ESG Report | Walmart

Environmental, Social and Governance Summary Report FY2022

N O TI C U D O NTR I Contents Y T I N INTRODUCTION 3 COMMUNITY 36 TU R About our reporting 4 Serving communities 37 O P P O Year at a glance FY2022 6 Safer, healthier food and other products 39 Y Leadership letters 8 Disaster preparedness & response 40 T I Our company 10 IL B A Our approach to ESG 12 ETHICS & INTEGRITY 41 IN A ST Ethics & compliance 42 U S OPPORTUNITY 15 Corporate governance 43 Y Human capital: Good jobs & Engagement in public policy 44 IT advancement for associates 16 N Digital citizenship: Ethical use of data U M Equity & inclusion at Walmart and beyond 20 & responsible use of technology 45 OM C Supplier opportunity 23 Human rights 46 Y T I SUSTAINABILITY 24 ENDNOTES 47 R G E Product supply chain sustainability 25 NT I & Climate change 27 S C I Waste: Circular economy 30 TH E Regeneration of natural resources: Forests, land, oceans 32 2 People in supply chains 34

N O TI C U D O NTR I Y T I N TU R O P P O Y T I IL B A IN A ST U S Y IT N U M Introduction OM C Y T I R G E NT I & S C I TH E 3

N O TI C U D About our reporting O NTR I Walmart has reported on a wide range of ESG issues since 2005. Our reporting is focused Y on our priority ESG issues—issues that we believe are the most relevant to our business and T I N important to our stakeholders. TU R O P P O This Annual Summary provides an overview of our shared value the Walmart Inc. consolidated financial statements, unless approach to ESG, ESG priorities and key highlights. The Annual otherwise noted. Y Summary covers our activities during the fiscal year ending T I This report also covers some activities of the Walmart IL January 31, 2022 (FY2022), except as otherwise noted. Calendar B Foundation, a separately incorporated Delaware charitable A years (CY) are marked as such or written in a four-digit format. IN private foundation. “Walmart.org” is used to refer to the A Beginning in 2021, our reporting has been centered around a ST collective philanthropy of Walmart Inc. and the Walmart U series of ESG issue briefs covering each of Walmart’s priority S Foundation. ESG issues in depth. Each of the 17 briefs covers our aspiration Y and strategy with respect to that issue, the relevance of the As discussed in Walmart’s fiscal year 2022 annual report on IT Form 10-K, the COVID-19 pandemic impacted Walmart’s N issue to business and society, our key goals and metrics and our U M progress to date. These briefs will be updated from time to time business in many ways throughout FY2022, including through OM and may not align with fiscal year reporting periods. As we cover net-sales growth and strong comparable sales in a majority of in certain instances third parties assisted in the process of C each issue in this summary, we will provide links to the relevant our international markets, pandemic-related costs, changes in collecting, analyzing and calculating information presented in Y issue brief or briefs. customer shopping patterns and employment trends. As the this Annual Summary. T I pandemic and related trends evolve in FY2023 and beyond, R All references to “Walmart” in our ESG reporting are to Our reporting is guided by frameworks, such as the Global G impacts on Walmart’s business may also evolve. E Walmart Inc., a Delaware corporation and its consolidated Reporting Initiative (GRI) standards, Sustainability Accounting NT I subsidiaries that were subsidiaries during the reporting period, We sought and received external assurance from a third party Standards Board (SASB), the Task Force on Climate-related & S C excluding all acquired eCommerce businesses, platforms and/ with respect to certain emissions information reported in this Financial Disclosures (TCFD) and the United Nations (U.N.) I TH or marketplaces, unless otherwise noted. Financial information Annual Summary. We did not seek or receive external assurance Sustainable Development Goals (SDGs). We also report through E referenced in our ESG reporting reflects the scope of from third parties with respect to other information, although programs such as CDP, a global environmental disclosure system. 4

N factors discussed in Item 1A of our most recent Annual Report O FORWARD‑LOOKING STATEMENTS TI on Form 10-K and subsequent quarterly reports on Form 10-Q C This Annual Summary contains certain forward-looking U filed with the Securities and Exchange Commission (SEC); they D statements based on Walmart management’s current O also include the challenges, assumptions and dependencies NTR assumptions and expectations, including statements regarding I identified in our ESG issue briefs. our ESG targets, goals, commitments and programs and other Y business plans, initiatives and objectives. These statements are We urge you to consider all of the risks, uncertainties and T I typically accompanied by the words “aim,” “hope,” “believe,” factors identified above or discussed in such reports carefully N TU “estimate,” “plan,” “aspire” or similar words. All such statements in evaluating the forward-looking statements in this report. R O are intended to enjoy the protection of the safe harbor for Walmart cannot assure you that the results reflected or implied P P forward-looking statements within the meaning of Section 21E by any forward-looking statement will be realized or, even if O of the Securities Exchange Act of 1934, as amended. substantially realized, that those results will have the forecasted Y or expected consequences and effects. The forward-looking T Our actual future results, including the achievement of our I statements in our reporting are made as of the effective date IL B targets, goals or commitments, could differ materially from A our projected results as the result of changes in circumstances, identified on the issue brief, unless otherwise indicated and IN A assumptions not being realized, or other risks, uncertainties and we undertake no obligation to update these forward-looking ST U statements to reflect subsequent events or circumstances. S factors. Such risks, uncertainties and factors include the risk Y IT N U M OM C Y Reporting resources Click to find resources on our ESG website T I R G E NT I & S C I TH E SASB ESG issue briefs SASB GRI UNSDG TCFD CDP ESG commitments 5 and progress

Year at a glance FY2022 N O TI OPPORTUNITY SUSTAINABILITY C U D O NTR I >$16.50 $35M Committed to help protect, 50M 1M Y more sustainably manage, or T I 1 acres of land and square miles of ocean N average hourly wage invested of the $100 million Walmart.org restore, by 2030, at least TU in the U.S. Center for Racial Equity commitment R O P P O Y T I IL B A Global private brand IN 100% 17.5% packaging estimated A 58% ST associates enrolled in Live 100% of LBU students’ college to be recyclable, U reduction in scopes S Better U since program tuition and books paid for by 1 and 2 emissions reusable or industrially 4,5,6 launched in 2018 Walmart as of August 2021 (2020 vs. 2015 baseline)2,3 compostable Y IT N U M OM C Y 7 T U.S. management I R G promotions went to E >4.5K >574M NT I of our suppliers engaged in metric tons of CO e & 2 S Project Gigaton™ since 2017 reduced or avoided, C 9 I >$13.3B ~2.6K 45% 40% cumulative since 2017 TH Women People E in goods and services diverse suppliers for of color 8 sourced from... our U.S. businesses 6

Year at a glance FY2022 N O TI COMMUNITY ETHICS & INTEGRITY C U D O NTR I ~230M >$1.5B Provided anti-corruption training to Y >2M T Providing access to customers per week in I in cash and in-kind donations N thousands of communities associates trained TU affordable, quality food, globally provided by Walmart in ethics R other essential products globally10 and the Walmart Foundation associates O and services to P P O Y T I 11 IL Board of Directors B A IN >5.1K >$132M Partnered with A ST COVID-19 vaccination sites in cash and in-kind donations, provided 18% U 27% the Data & Trust Alliance S supported across all U.S. Walmart by Walmart, Sam’s Club and the Walmart racially/ and Sam’s Club pharmacies Foundation, since 2016 to support community women ethnically to adopt a toolkit for evaluating Y preparedness and disaster relief diverse algorithmic bias in workforce decisions. IT N U M OM C Y T I 17% R G RECOGNITION E NT I & S >18K C reduction in priority 7B >356K I U.S. associates 100% TH chemical footprint pounds of food donated hours volunteered A- No. 15 score E (2020 vs. 2017 baseline), to Feeding America food for local causes by through the No. 26 … ranked in Fortune 12,13 14 Volunteerism Always exceeding our 10% goal banks since 2006 Pays program Change the World ranked in DiversityInc.’s th 2022 Top Companies for CDP 2021 2021 – 7 consecutive 2021 Disability 7 Climate Rating year on the list Equality Index Diversity

Leadership letters this approach in all aspects of our business and help guide us. company donated more than $1.5 billion in cash, food and other A MESSAGE FROM OUR CHIEF Throughout our journey, we have set goals, measured progress products globally. Our experience confirms for us that, when EXECUTIVE OFFICER and reported on that progress. And we continually push we understand what a community needs and partner with As the world continues to change, I’m often asked, “What ourselves, which is why we elevated our aspiration by making a others, we can strengthen the environment to create more N is the role of business in society today?” Our founder, Sam commitment to become a regenerative company—one that puts opportunities for the people who live there and end up with a O TI Walton, gave us a timeless and meaningful purpose to save people and nature at the center of our business practices. This stronger business. C U people money and help them live a better life. As we celebrate D commitment touches all parts of our business. It is anchored O th Regeneration also means strengthening our planet. This spring, Walmart’s 60 anniversary this year, that purpose still guides in our purpose—and we do that in a way that strives to create NTR us as we work to create environmental, social and economic we hit a major milestone with Project Gigaton™: We are halfway I equitable opportunity for our associates and suppliers, enhance progress in ways that strengthen our business and benefit our the sustainability of retail and product supply chains, help toward our goal to reduce or avoid one billion metric tons of Y stakeholders. We believe a business’s long-term success will create more resilient communities and operate with the highest greenhouse gases from the global supply chain by 2030. Since T I 2017, our suppliers have reported a cumulative total of more N depend on its work to help create a strong, resilient society standards of ethics and integrity. TU —for all. than 574 million metric tons of emissions reduced or avoided. R O Having a healthy business for the long-term requires healthy Additionally, we recently raised $2 billion through our first green P P In 2005, we committed to shifting our mindset and broadening relationships and a healthy planet. It also requires trust. It starts bond and for the past four years we have received an A or A- O our view to take a multi-stakeholder approach to our business. with us living our value of acting with integrity. We aim to do score from CDP for our transparency on climate action. Y This means not only do we want to be the primary destination that throughout all our work. T After 60 years in business, we are reflecting on the moments of I for our customers and return value to our shareholders, but IL B we want to do it in a way that creates value for all stakeholders There is a path of opportunity for everyone here. As I’ve visited celebration, challenge and change throughout our history. These A IN —including our associates, suppliers and other partners, stores, clubs and DCs over the past year, I’ve enjoyed talking milestones have a way of making you think about the future. A ST communities and the planet. As we engage and serve our with the many associates who are creating long, meaningful Though you’ll see some of the progress we’ve made this past U S stakeholders, we grow and strengthen our business—and vice careers at Walmart. Last year, we promoted more than year in this report, we know there’s more to be done. We will versa. If the past couple years have reinforced anything, it’s the 135,000 associates to positions of greater responsibility and continue to look for ways to make a difference and remain eager Y we continue to support and invest in them with job training, to collaborate—we need more businesses and NGOs, as well as IT need for this kind of shared value approach. N rising wages and by making it easier to gain a college degree governments, to get involved and do more. This work requires U M At Walmart, this isn’t something sprinkled throughout our or certificate by covering the costs of tuition and books collective action. OM business or added on as an afterthought—we strive to use C through our Live Better U program. In the U.S., 40 percent When our children and grandchildren look back at the work of management promotions went to people of color and we’re doing now, I hope it’s clear we were part of the solution— Y 45 percent to women. Creating opportunities for people is an T working every day to make this world a better place. For as long I R important part of our work to become a regenerative company G as we’re on this planet, Walmart will keep doing just that. E and we believe our success will depend on advancing prosperity NT I and equity for all. & S C I It is also at the heart of our work with communities. When TH E disaster strikes, we are there with food, water and helping hands—but we are there every day strengthening communities. Doug McMillon Last year, in the U.S. alone, our associates volunteered close President and Chief Executive Officer 8 to 1,000 hours a day to causes they care about and the Walmart Inc.

A MESSAGE FROM OUR CHIEF making. Yet we are encouraged by emerging shifts in mindsets, A rose by any other name… Debates have intensified about N SUSTAINABILITY OFFICER practices, resource flows and policies within each of these terminology—ESG, stakeholder capitalism, inclusive capitalism, O arenas as well as progress within our own company. shared value, etc.—and whether all of this is just a passing fad. TI C As we go to press, the world faces uncertainty: COVID-19 waves Our view is simple: a company’s long-term success depends U Climate action: more than promises. In the lead up to COP26 in D continue; inflation has kicked up while supply chains remain on its performance on the societal issues most relevant to its O Glasgow, many companies set goals to help the world get to NTR volatile; the effects of climate change have intensified; social net-zero emissions. Walmart has been engaging in climate action business and stakeholders. We can’t have a strong business I divides seem to have widened. without a thriving planet and the trust and engagement of since 2005 and enlisting suppliers to do the same since the customers, associates, suppliers, investors, civic partners and Y Yet despite such challenges—or as much spurred on by them— launch of Project Gigaton™ in 2017. This year we reported that we T communities. And the fundamentals of that are here to stay. I we are more committed than ever to our efforts to become continue to make progress toward our science-based targets for N TU a regenerative company, one that puts humanity and nature emissions reduction (for example, reporting a 17.5% reduction in We remain optimistic. In Walmart communities around the world, R O at the center of our business practices. We believe that we FY2021 relative to our 2015 baseline for Scope 1 and 2 emissions) our customers, associates, suppliers and civic partners help one P P O maximize the value of our company for our customers and and we significantly expanded our efforts and disclosures another live better every day in a million ways, big and small. other stakeholders by tackling relevant, pressing societal issues related to our nature goals. Thank you for your engagement to make us a better company. Y through business. T I No simple solutions. When it comes to complex societal issues, IL B In the pages of this year’s FY2022 Summary and the stakeholders don’t always agree on the way forward and there A IN accompanying ESG Issue Briefs, we share our aspirations, can be many obstacles to progress. Through our ESG reporting, A ST strategies, progress and challenges related to our priority we aim to provide insight into Walmart’s theories of change, U S environmental, social and governance issues. A few observations systemic challenges and the efforts of Walmart teams and our Kathleen McLaughlin Y about our FY2022 disclosures: partners to overcome them. EVP and Chief Sustainability Officer IT “Who’s #1? The customer, always.” In a year where so many Decision-useful reporting. Investors have asked businesses for Walmart Inc. N U M communities turned to Walmart for access to affordable food, more consistent and relevant ESG information. Nobody wants OM consumables, COVID-19 vaccines and other everyday essentials, an avalanche of data or—at the opposite end of the spectrum— C high-level headlines; they want concrete facts regarding policies, it became clearer than ever that delivering our customer Y proposition is itself a central ESG contribution. practices and results relevant to the creation of shared value. We T I aim to set the standard for decision-useful reporting. This year, R Progress on rewiring systems for equity. Because advancing G we have responded to investor requests for expanded disclosure E equity in society requires transformation of complex systems, NT I in specific arenas (for example, public policy engagement; our strategies in arenas such as economic mobility, racial & S approach to nature). We continue to aim for consistency and C equity and human rights in supply chains involve long-term, I relevance through the structure of our ESG issue briefs and TH intensive collaboration with others on business and philanthropic E approach to metrics (e.g., clear definitions; sharing progress for initiatives extending beyond the four walls of our company. the last three fiscal years). Substantial improvements in outcomes may be years in the 9

Our company N O TI C WALMART’S CORPORATE PURPOSE HOW WALMART CREATES VALUE FOR STAKEHOLDERS U D O Walmart’s purpose is to save people money and help them live NTR better. We provide convenient access to high-quality, affordable Customers: Convenient access to quality, Business Partners: Access to and I food and other essential products and services to millions of affordable products and services understanding of engaged customers for our Y people each week. In doing so, we aim to create value for our sellers, advertisers and ecosystem partners T I stakeholders. N Associates: Purpose-driven work; opportunity TU R O for good jobs and upward mobility Communities: Resources to build stronger, P OUR VALUES P O more inclusive communities Y Acting with Serving Shareholders: Strong long-term returns T I IL integrity the customer through financial, environmental, social and Planet: Leadership on zero emissions, B A governance (ESG) leadership zero waste and our regenerative approach IN A to nature ST Striving for Respecting U S excellence the individual Suppliers: Access to customers and support Y for supplier development and growth IT N U M OM C Y OUR BUSINESS IN FY2022 T I R G E NT I >$572 billion ~2.3 million eCommerce >10,500 7.7% $15.9 billion & S C I in revenue associates grew double-digits stores in two dozen U.S. comp sales returns to TH E countries growth including fuel shareholders 10

N O EARN PRIMARY DESTINATION Serve customers more broadly, deepen our TI Transforming C U (FOOD, CONSUMABLES, GM) relationship and sustain a healthy mix by expanding: D O our business NTR • In store • Delivery I HEALTH & FINANCIAL Y • Pick-up • Walmart+ ECOMMERCE WELLNESS SERVICES T I Our flywheel for N • 1P eCommerce • High quality TU • Trusted R becoming an omni- O P • 3P marketplace • Preventative P channel, regenerative • Digital O company • Accessible • Accessible Y T I • Affordable • Affordable IL B We are transforming our company to A IN provide customers with a seamless A ST omni-channel experience in stores and U S online—in a way that is regenerative. Y By regenerative, we mean fulfilling our REINVEST IN THE IT customer mission in a way that creates CUSTOMER VALUE N MONETIZE SUSTAINABLY U value for people and planet: creating PROPOSITION M opportunity, enhancing sustainability of CAPABILITIES LOWER COST OM C retail product supply chains, strengthening • Assortment communities and upholding the highest • Price • Marketplace • Store productivity Y standards of ethics and integrity. T I • Advertising • Supply chain design & R Transforming our business model toward • Experience G E an omni-channel, regenerative approach • Data automation NT I sets up a virtuous cycle that we call our • Trust & • Digital transformation S • Fulfillment C “flywheel.” Along with our assortment, I TH price and experience, we want to make • Regenerative E • Last mile trust a competitive advantage. 11

N O TI C U D O NTR I Our approach to ESG Y T I N TU CREATING SHARED VALUE R O P Shared value—addressing societal issues in ways that create The primary way that we create value for society is by bringing P O value for our business and stakeholders—lies at the heart of everyday essentials to people who need them. People need safer Walmart’s enterprise strategy and our approach to ESG issues. and healthier foods, quality general merchandise and critical Y services like pharmacy and healthcare. And they need them at T I We believe we maximize long-term value for shareholders by IL affordable prices. Sam Walton saw such a need in small-town B A serving our stakeholders: delivering value to our customers, America when he opened the first Walmart in Rogers, Arkansas IN creating economic opportunity for associates and suppliers, A in 1962. Sixty years later, Walmart meets that need through its ST strengthening local communities and enhancing the U S environmental and social sustainability of our business and presence in thousands of communities around the world. What’s product supply chains. Addressing such societal needs builds good for business is good for society and vice versa. Y IT the value of our business by extending our license to operate, Each of our ESG priority issue areas offers a discrete N U building customer and associate trust, creating new revenue shared-value proposition: an opportunity to meet a societal M OM streams, managing cost and risk, building capabilities for future need through our business. In each instance, our aspiration is to C advantage and strengthening the underlying systems we all operate our business in a regenerative way. Doing so aligns our Y rely on. In other words, business thrives by serving society: business objectives with societal objectives and increases our T as business strengthens society, serving society strengthens ability to create value for the long term. I R G business. We aspire to become a regenerative company—helping E NT to renew people and the planet through our business. I & S C I TH E 12

N O TI C U D O NTR I Y T I N TU R O P P O OUR APPROACH TO PRIORITY OUR ESG PRIORITIES ESG ISSUES We prioritize the ESG issues that offer the greatest potential for Walmart to create shared value; these are issues that rank Y T high in relevance to our business and stakeholders as well as Walmart’s ability to make a difference. I For each priority ESG issue, we develop an ESG impact IL B thesis that articulates the relevance of the issue for society A Based on our most recent ESG priority assessment conducted in spring 2021, we have organized our ESG priorities into four IN and Walmart’s business, reflects an understanding of A leadership themes: Opportunity, Sustainability, Community and Ethics & Integrity. ST stakeholder expectations and defines our aspirations, goals U S and strategies. Through such disclosures, we aim to provide OPPORTUNITY COMMUNITY Y stakeholders with an understanding of Walmart’s shared IT value approach and progress. • Good jobs and advancement for associates • Serving communities N U • Equity and inclusion at Walmart and beyond • Access to safer, healthier food, products M To create change we: OM • Growth for suppliers, sellers and local economies and services C • Lead through business by embedding our ESG aspirations and initiatives into how we do business and • Disaster preparedness and relief Y work with teams across the company SUSTAINABILITY T I ETHICS & INTEGRITY R G • Collaborate with suppliers, NGOs, governments and • Climate and renewable energy leadership E NT • Highest ethical and compliance standards I others to transform systems at scale • Zero waste in operations, products and packaging & S • Strong corporate governance C • Use our philanthropy to extend the societal impact of I • Regeneration of natural resources: forests, land TH business initiatives and oceans • Engagement in public policy E Read more: Our ESG priorities • Sustainable product supply chains • Digital citizenship { 13 white box element • Dignity of people in supply chains • Respect for human rights

N MANAGEMENT OF ESG and help shape the evolution of the ESG field to increase O focus on shared-value impact. TI C Leadership of ESG issues starts with our CEO—with oversight U D from committees of our Board of Directors—and cascades • Other groups, such as the ESG Disclosure Committee, O NTR across our enterprise. Walmart’s Chief Sustainability Officer help to guide and shape the company’s ESG strategy I (CSO) helps define the ESG agenda and provides dedicated and disclosures. Y management and oversight of Walmart’s global ESG initiatives Read more: ESG oversight and management T and goals. The CSO reports to our Executive Vice President { I N of Corporate Affairs and provides updates on our ESG agenda TU R and progress to the Nominating and Governance Committee of O P P the Walmart Board of Directors and to the Walmart executive STAKEHOLDER ENGAGEMENT O leadership team. Board committees also have oversight responsibility for particular ESG issues. Walmart business leaders Our ability to create shared value depends on direct and Y frequent engagement with our customers, associates and T I shape and deliver ESG strategies relevant to their segments IL community leaders, as well as the people who supply our B and functions. For example, the Real Estate team leads A products, hold our stock and evaluate our performance. IN renewable energy initiatives and the People team leads human A Stakeholder perspectives and feedback help improve the ST capital initiatives. U relevance and effectiveness of the products and services we S Additional governance bodies and working teams include: offer and the initiatives we support. Y Day-to-day, we engage with customers, fellow associates, IT • The ESG Steering Committee, a management committee N suppliers, members of the communities where we operate U that meets at least biannually and is composed of leaders M from various departments throughout the business, and shareholders. OM C including the Office of the Corporate Secretary, the Additionally, our 2021 ESG priority assessment included Controller’s Office, Investor Relations, Ethics and extensive outreach to stakeholders, including customers, Y Compliance, Global Audit, People, Global Public Policy and T I associates, shareholders, suppliers and NGOs, to understand R Government Affairs and Sustainability. G their perspectives on which issues Walmart should prioritize. E NT I • The ESG department, led by the Vice President, ESG, & Read more: Stakeholder engagement S reports to the CSO and helps Walmart business leaders { C I prioritize ESG issues and define impact theses. The TH E team helps to improve ESG strategies, performance and disclosures; engage with investors and other stakeholders; 14

N O TI C U D ~75% O NTR of U.S. salaried store, I club and supply chain Y management started T I their careers in hourly N Opportunity TU positions R O P P O Retail can be a powerful engine for inclusive Y T economic opportunity. We aim to advance equity and I IL B A opportunity throughout Walmart, our supply chain IN A and the communities we’re in to fulfill our customer ST U S mission, strengthen our business and help people Y build a better life for themselves and their families. IT N U M OM C Y T I R G Issue briefs E NT I Human capital: Good jobs & advancement for associates & { S C I TH Equity & inclusion at Walmart & beyond E { Supplier opportunity { 15

N O TI C U D O NTR I Y T I N TU R O P P O Human capital: Good jobs & Y T I IL advancement for associates B A IN A ST As one of the world’s largest private employers, we seek to U S accelerate the professional development and advancement of Y our associates and help make retail a gateway to upward mobility. IT N U Our human capital development strategy focuses on inclusion, M OM well-being, growth and digital enablement. C Y T I R INCLUSION G E We seek to make Walmart a place for everyone by creating opportunity and a sense of belonging. NT I Walmart offers jobs with low barriers to entry; for some it’s a first job and for others a second & S C chance—with access to career paths ranging from retail management to technology to health care. I TH We seek to enhance diversity across all levels in the organization. We are focused on equitably E hiring, developing and rewarding our associates. 16

N WELL‑BEING O TI We design jobs and offer benefits that support the financial, business format (e.g., Neighborhood Markets, Sam’s Clubs, C U physical and emotional well-being of our associates. Supercenters, eCommerce fulfillment centers and supply D O chain warehouses). We continue to invest in higher pay for NTR our associates, which has increased our average hourly wage I FINANCIAL WELL‑BEING 19 In the United States, we offer competitive total compensation to over $16.50 as of the end of FY2022. As we continue to Y roll out our team-based operating model in U.S. stores, we’ve T and benefits packages that provide paid time off (including I N sick leave to full- and part-time associates; up to 16 weeks’ invested in higher-paying roles and increased pay for more than TU 1 million hourly store associates in FY2022, including raises for R 15 O leave for birth mothers who are full-time associates ); 401(k) P associates who work in the digital, stocking, front end, food and P contribution plans for full- and part-time hourly associates O consumables and general merchandise areas of our stores. We 16 that offer a 6% match after one year (the average enrollment also offer predictable yet flexible scheduling. Associates get Y was approximately 700,000 in FY2022); and stock ownership their schedules at least two weeks in advance and can opt to T 17 I plans with a company match of up to $270 per plan year (in IL work the same shift with their teams for at least 13 weeks. This B FY2022, 38% of our active full-time and salaried U.S. associates A model provides for consistent scheduling for up to 40 hours IN participated in at least one of Walmart’s stock ownership A per week, helping associates to know what to expect in their ST 18 U programs ). S paychecks. At the same time, associates can swap shifts or pick In the U.S., our wage structure reflects varied market rates up extra shifts, giving them greater flexibility and ownership Y associated with each role, our geographic footprint and our over their schedules. IT N U M OM C Avg. total hourly 19 Segment Avg. hourly wage 20 Peer comparison Y compensation T I R Grocery chains, multicategory G 21 E Walmart U.S. >$16.50 >$21.25 retailers, dollar stores NT I & S Sam’s Club U.S.22 >$17.25 >$22.50 Warehouse clubs C I TH E Supply Chain only (Walmart 23 >$23.75 >$32.00 eCommerce fulfillment U.S. and Sam’s Club U.S.) 17 19 The average hourly wage in the U.S. is over $17 per hour as of the end of Q1 FY2023.

N O TI C U D O NTR I Y T I N TU R O P P O PHYSICAL WELL‑BEING DIGITAL Y T I In 2022, Walmart offered medical coverage starting at Walmart continues to integrate technology into our jobs to IL B $31.40 per pay period for full- and part-time associates when improve experiences for customers and associates alike. In 2021, A IN eligible. Enrolled associates have access to Walmart’s Centers we unveiled Me@Walmart, an app for U.S. store associates A ST of Excellence program, which provides quality care, often that helps connect them with their leader, their team and their U S at zero cost, through partnerships with the Mayo Clinic and work. The app allows associates to simplify daily tasks such as Y other leading health centers for serious medical conditions scheduling, clocking in, locating merchandise for customers IT such as spine and cardiac surgery, cancer evaluations and joint and communicating with other associates. To support use of N U replacements. Our Included Health program offers associates the app, Walmart is equipping U.S. store associates with new M enrolled in most medical plans access to expert second opinions smart phones, free of charge. We have provided more than OM C and help finding a high-quality doctor. 740,000 devices and plan to expand the program to most U.S. store associates by the end of FY2023. Y EMOTIONAL WELL‑BEING T I R G E Associates in the U.S. receive benefits aimed at enhancing NT I emotional well-being. For example, all associates and their & S families, regardless of whether they are on a Walmart medical C I plan, can receive support through Resources for Living, TH E including ten counseling sessions per type of concern at no cost and unlimited telephone support. 18

N GROWTH WALMART’S EDUCATION O BENEFIT PROGRAM TI C We are creating a ladder of opportunity so people can build a U D career at Walmart, regardless of where they start. Associates O NTR can begin working and learning on a team, receive role-specific I Walmart Academy training and take advantage of our Live Better U education offering. Associates can use experiences DEGREE & CAREER DIPLOMA PROGRAMS Y T • Business • Health & Wellness I and knowledge acquired through work or our learning programs N to continue moving up to roles with greater responsibility and • Supply Chain • Skilled Trades TU R higher pay. Walmart has a track record of making growth and • Technology O P P advancement a reality. Approximately 75% of our U.S. salaried O store, club and supply chain management started their careers SHORT‑FORM PROGRAMS Y in hourly positions. T I • People & Business Leadership • Process Improvement IL Walmart Academy helps associates learn through immersive B • Project Management • Human Resource Management A teaching that combines technology, classroom training and IN • Business Analytics • Training & Staff Development A ongoing coaching on the sales floor. In FY2022, we trained • Supply Chain / Operations • Frontline Leadership ST U S approximately 167,000 associates through Walmart Academy, including in-person and virtual trainings. Y IT As of August of 2021, Walmart pays 100% of college tuition N FOUNDATIONAL PROGRAMS U and books for LBU students. Since Walmart launched M OM LBU in 2018, more than 72,000 Walmart associates have • English Language Learning • ACT / SAT Test Prep C enrolled in the program and more than 11,000 students • High School Completion • College Courses for have completed LBU programs, including over • College Start (Bridge Program) HS Students Y 1,500 graduates who have earned an associate’s T I R { Read G or bachelor’s degree in an in-demand field. E more: Human capital: Good jobs & advancement NT I for associates & S C LBU ACADEMIC PARTNERS I TH E 19

N O TI C Equity & inclusion at Walmart and beyond U D O NTR We believe that our business and communities are stronger and more resilient when all I Y our associates, suppliers, customers and community members are included, heard and T I empowered. With approximately 2.3 million associates worldwide, a presence in thousands of N TU R communities and an extensive supplier base, we believe we can use our business to accelerate O P P progress toward a more just and inclusive society in ways that also strengthen our company O and better serve our stakeholders. Y T I IL B A FOSTERING A CULTURE OF from the recruiting process to mitigate bias. We also have IN A strategic partnerships with two Historically Black Colleges and ST INCLUSION THROUGHOUT U Universities focused on strengthening pathways to careers at S WALMART Walmart and support early career candidates across a broad Y We seek a workplace culture where associates at all levels portfolio of schools, the majority of which are minority-serving IT are—and feel—included. We have set governance structures, institutions. In FY2022, 56% of new hires in the United States N U incentives and reporting practices to guide this culture and were people of color and 51% were women.24 M OM drive accountability. Through training and resources, we strive C to develop our associates to be inclusive leaders and seek to Walmart invests in associate development as a key strategy enhance belonging by listening to our associates and facilitating to create a more diverse, inclusive team at every level of our Y company. For example, we offer focused development programs, T engagement in associate groups. I R such as Gateways, a two-year professional development program G E that aims to accelerate a pipeline of diverse leadership talent NT HIRING AND DEVELOPMENT I and enable business growth. We also believe our Live Better U & S Our approach to hiring focuses on enhancing diversity and C program can help address disparities in access to education and I TH inclusion throughout the talent pipeline. For example, we guide drive increased talent attraction, while creating upward mobility E hiring managers and recruiters to interview diverse candidate for associates and scaling our internal talent pipelines. Fifty slates, assemble diverse interview panels and remove photos percent of active LBU students identify as people of color. 20

N PAY EQUITY Representation at Walmart—FY2022 U.S.25 O TI C Our strategy to grow diverse talent pipelines includes rewarding U D our associates equitably. Our latest pay analysis in Canada and the O NTR United States confirms that—taking into account relevant factors I such as position, tenure and location—Walmart pays associates 40% 46% Y equitably regardless of race, ethnicity or gender. We conduct People of U.S. total management U.S. hourly-to-hourly T I analyses of pay and compensation practices in consultation with Color 24 N promotions promotions TU expert third-party firms following industry-leading standards. 49% R O Through pay and policy adjustments, we correct for unintended U.S. associates P P pay differences and where appropriate adjust for market O competitiveness as part of our annual and ongoing reviews. We Y continue to review our processes and analyses beyond the U.S. 39% 27% T I and Canada so that we can consistently review and report on our U.S. management U.S. officers IL B A equitable pay and practices globally. IN A ST U S ADVANCING EQUITY IN SOCIETY We aim to advance diversity, equity and inclusion in society, Y helping to tackle drivers of systemic disparities through IT 45% 54% N complementary business initiatives and philanthropic U Women U.S. total management U.S. hourly-to-hourly M investments. We are focusing our efforts on the U.S. criminal promotions promotions OM justice, education, finance and health systems. Our Shared C 53% Value Networks (SVNs) are teams of associates who identify the U.S. associates Y natural overlaps between Walmart’s business capabilities and T I R opportunities to advance racial equity within our four systems G E of focus. To extend the impact of the SVNs, Walmart and the NT 44% 34% I Walmart Foundation committed $100 million over five years to & U.S. management U.S. officers S create the Walmart.org Center for Racial Equity. The Center C I TH has invested $35 million as of January 2022 to address racial E inequities in these four systems. 21

Walmart’s Shared Value Networks and the Walmart.org Center for Racial Equity pursue initiatives aimed at advancing racial equity in four societal systems. Examples include: N O TI C U System Business (Shared Value Networks) Philanthropy (Center for Racial Equity) D O NTR Criminal Second Chance Hiring: Partnering with The Last Mile to Unlock Potential: Supporting a hiring program led by the I Justice provide technical training for incarcerated individuals, Responsible Business Initiative for Justice and Persevere, Y followed by wraparound services and job placement at through which a network of community organizations and T I Walmart once released from incarceration. employers provide jobs and wraparound services for youth N TU with incarcerated parents, foster youth, youth involved R O in the justice system and young people impacted by P P O human trafficking. Y Education Chicago Community Academy: Hosting classes for 1890 Universities Foundation: Helping students build T I community members in the Chatham neighborhood careers in fields such as agriculture, healthcare and IL B A on topics such as entrepreneurship, resume writing, technology by supporting technical assistance and IN A interviewing and personal finance, while providing our innovation across 19 1890 land-grant universities, including Accessibility Center ST U associates an opportunity to grow and develop the skills the launch of the Center of Excellence for Nutrition, S they need to build careers at Walmart and beyond. Health, Wellness and Quality of Life. of Excellence Y IT Finance Financial Literacy: Partnering with Operation Hope to Women’s Business Enterprise National Council (WBENC): N U launch a national initiative aiming to embed financial literacy Supporting WBENC’s Women of Color Outreach and M In FY2022, Walmart announced the formation of the OM into American culture and reach millions of youth and Development Programs, which provide education, C working adults to enable greater financial success. resources and access to peer and mentor networks for Accessibility Center of Excellence (ACE). The ACE businesses owned by women of color to overcome barriers develops and implements strategies aimed at making Y Walmart the most inclusive retailer and employer for T to their growth. I R people with disabilities. The mission of the ACE is to G E define, design and deliver accessible experiences at scale NT Health Healthier food and habits: Working with community American Heart Association Bernard J. Tyson Fund: I by adopting a culture of awareness and action around & organizations to design, test and evaluate Walmart food Supporting the Fund’s work with community-based S C accessibility, building the necessary infrastructure, I and nutrition offerings to improve access to healthier organizations and entrepreneurs in Atlanta and Chicago TH creating leadership champions and onboarding teams to E food options for Black and African American communities working to increase access to affordable and healthy food experiencing food insecurity. in communities of color. drive accessibility at scale. 22 Read more: Equity & inclusion at Walmart & beyond {

N Supplier opportunity O TI C U D Through sourcing, Walmart aims not only to delight our customers but also to provide O opportunities for economic growth and development for the people who work throughout NTR I our supply chains, including our suppliers, the people they employ and their communities. Y T As part of our local and global sourcing programs, we pursue several initiatives focused on I N TU building a more inclusive, diverse supplier base and contributing to local economies. Our R O P efforts include: P O Y America at Work: In FY2013, we committed to invest an Make in India: Walmart’s Vriddhi Supplier Development T I incremental $250 billion over ten years in products that support Program aims to prepare 50,000 of India’s micro-, small- and IL B the creation of American jobs. As of the end of FY2022, we medium-sized suppliers to participate in global supply chains. A IN have sourced an incremental $196 billion. In March 2021, we Additionally, we announced an ambition to triple our exports A ST announced a new ten-year commitment to invest an incremental from India to $10 billion each year by 2027. U S $350 billion in products made, grown or assembled in the United States. The additional $350 billion commitment has the potential Supplier inclusion: Walmart uses its sourcing strategies to foster Y equity and inclusion of underrepresented and disadvantaged IT to support an estimated 750,000 new jobs.27 As of the end of N >$13.3 billion groups while enhancing our product offering. In FY2022, U FY2022 we have increased U.S. purchases by $12 billion toward M in goods and services Walmart’s U.S. businesses spent over $13.3 billion in goods and OM this new goal. services sourced from approximately 2,600 diverse suppliers. C sourced from diverse 26 American Lighthouses: In 2021 we introduced American In 2021, we partnered with C2FO to expand our early payment suppliers for Walmart’s Lighthouses, aimed at identifying and overcoming barriers program to help diverse suppliers28 increase their cash flow by Y U.S. businesses T I to U.S. manufacturing by fostering collaboration among accelerating their receipt of invoice payments from Walmart; R G E manufacturers, NGOs, academia, government and local this gives these suppliers the ability to receive paid invoices NT I economic development groups. We are beginning by focusing within 48 hours of submission. & S on two supply chains—textiles and pharma/medical—and C I Read more: Supplier opportunity TH $196 billion plan to expand the program to plastics, food processing and { E incremental purchases motors/metals. Read more: People in supply chains in products supporting { 23 American jobs since 2013

Committed to help protect, N more sustainably manage or O restore TI C U D O 50M 1M NTR I Sustainability acres sq miles Y of land of ocean T I N by 2030 TU R Walmart seeks to transform our business and product O P P supply chains to be regenerative. In the following pages, O we describe our approach to addressing issues and Y T I opportunities related to climate change, nature, waste IL B A and people working in product supply chains. IN A ST U S Y IT N U M Issue briefs OM C Product supply chain sustainability { Y T I Climate change R { G E NT Regeneration of natural resources: Forests, land, oceans I { & S C I Waste: Circular economy TH { E People in supply chains { 24

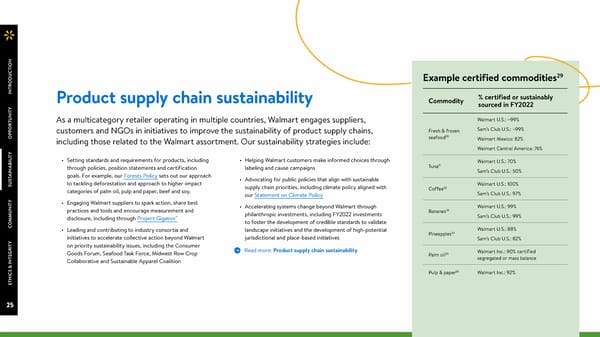

N O TI C U 29 D Example certified commodities O NTR I % certified or sustainably Product supply chain sustainability Commodity sourced in FY2022 Y T I N As a multicategory retailer operating in multiple countries, Walmart engages suppliers, Walmart U.S.: ~99% TU R O Fresh & frozen Sam’s Club U.S.: ~99% P customers and NGOs in initiatives to improve the sustainability of product supply chains, P 30 O including those related to the Walmart assortment. Our sustainability strategies include: seafood Walmart Mexico: 82% Y Walmart Central America: 76% T I • Setting standards and requirements for products, including • Helping Walmart customers make informed choices through IL Walmart U.S.: 70% B Tuna31 A through policies, position statements and certification labeling and cause campaigns IN Sam’s Club U.S.: 50% A goals. For example, our Forests Policy sets out our approach ST • Advocating for public policies that align with sustainable U to tackling deforestation and approach to higher-impact Walmart U.S.: 100% S supply chain priorities, including climate policy aligned with Coffee32 categories of palm oil, pulp and paper, beef and soy. our Statement on Climate Policy Sam’s Club U.S.: 97% Y • Engaging Walmart suppliers to spark action, share best IT • Accelerating systems change beyond Walmart through Walmart U.S.: 99% N practices and tools and encourage measurement and Bananas33 U philanthropic investments, including FY2022 investments M disclosure, including through Project Gigaton™ Sam’s Club U.S.: 99% OM to foster the development of credible standards to validate C • Leading and contributing to industry consortia and landscape initiatives and the development of high-potential Walmart U.S.: 88% Pineapples34 Y initiatives to accelerate collective action beyond Walmart jurisdictional and place-based initiatives Sam’s Club U.S.: 82% T on priority sustainability issues, including the Consumer I R Read more: Product supply chain sustainability G Goods Forum, Seafood Task Force, Midwest Row Crop { 35 Walmart Inc.: 90% certified E Palm oil segregated or mass balance NT Collaborative and Sustainable Apparel Coalition I & S 36 C Pulp & paper Walmart Inc.: 92% I TH E 25

* Product supply chain sustainability: Improvement priorities and strategies by product category Consumables Food Apparel and home Entertainment and hardlines t GHG emissions, packaging & product waste, deforestation & conversion, forced labor & worker safety en s N e Sustainable chemistry Biodiversity Biodiversity O ti em i TI v r Soil health, water management & chemical management Soil health, water management & chemical management C o io U r r Overfishing & IUU fishing D p P O m Animal welfare I Food Waste NTR I TM Climate Engage suppliers on energy, nature, waste, packaging, transportation, product use & design through Project Gigaton Provide suppliers with tools & resources Y Lead consortia and advocate for public policy aligned with Paris Climate Agreement T I N TU Waste Transition private brand packaging for recyclability & post-consumer content R TM and provide playbooks & tools O Engage suppliers through Project Gigaton P Lead consortia and advocate for public policy to promote circularity P O Engage customers on recycling and circularity Support philanthropic efforts in recycling infrastructure, materials innovation & design, consumer behavior Y Engage suppliers and lead consortia on food waste Increase recycled fiber in products Trade-in & refurbishment program T I Support philanthropic efforts in food waste prevention & recovery Promote reuse & upcycling IL B A IN s Nature Set sourcing policies and position statements, including certification requirements A e TM ST v Engage suppliers through Project Gigaton , joint sustainability planning, collective action and access to tools & resources i U t Advocate for public policy to advance nature-related goals S a i t Support conservation and restoration and investments in traceability/transparency tools through philanthropy Ini Y d Source RSPO-certified palm oil Host sustainable commodity summits: beef, row crops, tuna Source more sustainable cotton & cellulosic fibers Source certified deforestation-free pulp & paper IT an Encourage place-based sourcing projects Source from suppliers using Higg FEM Walmart U.S. Pollinator Health Position N s U e Address animal welfare with suppliers M gi Walmart U.S. Pollinator Health Position e OM t a C r t Respect for Promote responsible sourcing through standards, engagement, training, & monitoring S Collaborate with suppliers & NGOs to promote responsible recruitment principles & reporting human rights Y Lead consortia to promote responsible recruitment, worker safety, & enhanced ethical standards T Philanthropically support demand for responsible labor, enhancement of certifications, improved transparency, & place-based initiatives I R G E Promote supplier endorsement of Ethical Charter Leverage Nirapon & LABS to improve factory safety Promote alignment with RBA Code of Conduct NT Engage produce & seafood suppliers to set goals & report on responsible Engage ICT suppliers to set goals & report on I & recruitment responsible recruitment S C I TH Inclusive Support U.S. manufacturing through incremental spend E economic Promote supplier diversity through sourcing and financing opportunity Enhance supplier capacity and market access through sourcing & philanthropy 26 Safer, healthier Reduce priority chemicals in formulated consumables Enhance food safety through standards, audits, training, blockchain Enhance product safety through standards, testing, training and collaboration products Enhance product safety through standards, testing, training and Promote nutrition and choice through reformulation, labeling, education, collaboration expanded assortment * Table is intended as a guide to understand Walmart’s product supply chain sustainability strategies. See the relevant issue briefs for full descriptions of goals and metrics.

Climate change N O TI Walmart aims to galvanize collective climate action across the retail and consumer C U D goods sector through our operational emissions reduction initiatives, supplier O NTR engagement, innovation in product supply chain practices, advocacy and I Y philanthropy, while taking steps to strengthen the resilience of our business against T I the effects of climate change. N TU R O P P and adaptation strategies. Climate risk is also incorporated O GOVERNANCE The Walmart corporate sustainability team leads the into the company’s Enterprise Risk Management process. Y development of the company’s climate strategy, working Walmart’s executive leadership team reviews Walmart’s T I climate strategy at least annually. The Nominating and IL with a team including finance, real estate, operations, B A merchandising, strategy and public policy. Walmart Governance Committee of the Walmart Board of Directors IN A periodically conducts a scenario-based climate risk oversees that strategy. ST U S assessment, which informs Walmart’s climate mitigation Y IT Annual GHG emissions37 Carbon intensity38 N U M 20 6.08 $600,000 OM 6.71 6.67 40 41.29 40.04 C 6.15 6.85 37.89 $559,151 O₂e15 7.24 34.42 32.86 $550,000 Y T) C 13.83 30 29.38 T $514,405 I 12.74 12.29 R 11.37 $523,964 G 10 $482,130 $500,000 E tons (MM 10.37 20 $500,343 NT 9.19 I $485,873 & S 5 $450,000 C 10 I TH Million metric E 0 $400,000 0 CY2015 CY2016 CY2017 CY2018 CY2019 CY2020 FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 27 Scope 1 Scope 2 Carbon intensity Total annual revenue [$M] (Scope 1 and 2 MT CO e / $M revenue)

TM 40 MITIGATION Project Gigaton – Key Highlights N Walmart has committed to science-based targets (SBTs) for O • Part of Walmart’s approved science-based target and TI emissions reduction—including achieving a 35% reduction in C U absolute scopes 1 & 2 emissions by 2025 and a 65% reduction aligned with the 2° warming scenario D >2,500 O by 2030 (vs. 2015 base year)—on the way to achieving zero NTR • Achieving the target would be equivalent to at least a 30% suppliers reporting I emissions in our operations by 2040. We are also committed reduction of the estimated scope 3 footprint Walmart in 2021 to engaging suppliers through Project Gigaton™, an ambitious used as the basis for the initiative Y effort to reduce or avoid one billion metric tons (a gigaton) of T I • Target and accounting methodology developed in N GHG emissions in the global value chain by 2030. TU partnership with experts including CDP, Environmental R O We achieved a 17.5% reduction in combined scopes 1 and Defense Fund (EDF) and the World Wildlife Fund (WWF) P P 2 emissions between our 2015 calendar year baseline and O • Intended to get immediate traction with suppliers on Reporting from 39 2020. While scope 2 emissions in 2020 declined by 11% over actions to reduce and avoid emissions, with 2030 serving suppliers representing Y 2019, 2020 scope 1 emissions increased by approximately 6% T I due primarily to increases in onsite refrigerant and transport as an interim milestone toward the Paris Agreement’s IL B 2050 date >70% A fuel emissions. To continue our progress, we are focused on IN of U.S. product A renewable energy procurement, energy efficiency, refrigeration, • Serves as a platform to engage and encourage our ST net sales U transportation and stationary fuels. suppliers to take action in arenas key to net-zero supply S chains: energy, nature, waste, packaging, transportation Y and product use & design IT N • Annual opportunity for suppliers to report on specific U M actions taken that are translated via calculators into OM C metric tons of CO e. Calculators created in collaboration 2 with WWF and EDF >574 MMT Y T cumulative emissions I • Suppliers determine the scope of their efforts to report— R G e.g., total company actions or Walmart’s proportional reduced or avoided E NT share. Select supplier submissions reviewed by WWF and (2017 through 2021) I & EDF as part of the data review S C I TH E 28

N O TI ADAPTATION C U D Our climate strategy includes adapting our operations to O NTR enhance resilience in the face of climate risk. Strategies include I preparing our facilities and associates for weather-related Y disasters, taking steps to enhance surety of supply in the face T of near-term disasters and disruptions and longer-term climate I N change and accounting for transition risk in business planning. TU R O P P ADVOCACY O Walmart has a Board-adopted climate policy and advocates for Y 1.5° Celsius-aligned, science-based national and international T I IL climate policies that are consistent with achieving net-zero B A emissions by 2050 and fairly and equitably addressing the IN A needs of all stakeholders. Walmart’s advocacy activities in ST U S FY2022 included: Y • Direct engagement of lawmakers, including to support the IT Infrastructure Investment and Jobs Act and the climate N U provisions of Build Back Better. M OM • Engaging the public to make the case for climate action, C including through blogs, op-eds, articles and forums. Y • Working with trade associations and consortia to share our T I R point of view on climate action and influence their positions G E and actions. NT I & S • Supporting other coalitions and initiatives advocating for C I an enabling policy environment, including co-leading the TH E Retail Race to Zero campaign and representing the coalition at COP26. 29

Waste: Circular N O economy TI C U D O We aim to break the link between NTR I consumption and waste as part of a Y movement toward a more circular T I N economy, aspiring to achieve zero TU R 41 O waste to landfill or incineration P P O in our operations as we work with Y suppliers, customers and communities T I IL to accelerate the adoption of circular B A IN packaging and products. A ST U S Achieving zero operational waste in Canada, Mexico and the Highlights Y United States by 2025: We diverted 78% of waste42 globally IT in 2021. Our efforts include addressing secondary packaging, N U unsold food and general merchandise, automotive waste M OM and unused assets. We are recycling corrugated cardboard, Percentage of waste42 diverted from C utilizing reusable packaging containers, recycling rigid plastics landfill and incineration: >7% 58% 827 million and plastic film, refurbishing fixtures, improving sell-through • Global: 78% • Mexico: 72% Global private- Global private operational food Y brand packaging waste diverted T • United States: 81% • Goal: 90% by 2025 I of food, donating food to food banks and other charities brand plastic R • Canada: 89% G and converting food that is no longer edible to animal feed, packaging made estimated to be from waste stream E recyclable, reusable through composting, NT compost or energy. I from post-consumer Percentage of sales with & 44 or industrially animal feed, S Reducing food waste in the value chain: We have set a 50% How2Recycle label: recycled content. C 45 I Goal: 17% by 2025 compostable. anaerobic digestion TH food waste reduction goal (by 2030 vs. a 2016 baseline); as • Walmart U.S.: 80% E Goal: 100% by 2025 and biochemical 46 of the end of 2021, we had achieved an 18% reduction. We • Sam’s Club U.S.: 84% processing. 43 engage suppliers through Project Gigaton™, the Champions • Goal: 100% by 2022 30

N O TI C 12.3 10x20x30 initiative and the Consumer Goods Forum’s Date Addressing plastic bags: Walmart is undertaking multiple efforts U D Labeling Call to Action and Food Waste Coalition of Action. to reduce single-use plastic bag material, which we estimate O NTR accounts for approximately 15% of our global plastic packaging I Optimizing packaging and using labeling to help customers footprint. We have eliminated single-use plastic bags in Canada reduce, reuse and recycle: We joined the U.S. and Canada and parts of Mexico, as well as several states (Connecticut, Y Plastics Pact as part of the Ellen MacArthur Foundation’s T I Maine, New York and Vermont). Since 2020, we have been a N initiative to create a circular economy for plastics. In 2021, 58% partner in Closed Loop Partners’ Beyond the Bag effort, which TU of our private brand packaging was recyclable, reusable or R aims to identify scalable alternatives to single-use plastic bags. O P industrially compostable, up from 54% the prior year, toward P In 2021, the consortium welcomed winners of the Beyond O our goal of 100% by 2030.47 In 2021, 7% of our private brand packaging was made of post-consumer recycled content, the Bag Challenge into a six-month accelerator that pilots Y 48 innovative solutions. T down from 11% the year prior, while our virgin plastic volume I IL increased by 3%, a headwind against a new goal we announced Engaging customers: We set a goal to have the How2Recycle B A to reduce our private brand packaging 15% by 2025 (vs. a label on 100% of Walmart U.S. private-brand food and IN A 2020 baseline). The decreased post-consumer recycled content consumable products by 2022. As of our 2021 reporting cycle, ST U S and the increase in virgin plastic are largely attributable to 80% and 84% of Walmart U.S. and Sam’s Club U.S., private-brand global shortages of post-consumer recycled content, which food/consumables supplier-reported sales respectively came Y reduced availability and increased prices substantially. We are from items carrying the How2Recycle label.49 We also offer IT N focused on helping our suppliers secure additional supplies our customers the opportunity to recycle, taking in >1.9 million U M of post-consumer recycled content and taking other steps, pounds of recyclable materials—including plastic bags and film— OM including overall packaging reductions, to get back on track. from customers in 2021. Additionally, we offer ecoATM kiosks C In collaboration with the Association of Plastic Recyclers, to make it simple and convenient for consumers to sell back Y we developed the Walmart Recycling Playbook, hosted a used smart devices; in FY2022, we collected 3.4 million devices T I 2021 Sustainable Packaging Innovation Summit and supported for reuse and recycling through ecoATM machines. Through R G E the development of Plastic IQ, a scenario-modeling tool, used philanthropy, we support programs to expand the availability and NT I by over 170 companies that represent approximately 20% of all understanding of how to recycle in the U.S. & S plastic packaging generated in the U.S. C I Read more: Waste: Circular economy TH { E 31

N O TI C Regeneration of natural resources: U D O NTR Forests, land, oceans I Y T Many of the products we sell are derived from or depend on nature. We aspire to operate I N TU our business in a way that regenerates natural resources, with a goal to help to conserve, R O P restore, or more sustainably manage at least 50 million acres of land and 1 million square P O miles of ocean by 2030. Our nature initiatives focus on grasslands, forests and seascapes that >$14 million Y have high value for nature, relate to our product sourcing footprint and afford opportunities invested by Walmart and T I IL the Walmart Foundation B for Walmart, our suppliers, or NGO collaborators to influence change. A to help preserve IN A irreplaceable landscapes ST U S SETTING PRIORITIES We encourage our suppliers to source certain commodities— in FY2021 & FY2022 Y In 2020, we identified critical landscapes and seascapes that including palm oil and seafood—in accordance with certifications IT have high value for nature, relate to our product sourcing that support our nature-related goals. N U footprint and afford opportunities for Walmart, our suppliers, We encourage suppliers to pursue nature initiatives and report M OM or NGO collaborators to influence change. Those areas are on their progress, including through Project Gigaton™’s Nature C grasslands, forests and oceans. pillar. As of the end of FY2022, more than 550 suppliers were Y reporting progress through the Nature pillar (for example, our T I SUSTAINABLE SOURCING fresh beef suppliers report implementing sustainable grazing R G management practices on over half a million acres). E As a retailer, we believe product sourcing can play a major role NT I in achieving our nature goals. We set sourcing specifications We also support supplier efforts to source more sustainably & S and aspirations through policies and position statements (for by providing resources and knowledge-sharing opportunities. C I TH example, Forests Policy, Seafood Policy, Sustainable Row Crop Our Sustainability Hub houses guidance and playbooks and E Position Statement and Walmart U.S. Pollinator Health Position). connects suppliers to place-based projects. Since 2020 we have 32

N O TI C U ~99% D O Walmart U.S. and NTR I Sam’s Club U.S. fresh and frozen, wild-caught also hosted summits on key topics like tuna, beef and row crops INVESTING IN PLACE‑BASED Y where Walmart merchants, suppliers and stakeholders discuss T and farmed, seafood INITIATIVES I strategies, aspirations, achievements and challenges. N 30 TU sustainably sourced We support the development of place-based and jurisdictional R Read more: Product supply chain sustainability O { initiatives, which aim to create shared value for producers, P P O ~90% suppliers and communities across a landscape or seascape palm oil in private through activities that restore and rebuild the natural resources Y SUPPORTING CONSERVATION that communities depend on and that produce the goods we T I brand products IL AND RESTORATION sell. For example, in FY2022, we partnered with the Nature B A RSPO-certified Conservancy and the government of the Republic of the IN 35 We support conservation and restoration initiatives, primarily A sustainable Marshall Islands (RMI) to more sustainably source tuna for our ST through philanthropy. For example, over the past 17 years, the U private brand and support communities throughout RMI. S Walmart Acres for America program (in partnership with the National Fish and Wildlife Foundation) has helped protect more Y than 1.8 million acres across 41 states, the District of Columbia ADVOCATING FOR AND IT N and Puerto Rico—an area larger than Everglades National Park. U INVESTING IN ENABLERS M And in November 2021, Walmart.org joined the LEAF Coalition, OM We leverage our voice, convening power and strategic C a new public-private initiative designed to accelerate climate philanthropy to advocate for an enabling environment that action by providing results-based finance to national and sub- supports our nature objectives. Examples in FY2022 include Y national jurisdictions committed to protecting and restoring T submitting a letter of support to the U.S. Senate regarding the I R their tropical forests. G passage of the Growing Climate Solutions Act, engaging with E NT Business for Nature and supporting the development of new I & collaborative technologies. S C I TH Read more: Regeneration of natural resources: E { Forests, land, oceans 33

N People in supply chains O TI C U D We aim to source responsibly while acting as a catalyst to improve the well-being of people O >$67 million NTR working in consumer product supply chains. We pursue these goals through our responsible I Walmart Foundation grants to support sourcing programs, creating economic opportunity for people in supply chains and by Y smallholder farmers T I collaborating to address systemic risks to workers. N (since 2017) TU R O P P RESPONSIBLE SOURCING South Africa, Walmart teams work to develop small producers O Our Responsible Sourcing program sets expectations for as suppliers and to help them reach Walmart’s customers. In the Y product suppliers in alignment with our Human Rights U.S., our annual Open Call event allows hundreds of small- and T I medium-sized business owners from across the country to pitch IL Statement, monitors supplier performance against those B products made, grown or assembled in the U.S. to our Walmart A expectations and works through our business to continuously IN U.S. and Sam’s Club U.S. merchants. A improve our product supply chains. In FY2022, we assessed ST U S approximately 14,000 third-party audits of facilities producing Additionally, the Walmart Foundation helps promote market products for Walmart and managed more than 700 cases access for small producers. Since 2017, the Foundation has Y involving allegations of supply chain misconduct. In 2021, we awarded grants of more than $67 million that are expected IT N revised and reissued our Standards for Suppliers and issued new to benefit more than 730,000 smallholders (44% of whom U M Responsible Sourcing and Forced Labor Prevention policies. are women) in Central America, India and Mexico. The grants OM provide access to training and capacity development along C CREATING ECONOMIC OPPORTUNITY FOR PEOPLE IN with market linkages for smallholders in Farmer Producer Y Organizations (FPOs). As part of these efforts, the Walmart T I Foundation committed $25 million over five years to strengthen R SUPPLY CHAINS G E smallholders in FPOs in India. The Foundation has met this NT Growing, making and transporting products can significantly I commitment through grants totaling more than $29 million, & benefit local economies and provide economic opportunity for S providing support for over 590,000 smallholder farmers, 48% of C I people who work in product supply chains. whom are women. TH E For example, 92% of merchandise sold in Mexico is sourced in the country while 83% of merchandise sold in Central America is 34 sourced from the region. In these markets as well as in India and

N O TI C U D COLLABORATING TO ADDRESS FORCED LABOR WORKER SAFETY O NTR SYSTEMIC RISKS TO WORKER Walmart has prioritized working with stakeholders to combat Building on our experiences as a founding member of the I WELL‑BEING forced labor and other exploitative practices in global supply Alliance for Bangladesh Worker Safety, Walmart is a founding Y Systemic issues such as forced labor, unsafe working conditions chains, including helping to make responsible recruitment the member of the Life and Building Safety initiative (LABS), an T I standard business practice for employers throughout global initiative of European and American brands to set international N and gender inequity require collective action to bring about TU supply chains. best practices for factory safety in the apparel and footwear R significant, positive and lasting protection of worker well-being. O industries. LABS works with engineering companies to develop P Walmart and the Walmart Foundation collaborate with suppliers, P To advance responsible recruitment across our supply chain, O NGOs, experts and others to address root causes of these we launched a Supplier Responsible Recruitment initiative country-specific factory safety standards and commissions issues, foster solutions and accelerate adoption at scale. We have at the March 2022 Walmart Supplier Growth Forum. The fire, electrical and structural audits of factories. Factories Y develop supervised corrective action plans to remediate T committed to working with others to address risks to the dignity I initiative invites suppliers (starting with seafood and produce) IL problems and are assessed on their implementation of those B of workers in a minimum of 10 retail supply chains by 2025, to adopt and report on practices related to recruiting, worker A plans. LABS has been active in India and Vietnam since 2019, IN focusing on the following supply chains to date: empowerment and transparency that are believed by experts to A covering over 572,000 workers. The program expanded to ST facilitate responsible recruitment. U • Apparel in Bangladesh Cambodia in May 2022 and is expected to cover approximately S • Produce in Mexico and the U.S. We also promote the adoption of best practices in certain 206,000 additional workers. Y category supply chains. For example, as of the end of FY2022, Read more: People in supply chains IT • Shrimp in Thailand 69% of Walmart U.S. fresh produce and floral net sales came { N U from suppliers who have endorsed the Ethical Charter on M • Tuna in Thailand Read more: Human rights OM Responsible Labor Practices (we aim for 100% by the end of { C • Electronics sourced for the U.S. retail market calendar 2022). In FY2022, 87% of Walmart U.S. information, Read more: Supplier opportunity { Y communication and technology net sales were from suppliers T I who implemented the Responsible Business Alliance (RBA) R G Code of Conduct. E NT I To accelerate system-wide change, the Walmart Foundation & S C has awarded over $45 million in grants since FY2016 to help I TH strengthen worker dignity by promoting the responsible E recruitment of workers and fair and responsible labor practices in global supply chains. 35

N O TI C U D O NTR I Y T I N TU R >356K O P P hours volunteered for O Community local causes by… Y T I As an omni-channel retailer with stores in IL B >18K A thousands of communities around the world, IN U.S. associates through A ST we seek to help those communities thrive and the Volunteerism Always U S become more resilient. Pays program Y IT N U M OM C Y Issue briefs T I R G E Serving communities NT { I & S C Safer, healthier food & other products I { TH E Disaster preparedness & response { 36

N O TI C U Serving communities D O NTR I We create value for the communities we operate in by Y providing access to affordable products and services and by T I N contributing to economic vitality and community resilience. TU R O P P O ACCESS TO AFFORDABLE PRODUCTS AND SERVICES Y Approximately 90% of American households live within 10 miles of Walmart stores and T I clubs and our eCommerce capabilities allow us to reach many more. With our omni-channel IL B model, we provide affordable access to essential products and services, including pharmacy, A IN health and wellness and financial services. A ST U S Y IT N OUR COVID‑19 RESPONSE IN FY2022 U M OM Testing: Walmart worked closely with federal and state governments, labs and insurance C companies to expand COVID-19 testing, including standing up free community testing sites and Y testing at drive-up pharmacy windows. As of January 2022, we supported more than 800 testing T sites across the country and have tested hundreds of thousands of people. I R G E Vaccinations: Walmart has administered millions of vaccines across the United States, with 80% NT I being delivered in medically underserved communities as classified by the Health Resources and & S Services Administration. A report by the Network Contagion Research Institute concluded that C I TH Walmart outperformed the aggregate as a vaccine distribution network and was able to reach E key areas of vaccine-reluctant populations. We have offered vaccinations in all Walmart and Sam’s Club pharmacies, with more than 5,100 retail locations across the United States. 37

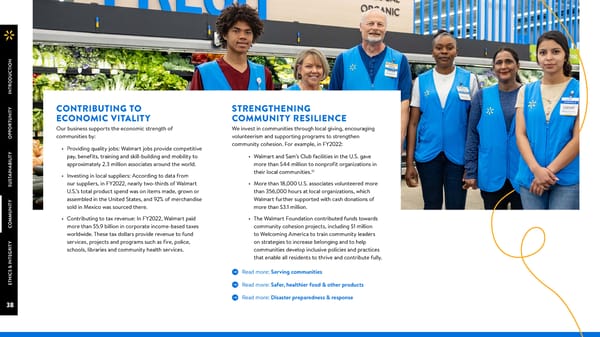

N O TI C U D O NTR I Y CONTRIBUTING TO STRENGTHENING T I N ECONOMIC VITALITY COMMUNITY RESILIENCE TU R O Our business supports the economic strength of We invest in communities through local giving, encouraging P P communities by: volunteerism and supporting programs to strengthen O • Providing quality jobs: Walmart jobs provide competitive community cohesion. For example, in FY2022: Y T pay, benefits, training and skill-building and mobility to • Walmart and Sam’s Club facilities in the U.S. gave I IL B approximately 2.3 million associates around the world. more than $44 million to nonprofit organizations in A IN their local communities.51 A • Investing in local suppliers: According to data from ST U our suppliers, in FY2022, nearly two-thirds of Walmart • More than 18,000 U.S. associates volunteered more S U.S.’s total product spend was on items made, grown or than 356,000 hours at local organizations, which Y assembled in the United States, and 92% of merchandise Walmart further supported with cash donations of IT sold in Mexico was sourced there. more than $3.1 million. N U M • Contributing to tax revenue: In FY2022, Walmart paid • The Walmart Foundation contributed funds towards OM C more than $5.9 billion in corporate income-based taxes community cohesion projects, including $1 million worldwide. These tax dollars provide revenue to fund to Welcoming America to train community leaders Y services, projects and programs such as fire, police, on strategies to increase belonging and to help T I R schools, libraries and community health services. communities develop inclusive policies and practices G E that enable all residents to thrive and contribute fully. NT I & S Read more: Serving communities C { I TH E Read more: Safer, healthier food & other products { Read more: Disaster preparedness & response { 38