KPMG Global Economic Outlook - H2 2022 report

Global Economic Outlook September 2022 home.kpmg/globaleconomicoutlook

Global Economic Outlook – September 2022 Introduction 2022 has arguably been one of the most challenging years the world has experienced in modern times. It’s hard to downplay the scale of the geopolitical and economic uncertainty facing every one of us – from individual households to governments and business leaders. We entered the year with a degree of Combined with the devastating war cautious optimism as Covid restrictions in Ukraine, C-suites are grappling with were gradually eased, but what shortages in everything from oil and followed was a series of challenges that gas to wheat and microchips. This have tested the resilience of even the has had a significant impact on both most robust, sustainable companies. inflation and recessionary fears. Economic modelling and forecasting In my previous role with KPMG, I led is a notoriously challenging task, the global organization’s Energy & especially in a time of great uncertainty, Natural Resources practice – supporting but taking a step back and looking member firm clients in an industry at the bigger picture is essential. that has become used to experiencing KPMG’s Global Economic Outlook profound highs and lows. I now work brings together teams of experts from with CEOs across all sectors as Global across the world. Our aim? To dig Head of Clients & Markets and much deeper into past trends, challenges of what I witnessed in the energy and opportunities and explore how we world is applicable today across all believe the actions that are taken today businesses. KPMG’s Global Economic may impact on economic output over Outlook is not an exact science, but the coming weeks, months and years. in a time of great unease, I believe it is an invaluable asset, helping to The international outlook is patchy. map out some of the challenges Some countries, regions and territories and opportunities ahead and enable achieved a strong post-pandemic corporate leaders to plan for the future rebound, for others – chronic political and prepare for an eventual return to and economic challenges dampened sustainable, long-term growth. hopes of regaining lost ground. It’s a similar story across all areas of analysis – with different outlooks and Regina Mayor outcomes in different areas. That said, Global Head of Clients & Markets there are several universally consistent KPMG themes and stories. The rapid return to economic activity after Covid created supply chain challenges which appear to be easing slightly but continue to drag down growth projections. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 2

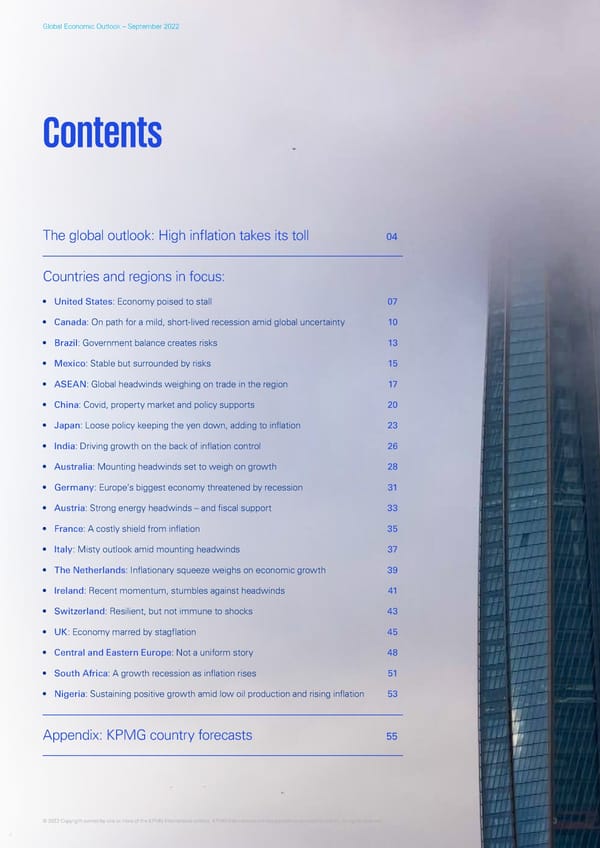

Global Economic Outlook – September 2022 Contents The global outlook: High inflation takes its toll 04 Countries and regions in focus: • United States: Economy poised to stall 07 • Canada: On path for a mild, short-lived recession amid global uncertainty 10 • Brazil: Government balance creates risks 13 • Mexico: Stable but surrounded by risks 15 • ASEAN: Global headwinds weighing on trade in the region 17 • China: Covid, property market and policy supports 20 • Japan: Loose policy keeping the yen down, adding to inflation 23 • India: Driving growth on the back of inflation control 26 • Australia: Mounting headwinds set to weigh on growth 28 • Germany: Europe’s biggest economy threatened by recession 31 • Austria: Strong energy headwinds – and fiscal support 33 • France: A costly shield from inflation 35 • Italy: Misty outlook amid mounting headwinds 37 • The Netherlands: Inflationary squeeze weighs on economic growth 39 • Ireland: Recent momentum, stumbles against headwinds 41 • Switzerland: Resilient, but not immune to shocks 43 • UK: Economy marred by stagflation 45 • Central and Eastern Europe: Not a uniform story 48 • South Africa: A growth recession as inflation rises 51 • Nigeria: Sustaining positive growth amid low oil production and rising inflation 53 Appendix: KPMG country forecasts 55 © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 3

Global Economic Outlook – September 2022 The global outlook: High inflation takes its toll Clouds are once again gathering, marring the outlook Chart 1: The impact of the Covid-19 pandemic for the global economy. As inflation accelerates, putting and the speed of recovery have been uneven pressure on households’ finances and businesses’ margins, and causing central banks to tighten monetary policy 15% aggressively, recession is once again on the horizon in 10% many economies. 9 Q4 5% 1 It was not long ago that the Covid-19 pandemic brought a ve to 200 big part of the economy to a halt, and while the recovery -5% has been relatively swift once restrictions were lifted, its strength has varied across countries (Chart 1). -10% -15% With all the new challenges so far this year, it is easy to Changes in GDP relati forget that the virus has not yet disappeared. We could see -20% a rise in infections over the colder months, including more -25% disruptions to production in China due to the zero-Covid India China Australia US Italy France UK Japan Germany policy. The impact on labor supply and the health service COVID trough Latest is also likely to linger, causing a tighter labor market and additional burden on public finances in the medium term. Source: National statistics bodies, KPMG analysis. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 4

Global Economic Outlook – September 2022 Pressures on global supply chains have eased since their Although inflationary pressures were already present as peak late last year, despite the setbacks caused by the economies reopened from Covid, the invasion of Ukraine by Russia-Ukraine war. However, they remain at historically Russia added an extra strain, with a range of commodities high levels, contributing to the rise in costs experienced by exported by the region seeing their price rise significantly. many producers. While we expect the weakening in global More recently, some prices have moderated somewhat economic activity to ease the pressure on supply chains and supplies have adjusted while demand eased as the in the short term, other factors could be working in the economy slows. opposite direction. Energy prices have been at the centre of the inflationary With geopolitical tensions on the rise, more friction in surge, although oil prices have moderated lately, which supply chains could become the norm. And as labor costs contributed to a minor ease in annual inflation figures in rise in less developed economies and changes in production many countries. Nevertheless, the price of gas remains methods in some industries favor more localized presence, heavily impacted by the conflict in Ukraine, with the rush to there may also be less impetus for companies to seek secure shipments of liquefied natural gas (LNG) for winter production sites further afield, causing globalization to be causing not just European but also Asian gas prices to spike on the retreat. All this could see inflationary pressures recently (Chart 3). It is still uncertain whether sufficient gas remaining more elevated over the longer term. supply will be forthcoming over the winter months. This could prove a significant blow to the short-term outlook Scarcity of workers has contributed to supply bottlenecks, of some European economies which are more reliant on as well as to more elevated inflationary pressures. As 2 Russian supply . Covid-induced restrictions were lifted, demand for labor rose sharply. But the availability of workers fell in many countries, as some were affected by the pandemic while others chose Chart 3: Gas prices are particularly to retire early. As a result, unemployment rates fell swiftly high across most regions and have now reached pre-Covid levels or even below (Chart 2). 600 While a weakening economic environment is likely to see 500 a fall in vacancies, the labor market could remain relatively 400 1 tight over the next year . 300 Chart 2: Tight labor markets add as price (monthly average), GBp/th200 to inflationary pressures 100 16% Wholesale g 14% 0 2015 2016 2017 2018 2019 2020 2021 2022 12% UK US Europe Asia 10% Source: Refinitiv Datastream, KPMG analysis. 8% 6% Unemployment rate 4% 2% 0% Eurozone Canada Switzerland US UK Australia Mexico Japan Pre-COVID COVID peak Latest Source: OECD, KPMG analysis. 1 See KPMG’s detailed forecasts for unemployment rates in the Appendix. 2 See our European country analysis for potential implications of lower gas supply in different economies. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 5

Global Economic Outlook – September 2022 The combination of supply chain bottlenecks, generous Chart 4: Central banks are expected to government spending, tight labor markets and a remain hawkish in the short term commodity shock triggered by the Russian invasion of Ukraine, have together caused inflation to shoot well above 7% central banks’ target across many developed economies. 6% We expect inflation to moderate significantly from the 5% middle of next year, as the energy shock is no longer 4% reflected in the year-on-year inflation calculation. However, 3% we could be entering an environment that is structurally Interest rate more inflationary, as production costs – from materials to 2% energy and labor – remain elevated. 1% 0 Faced with inflation well above targets, an immediate concern for most central banks is that inflation -1% 2018 2019 2020 2021 2022 2023 expectations stay high, while their credibility in fighting inflation is lost. The need for fiscal support is likely to stoke UK US Eurozone more inflation in the medium term, placing fiscal policy Source: BIS, FRED, Refinitiv Datastream, Bank of England, ECB, KPMG analysis. actions at odds with the aims of central banks in meeting Note: Yield curves shown as of 26 September. their mandates. In the cases where investors have been led to question the sustainability of public finances, such Chart 5: Consumer confidence has fallen as the UK in late September 2022, depreciating currencies and rising borrowing costs have exposed vulnerabilities and 40 increased the risk of contagion. 30 That is why central banks are likely to be more hawkish 20 in their response to what could be a relatively short-lived 9 average 10 2-1 1 0 burst in inflation, with markets pencilling in aggressive rate rises over the coming months (Chart 4). -10 -20 Moreover, if inflationary pressures are to become -30 embedded, interest rates may stay at higher levels -40 than what we saw in the past decade even after the Deviation of index from 20 -50 current spike in inflation subsides. This would represent -60 a significant shift in monetary policy in a relatively short Jan Jul Jan Jul Jan Jul Jan Jul 2019 2019 2020 2020 2021 2021 2022 2022 space of time. UK US France Germany India Australia Japan China Rising costs are taking their toll on consumers, with a Source: GfK, The Conference Board, Cabinet Office of Japan, INSEE, Westpac-Melbourne Institute, cost-of-living crisis putting a significant dent on households’ China National Bureau of Statistics, Reserve Bank of India, KPMG analysis. purchasing power. Consumer confidence has taken a big knock across most economies (Chart 5) and spending are Chart 6: World GDP growth and inflation projections following suit, causing overall economic growth to weaken. 8% Our overall forecast for the world economy is for GDP growth to moderate to 1.9% in 2023 after growth of 2.7% 6% in 2022. Weaker growth could see inflation moderate to 4% 4.7% in 2023 after averaging 7.6% in 2022, according to KPMG forecasts (Chart 6). But as economies around hange 2% the world brace for another period of headwinds and slowdown in activity, the hope is that on this occasion the Annual % c0% downturn will be relatively mild. -2% Forecast -4% Yael Selfin 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Chief Economist, KPMG in the UK GDP Inflation Source: World Bank, KPMG projections. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 6

Global Economic Outlook – September 2022 United States: Economy poised to stall The Federal Reserve has Economic growth is expected Fiscal stimulus is expected to committed to raise rates and to slow below the economy’s remain limited as pandemic aid hold them high for longer, to potential rate of growth, wanes and infrastructure projects slowly bring inflation back to employment is expected to take time to ramp up. Midterm its 2% target. The goal is to stall and lose ground as we get elections will play a key role in prevent a more entrenched into 2023. The unemployment determining whether the White and persistent cycle of inflation rate is expected to cross 5% House can deliver more on its from taking root with a mild by year-end 2023 and 5.5% promises to curb climate change but prolonged recession. before inflation fully cools. and deal with social issues. Overall economic growth hit a wall in 2022, after surging at Table 1: KPMG forecasts for the U.S. its fastest pace since1984 in 2021. Real GDP contracted for 2021 2022 2023 the first two quarters of the year; a phenomenon usually associated with a recession. The U.S. is not in a recession, GDP 5.7 1. 5 -0.1 yet. Payroll employment surged by 2.8 million jobs in the Inflation 4.7 8.2 3.8 first six months of the year, twice the annual pace of the 2010s. Consumer spending slowed but did not collapse. Unemployment rate 5.4 3.7 4.3 That means that the losses we endured did not meet the Source: KPMG Economics, Bureau of Economic Analysis, Bureau of Labor Statistics. depth and breadth of losses typically associated with a Note: Forecasts are dated as of September 2, 2022. GDP and inflation are year-over-year % change. recession by the Business Cycle Dating Committee of the The unemployment rate is an annual average. Numbers are percentages. National Bureau of Economic Research (NBER), the official arbiter of business cycles. That begs the question: Why do most Americans believe we were in a recession? Because the surge in inflation that they experienced eroded all they had gained in wages since the economy reopened and then some. Rate hikes and the collapse in housing are expected to take a larger toll on consumer spending by the turn of the year. Home sales and construction activity have already cratered; housing prices will be the next shoe to drop. Housing is one of the single largest triggers to additional consumer spending; now, it is working in reverse. Business investment is expected to contract after playing catch-up to supply chain delays over the summer. Spending on structures and equipment will be hardest hit. Spending on intellectual property, automation and cyber security is expected to remain buoyant. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 7

Global Economic Outlook – September 2022 The pandemic aid that buoyed federal spending in 2020 Inflation slowly cools and 2021 has come to an end, while much of the spending associated with the infrastructure bill and efforts to A perfect storm of strong demand, supply chain disruptions deal with climate change will take time to ramp up. The and the war in Ukraine created the largest move up in full effects of those latter shifts will not be felt until the inflation we have seen in more than four decades. A strong mid-2020s. dollar, a drop in prices at the gas pump and some easing State and local government coffers are in better shape. Tax of supply chain disruptions have alleviated the upward revenues shot up with the surge in spending on goods and pressure on some goods prices. Used vehicle prices are homes, while transfers from the federal government to deal once again depreciating after soaring above the sticker price with the pandemic have yet to be spent. Many of those of new vehicles in 2021. windfalls were put into rainy-day funds to cushion budgets The jury is still out on how long energy prices can remain from future claims on revenues. low. Much depends upon supply constraints, which remain A portion is being used to temporarily suspend taxes on substantial, and how far the Russian government is willing energy, food and school supplies. Those shifts and a surge to go to weaponize its oil reserves. Investors pushed shale in tax rebates is helping to blunt the blow of persistently producers to curb their expansions and return more of high inflation and keep spending afloat. That makes for good their profits to the owners of capital in the shale industry, politics but bad economics; tax rebates are poorly targeted after the bath they took at the onset of the crisis. Neglect and will boost demand at the same time the Federal of energy infrastructure is another hurdle to increase Reserve is trying to curb demand and inflation. production at home and abroad – refining capacity is particularly limited. A strong dollar and weaker growth abroad suggest that A larger issue is service sector inflation, which is more the trade deficit will reverse course and widen by year- dependent upon the cost of labor. High wages, high end. A sharp slowdown in growth here is not expected to turnover rates and a persistently high level of Covid offset the drag of even deeper recessions abroad. Imports infections, which is exacerbating staffing shortages, are should continue to outpace exports and the trade deficit is boosting labor costs. Aging demographics and a surge in expected to widen in 2023. Long Covid cases are adding to labor shortages and will make those shortages more chronic as we get into the Chart 7: U.S. growth stalls below trend mid-2020s. 22 This is happening at the same time as the boost to productivity growth triggered by the pivot to working from ecession ecession CBO 2020 home is evaporating; workers are using more of the time 21 R R Projection they saved by not commuting to engage in leisure activities. rillions20 The payoff to technological advances remains concentrated T Forecast in a few large tech-savvy firms. It is not yet diffuse enough , 2021 $, 19 to raise the level of overall productivity growth and offset GDP Actual the shortfall in labor due to aging. A surge in retirements 18 by the baby boom generation and early retirements is not being offset by younger workers entering the labor force. An 17 additional two to four million workers are estimated to be Q4 Q2 Q4 Q2 Q4 Q2 Q4 Q2 Q4 Q2 Q4 suffering from Long Covid and are unable to work. 2019 2020 2020 2021 2021 2022 2022 2023 2023 2024 2024 Source: KPMG Economics, Bureau of Economic Analysis. A surge in immigration could help alleviate those pressure but doesn’t seem likely. The backlogs to immigration created by the pandemic are still substantial, while immigration reform remains on hold. Foreign students, who are dwindling in ranks, are looking for guarantees that they can continue to work in the U.S. once they relocate. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 8

Global Economic Outlook – September 2022 The largest near-term push on inflation is shelter costs. The Fed commits to a recession Changes in home values take at least a year to show up as a change in measures of home ownership costs; they were Federal Reserve Chairman Jay Powell laid to rest the fantasy still accelerating through spring 2022. Rents, where demand of a soft landing in his annual speech for the Kansas City has shifted in recent months, continue to skyrocket. Shelter Federal Reserve Bank’s Jackson Hole, Wyoming Symposium costs are particularly problematic, as they account for nearly held in August. Either the Fed runs the risk of stoking a a third of the consumer price index and are still rising. more entrenched and corrosive cycle of inflation, which Acute labor shortages, a surge in more chronic and costly requires a deep and scarring recession to derail, or it health conditions and the costs associated with treating triggers a mild but prolonged recession and smaller increase Covid patients are putting upward pressure on medical in the unemployment rate today. The latter represents the costs. Rural hospitals are the most vulnerable. Consolidation lessor of two evils. is accelerating, which will further increase costs and limit The Fed can’t grow food or pump oil. It can reduce demand access to care. to better balance with what is becoming a more chronically Last, but by no means least, inflation is inertial. Long undersupplied world; that is what it intends to do. periods of high inflation tend to distort the behaviors of households and firms. Workers demand wages be indexed to move up with measures of inflation, while firms start Diane Swonk baking price hikes into their strategies to cover elevated Chief Economist, KPMG US costs. That phenomenon stoked the stagflation of the Timothy Mahedy 1970s, a period the Fed wants to avoid, even if it means a Senior Economist, KPMG US rise in unemployment. Chart 8: U.S. unemployed persons per job opening 700 Slack labor market 600 500 t of recession400 0 = star300 0 200 Index, 1 100 Tight labor market 0 2 4 6 8 10 12 14 16 18 20 22 24 Months since start of recession 2001 recession 2008 recession 2020 recession Source: KPMG Economics, Bureau of Labor Statistics. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 9

Global Economic Outlook – September 2022 Canada: On path for a mild, short-lived recession amid global uncertainty The economic slowdown underway Inflation may have peaked but will Provincially, Ontario’s labor will likely continue in the next few remain elevated relative to target market keeps posting months, responding to tighter monetary due to tight labor markets and robust growth, Alberta policy and slowing aggregate demand. uncertainty related to commodity is benefiting from strong While the labor market remains strong, prices. Avoiding a wage-fueled demand for Canada’s and despite increased savings since inflation remains a priority for energy products, and 2020, household debt, especially for global central banks while longer- Québec and British first-time home buyers, remains a risk term inflation expectations have Columbia are facing broad to the outlook. remained stable. labor shortages. Mild, short-lived, recession Table 2: KPMG forecasts for Canada may occur in early 2023 2021 2022 2023 GDP 4.5 3.4 1. 3 Covid variants have come and gone, and Canada’s GDP has Inflation 3.4 6.8 3.4 recovered and stabilized above its pre-pandemic level. After Unemployment rate 7. 4 5.3 5.6 rebounding 4.5% in 2021, GDP growth expectations for this year and next have been revised down in recent months. Source: Statistics Canada, KPMG analysis. While another cycle from the ongoing pandemic could still Note: Average % change on previous calendar year except for the unemployment rate, disrupt Canada’s growth engine, restrictions for this coming which is the average annual rate. winter are anticipated to remain lighter than they have been in recent years. Some analysts are now forecasting a 1 The main catalyst for these downgraded expectations has short-lived recession for early 2023 . been the coordinated approach taken by global central banks to fight the current bout of inflation by slowing the demand side of the economy. In July, Canada’s overnight rate increased by 100 basis points (bps). The following hike of 75 bps on September 7th took the overnight rate to 3.25%, for a yearly tally of 300 bps so far – a pace of monetary tightening not seen since the mid-1990s following close to 15 years of accommodative monetary policy. Markets are pricing in another 50 bps hikes during the fall, as the Governing Council “judges that the policy interest rate will need to rise further”. It also stated that further changes in 2023 “will remain data-dependent”. In a rising rate environment, governments, consumers, and businesses will find their debt more expensive to roll over. Canadian residential real estate prices have already started feeling the pinch of tighter monetary policy. While higher rates will cause the economy to gradually slow, most analysts expect Canada to eke out positive growth for 2023, albeit at a rate slightly below potential. 1 See, for example: Desjardins, Economic and Financial Outlook (August 25, 2022); and RBC, Daily Economic Update (August 31, 2022). © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 10

Global Economic Outlook – September 2022 Here are some reasons to think Canada will achieve only a Uncertainties and opportunities ahead mild, short-lived, recession: • Labor markets remain steady, which does not align with In the current high energy price environment, Canada’s a deeper recession – the national unemployment rate energy exports remain strong, displaying month-on-month is close to an all-time low and more than a million jobs increases during the first six months of 2022, with a jump remain unfilled; of 25% in Q2 over Q1. The energy sector, which now takes up a 30% share of all Canadian merchandise exports, is • Households have accumulated excess savings during contributing significantly to Canada’s total merchandise the first two years of the pandemic, somewhat trade growth (see Chart 10). counterbalancing elevated domestic debt-to-income ratios in some key housing markets; • Canadian banks are well capitalized, which points to Chart 10: Energy exports, a key contributor to limited systemic downside risks; Canada’s merchandise exports growth • Canada’s energy sector, a key contributor to the country’s 80 economic growth, continues to increase its exports in the 70 face of higher commodity prices; and 60 • Different levels of governments are still enacting relatively 50 loose fiscal policy. 40 $, billions Inflation to remain elevated in the short run, 30 25-30% of all exports winding down towards target over time 20 10-15% of 10 all exports Inflation is expected to have peaked at an annual rate of 0 8.1% in June. While overall inflation decelerated to 7.6% in Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul 2020 2021 2022 July, core inflation (excluding food and energy prices) still inched up to reach 5.5% (see Chart 9). With shelter costs Total of all merchandise Energy products expected to contribute more to inflation in the coming Source: Statistics Canada, KPMG analysis. quarters, most forecasters expect inflation to remain above the BOC’s 1-3% target range into Q4 2023. Strong demand for Canada’s energy products may enable more significant investments and growth opportunities in Chart 9: Inflation has likely peaked in Canada Canada’s energy sector. Western provinces, particularly Alberta, are already reaping the benefits with increased 9% capital spending in the oil and gas sector. Yet, domestic oil 8% and gas producers are also maintaining capital discipline as 7% the investment to cash flow ratio remains in check. 6% 5% Supply chains may continue to be put to the test as zero- hange Covid policies in key manufacturing countries may keep 4% 3% some key businesses on hold. This volatility may in turn CPI , y/y c have an outsized impact on exporters and importers as 2% they deal with an unreliable flow of goods. Nevertheless, Bank of Canada’s target range 1% with recent suspensions in vaccine mandates for domestic 0% travelers and a general easing of restrictions globally, -1% restrictions for this coming winter are anticipated to remain Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul 2020 2021 2022 lighter than they have been in recent years. Thus, the impact All items Excluding food & energy of Covid on economic activity is not expected to pick up significantly over the forecast horizon. Source: Statistics Canada, KPMG analysis. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 11

Global Economic Outlook – September 2022 Tight labor markets will keep pressuring services inflation Excess savings from Canadians since 2020 are likely for some time. By mid-2022, there were more job openings to prevent any economic slowdown from turning into a in Canada than available workers. Employment rates quickly protracted recession. Retail sales have so far remained rebounded since the first wave of the pandemic and have robust in the face of global uncertainty. reached historic highs for all age cohorts (see Chart 11). Job creation has however been muted since February. On the downside, Canada’s economy remains open to global economic trends and uncertainty. For one, European consumers may be forced to cut back on discretionary Chart 11: Very little slack in the Canadian labor market spending given the expected higher energy prices in the coming months, which may contribute to a further global 90% economic slowdown. As the adage also goes, when the U.S. sneezes, Canada catches a cold – any pothole in the 80% U.S. economy would also have implications for Canada’s growth path. 70% A higher inflation for a longer period of time may incentivize central banks to tighten monetary policy further. Combined 60% with vulnerabilities coming from Canadian household debt Employment rate, % levels, this may represent a downside risk to this outlook. 50% As households may have to tighten their spending in the face of increasing interest rates, a correction in Canadian 40% real estate prices may also lead to negative wealth effects 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 that affect the economy at large. Men, aged 25-54 Men, aged 55-64 Women, aged 25-54 Women, aged 55-64 Another key downside is that inflation expectations become Source: Statistics Canada, KPMG analysis. entrenched at a higher level, which may trigger further monetary policy tightening. The prospect of a wage-price Some further gains on labor markets may occur as spiral remains a tail-end scenario, as various surveys point Canada implements a national daycare system akin to the to relatively stable inflation expectations over a five-year 2 one established in Québec in the late 1990s, which has horizon . contributed to the province showing one of the highest All in all, central banks are committed to taming inflation – participation rates in the world among women of child- the benefits of a stable low-level of inflation having been bearing age. However, the program’s contribution to made clear since the early 1990s. This may come at the cost alleviating the undersupply of workers can be expected to of a mild recession. take time. A more ambitious immigration target, after two years of lower intakes due to the pandemic, is more likely to relieve stress in the short run. Sonny Scarfone Manager, Economics & Strategy at KPMG in Canada Economies facing elevated Karicia Quiroz uncertainty for the near future Manager, Economics & Policy at KPMG in Canada While only a mild recession is the base case scenario for Mathieu Laberge the Canadian economy, there are risks to this forecast. Partner, Economics & Policy at KPMG in Canada On the upside, a decline in supply chain bottlenecks may Caroline Charest reverse some of the increase in prices we have seen in the Partner, Economics & Strategy at KPMG in Canada past 18 months. Retailers are reporting elevated inventories, while intermediary goods accumulation in manufacturing facilities dissipated throughout 2022. 2 Canadian Survey of Consumer Expectations—Second Quarter of 2022. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 12

Global Economic Outlook – September 2022 Brazil: Government balance creates risks Consumption experienced Central government is continuing The proposed budget poses a growth in the first half, but stimulus while the central bank major risk to the government’s momentum is slowing. tries to tackle inflation. ability to counter slowing growth. The Brazilian economy advanced 3.2% year-over-year in Q2, Table 3: KPMG forecasts for Brazil the sixth consecutive quarter of economic expansion, driven 2021 2022 2023 by household consumption and government expenditures. Trade and investment have both been a drag on economic GDP 4.8 1. 9 0.8 growth, as exports dropped dramatically. Key to the outlook Inflation 8.3 9.8 5.8 for Brazil is the fiscal balance – and whether it is sustainable post-2022. Looking forward, we expect growth to slow in Unemployment rate 13.6 10.4 10.1 2023 as inflation continues to weigh on households while Source: KPMG Economics, Instituto Brasieiro de Geografia e Estatistica. monetary policy remains contractionary. Note: Forecasts are dated as of September 1, 2022. GDP and inflation are year-over-year % change. The unemployment rate is an annual average. Numbers are percentages. Growth in government expenditures is painting over underlying weaknesses in the economy. Corporate tax revenues have surged, which improved the government’s balance sheet and allowed for continued fiscal stimulus at levels similar to the 2020 pandemic-era. This has boosted household spending even as high inflation erodes real incomes, and the central bank continues to tighten monetary policy to control inflation. Fiscal stimulus is likely to retreat in the next few quarters, which will reveal an economy that is facing the potential for a significant slowdown in economic activity in 2023. Chart 12: Brazil’s government expenditures far exceed pre-pandemic averages $800 $600 $400 $200 0 vernment Balance, Billions R$ -$200 -$400 Central Go-$600 -$800 2016 2017 2018 2019 2020 2021 2022 Central government expenditures Central government revenues Deficit Source: KPMG Economics, Secretaria do Tesouro Nacional. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 13

Global Economic Outlook – September 2022 Even though fiscal stimulus is likely to be withdrawn, Brazil is heavily integrated in global trade, making net the deficit is set to worsen on falling revenues. Falling exports key to Brazil’s outlook. Between 2011 to 2021, revenues matter for Brazil’s fiscal capacity – the government trade averaged 28% of GDP for Brazil, according to the bases its target budget deficit on projected GDP growth. World Bank. Brazil’s exports have suffered from supply chain Brazil’s congress approved a target deficit based on their and infrastructure disruptions as well as poor harvests in own GDP projection for 2023 of 2.5% and much stronger agricultural industries. Higher oil and gas prices precipitated government revenues, compared to market expectations of by the Russia-Ukraine war also weighed on exporters of 0.8%. The budget leaves little room for Brazilian lawmakers non-petroleum products – Brazil imports more refined to counteract slowing growth should a recession occur petroleum than it exports, and non-petroleum products in 2023. constitute over 80% of export value. Brazil’s exporters will also likely be facing a global slowdown in the coming The persistence of inflationary pressures means that the quarters decreasing external demand. Meanwhile, imports central bank will be unable to provide monetary policy from the U.S. and China have increased in recent quarters support as the economy slows. The Brazilian economy has due to increasing domestic demand, creating a drag on been hit by its worst bout of inflation since 2004, forcing overall net exports as a share of GDP. However, this trend the central bank to increase the policy rate starting in March may reverse as overall demand in Brazil slows. 2021. Despite Brazil’s CPI inflation coming down to 8.7% in August amid falling crude oil prices, transport, and energy Though GDP and unemployment have showed signs of prices, the central bank will need to continue tightening improving in the first half of 2022, the economy is likely policy to bring down inflation. to begin slowing due to high interest rates and continuing inflation. Tighter credit conditions, a global slowdown, and High inflation is beginning to erode household spending in worsening terms of trade are also likely to weigh on Brazil’s Q3 despite a strong labor market. While consumption has already slowing net exports. Retreating fiscal stimulus in been driving Brazil’s recovery in 2021 and 2022, retail sales the coming quarters will reveal an economy that is facing a have been slowing over the summer. This trend indicates significant slowdown in 2023, with little room for maneuver that consumers may be feeling the impacts of higher Selic from either the fiscal or monetary policy side. rates from the Central Bank of Brazil. The unemployment rate decreased to its lowest level since 2015 and is falling, somewhat mitigating the impacts on high inflation on Meagan Martin real incomes. Economist, KPMG US © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 14

Global Economic Outlook – September 2022 Mexico: Stable but surrounded by risks Compared to other emerging markets, In case of a The central bank’s Mexico has been a laggard in economic recession, Mexico response to inflation has growth. With or without a recession in late has the fiscal space been strong, with rates 2022 or early 2023, the long-term outlook for a countercyclical expected to hit 9.5% by for Mexico remains about 2%. policy response. the end of 2022. Growth in Mexico is expected to slow over the remainder of Table 4: KPMG forecasts for Mexico 2022, even though the first half of the year surprised to the 2021 2022 2023 upside. GDP is expected to come in at 1.7% year-on-year after rising by 5% in 2021. The level of economic activity is GDP 5.0 1. 7 1. 5 expected to be 2% below its pre-pandemic level by the end Inflation 5.7 8.0 5.5 of this year. Public and private investment have been a drag on growth. The Mexican economy is currently 7% below the Unemployment rate 4.1 3.5 3.8 growth trajectory it was on before Covid hit. A slowing U.S. Source: KPMG Economics, National Institute of Statistics and Geography (INEGI). economy will further impact growth prospects in Mexico Note: Average % change on previous calendar year except for unemployment rate, due to close trade relations. which is average annual rate. Compared to other emerging markets, Mexico has been a laggard in economic growth. Prior to the pandemic, Chart 13: Growth in Mexico remains below trend Mexico’s growth had been rising at a meager (compared to its Latin American counterparts) 2% per year. With or 21 without a recession in late 2022 or early 2023, the long-term Recession Pre-pandemic outlook for Mexico remains about 2%. 20 trajectory rillions19 Consumer spending is over two-thirds of the economy and T has been rising steadily since the pandemic slump in early eso, 18 2020. With inflation at multi-decade highs, retail activity has Forecast been hit in recent months, but remains above pre-pandemic 17 3 Mexican P levels for now due to strong consumption and a return of 1 , 20 16 Actual tourism (which accounts for 15% of GDP). GDP 15 The unemployment rate hit 3.3% in July 2022 – a 14 pre-pandemic low. Wage growth remains strong, while 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 remittances hit a record high in 2022 and are expected to Source: KPMG Economics, INEGI/Haver Analytics. keep rising. Remittances are a crucial source of income for Mexican households, adding up to about 3.9% of GDP in 2020. The unemployment rate is expected to move up into next year and 2024 as the central bank continues its tightening cycle. By the end of 2022, the unemployment rate will likely hit 3.5%, with 2023 averaging 3.8%. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 15

Global Economic Outlook – September 2022 Exports are expected to grow by 9.6% in 2022 and slow Chart 14: Mexico has more fiscal space down to 4% in 2023. Strong demand from the U.S. than most of its neighbors consumer for cars, along with an uncoiling of supply chains, has helped this year. Mexico is an oil exporter and 90% has benefitted from higher oil revenues in 2022 as prices 80% 81% skyrocketed. This has helped offset the 2% of GDP the 80% 70% government spent on fuel subsidies. Additionally, imports 65% are expected to grow by 8% in 2022 and slow down to 60% 3.7% in 2023. 50% 51% 40% Pre-pandemic political reforms from the current government % Debt to GDP 36% 36% 30% tightened the fiscal belt during a time when other governments were funneling funds to their troubled 20% sectors. The silver lining is it allowed the country to keep 10% its low investment grade debt rating. However, investment 0% has been poor, as fiscal reforms have pushed out Argentina Brazil Colombia Mexico Chile Peru private investment. Source: KPMG Economics, Ministerio de Economía y Finanzas Públicas, Banco Central do Brasil, Banco Central de Chile, World Bank, Departamento Administrativo Nacional de Estadísticas, Bank of Mexico, Instituto Nacional de Estadística Geografía e Informática, International Monetary Fund/ Mexico’s public deficit will hit about 3.1% of GDP in 2022. Haver Analytics. A positive fiscal impulse has allowed Mexico’s government to provide fuel and energy subsidies to households in the first half of the year; the windfall received from rising oil The central bank’s response to inflation has been strong, prices has allowed the spending to net out. In case of a with Banxico’s August meeting resulting in a 75 basis point recession, Mexico has the fiscal space for a countercyclical hike to 8.5%. Rates are expected to hit 9.5% by the end policy response. However, Mexico did not enact as strong a of 2022. Mexico is at a different stage of the business response as its neighbors when the pandemic first hit, and cycle than the U.S.; a slowdown in world economic growth therefore is unlikely to do so due to a global slowdown. could be enough to help the central bank achieve its inflation target. Inflation surged to 8.6% in the first half of August compared to a year ago. Much of that was caused by soaring food A recession is not in our base case but is the downside prices, as energy prices have come off their peak. Inflation scenario, especially if the U.S. enters one at the end of is not expected to come down to the Banxico’s target of 3% the year. A recession in the U.S. would wipe out almost all (+/- 1 percentage point) until 2024 or later. growth for Mexico in 2023. About 80% of Mexico’s exports go to the U.S., therefore any drop in consumer or business activity in the U.S. will impact the Mexican economy and create a lasting damage to industrial production and private investment. A more severe global slowdown would pose even more downside risks for Mexico. Yelena Maleyev Economist, KPMG US © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 16

Global Economic Outlook – September 2022 ASEAN: Global headwinds weighing on trade in the region While the relaxing of Covid Inflation rates are rising While interest rates in the region are restrictions has benefited but remain low by generally being raised, the pace of ASEAN economies, global standards. Export tightening is slower than in some continued lockdowns in revenues for commodity developed economies. The move China and high commodity producers have been into safe assets has resulted in prices have been a boosted by higher currencies across the region losing dampener on growth. commodity prices. value against the USD this year. Covid restrictions have been unwound in many ASEAN Chart 15: Purchasing Managers’ Index, Asia countries this year allowing domestic activity to normalize. This has driven a strong rise in consumption, which has 60 been particularly marked in Singapore (up 6.1% since the 55 start of the year) and Malaysia (up 11.7%) – the rebound is consistent with both jurisdictions having some of the 50 toughest lockdowns and ongoing restrictions in 2020 and 2021. 45 ve 50 = expansionary40 Solid consumption growth has been somewhat offset by difficult external conditions (a result of the lockdowns in 35 Index, abo China) and a mixed outturn for investment growth; rising 30 inflation and borrowing costs have combined with concerns about the outlook to weigh on business’ capital expenditure 25 Sep Jan May Sep Jan May Sep Jan May Sep plans. Overall, the pace of GDP growth in most ASEAN 2019 2020 2020 2020 2021 2021 2021 2022 2022 2022 countries has broadly held steady this year, with the boost Singapore Vietnam Thailand Malaysia Indonesia to household spending offset by drags elsewhere. But there have been some notable exceptions, with Malaysia Source: KPMG Economics, IHS Markit, Macrobond. recording a spectacular pace of GDP growth in the first half of the year. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 17

Global Economic Outlook – September 2022 Merchandise goods trade weighed down by lockdowns and global headwinds More generally, lockdowns in China have disrupted trade throughout the region. A number of cities in China are currently in lockdown, which is creating ongoing disruption to supply chains as well as dampening China’s imports from across the Asia region. And the sharp slowdown in activity, particularly in the construction sector, has weighed on demand for key exports for most economies across the region. China’s importance as a source of demand means that all economies will continue to be impacted; growth in Korea’s exports (a bellwether for the region) moderated to 6.6% year-on-year in August. Chart 17: Export growth, Asia 40% 30% Tourism arrivals recovering slowly but surely 20% 10% While tourism arrivals have started picking up, they remain well below pre-Covid levels. The recovery in Singapore -on-y 0 % y appears to be one of the strongest in the region, with -10% visitor arrivals reaching 50% of pre-pandemic levels in July. -20% But given the ongoing lockdowns and border restrictions in China, a full recovery is unlikely in the near term. With -30% tourism typically accounting for a significant share of GDP -40% in Thailand, Vietnam, and Indonesia, the speed of the 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 recovery in this sector will be a major driver of growth in the Singapore South Korea Thailand Malaysia Indonesia Philippines years ahead. Source: KPMG Economics, Macrobond. Chart 16: International arrivals, Asia Looking ahead, conditions are set to remain challenging. If the authorities are able to ease restrictions and policy, a 125 rebound in China’s economy will provide some welcome 100 relief. But with growth momentum slowing and major advanced economies in Europe and North America leading 0 0 the slowdown, any relief from an improved outlook for the 75 region will be short-lived. Overall, export momentum is 50 set to moderate over the next twelve months, as the full anuary 2020 = 1 impact of interest rate rises and high inflation materializes in 25 external demand for goods. Index, J 0 -25 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Singapore Vietnam Thailand Malaysia Indonesia Philippines Source: KPMG Economics, Macrobond. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 18

Global Economic Outlook – September 2022 Inflation rising to uncomfortable levels Policy tightening set to become As elsewhere, inflation is picking up across the region. But a drag on growth the rates are generally lower than in much of the rest of In the absence of widespread domestic pressures, the the world. Movements in global energy and food prices are pace of interest rate rises has generally been slower than flowing through and are being exacerbated by exchange in other countries (albeit starting from a higher base in rate depreciations. But relatively small amounts of fiscal Indonesia and the Philippines). This outcome, coupled with stimulus through the pandemic and the lingering impact of a flight to safe assets (particularly the USD), has resulted in restrictions means that domestic demand has not moved many currencies depreciating sharply this year; the Korean substantially beyond supply, resulting in limited domestic won has lost 19% and the Thai baht 13%. But in line with wage and price pressures. Overall, inflation rates are the positive shock to their terms of trade, commodity expected to peak at relatively low levels across the region. exporters have generally seen smaller movements, with the The surge in commodity prices has also been a benefit Indonesian rupiah depreciating by just 5% since January. to some Asian countries. In particular, Indonesia and Fiscal tightening will add a further headwind to growth over Malaysia have seen significant rallies in their terms of the medium term, with the elevated levels of government trade this year as the price of crude and palm oil has spending through the pandemic now being unwound. In skyrocketed. Those rallies have subsided in recent months, fact, in some countries such as Indonesia and Singapore, but strong commodity prices are clearly still benefiting attention has started to shift towards fiscal consolidation, commodity exports. with the announcement of tax increases as initial signs of economic recovery emerge. Chart 18: Headline CPI inflation, Asia 10% Ben Udy Economist & Senior Manager, KPMG in Australia 8% Dr. Sarah Hunter 6% Senior Economist & Partner, KPMG in Australia 4% 2% Headline inflation, % 0% -2% -4% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Singapore South Korea Thailand Malaysia Indonesia Philippines Source: KPMG Economics, Macrobond. While the recent dip in oil prices may take some of the sting out of price hikes for consumers, we doubt that inflation has reached its peak for most of the region. We have therefore lifted our forecasts for inflation in 2022 and 2023 throughout the region. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 19

Global Economic Outlook – September 2022 China: Covid, property market and policy support China will likely stick to its strict The property market has faced The Chinese government Covid containment policies in the considerable headwinds since has taken a series of near future. How the government H2 2021 and the pressure fiscal and monetary policy balances the objectives of continues to mount. The measures to stimulate controlling the pandemic and slowdown has had a large impact demand. We expect more maintaining economic growth is on investment, bank loans, and measures to be announced still the key issue to watch. housing-related consumption. to support growth. China’s GDP grew by 2.5% year-over-year (yoy) in H1 Table 5: KPMG forecasts for China 2022, below its 5.5% annual growth target set in March. 2021 2022 2023 The economy grew 0.4% in Q2. It was the second lowest quarterly growth, only higher than the first quarter of 2020 GDP 8.1 3.5 5.2 when the pandemic started (-6.9%). The slowdown in Q2 Inflation 0.9 2.5 2.3 was mainly due to a resurgence of the Omicron variant of Unemployment rate 5.1 5.4 5.1 Covid between March to May, which caused lockdowns in some areas and logistic disruptions. Source: Wind, KPMG forecasts. Average % change on previous calendar year except for the unemployment rate, which is the average annual rate. Inflation measure used is the CPI, and the unemployment measure is the surveyed unemployment rate. Chart 19: Contributions to China’s real GDP growth by sector 20% 15% 10% 5% 0 -5% -10% 2015 2016 2017 2018 2019 2020 2021 2022 Final consumption Gross capital formation Net exports Real GDP growth Source: China’s National Bureau of Statistics, Wind, KPMG analysis. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 20

Global Economic Outlook – September 2022 Economic activity showed a recovery in June as the The government has maintained its overall real estate policy Omicron outbreak came under control. However, summer that ‘housing is for living in, not for speculation’. Although travels led a resurgence of infections in some cities, the property market is facing considerable headwinds, and the daily new cases (including asymptomatic cases) China’s increasing urbanization and households’ growing increased to over 2,000 in mid-August from below 100 at demand for quality homes should support the market in the the end of June. Growth in industrial production slowed long run. and manufacturing purchasing manager index (PMI), a leading indicator, fell into contraction territory again in July. Infrastructure investment has become the key driver to Meanwhile, the most severe heatwave in six decades hit support economic growth. The government has speeded up many areas this summer, sending electricity usage up the issuance of local government special bonds (LGSBs), 6.3% in July – the fastest growth since last September. The a major funding source for infrastructure investment. drought also caused a shortage of hydropower production in By the end of July, the government had issued a total some places, weighing on industrial production. of RMB 3.47 trillion LGSBs, 95% of the annual quota. The pace of issuance was much faster than in previous The recovery of consumption is still slow and is subject years. Infrastructure projects such as water conservancy, to the pandemic evolvement. Growth of the retail sector transportation and urban renovation have seen fast growth. rebounded to 3.1% in June from -11.1% in April, but We expect infrastructure investment to remain strong in the it moderated again to 2.7% in July due to the recent second half of this year. resurgence. Besides the pandemic, household expectations for job security and income growth are important drivers to consumer spending. The government has taken various Chart 20: Cumulative issuance of local measures to keep the job market stable, and the urban government special bonds in recent years surveyed unemployment rate dropped to 5.4% in July from 6.1% in April. We expect the unemployment rate to 4,000 average at 5.4% in 2022. Income sentiment and consumer confidence will likely improve in H2, supporting a gradual 3,500 recovery of consumption. 3,000 2,500 Meanwhile, the real estate market faces continued pressures. Liquidity is a key challenge for developers, 2,000 especially those with high leverage ratios. Funding pressure RMB billion 1,500 has caused some developers to suspend construction of pre-sold houses, causing some homebuyers to threaten to 1,000 stop making mortgage payments. We estimate the overall 500 exposure of banks to the troubled projects is still relatively 0 small, but possible contagion risks should be monitored. Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec The government has taken actions to stabilize the market. 2019 2020 2021 2022 On the demand side, many local governments have relaxed restrictions on property purchases, cut mortgage rates Source: Ministry of Finance, Wind, KPMG analysis. and lowered down-payment ratios. On the supply side, some cities are setting up relief funds to help developers with liquidity issues. The central bank also plans to provide targeted credit support to distressed developers to ensure delivery. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 21

Global Economic Outlook – September 2022 Exports have remained resilient. Driven by strong external Inflation has remained low in China compared to many demand, China’s exports were up 18% in July and increased parts of the world, but it may see some upward pressure 14.6% in the first seven months of the year. July’s trade in H2. Food accounts for nearly 30% of China’s consumer surplus hit a record high, exceeding USD 100 billion for the price inflation (CPI) and the cyclicity of pork prices is an first time. The bilateral trade between China and ASEAN important factor behind inflation fluctuations. Driven by has further strengthened since the RCEP agreement took recent increase of pork prices, CPI rose by 2.7% in July, up effect at the beginning of the year. With easing supply from 2.1% in May. In September, China released state pork chain disruptions and production ramp-up, Southeast Asian reserves to ease pork prices. Excluding food and energy, countries are increasing their demand for intermediate core CPI remains muted as the consumption recovery stays goods from China. Exports of new energy products such weak. We expect overall inflationary pressure to remain in as solar cells and lithium-ion batteries also saw strong check in 2022. Meanwhile, producer price inflation (PPI) momentum. Looking ahead, we expect exports’ strong continued to moderate from a high base, slowing from growth to moderate in H2, due to both high bases and 6.1% in June to 4.2% in July. slowing global growth. With the easing of Covid infections and relaxing of social We expect China’s fiscal and monetary policy to remain distancing requirements, as well as the government’s supportive. After announcing a set of 33 supportive continued support measures, Hong Kong (SAR)’s economy measures at the end of May, the government introduced showed a sequential improvement in Q2. Real GDP another 19 measures in August to bolster growth. Utilizing growth contracted at a moderate pace of 1.3%, narrowing the remaining balance accumulated from previous years, from -3.9% in Q1. As Hong Kong has adopted a pegged it announced a new RMB 500 billion quota in LGSBs to exchange rate with the USD, the government raised its support local government spending. The new quota is interest rate to 2.75% in lockstep with the U.S. Federal expected to be fully issued by October. In addition, on top of Reserve’s rate hikes. Monetary tightening and a global the RMB 300 billion policy bank bond issuance announced economic slowdown may weigh on Hong Kong’s recovery. in June, the government added another RMB 300 billion Looking ahead, we expect Hong Kong’s economic growth to bond quota, which can be used as equity capital for key continue to recover in H2, but challenges also remain. infrastructure projects. On the monetary side, the central bank reduced the policy Kevin Kang, PhD rate (medium-term lending facility, MLF) in August again, Chief Economist, KPMG China after cutting it in January. It also used special relending facilities to provide direct credit support to small and medium enterprises (SMEs), green investment and the transportation sector. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 22

Global Economic Outlook – September 2022 Japan: Loose policy keeping the yen down, adding to inflation Headwinds to households Inflation has risen above The Bank of Japan’s continuation are mounting, exports the Bank of Japan’s target with loose policy settings has weighed down by global and has further to rise in caused the yen to depreciate to environment. the months ahead. its lowest level in decades. Japan has had a slow start to 2022 with GDP rising by Table 6: KPMG forecasts for Japan less than 0.6% in the last six months. Activity has been 2021 2022 2023 supported by the continued relaxation of Covid restrictions, which has enabled a solid rebound in consumption. But GDP 1. 7 1. 6 2.2 momentum is expected to ease over the rest of 2022, as Inflation -0.2 2.4 1. 6 household budgets are squeezed by the step up in inflation. Lockdowns in China have put a significant drag on exports, Unemployment rate 2.8 2.5 2.6 and while conditions there are now improving, there are Source: Cabinet Office of Japan, KPMG analysis. significant clouds hanging over other regions. Overall, we Note: Average % change on previous calendar year except for unemployment rate, now expect Japan’s economy to grow by 1.6% this year, which is average annual rate. followed by 2.2% in 2023. After rebounding through Q2, the latest activity data suggests that momentum in Japan’s economy is now easing. The services PMI, an indicator of growth momentum in the sector, fell into contractionary territory in August (49.2), suggesting that the inflationary headwinds facing households are flowing through to spending. But pent-up demand and excessive savings accrued during the pandemic are providing some immediate relief, with retail sales increasing by a robust 2.6% on the month in July. Outside of domestic consumers, there is still scope for a further rebound in service activity through a continuing recovery in tourism inflows. Japan’s border restrictions have remained among the tightest in the world this year, with steps to re-open lagging behind most other countries. There was a further easing of the rules in September, with travellers outside of tour groups now allowed to enter as long as they have pre-booked their trip with an agent. Even so, the new daily cap of 50,000 for inbound arrivals is still around half of pre-virus arrivals so there is some way to go before the sector has fully recovered. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 23

Global Economic Outlook – September 2022 Japan’s manufacturing sector continues to face challenges, Chart 21: Purchasing Managers’ Index, Japan with the PMI reading falling to 51.5 in August. While this is still in expansionary territory, the key output and new 55 orders sub-indices fell into contractionary territory. Global demand for Japan’s machinery and equipment capital goods 50 is likely to ease as interest rate rises dampen investment 45 momentum. And although exports to China have begun to rebound, in line with the re-opening of the economy, they 40 are likely to remain subdued given the ongoing lockdowns and outlook for the domestic economy. 35 As-in most other countries, headline inflation is set to Index, 50 = expansionary/contractionary30 remain elevated through the rest of 2022, as the impact of imported food and fuel price rises flow through. Indeed, 25 Sep Jan May Sep Jan May Sep Jan May Sep Tokyo energy prices are up 29% from a year ago, the fastest 2019 2020 2020 2020 2021 2021 2021 2022 2022 2022 pace of energy inflation since the 1980s. High energy prices have prompted the government to explore the restarting Source: KPMG Economics, IHS Markit, Macrobond. of some idle nuclear plants and the building of new plants. Food inflation is close to 5%, the highest rate in nearly a decade, and the strength in agricultural commodity prices Chart 22: CPI inflation, Japan and ongoing war in Ukraine means it is unlikely to moderate soon. The moves in global prices are also being reinforced 20% by the depreciation of the yen, which is further increasing the local price of these essentials. 15% 10% Unlike most other countries, wages growth in Japan has remained relatively subdued, at around 2% year-on-year, -on-y5% with the Spring Negotiation culminating in a subdued base % y pay increase. Given this, the risk of wage growth lifting 0% markedly in response to inflationary pressures is very low, and this in turn is limiting domestically-generated price -5% increases. Looking ahead, headline inflation is expected to moderate to 1.6% in 2023, as the impact of external price -10% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 moves in 2022 drops out of the calculation. Fuel and energy Food Headline Source: KPMG Economics, Statistics Bureau of Japan Macrobond. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 24

Global Economic Outlook – September 2022 Given the lack of domestic inflationary pressures and the Chart 23: Total cash earnings, Japan subdued economic outlook, the Bank of Japan (BoJ) is continuing to signal its commitment to ultra-loose monetary 3% policy. Markets have repeatedly challenged the Bank’s yield curve control, but the BoJ has responded by lifting the pace 2% of asset purchases to record levels, to maintain the 10-year 1% bond yield close to 0%. This supports our view that the BoJ is unlikely to tighten policy settings any time soon. -on-y0% % y The BoJ’s determination to keep policy settings loose has -1% driven the yen to the weakest level since the 1990s, with the currency currently sitting around 140 yen per USD. -2% And looking ahead, continued policy tightening in other countries may force the yen lower in the months ahead. The -3% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 weak exchange rate is contributing to the recent strength in inflation; import prices are up by nearly 50% from a Source: KPMG Economics, Statistics Bureau of Japan Macrobond. year ago. As the yen continues its descent this trend will continue and will be a driver of further increases in headline inflation in the near term. Chart 24: Currencies vs US$ 130 Ben Udy 125 Economist & Senior Manager, KPMG in Australia 120 0 115 Dr. Sarah Hunter 0 Senior Economist & Partner, KPMG in Australia 110 an 2020 = 1105 Index, J100 95 90 85 Jan Jul Jan Jul Jan Jul Jan Jul Jan Jul 2018 2018 2019 2019 2020 2020 2021 2021 2022 2022 Euro Pound Yen Australian Dollar Source: KPMG Economics, Macrobond. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 25

Global Economic Outlook – September 2022 India: Driving growth on the back of inflation control India to remain Global geopolitical Investor-friendly policies such as the PLI among the fastest- tensions expected to schemes and their extension to newer growing economies create uncertainty in the sectors expected to help promote the globally. trajectory of inflation. manufacturing ecosystem in India. With the global economy suffering repeated shocks with Table 7: KPMG forecasts for India surges in inflation, sluggish growth across countries, and 2021 2022 2023 monetary policy tightening, the ripples are also being felt in India, discernible from the high inflation. However, the GDP 8.7 7. 2 6.3 country’s economy grew by 13.5% in Q1 of fiscal year Inflation 5.5 6.7 5.0 2022-23 backed by improvement in private consumption, largely on the back of the reopening of the services sector. Unemployment rate 8.0 7. 6 7. 1 As India celebrates 75 years of its independence, the Source: Ministry of Statistics and Programme Implementation; CMIE, KPMG analysis. country has emerged as the fifth largest economy in the Note: The years represent the April-March period; for instance, 2021 spans from April 2021 to world replacing the UK , in value terms. As India celebrates March 2022. Real GDP numbers (at constant prices) for 2022 and 2023 and inflation rates for 2022 are advanced estimates by National Statistical Office (NSO) and the RBI’s survey of professional 75 years of its independence, the country has emerged forecasters. as the fifth largest economy in the world replacing the UK, in value terms, and is expected to rank among the fastest growing globally, with the Reserve Bank of India (RBI) projecting a GDP growth of 7.2% for the fiscal year 2022-23 . Chart 25: India’s quarterly GDP growth 25% Forecast 20% 15% 10% -on-year5% 0% -5% -10% GDP growth, % year -15% -20% -25% Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 2019 2020 2021 2022 2023 Source: Survey of Professional Forecasters, RBI and National Statistical Office. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 26

Global Economic Outlook – September 2022 An uptick in domestic economic activity is observable, with Unemployment rates, however, surged to a 12-month high indicators of urban and rural demand such as automobile of close to 8.3% in August 2022. Rural unemployment, sales, consumer durables manufacture, and domestic which had been affected by factors such as erratic rainfall, air travel showing improvement. A positive movement in is expected to decrease towards the end of the monsoon domestic demand is discernible from the robust import season, as agricultural job opportunities increase. However, requirements for non-oil and non-gold commodities. Rising concerns around the trajectory of urban unemployment are consumer optimism, improved corporate performance, expected to persist in the immediate future. and enhanced demand for contact-intensive services are expected to drive consumption. Retail inflation, which was one of the highest in April 2022 (nearly 7.8%) due to the high prices of articles such as Investments are also rising in the country, and factors food and fuel, has witnessed a downward trend since May such as a capex push by the government, improvement 2022. The government’s reduction of excise duties on fuel in capacity utilization and widening of bank credit will in May, coupled with three interest rate hikes by RBI this contribute to ramping up investment activity. In addition, year to 5.4% have helped moderate inflation. However, the Foreign Portfolio Investors poured over INR56,000 crore central bank expects inflation to remain high in fiscal year (~US$7.1 billion) in August 2022 after nine months of 2022-23 at 6.7%, owing to effects of the global geopolitical continued outflows, indicating improved enthusiasm headwinds. Furthermore, the appreciation of the U.S. dollar of foreign investors for the Indian equity market, which is a factor contributing to inflationary pressures. became the fifth largest recently in terms of market capitalization. The government’s production-linked incentive (PLI) schemes are also promoting domestic manufacturing and job Chart 26: India’s Consumer Price Index creation, with investment commitments of INR2.34 lakh crore (~US$29.53 billion) as of April 2022. PLI schemes 9% are also being considered for additional sectors such as furniture and toys, which will help bolster domestic 8% manufacturing. 7% 6% Over the coming years, India is expected to continue on -on-year its path of economic growth and become a US$5 trillion 5% economy by 2027. However, geopolitical uncertainties and 4% tensions coupled with inflationary pressures and monetary 3% tightening in economies like the U.S. and elsewhere are CPI inflation, % year 2% cautionary factors that could affect growth estimates. 1% 0% Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Preeti Sitaram 2021 2022 Director, Government & Public Services, KPMG in India Source: Ministry of Statistics and Programme Implementation. Note: Inflation rate for July 2022 is provisional. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 27

Global Economic Outlook – September 2022 Australia: Mounting headwinds set to weigh on growth The Australian economy has Rising inflation, a tight labor As the full impact of the recent rate proven resilient to recent market and strong growth rises flows into the economy in the headwinds, achieving solid are forcing the RBA to hike months ahead, growth and inflation growth in H1 2022. rates aggressively. are expected to moderate in 2023. Households resilient despite headwinds Table 8: KPMG forecasts for Australia 2021 2022 2023 Supply chain disruptions, elevated commodity prices, and GDP 4.9 4.2 2.2 rising interest rates are all weighing on economic activity to some extent. But households have thus far shaken off these Inflation 2.9 6.3 5.2 pressures and are continuing to lead solid GDP growth. Unemployment rate 5.1 3.8 4.4 Helped by the release of pent-up demand from 2021’s Delta lockdown, consumption rose by 2.2% quarter-on-quarter Source: Australian Bureau of Statistics, KPMG analysis. in both Q1 and Q2, well above trend growth. The increase Note: Average % change on previous calendar year except for unemployment rate, which is average annual rate. in spending is being led by a rebound in services, with households continuing to normalize their spending patterns. Despite the lockdowns and real estate downturn in China, which are disrupting construction activity and demand for iron ore, strong demand for Australian energy exports has helped lift the trade balance to new highs. While some of that reflects elevated commodity prices, export volumes have increased too. Indeed, net trade (the difference between export and import volumes) made a 1 percentage point contribution to GDP growth in Q2. Notwithstanding the robust growth in disposable income, which increased by 1% on the quarter in Q2, households have partly funded additional consumption in recent quarters by reducing their saving rate. The household saving rate is now 8.7%, still a little above its pre-Covid level, but at its lowest level in two years. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 28

Global Economic Outlook – September 2022 Businesses still signalling rising investment, Inflationary pressure easing government spending set to moderate but still elevated A rebound in business investment is likely in the near term, Oil prices have eased in recent months, but overall energy as the impact of the recent floods on building construction prices remain very high. The war in Ukraine has also put activity ease and firms continue to take advantage of tax pressure on food prices globally and those pressures have incentives. The ongoing recovery in services exports, been exacerbated in Australia due to the floods disrupting together with a recovery in inward migration, will also agricultural activity. In addition, escalating construction costs encourage firms to expand capacity. But overall, we expect and rising housing rents are providing a significant boost to momentum to moderate as the environment deteriorates. headline inflation. Taken together the headline inflation rate And after two years of outsized increases in government reached 6.1% in Q2, and trimmed mean inflation rose to spending, we expect expenditure to fall back slightly, as 4.9%, the highest rate for each series since 1991. emergency pandemic expenditure finally comes to an end. Businesses are reporting that purchase cost are continuing Overall, GDP growth momentum is expected to ease to surge, consistent with inflation increasing further in the going through H2 2022, to a trough in mid-2023. But we near term. The ending of the Government’s fuel excise still expect the economy to escape a recession, given its reduction is set to boost inflation to a peak of more than positive fundamentals. 7% in Q4. Thereafter, the modest easing in energy prices, the unwinding of flood impacts on food price, and softening demand momentum should see inflation moderate. Chart 27: Quarterly GDP growth by component, Australia Chart 28: Australia’s CPI inflation 7.5% 7% 5.0% 6% 5% 2.5% 4% 0% 3% ercent hange, y/y P -2.5% % c 2% -5.0% 1% -7.5% 0% -10.0% -1% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022 2018 2019 2020 2021 2022 Household consumption Government spending Change in inventories GDP Headline Trimmed mean Private investment Net exports Statistical discrepancy Source: KPMG Economics, Australian Bureau of Statistics, Macrobond. Source: KPMG Economics, Australian Bureau of Statistics, Macrobond. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 29

Global Economic Outlook – September 2022 Labor market tightness stoking wage growth RBA raising rates rapidly to cool The tightening in the labor market has continued in recent domestic inflation pressures months. The participation rate remains close to its recent The rapid rise in inflation and tight labor market has forced record high. But employment growth has been robust and the RBA to accelerate its hiking cycle. The cash rate is now there are now more job vacancies than unemployed people at 2.35% and Governor Lowe has indicated that further rate in Australia. Looking ahead, a slowdown in growth and hikes will be needed in the months ahead. But we expect a rebound in net migration should start to take some of the pace of tightening to slow from here. By the end of the tightness out of the labor market. But given the huge this year we expect the cash rate to have reached 3.1%, backlog of job vacancies, the labor market is likely to remain with a further 0.25%pt hike possible in early 2023. Further very tight for some time to come. significant hikes beyond this increase the risk that the Bank The tight labor market is finally spurring wage growth. To overshoots and tightens rates too aggressively. If that turns be sure, the pace of wage inflation remains low compared out to be the case, the RBA would probably need to reverse to many advanced economies. Annual growth in the wage course and cut rates in late 2023 or early 2024. price index reached 2.6% in Q2, a little above its 2019 peak of 2.4%. But the historically large 5.2% increase in the minimum wage in Q3, further tightening in the labor market Ben Udy and continued rise in inflation mean that wage growth will Economist & Senior Manager, KPMG in Australia likely accelerate in the months ahead. Dr. Sarah Hunter Senior Economist & Partner, KPMG in Australia Chart 29: Job vacancies and the unemployment rate, Australia AU3 unemployment 7.5% 275,000 7.0% 250,000 6.5% 225,000 6.0% 200,000 5.5% 175,000 5.0% 150,000 Unemployment rate, %4.5% 125,000 Number of vacancies 4.0% 100,000 3.5% 75,000 3.0% 50,000 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Unemployment rate (LHS) Job vacancies (RHS) Source: KPMG Economics, ANZ, Australian Bureau of Statistics, Macrobond. © 2022 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. 30