is a product of collaboration with committed partners worldwide. At Apple, we believe that the only way to effectively tackle global challenges is by working together, and we are grateful to share this road with so many passionate leaders. We’re engaged in this work because it’s right — and because we want to leave the world better than we found it in everything we do. By leading with our values, we hope to be a ripple in the pond that inspires a far greater change. Tim Cook CEO Tim Cook CEO At Apple, we believe the measure of any great innovation is the positive impact it has on people’s lives. It’s why we work every day to make our technology an even greater force for good. Apple’s 2022 ESG Report 3 Appendix Governance Communities Suppliers Customers Our People Environment Introduction

Report highlights * Pay equity at the intersections of race and ethnicity with gender was achieved in 2022. ** Leadership roles include managers at all levels of our company. Increased representation in leadership In calendar year 2021, 47% of open leadership** roles were filled by women globally, an increase of 10 percentage points since 2020, and we’ve had an 87% increase in women in leadership since 2014. And in 2021, we hired more Black and Hispanic/Latinx team members in the U.S. than ever before, with 13% open leadership roles filled by Black candidates and 12% filled by Hispanic/Latinx candidates. Since 2014, we’ve had an 84% increase in the number of Black employees and a 90% increase in the number of Hispanic/Latinx employees in leadership in the U.S. - – –> Continue reading on page 24 More than doubled renewable energy in our supply chain As of March 2022, 213 suppliers have committed to renewable electricity for Apple production, representing the majority of Apple’s direct supplier spend. In fiscal year 2021, Apple and its suppliers brought online over 10 megawatts of renewable energy in our supply chain, doubling the amount from the prior year. - – –> Continue reading on page 16 Continued to maintain pay equity Since 2017, Apple has achieved and maintained gender pay equity for our employees worldwide. In the U.S., we’ve also achieved pay equity with respect to race and ethnicity — as well as pay equity at the intersections of race and ethnicity with gender.* - – –> Continue reading on page 28 Carbon neutral for corporate emissions Since April 2020, we’ve achieved carbon neutrality for our corporate emissions by sourcing 100 percent renewable electricity for Apple facilities, implementing energy efficiency initiatives, and securing carbon offsets for remaining emissions. - – –> Continue reading on page 13 Protected privacy with App Tracking Transparency With iOS 14.5 in April 2021, we released App Tracking Transparency for iPad and iPhone, requiring developers to obtain a user’s permission to track them across apps or websites owned by other companies for advertising purposes. - – –> Continue reading on page 49 Reduced overall emissions by 40% In fiscal year 2021, our environmental initiatives avoided over 23 million metric tons of emissions across all scopes, and we reduced our carbon footprint by 40 percent compared with fiscal year 2015. Efforts and initiatives that we’ve been growing for years made this possible — like sourcing 100 percent renewable electricity for our facilities, transitioning suppliers to clean energy, and using low-carbon materials in products. - – –> Continue reading on page 13 At Apple, we’re demonstrating every day that business can and should be a force for good. And we’ve made important progress over the last year through our Environmental, Social, and Governance (ESG) initiatives. That would not be possible without the innovation and collaboration of teams across Apple, and the people and organizations we partner with. As we look ahead, we know there is more to be done. We’re committed to continue to build on our efforts and drive even greater impact in the years to come. Apple’s 2022 ESG Report 4 Appendix Governance Communities Suppliers Customers Our People Environment Introduction

Marked 10 years of our Employee Giving program In 2021, Apple’s Employee Giving program celebrated its 10th anniversary, having raised nearly $725 million for 39,000 organizations worldwide — with over $120 million distributed to organizations around the globe in 2021 alone. The funds raised through Apple’s Employee Giving program include the work of 68,000 employees who have logged almost 2 million volunteer hours. - – –> Continue reading on page 67 Improved access to education for our schools and communities Our Community Education Initiative continued to grow, supporting and partnering with 147 education institutions and nonprofit organizations — including 47 HBCUs — in over 500 different locations across 36 states in the U.S. and four locations across the UK since its launch in 2019. - – –> Continue reading on page 62 We launched Apple Learning Coach, a free professional learning program that trains instructional coaches, digital learning specialists, and other coaching educators to help teachers effectively use Apple technology in the classroom. - – –> Continue reading on page 54 Committed an additional $55M to our Racial Justice and Equity Initiative Building on our initial $100 million commitment in 2020, we announced an additional $30 million commitment in August 2021. The funding supports efforts including the Global HSI Equity Innovation Hub, expanded learning opportunities for HBCUs, the first Apple Entrepreneur Camp for Hispanic/Latinx Founders and Developers, and funding for organizations driving criminal justice reform and environmental justice. And in May 2022, we committed $25 million to expand access to capital for community financial institutions supporting communities of color in historically underserved markets across the U.S. - – –> Continue reading on page 60 Expanded our investment in educational opportunities through our Supplier Employee Development Fund We announced our Supplier Employee Development Fund, which will expand our best-in-class labor programs in our supply chain and establish a global Education Hub to scale the expansion of the technical and professional skills necessary for the jobs of today and tomorrow in our supply chain and surrounding communities. - – –> Continue reading on page 45 Expanded new features to support accessibility To celebrate Global Accessibility Awareness Day 2022, we previewed upcoming software features to offer users with disabilities new tools for navigation, health, communication, and more. Apple’s announcement included Door Detection, a cutting-edge navigation feature for users who are blind or low vision, Live Captions for the Deaf and hard of hearing community, and Apple Watch Mirroring, which helps people with physical and motor disabilities control Apple Watch remotely from their paired iPhone. - – –> Continue reading on page 52 Upholding the highest standards in our supply chain We hold ourselves and our suppliers to the highest standards of labor and human rights, health and safety, and environmental stewardship. In fiscal year 2021, we conducted 1177 assessments, including 291 smelter and refiner assessments, to verify that suppliers are meeting our strict requirements. - – –> Continue reading on page 38 Responsibly sourced primary materials and supported local communities We continue to source primary materials responsibly. 100 percent of the identified tin, tungsten, tantalum, and gold (3TG), cobalt, and lithium smelters and refiners in our supply chain have participated in independent, third-party audits to assess and identify social, environmental, human rights, and governance risks. - – –> Continue reading on page 44 Further supported inclusive design Across Apple we’ve continued our sustained commitment to making products more inclusive. For example, we released new diverse voices for Siri, and we’re taking steps to advance equity in our cameras’ person recognition features. We’ve also developed Human Interface Guidelines to support developers in building inclusive apps. - – –> Continue reading on page 52 Apple’s 2022 ESG Report 5 Appendix Governance Communities Suppliers Customers Our People Environment Introduction

Our approach Our values flow through the technology we make, the way we make it, and how we care for people and the planet we share. These values — accessibility, education, environment, inclusion and diversity, privacy, and supplier responsibility — are central to our ESG approach. And we go further to address a comprehensive set of critical issues that matter to our company and to our stakeholders. From our commitment to human rights to our 2030 environmental goals, ESG topics are deeply interconnected. We can make the biggest impact only when we understand how these issues relate to one another. ESG priorities are managed across Apple, and our senior leaders play an important role in integrating ESG into functions across the company. We listen to stakeholders — including our people, suppliers, communities, shareholders, and other external groups — to understand the issues they care about. And we measure our ESG progress across our business so that we can work toward being more transparent with each year. Above all, we’re always working to leave the world better than we found it, and to create powerful tools that empower others to do the same. Since 2018, Apple sources all of the electricity for its facilities from 100 percent renewable energy. The Montague Wind Farm in Oregon is one of Apple’s largest projects at 200 megawatts and powers Apple’s Prineville data center. Environment We’ve been carbon neutral for our own operations since 2020, including business travel and employee commute, and are progressing toward an urgent goal to be carbon neutral across our entire business — including the full life cycle of our products — by 2030. We’re on an ambitious journey to one day make our products using only recycled or renewable materials. We design our products to be safe for anyone who assembles, uses, or recycles them — and to be better for the environment. At the same time, we’re partnering with communities and local leaders and working to make sure our environmental efforts are also a force for equity and justice. Climate change Resources Smarter chemistry Apple’s 2022 ESG Report 6 Appendix Governance Communities Suppliers Customers Our People Environment Introduction

Social At Apple, we work every day to put people first — by empowering them with accessible technology, being a force for equity and opportunity, creating an inclusive and diverse work environment, and respecting the human rights of everyone whose lives we touch. Human rights Our People We’re committed to inclusion and diversity for our team and in our world. And we have programs and benefits to support the development of our team members. We continue to prioritize the health and safety of our teams, customers, supplier employees, and communities. Inclusion and diversity Growth and development Engagement Benefits and compensation Workplace practices and policies Health and safety Suppliers We hold ourselves and our suppliers to the highest standards of labor and human rights, health and safety, environmental protections, and ethics. We’re working every day to support more people in our supply chain and surrounding communities. And we’re collaborating with others to promote best practices and scale innovative solutions. Labor and human rights in the supply chain Health, safety, and wellness Responsible materials sourcing Education and professional development Environment Customers We’re focused on infusing our values into our products — engineering privacy and security into everything we make and designing our products and services to be accessible to and inclusive of the widest range of users. We also find innovative ways to support people’s education, health, and a range of human rights topics, with a specific focus on communities too often denied opportunities. Privacy Accessibility Inclusive design Education Health Caring for customers Communities We’re accelerating social change by supporting communities and organizations that are addressing society’s toughest problems, including a focus on communities of color. Some of our key initiatives include the Racial Equity and Justice Initiative (REJI), Community Education Initiative, Developer Academies, Entrepreneur Camp, and affordable housing initiative. Our corporate donations support nonprofits and other organizations with which we partner, and we empower employees to contribute to the causes they care about through our Employee Giving program. Racial Equity and Justice Initiative Education Affordable housing Corporate donations Employee giving Job creation Governance We embed transparency and accountability at every level of our company. Apple’s board and governance structure helps foster principled actions, informed and effective decision- making, and appropriate monitoring of our compliance and performance. We’re committed to conducting business ethically, honestly, and in compliance with applicable laws and regulations. Corporate governance Ethics and compliance Tax payments Apple has over 165,000 team members who work in corporate offices and Apple Stores around the world. Apple’s 2022 ESG Report 7 Appendix Governance Communities Suppliers Customers Our People Environment Introduction

Suppliers People and Environment in Our Supply Chain (22.5Mb PDF) Supplier Responsibility website Efforts to Combat Human Trafficking and Slavery Conflict Minerals Report Our ESG Index demonstrates how all of our reports and public disclosures map to leading frameworks, including the Sustainability Accounting Standards Board (SASB), Global Reporting Initiative (GRI), and Task Force on Climate-related Financial Disclosures (TCFD). Apple’s Newsroom also provides the latest updates regarding our programs, initiatives, and offerings mentioned throughout this report. Environment Environmental Progress Report (24.5Mb PDF) Environment website CDP Governance Human Rights Policy 2022 Proxy Statement Form 10-K Ethics & Compliance website Our people, customers, and communities Inclusion & Diversity website Benefits website Privacy website Transparency Report Accessibility website Education website Racial Equity and Justice website ESG Index ESG Index (2.6Mb PDF) Our commitment to transparency In addition to this report, we’ve been reporting on ESG topics for many years. See our topic-specific reports and websites for more information on each issue. Covering fiscal year 2021 Environmental Progress Report 2022 Annual Progress Report People and Environment in Our Supply Chain Apple’s 2022 ESG Report 8 Appendix Governance Communities Suppliers Customers Our People Environment Introduction

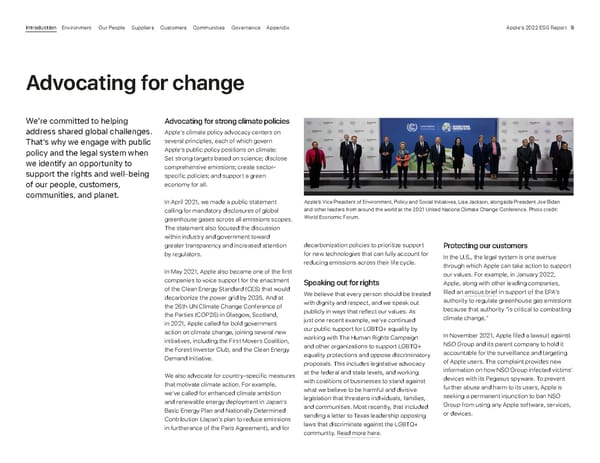

We’re committed to helping address shared global challenges. That’s why we engage with public policy and the legal system when we identify an opportunity to support the rights and well-being of our people, customers, communities, and planet. decarbonization policies to prioritize support for new technologies that can fully account for reducing emissions across their life cycle. Speaking out for rights We believe that every person should be treated with dignity and respect, and we speak out publicly in ways that reflect our values. As just one recent example, we’ve continued our public support for LGBTQ+ equality by working with The Human Rights Campaign and other organizations to support LGBTQ+ equality protections and oppose discriminatory proposals. This includes legislative advocacy at the federal and state levels, and working with coalitions of businesses to stand against what we believe to be harmful and divisive legislation that threatens individuals, families, and communities. Most recently, that included sending a letter to Texas leadership opposing laws that discriminate against the LGBTQ+ community. Read more here . Protecting our customers In the U.S., the legal system is one avenue through which Apple can take action to support our values. For example, in January 2022, Apple, along with other leading companies, filed an amicus brief in support of the EPA’s authority to regulate greenhouse gas emissions because that authority “is critical to combatting climate change.” In November 2021, Apple filed a lawsuit against NSO Group and its parent company to hold it accountable for the surveillance and targeting of Apple users. The complaint provides new information on how NSO Group infected victims’ devices with its Pegasus spyware. To prevent further abuse and harm to its users, Apple is seeking a permanent injunction to ban NSO Group from using any Apple software, services, or devices. Apple’s Vice President of Environment, Policy and Social Initiatives, Lisa Jackson, alongside President Joe Biden and other leaders from around the world at the 2021 United Nations Climate Change Conference. Photo credit: World Economic Forum. Advocating for strong climate policies Apple’s climate policy advocacy centers on several principles, each of which govern Apple’s public policy positions on climate: Set strong targets based on science; disclose comprehensive emissions; create sector- specific policies; and support a green economy for all. In April 2021, we made a public statement calling for mandatory disclosures of global greenhouse gases across all emissions scopes. The statement also focused the discussion within industry and government toward greater transparency and increased attention by regulators. In May 2021, Apple also became one of the first companies to voice support for the enactment of the Clean Energy Standard (CES) that would decarbonize the power grid by 2035. And at the 26th UN Climate Change Conference of the Parties (COP26) in Glasgow, Scotland, in 2021, Apple called for bold government action on climate change, joining several new initiatives, including the First Movers Coalition, the Forest Investor Club, and the Clean Energy Demand Initiative. We also advocate for country-specific measures that motivate climate action. For example, we’ve called for enhanced climate ambition and renewable energy deployment in Japan’s Basic Energy Plan and Nationally Determined Contribution (Japan’s plan to reduce emissions in furtherance of the Paris Agreement), and for Advocating for change Apple’s 2022 ESG Report 9 Appendix Governance Communities Suppliers Customers Our People Environment Introduction

Our commitment to human rights Embedding respect for human rights We’ve worked to embed respect for human rights across our company — in the technology we make, the way we make it, and how we treat people. A number of teams are responsible for carrying out human rights due diligence, including the Privacy, Corporate, and Compliance teams within Apple’s Legal and Global Security organization, as well as Apple’s Environment and Supply Chain Innovation (ESCI) team within Worldwide Operations. Our commitment begins with treating everyone with dignity and respect. But it doesn’t end there. We believe in the power of technology to empower and connect people around the world — and that business can and should be a force for good. Identifying and managing salient human rights risks Identifying human rights risks is the first step to addressing those risks through improvements to our policies and management systems. We work to align our efforts with the business and human rights due diligence process set forth in the UNGPs to identify, mitigate, prevent, and remedy human rights risks. We identify salient human rights risks through internal risk assessments and external industry- level third-party audits, as well as through the channels we maintain with rights holders and other stakeholders, including investors, human rights and labor experts, governments, and international bodies such as the UN. In addition to our own internal monitoring, we consider reports identifying potential risks from external sources, including international organizations, policy makers, shareholders, civil society organizations, news outlets, customers, individuals in the supply chain or supply chain communities, whistleblower mechanisms, and third-party hotlines. Reports also come through the reporting mechanisms we make available directly to all supplier employees, Apple employees, and the general public. These reports can come to us in any language and can be anonymous. Our commitment to civil rights We are deeply committed to building a more just and inclusive world and are moving forward with plans to conduct a civil rights audit. Apple’s Human Rights Policy Our Human Rights Policy governs how we treat everyone, including our customers, employees, business partners, and people across our supply chain. We’re deeply committed to respecting internationally recognized human rights in our business operations, as set out in the United Nations (UN) International Bill of Human Rights and the International Labour Organization’s (ILO) Declaration on Fundamental Principles and Rights at Work. Our approach is based on the UN Guiding Principles on Business and Human Rights (UNGPs). We conduct human rights due diligence to identify risks and work to mitigate them. We also seek to remedy adverse impacts, track and measure our progress, and report our findings. Our board of directors adopted the policy and is responsible for overseeing and periodically reviewing it. Apple’s Senior Vice President and General Counsel is responsible for its implementation, and reports to the Board and its committees on our progress and significant issues. Apple’s 2022 ESG Report 10 Appendix Governance Communities Suppliers Customers Our People Environment Introduction

Based on this due diligence, examples of human rights issues of particular focus at Apple include: • Privacy, freedom of expression, and access to information risks • Discrimination risks in workforce management and in product and services development • Labor and human rights risks in the supply chain Across Apple, teams such as ESCI, EPSI, People, Privacy, and others work to avoid, prevent, mitigate — and where appropriate, remediate — human rights issues and impacts across Apple’s business, including through our commitments to: • Respecting the rights to privacy, freedom of expression, and access to information • Promoting diversity, equity, and inclusion, including in our workforce, leadership, product and services development, and our industry • Respecting labor and human rights in our supply chain by working closely with suppliers so that people in our supply chain are treated with dignity and respect • Respecting human rights through our efforts to protect the planet in how we design, build, and recycle our products, and through responsible sourcing and use of materials and natural resources Tracking progress We’re committed to continually assessing our progress and incorporating what we learn into our work. We track and measure our performance across a range of areas, and apply the lessons we learn to continually improve. We publicly report detailed information on our approach and our performance in the reports, websites, and other disclosures listed on page 8 , as well as within this ESG Report: Inclusion and diversity Workplace practices Health and safety Labor and human rights in the supply chain Privacy Accessibility Inclusive design The rainbow arches at Apple Park in Cupertino, California are a nod to Apple’s original logo and an expression of our inclusive values. Apple’s 2022 ESG Report 11 Appendix Governance Communities Suppliers Customers Our People Environment Introduction

A planet- size plan. Environment In this section Our approach 13 Climate change 13 Resources 18 Smarter chemistry 20 Appendix Governance Communities Suppliers Customers Our People Introduction Apple’s 2022 ESG Report 12 Environment

Climate change As a global business, we believe it is our responsibility to take strong, decisive, and inclusive steps to mitigate our climate impact. We’ve committed to achieving carbon neutrality — reducing emissions 75 percent compared with fiscal year 2015 and balancing the residual emissions with carbon removal — across the life cycle of all of our products by 2030. 1 And the Science Based Targets initiative (SBTi) has validated an emissions reduction target for Apple derived from this goal. 2 It’s an ambitious plan with plenty of challenges ahead. But we’re already well on our way, having cut carbon emissions across our value chain by 40 percent since fiscal year 2015. Our work began years ago, making the transition to sourcing 100 percent renewable electricity at our offices, retail stores, and data centers, At Apple, we’re acting with urgency to protect our planet’s limited resources and to be a leader in the fight against climate change. Since 2020, we’ve been carbon neutral for our worldwide operations, and by 2030, we plan to expand that progress to our entire supply chain and the lifetime use of our products. And today, nearly 20 percent of the materials in our products were made from recycled content — a number we’re working to increase. Across our environmental work, we’re also committed to being a force for equity. We’re working with communities on the frontlines of climate change and the next generation of diverse entrepreneurs to create shared opportunity and to build a more just world. Our approach The environmental challenges we face today are significant, and we’re responding with urgency and dedication. We approach our work by focusing on fundamental questions. What matters most? And where can we make the greatest impact? These questions guide our work across our strategic focus areas of climate change, resources, and smarter chemistry — and inform our goals in how we can best achieve change. We know we’re not alone in working to reduce our environmental footprint. So we’re engaging with others to support our efforts and find opportunities to lift local communities along the way. Setting ambitious goals is essential to our approach — to drive the innovation and collaboration that makes change possible and to be transparent and accountable to our progress. Our work is led by Lisa Jackson, Apple’s Vice President of Environment, Policy and Social Initiatives, reporting directly to CEO Tim Cook. The Environment, Policy and Social Initiatives team works with other teams across Apple to set strategy, engage stakeholders, and communicate progress. Our integrated approach means that decisions about the environment are reviewed and supported at the highest levels of the company. Our 2022 Environmental Progress Report provides a detailed overview of our work and how we’re progressing toward our goals. which we achieved in 2018. And in 2020, we reached the milestone of being carbon neutral for our corporate operations, including direct emissions as well as business travel and employee commute. Our 10-year Climate Roadmap is addressing Apple’s carbon footprint through five pillars: Low-carbon design: We will design products and manufacturing processes to be less carbon-intensive through thoughtful material selection, increased material efficiency, and greater product energy efficiency. Energy efficiency: We will increase energy efficiency at our facilities and in our supply chain by finding opportunities, such as retrofitting, to reduce energy use. Appendix Governance Communities Suppliers Customers Our People Environment Introduction Apple’s 2022 ESG Report 13

Renewable electricity: We will continue to source 100 percent renewable electricity for our facilities, and transition our entire supply chain to 100 percent clean, renewable sources of electricity. Direct emissions abatement: We will reduce direct greenhouse gas emissions in our facilities and our supply chain through process innovation, emissions abatement, and the use of non- fossil -based low -carbon fuels. Carbon removal: Working in parallel with our emissions reduction efforts, we will scale up investments in carbon removal projects, including nature -based solutions that protect and restore ecosystems around the world. Low-carbon design To reduce the carbon footprint of our products, we’re increasing efficiency and transitioning to materials from recycled sources and those made using low-carbon energy. In 2021, we continued to improve the carbon efficiency of the integrated circuits we use in our products — components we’ve prioritized because they are carbon-intensive. For example, switching to the Apple M1 chip for the 13-inch MacBook Pro reduced the energy needed to manufacture and use the device, driving down the product’s carbon footprint by over 8 percent. We’ve continued to expand our use of 100 percent recycled aluminum in the enclosures of a number of products. All iPad models in our lineup now use 100 percent recycled aluminum in their enclosures — joining Apple Watch Series 7, Apple Watch SE, MacBook Air, Mac mini, and the 14-inch and 16-inch MacBook Pro devices. For products released in 2021 that had enclosures made with primary aluminum, we Energy efficiency We’re focused on using less energy across our operations, beginning with how we design, operate, and maintain our facilities. And we continue these same efforts into our supply chain, which benefits the communities where our suppliers operate. Drawing less energy from electrical grids — many of which still rely heavily on fossil fuels — helps reduce local air pollution and improve air quality for nearby communities. The emissions from manufacturing our products account for about 70 percent of Apple’s gross carbon footprint. We launched our Supplier Energy Efficiency Program in 2015 with the goal of helping suppliers optimize their facilities and operations to use as little energy as possible. We provide guidance designed to help suppliers uncover opportunities for energy efficiency. Suppliers in our Supplier Energy Efficiency Program avoided more than 1,150,000 annualized metric tons of supply chain carbon emissions in fiscal year 2021. 40% decrease in emissions across our entire value chain since 2015 100% renewable energy sourced for all Apple facilities 213 suppliers committed to 100 percent renewable electricity for Apple production $4.7B issued in green bonds to model how businesses can drive investments to reduce global emissions. In our latest Green Bond Impact Report , we share progress on the projects funded in fiscal year 2021. To minimize the carbon footprint of our products, we seek to create less waste in the processing of materials, reduce machining time and the associated energy used, more efficiently transform material into the shapes we need, and maximize recovery and reprocessing of manufacturing scrap. prioritized the use of aluminum smelted using low-carbon sources of electricity rather than fossil fuels — for a lower carbon impact. These changes alone have decreased the carbon emissions associated with our use of aluminum by 68 percent since 2015. Product energy use accounts for 22 percent of our gross carbon footprint — and has an impact on the individual energy use of each of our customers. By addressing this in the earliest phases of design, we’ve cut the product energy use across all major product lines by more than 70 percent since 2008 through energy efficiency improvements. 3 In fiscal year 2021, over 99 percent of Apple’s eligible products, by revenue, received an ENERGY STAR rating for superior energy efficiency. 4 And over 99 percent of Apple’s eligible products, by revenue, met the requirements for EPEAT registration. 5 Appendix Governance Communities Suppliers Customers Our People Environment Introduction Apple’s 2022 ESG Report 14

Gross emissions Avoided emissions Emissions offset Corporate footprint Product footprint 0.02% Direct emissions (Scope 1) 0% Electricity (Scope 2) 0.5% Business travel and commute (Scope 3) 70% Product manufacturing (Scope 3) 22% Product use (Scope 3) 8% Product transport (Scope 3) 0.3% End-of-life product processing (Scope 3) Gross emissions Offsets Emissions categories (% of gross emissions) Corporate energy Corporate energy efficiency: efficiency: 0.06 million metric tons avoided Use of renewable Use of renewable electricity: electricity: 1.0 million metric tons avoided Load reduction and Load reduction and mode switching: mode switching: 0.2 million metric tons avoided tons avoided FY21 REC purchase: FY21 REC purchase: 0.2 million metric tons avoided Product energy efficiency: Product energy efficiency: 0.2 million metric tons avoided Supplier clean energy: Supplier clean energy: 13.9 million metric tons avoided Low-carbon materials*: Low-carbon materials*: 7.3 million metric tons avoided FY21 REC purchase: FY21 REC purchase: 0.4 million metric tons avoided Supplier energy efficiency: Supplier energy efficiency: 1.1 million metric tons avoided Apple’s comprehensive carbon footprint This past year we intensified our efforts to reduce Apple’s emissions. In fiscal year 2021, we avoided over 23 million metric tons of emissions across all scopes. Initiatives that we’ve been growing for years — like sourcing 100 percent renewable electricity for our facilities, transitioning suppliers to clean energy, and using low-carbon materials in products — yielded indisputable results. Thanks to this work, we’ve begun to decouple business growth from emissions: While our revenue grew 33 percent, our emissions grew by less than 5 percent. To mitigate this increase in emissions, we applied an additional 0.6 million tons of renewable energy credits (RECs) and 0.5 million metric tons of carbon offsets to proportionally cover electricity use and direct emissions, respectively, across our value chain. This represents a short-term bridging solution as we grow our carbon reduction programs to meet the scale of the challenge. * Low-carbon materials represents emissions savings from transitioning to recycled materials in our products, or use of low-carbon aluminum, as described on page 18 . ** Net carbon emissions represents our total gross footprint minus carbon offsets applied to each category. Percentages shown for each emissions category represent the share of Apple’s gross footprint. Totals add up to more than 100 percent, due to rounding. 22.5 million metric tons net carbon emissions ** Appendix Governance Communities Suppliers Customers Our People Environment Introduction Apple’s 2022 ESG Report 15

Renewable electricity Our retail stores, data centers, and offices around the world currently source 100 percent renewable electricity. We’ve focused our efforts to source renewables around several key pillars: creating new renewable energy projects, undertaking projects that deliver clear benefits to local communities, and supporting renewable energy innovations. About 1.5 gigawatts of Apple-created renewable electricity projects account for over 90 percent of the renewable electricity our facilities use. We continue to experience tremendous progress toward our goal of transitioning our manufacturing supply chain to 100 percent renewable electricity by 2030. As of March 2022, 213 manufacturing partners in 25 countries have committed to 100 percent renewable energy for Apple production. Over 70 percent of companies on Apple’s Supplier List — those suppliers that make up 98 percent of Apple’s direct spend for materials, manufacturing, and assembly of our products worldwide — have committed to 100 percent renewable electricity. In addition, many other smaller suppliers have also made these commitments. Direct emissions abatement To address the non-electricity emissions associated with our materials and manufacturing processes, we seek technological solutions through emissions abatement or switching to low-carbon fuel options. For example, we partnered with aluminum companies and the governments of Canada and Quebec to help fund research and development for ELYSIS, a technology that eliminates direct greenhouse gas emissions from aluminum smelting. Many components essential to products like ours, including integrated circuit chips and display panels, currently rely on manufacturing processes that use fluorinated gases, which have high global warming potential. We’re partnering closely with key manufacturers to prevent these gases from being released into the atmosphere by optimizing manufacturing processes and deploying abatement technologies. To address emissions from shipping products to our customers, we’re shifting whenever possible toward less carbon-intensive shipping modes, such as rail and ocean. And we’re seeking out technical innovations, including alternative fuels and electric vehicles. In fiscal year 2021, Apple avoided 180,000 metric tons of CO 2 e by shifting the mode of transport and reducing product weight through the removal of the power adapter from the box of iPhone devices. Providing access to clean energy in South Africa Even a few years ago, not everyone in one community in South Africa had electricity at home. Many people had been using battery-powered lanterns because upfront costs and other challenges put connecting to the grid out of reach. As we worked with our partners to identify new renewable energy projects for our Power for Impact program, we saw exciting potential in this community. Our partner on the ground, DC GO, a solar energy provider based in Johannesburg, got to work meeting members of the community and learning more about their needs. Ultimately, DC GO developed a pay-as-you-go model that brought solar energy to 3500 homes that previously lacked access. This was possible only because of the way they built relationships with community members and worked with Apple to price the solution in line with what people were already spending on batteries for their lanterns. In addition, DC GO hired and trained local people for jobs in sales, maintenance, and other roles that not only created local jobs but also helped to make sure the project — and the community’s access to electricity — would be sustainable over time. This is just one example of how the Power for Impact program is working to benefit communities, our company, and the environment at the same time. Learn more on pages 22 and 27 of our Environmental Progress Report . With access to electricity in their homes, kids can now do homework at night and families can cook meals indoors. Appendix Governance Communities Suppliers Customers Our People Environment Introduction Apple’s 2022 ESG Report 16

Carbon removal To address the emissions we can’t yet avoid, we’re are investing in carbon removal projects. In addition to removing carbon, nature-based carbon removal projects also offer important ecological and social benefits, such as preserving biodiversity and enhancing the resilience of ecosystems, while often providing economic development opportunities for local communities. We partnered with Conservation International and Goldman Sachs to launch the innovative Restore Fund, which seeks to blend responsible forestry practices with carbon removal: We’re working with forestry managers to create sustainably managed forests that optimize for both carbon and wood production, creating revenue from timber, and generating high- quality carbon credits. Apple will invest up to $200 million in projects that aim to remove carbon from the atmosphere and store it, all while meeting clear social and environmental impact criteria and offering a financial return. In its pilot phase, the Restore Fund has a goal of removing at least 1 million metric tons of carbon dioxide per year. For more information on our efforts to combat climate change and reach our 2030 carbon neutral goal, read our 2022 Environmental Progress Report . Climate scenario analysis In 2020, we conducted a climate scenario analysis to help us better understand the potential physical and transition effects of climate change. To align with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, we considered a range of future scenarios, including a scenario below 2°C. And we assessed geographies around the world to capture both corporate and supplier activities. The analysis highlighted how our renewable energy program and carbon neutrality goals could contribute to our corporate resiliency. It also provided environmental data that we considered in developing business strategies, including considerations around supply chain diversification, as well as safeguarding our global assets. We’re committed to managing regulatory, reputational, and market risks related to climate change. For more information on these climate-related risks and Apple’s governance of these risks, read our 2021 CDP submission (PDF) . As the Restore Fund projects come online, we’ve partnered with Conservation International to develop and invest in nature-based carbon removal projects. This includes a project to protect and restore 27,000 acres of mangrove forests in Colombia. As the projects in the Restore Fund come online, we’re also working to address difficult- to-avoid emissions in the short term. In fiscal year 2021, 167,000 metric tons of carbon credits were retired from the Chyulu Hills project in Kenya to maintain carbon neutrality for our corporate emissions in fiscal year 2021. And we purchased carbon credits from two additional projects to offset a total of 500,000 metric tons of direct emissions across our value chain: a REDD+ coastal conservation project in Guatemala and a reforestation project in Guizhou Province of China . These projects are all certified to the VCS and CCB standards. Appendix Governance Communities Suppliers Customers Our People Environment Introduction Apple’s 2022 ESG Report 17

Resources Natural resources make our work possible — and we take responsibility for how we source, use, and recycle the materials we rely on to create our products. As a starting point, this means sourcing responsibly, minimizing our freshwater use, and eliminating waste across our operations and those of our suppliers. And we’re also seeking to redefine the overall resource footprint of our products. Our goal is to one day make products using only responsibly sourced recycled and renewable materials. Within resources, we focus on three main areas of impact: • Materials: Transitioning to only recycled or renewable materials in our products and packaging, and maximizing material efficiency, product longevity, and recovery. • Water: Reducing water impacts in the manufacturing of our products, use of our services, and operation of our facilities. At the same time, transitioning to alternative sources, improving the quality of water we discharge, and protecting shared water resources. • Zero waste: Minimizing overall waste generated and eliminating waste sent to landfill from our manufacturing supply chain as well as corporate offices, data centers, and retail stores. Materials We aim to make the best use of the materials we rely on to make our products. That’s why we’re focusing on three different levers to reduce our footprint and achieve circularity: sourcing and efficiency; product longevity; and product end-of-life. Sourcing and efficiency Last year, we made progress across materials — from expanding our use of recycled rare earth elements to designing cameras with recycled gold. In September, we introduced iPhone 13, with more certified recycled materials than any previous version of iPhone. We also introduced 100 percent recycled aluminum enclosures on every single model in the iPad lineup. Welcoming the first class of the Impact Accelerator Last year, we welcomed the first class to our Impact Accelerator, a program for Black- ,Hispanic/Latinx-, and Indigenous-owned businesses headquartered in the United States that share our focus on innovation and our commitment to the environment. Part of Apple’s Racial Equity and Justice Initiative (see page 60 ), the Accelerator aims to help combat systemic barriers to opportunity, while also advancing innovative solutions for communities most impacted by climate change. We selected our first class of 15 businesses on the cutting edge of green technology and clean energy to begin the program in August 2021. The three-month program included live virtual sessions, online courses on supply chain management, supplier diversity, financial and legal subjects, as well as one-on-one mentorship with an Apple expert on topics from renewable energy to responsible sourcing. The goal of the Impact Accelerator is to better position the participating companies for growth, to improve their abilities to take on larger contracts, and to expand their customer base — all while fostering their environmental commitment. For example, last October we announced that we will be working with the Oceti Sakowin Power Authority, formed by six Sioux tribes to jointly develop tribal renewable energy resources, on a project to create a wind power development in the Midwest. And following the success of this year’s class, our efforts continue. This spring, applications opened for the next class to join our Impact Accelerator. For Apple’s inaugural Impact Accelerator, leaders from 15 companies participated in a three-month virtual program with customized training and access to Apple expert mentors. 20% In fiscal year 2021, nearly 20 percent of the material we shipped in products came from recycled and renewable sources 2x In fiscal year 2021, we more than doubled our use of recycled tungsten, rare earth elements, and cobalt — and introduced certified recycled gold for the first time in an Apple product 75% We’ve reduced the plastic in our packaging by 75 percent compared with 2015, progressing toward our goal to eliminate all plastic from our packaging by 2025 Appendix Governance Communities Suppliers Customers Our People Environment Introduction Apple’s 2022 ESG Report 18

Across our business, we released eight products with more than 20 percent recycled content. 6 The MacBook Air with M1 chip (2020) had the highest total — made with 44 percent recycled content device-wide, including 100 percent recycled aluminum in the enclosure. These and other innovations helped us increase our use of recycled or renewable content to 18 percent of all the material shipped in products in fiscal year 2021. 7 Product longevity We want to make the most of the materials we use through designing long-lasting products. We are designing durable hardware, leveraging software updates to extend functionality, expanding access to repair services, refurbishing devices for their next user, and reusing parts that still have more to give. Read more on caring for customers on page 56 . Product end-of-life By effectively recovering the materials in our products, we enable the circular supply chains that make the best use of finite resources. Through our work in this area, we’re reducing the need to mine new materials and the amount of energy needed to manufacture new products, ultimately driving down emissions and conserving resources. In 99 percent of the countries where we sell products, we continue to provide and participate in product take-back and recycling collection programs. With the help of customer and employee participation across recycling programs, we directed more than 38,000 metric tons of e-waste to recycling globally in fiscal year 2021. We’ve also continued to innovate on disassembly technologies. Daisy, the robot we designed to disassemble iPhone devices, has now been joined by Dave, which dismantles Taptic Engines from iPhone to enable the recovery of materials like rare earth elements, tungsten, and steel, and Taz, designed to recycle modules containing rare earth magnets. At our Material Recovery Lab we’re working on developing better, more efficient means of disassembling products that maximize material recovery, while minimizing waste. Water stewardship We’re committed to managing the resources we share with the communities where we and our suppliers operate. Our efforts to address the water footprint of our corporate sites and of our suppliers’ sites focus on: • Using water efficiently • Expanding the use of alternative water sources, including onsite reuse • Discharging water responsibly • Enhancing our water stewardship to keep watersheds healthy for all who rely on them In fiscal year 2021, our facilities used about 1.4 billion gallons of water. We saved 133 million gallons of freshwater this fiscal year due to efficiency projects implemented since 2017. 9 Last year, alternative water sources accounted for 10 percent of our total corporate water usage — primarily from recycled water sources. 10 Our supply chain accounts for 99 percent of our total water footprint, based on our detailed water inventory. That’s why we partner closely with our suppliers through our Clean Water Program. The more than 195 participating supplier sites increased their average reuse rate to 41 percent and saved our suppliers 12.3 billion gallons of freshwater in fiscal year 2021 — for a total of 50.3 billion gallons of water savings since the program’s launch in 2013. 11 Innovating packaging to reduce our footprint We’ve made significant progress toward eliminating all plastics from our packaging by 2025. This past year, plastics accounted for only 4 percent of our packaging. Since 2015, we’ve dedicated our efforts to replacing large plastic trays, wraps, and foam cushioning with fiber alternatives that have higher recovery rates and reduced environmental footprints. This year, the iPhone 13 and iPhone 13 Pro were the first iPhone models to be shipped without any plastic packaging components. 8 And we replaced plastic foam with a fiber alternative to protect the 24-inch iMac during shipping. For the 24-inch iMac, using corrugated fiber rather than foam for shock absorption allowed us to reduce plastic by 72 percent. Appendix Governance Communities Suppliers Customers Our People Environment Introduction Apple’s 2022 ESG Report 19

Smarter chemistry The well-being of our employees, customers, people in our supply chain, and the planet is a priority for Apple, which is why we’re committed to using safer materials to create safer products. This commitment requires diligent work — to build a comprehensive picture of chemicals across our supply chain, to insist on rigorous chemical management processes, to promote adoption of safer chemical alternatives, and to innovate through design smarter approaches to making our products. Using safer chemistry in our products also enables recycling and material recovery, so that our products can be the raw materials for the next generation. The pillars of our smarter chemistry strategy are: Mapping and engagement: Engage our supply chain partners to comprehensively identify the chemicals in the materials used to make our products, allowing us to drive change that goes beyond what is required for regulatory compliance. Assessment and management: Assess the potential human health and environmental risks of chemicals to evaluate compliance with our requirements and inform product design. Innovation: Drive the development and use of innovative materials that enable the creation of groundbreaking products and also support industrywide change. Mapping and engagement Our Full Material Disclosure (FMD) program maps the chemicals used in our products — an effort that includes tens of thousands of parts and assemblies. Then we look at how our products are manufactured. Our Chemical Safety Disclosure (CSD) program engages with supply chain partners to get the most recent information on which materials are in use. This information includes the volume of materials being consumed and how they’re being applied, stored, and handled — as well as the steps being taken to protect employees. We require each of our suppliers to participate in the CSD program, collectively sharing information on thousands of materials used to manufacture our products. More than 1000 supplier facilities have shared their chemical inventories as well as storage and safety Zero waste Across our corporate operations, we’re reducing the amount of waste we generate and directing more toward recycling programs. In fiscal year 2021, recycling and composting efforts allowed us to achieve a waste diversion rate of 68 percent, limiting landfill waste from our global operations to about 15,000 metric tons. 12 Our overall waste generated also remained low, in part due to COVID-related temporary closure of facilities. Last year, our Mesa, Arizona, data center became the second Apple facility to receive TRUE certification for zero waste, following the Prineville data center in 2020. 13 Apple works with the Alliance for Water Stewardship and others to promote water stewardship that protects the health of water basins, including the Kunshan watershed in China. 100+ Apple supplier facilities are zero waste verified 2M+ metric tons of waste redirected from landfill by supplier facilities as part of Apple’s Zero Waste Program Read more about our efforts to conserve resources in our 2022 Environmental Progress Report We’ve partnered with our suppliers, recyclers, and waste solution providers to eliminate waste from our manufacturing processes. At the close of fiscal year 2021, more than 100 facilities had been zero waste verified — nearly half of the supplier facilities that are part of our Zero Waste Program. 14 All participating facilities across 12 countries can access resources including guidance on how to reduce waste and then reuse, recycle, or compost the waste they do create. And we’re seeing results: In fiscal year 2021, suppliers redirected 491,000 metric tons of waste from landfills, bringing the total to over 2 million metric tons since the program’s inception — the equivalent of eliminating more than 2.5 million square meters of landfill space. Appendix Governance Communities Suppliers Customers Our People Environment Introduction Apple’s 2022 ESG Report 20

protocols as part of our CSD program. Through this process, we’ve identified more than 17,000 chemicals and applications. These efforts contribute to a safer work environment for people across our supply chain. Assessment and management The data we collect on chemicals and materials forms the foundation for key decisions that have an impact on our product designs, manufacturing processes, and approach to recycling and reuse. This data enables us to establish requirements for our suppliers, including those set out in our Regulated Substances Specification (RSS) and the Restricted Chemicals for Prolonged Skin Contact Materials list . These requirements provide clear guidelines on potentially harmful materials, including those that are restricted. Our assessment system helps to ensure that only materials that meet our stringent requirements are used in Apple products. At our Environmental Testing Lab, we evaluate the safety of our products and materials through chemical analyses. Our chemists test materials for safety and monitor compliance with our specifications. In fiscal year 2021, we performed toxicological assessments on 1000 new materials to proactively evaluate and eliminate potentially harmful substances from our products. Both the data we gather on chemicals and our rigorous assessments allow us to make informed decisions and manage chemicals, for the safety of those who use, make, and recycle our products. Comprehensive chemical mapping Understanding chemical ingredients leads to better materials for Apple products Through our Full Material Disclosure (FMD) program, manufacturers share chemical ingredients used to make materials with Apple. With FMD data, Apple evaluates the chemicals in materials against restrictions. Data helps Apple suppliers manage chemicals when making Apple products Information on how chemicals are used, how they’re stored, and how employees are protected is shared with Apple by suppliers through our Chemical Safety Disclosure (CSD) program. CSD data informs and prioritizes supplier engagement, helping to ensure rigorous chemical management practices and adoption of safer alternatives. Apple customers benefit from use of products made with safer ingredients The FMD and CSD programs help support creation of best-in-class products in a responsible manner for our customers. Mapping chemicals Mapping chemicals throughout product throughout product development leads to development leads to better, better, safer products safer products Read more about our commitment to using safer materials to create safer products in our 2022 Environmental Progress Report Innovation The work we do in mapping, assessing, and managing the chemicals within our supply chain underpins our innovations. We rely on detailed information on the material properties, including toxicological data and environmental performance characteristics. We also look at how these materials are used at each point in the product life cycle, from design, to manufacturing, to end-of-life. This allows us to seek out and support the development of safer chemistries that have an impact on each phase — and contribute to continually improving the overall safety of our products and processes. Since the late 1990s, we have diligently identified and removed potentially harmful chemicals from our products, such as brominated flame retardants, beryllium, mercury, and lead. We’re also driving the use of safer process chemicals in our supply chain: Since 2018, all our final assembly sites have used only safer alternative cleaners and degreasers. As we work toward minimizing potentially harmful chemistries in our products and processes, we’re making the transition to safer alternatives accessible to others through industry initiatives, partnerships, and standards with the hope of driving chemical safety across the industry. Appendix Governance Communities Suppliers Customers Our People Environment Introduction Apple’s 2022 ESG Report 21

Our People In this section Our approach 23 Inclusion and diversity 23 Growth and development 26 Benefits 27 Compensation 28 Engagement 29 Workplace practices and policies 30 Health and safety at Apple 33 The heart of who we are. Appendix Governance Communities Suppliers Customers Environment Introduction Apple’s 2022 ESG Report 22 Our P eople

Inclusion and diversity At Apple, we remain committed to building a more equitable and inclusive world by increasing diverse representation at every level, fostering an inclusive culture that brings everybody in, and ensuring equitable pay and access to opportunity for all. Inclusive representation in leadership is a powerful driver of progress. At Apple, leaders of all backgrounds are working to grow and develop our next generation of leaders from within. We’re committed to increasing the number of managers from underrepresented communities, because differences in our backgrounds, our identities, and the way we think ultimately make our teams stronger and more innovative. At Apple, we work every day to create an inclusive, safe, and supportive environment for all our team members. We’re always finding new ways to invest in our teams’ development and to encourage collaboration and creativity. And we provide strong and comprehensive benefits and competitive compensation. We believe we’re a better and more innovative company when people have support and the opportunity to be their best selves. Our approach With over 165,000 team members* around the world, our people are at the heart of everything we do. From their first day, Apple team members have the resources and opportunities to build new skill sets, pursue new passions, and feel supported and cared for at work and beyond. Our People team supports our overall employee experience — from hiring to retaining our talented team members — through our inclusive culture, learning opportunities, compensation, and benefits. The team is led by Deirdre O’Brien, Senior Vice President of Retail + People, reporting to CEO Tim Cook. Deirdre works with the People team to help Apple connect with, develop, and care for team members — and to help everyone do the best work of their lives. A safe environment is also integral to unlocking the potential of all of our team members. And our commitment to environment, health, and safety (EHS) extends to contractors, customers, and communities as well. We’re working hard to make sure our people are safe no matter where they are when they’re conducting business for Apple. We have procedures in place to identify and mitigate possible hazards, and we’re prepared to respond to any crises that may arise. Our Senior Vice President and Chief Financial Officer (CFO) Luca Maestri oversees Apple’s EHS program, which is driven by an expert leadership team. We have robust workplace policies and practices, including our Business Conduct Policy, Human Rights Policy, and EHS Policy, that articulate our strong commitment to our people and to creating an environment where they can do their best work. Accountability measures across the company allow us to track progress and build a foundation for lasting and durable change. We’re listening to employee feedback, amplifying underrepresented voices, and taking action to meet our teams’ needs. From hiring to development and engagement, we’re making sure every part of Apple is increasing inclusion and representation. Senior leaders now have access to data that helps them assess how well they’re driving diversity within their teams and organizations. We’re building inclusion and diversity measures into our annual review process to create consistency in how we drive and track progress. In the last year, we completed comprehensive data reviews with executive leadership and organizational action plans within every line of business. *As of December 2021 Appendix Governance Communities Suppliers Customers Our P eople Environment Introduction Apple’s 2022 ESG Report 23

Inclusive representation To create products for everyone in the world, we need a workforce with diverse backgrounds and experiences. We’re making continuous progress in building an Apple community that represents the diverse and ever-changing world we live in. And we’re committed to far more. We’re making progress in increasing representation, and currently 50 percent of our workforce in the U.S. is made up of people from underrepresented communities. With more than 165,000 employees globally, even a 1 percent improvement impacts a substantial number of people, and increasing overall representation requires focus to drive progress. Please see the Appendix on page 81 for more data on representation across our workforce. Additionally, more than half of our Board identify as women and/or members of Asian, Black, Hispanic/Latinx, LGBTQ+, and veterans communities. And women hold half of our Board and committee leadership positions. Read more on page 6 of our 2022 Proxy Statement . Inclusive hiring We’ve built inclusion and diversity measures into our candidate assessment framework. And we continue to make progress toward our goal of having more diverse interview panels and candidates so that diversity is reflected at every stage of the hiring process. We’re making sure everyone involved in the hiring process has access to the information and resources they need to develop inclusive interviewing skills. All of our hiring managers and recruiters receive training in inclusive hiring practices. Our recruiters also receive training on how to continuously drive meaningful conversations with hiring managers to help implement these hiring practices with every role. These trainings help mitigate inherent biases and create more consistent hiring experiences for all. We’re working to accelerate progress through our diversity recruiting and hiring efforts across Apple, with a focus on technical, engineering, and leadership roles. We’re expanding our diversity outreach efforts, including our ties with Historically Black Colleges and Universities (HBCUs), Hispanic-Serving Institutions (HSIs), and other organizations that serve and engage talent from underrepresented communities. Beyond our own operations, we’re partnering to challenge systemic bias through initiatives like REJI ( page 60 ), Entrepreneur Camp ( page 64), Impact Accelerator ( page 18 ), Apple Developer Academy ( page 63 ), work with Historically Black Colleges and Universities (HBCUs) and HSIs ( page 60 ), as well as our responsible procurement work ( page 45 ). Data is for the 2021 calendar year. Continuing to increase Black and Hispanic/Latinx team members Over the past year, we hired more Black and Hispanic/Latinx team members in the U.S. than ever before. Additionally, in the open positions we filled during this time period, representation of these communities was the highest ever in corporate and retail roles filled in the U.S. 13% Open U.S. leadership roles filled by Black candidates 12% Open U.S. leadership roles filled by Hispanic/Latinx candidates 23% Open U.S. retail leadership roles filled by Black candidates 18% Open U.S. retail leadership roles filled by Hispanic/Latinx candidates 47% Open leadership roles filled by women globally 34% Open R&D leadership roles filled by women globally 59% Open leadership roles filled by people from URCs in the U.S 38% Open R&D leadership roles filled by people from URCs in the U.S Progress in retail 58% Open retail leadership roles globally filled by women 76% Open retail leadership roles in the U.S. filled by people from URCs More inclusive leadership Compared to the previous year, open leadership* roles filled by women globally increased by 10 percentage points overall, and by 8 percentage points in R&D. And in the U.S., open leadership roles filled by people from underrepresented communities (URCs)** increased by 16 percentage points overall, and by 9 percentage points in R&D. * Leadership roles include managers at all levels of our company. ** URCs: Groups whose representation in tech has been historically low — Female, Black, Hispanic/Latinx, Multiracial, and Indigenous peoples. Data is for the 2021 calendar year. Appendix Governance Communities Suppliers Customers Our P eople Environment Introduction Apple’s 2022 ESG Report 24

Training and resources Apple team members have access to career development programs, ongoing inclusion and diversity education, and support throughout their career journey. From new-hire orientation, to specialized classes for individual contributors and managers, to talent planning and mentorship, we’re always finding new ways to help team members continue to learn, thrive, and advance in their careers in an inclusive environment. All of our employees complete unconscious bias and inclusion training, and can access expert-led courses on race, gender, justice, allyship, and more. Equitable, inclusive experiences for all employees begin with equipping our leaders with the resources they need. Apple’s more than 15,000 managers are trained in unconscious bias and inclusive leadership. In addition, in fiscal year 2021, we reached 90 percent of all managers with new material on creating inclusive environments and mitigating bias within their teams. This offering will now be available to all new managers. We also work to ensure equitable access across all of our growth and development programs (see page 26 ). Nearly 10,000 coaching hours provided to managers and individuals in support of inclusion through Apple University in FY2021 4000 hours for optional in-depth courses exploring race and justice in the U.S., gender in the workforce, and building inclusive products through Apple University in FY2021 185,000 hours of inclusion and diversity training in calendar year 2021* * In addition to training and embedded material provided through Apple University below. 80,000 hours of management education including focus on mitigating bias and creating inclusive environments through Apple University in FY2021 55K employee members of DNA communities worldwide 1000+ community events and heritage celebrations worldwide in the last year Supporting accessibility for our employees Accessibility is one of our values and a fundamental human right. To make sure that all of our team members have the support they need, Apple’s own best-in-class accessibility features are in use across the company by team members with disabilities to remove barriers and enable them to be more productive and successful. We offer on-demand sign language interpretation in the U.S., Canada, the UK, and France to support in-person conversations, or to reach out to employee services. We have multiple accessibility-focused trainings available to team members, managers, and recruiters. We have a dedicated global accessibility and accommodations team to support team members throughout their career journeys. And we have a directory of all of these accessibility resources available that team members can access and search. Supporting our team members to find community and build connections is central to our culture. Community is the core of our culture For more than 35 years, Apple employees have found community and connection in Apple’s Diversity Network Associations (DNAs). These employee -led groups foster a culture of belonging through education, leadership development, networking, and volunteering — while also encouraging the kind of open dialogue that leads to stronger allyship across Apple. In the last year, we’ve grown our global DNA communities more than 50 percent, including expansions in Apple Store locations and across all regions. More than 55,000 Apple employees belong to groups like Accessibility@Apple, AsianPacific@Apple, Beacon@Apple, Black@Apple, Familia@Apple, Indigenous@Apple, Pride@Apple, SouthAsian@ Apple, Veterans@Apple, Women@Apple, and more. Many of our community-led initiatives and volunteer engagements drive progress within the business as well as outside Apple in local communities. Appendix Governance Communities Suppliers Customers Our P eople Environment Introduction Apple’s 2022 ESG Report 25

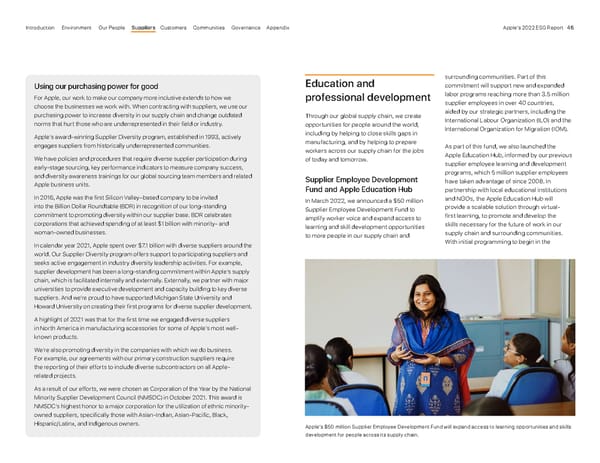

Growth and development We want everyone to flourish in their time at Apple, whether in their current role or their next career opportunity. We offer many different paths to career fulfillment, and we continue to take new steps to ensure that everyone at Apple has the opportunity to find support to grow and develop. Across Apple, our managers and leaders help our team members progress, creating development pathways that enable individuals to learn, improve, and empower their colleagues to do the best work of their lives. We provide a growth and development framework and tools — including planning worksheets, manager toolkits, and a dedicated internal web page — that team members can use to create individual plans to shape their careers and identify their goals. We encourage our team members to discover new opportunities and roles listed on our internal career site, and for many roles and lines of business, we provide detailed profiles of the skills required to be successful. We help ensure an end-to-end selection process that is clear and equitable for all, and we encourage regular discussions with managers about team members’ growth and development goals at Apple. In addition to our company-wide programs and initiatives, a significant amount of learning happens within teams because of our unique functional structure. Our leaders are experts in their fields and thus guide their teams of experts to further deepen very specific knowledge and skill sets. We also support team members through formal education and career development initiatives, including: Apple University: Apple University began in 2010 with a simple mission — to foster understanding and critical thinking about Apple’s culture, organization, and values. Apple University offers original classes, tools, and resources across a distinctive range of topics to help employees learn to lead and explore important topics like fairness and justice. All employees have access to Apple University, and to date, more than 95 percent of executives and managers and nearly 60 percent of individual contributors have participated in classes. In fiscal year 2021, team members spent more than 175,000 hours participating in all Apple University courses combined. Educational Assistance Program: Our Educational Assistance Program offers tuition reimbursement for team members to continue their education. Apple Mentorship Program: Our new mentorship program creates opportunities for Apple employees of all backgrounds to learn from one another and grow their careers at Apple. After successful pilot programs in the U.S. and the UK, we’re continuing to expand the program globally, pairing a greater number of experienced Apple mentors with future leaders from across the company. Retail-specific training: Through onboarding training, new Apple Retail employees learn the fundamental knowledge and skills that will support their success at Apple. Ongoing training opportunities cover Apple culture and values, products and services, systems, processes, and customer engagement skills. Across Apple, our managers and leaders help our team members to learn, improve, and do the best work of their lives. Career Experience: Career Experiences enable temporary, hands-on development opportunities for Apple Store, service, and support team members by creating short- term rotations in technical, operations, and corporate functions across Apple. Participants build new skills, explore an aspirational role up close, and gain in-role experience, while host teams benefit from the unique customer- facing perspectives, talents, and passions of participants. The program is currently available in 11 locations in every geographic region, with more countries being added each year, and 96% of Apple’s lines of business participate. 175,000 training hours in Apple University in FY2021 Appendix Governance Communities Suppliers Customers Our P eople Environment Introduction Apple’s 2022 ESG Report 26