2022 Annual Report

2022 Annual Report 30% Club France Investor Group 2 2 2

2022 Annual Report 2 30% Club France Investor Group About 30% Club France Investor Group 3 Forewords 4 • Marie-Pierre Rixain, Member of the French Parliament 4 • Matt Christensen, Global Head Sustainable & Impact Investment, Allianz Global Investors 6 • Marie-Sybille Connan, 2022 Chair of the 30% Club France IG 7 Executive Summary 8 Investor Outreach 10 2022 Engagement Campaign 11 • MEDEF Study on Gender Equality Commitments among SBF 120 12 • Best Practices to Share 14 • Our Thought Leadership Ecosystem and Key Learnings f rom Friends 18 • Debunking Myths 24 Future Plans 25 Message f rom the Co-Chairs of the 30% Club France IG 26 Appendix 27 • Becoming a Member 28 • 30% Club Investor Group KPI List – Our Reporting Expectations for Corporates 29 Contents Important information This document is not a financial promotion nor a marketing communication. It has been produced by 30% Club France Investor Group (‘we’, ‘our’ or ‘us’) as thought leadership which represents our intellectual property. The information contained in this document (the ‘Information’) may include our views on governance and social issues which can affect listed companies and issuers of securities generally. It intentionally ref rains f rom describing any products or services provided by any of the regulated entities within our group of signatories, this is so the document can be distributed to the widest possible audience without geographic limitation.

2022 Annual Report 3 30% Club France Investor Group Objective 2: Disclosure Expectations from Investee Companies We expect companies to be transparent regarding the procedures used to find and appoint new members to the executive management team and how that process ensures a diverse leadership committee. We call on companies to provide information on how diversity materializes at every management level. What is the 30% Club? Why 30%? • A business campaign aiming to boost the number of women in board seats and executive leadership of companies worldwide • Calling on members to commit to at least 30% female representation on their boards and executive leadership teams because this is the critical mass at which minority voices become heard; it’s a floor, not the ultimate goal • Two pillars for a complete 30% Chapter: 30% Club CEOs and 30% Club Investor Groups • First 30% Club investor group was established in the UK in 2010; now there are six more Club chapters • All Clubs share the same objective but have varying timelines as they adapt to local situations About the 30% Club France Investor Group Objective 1: At Least 30% Women in the Executive Committee by 2025 As members of the 30% Club France Investor Group, we expect executive management teams of SBF 120 companies to appoint women to at least 30% of seats by 2025. We encourage companies to develop an internal female talent pipeline f rom entry positions to the top. *Objectives have been shortened for length. Full objectives can be found in the appendix. Key Objectives of the 30% Club France Investor Group* The 30% Club France Investor Group Our Ambitions and Objectives As investors, we are stewards of our investee companies. Part of that responsibility includes the assessment of their executive management teams. Since 2017, listed companies in France must have a minimum of 40% of women on the Board of Directors under the Copé Zimmermann law. The Rixain Law adopted in 2021 also enforces that Executive Committees have 30% female representation by 2027 and 40% by 2030. This law provides the opportunity to rethink and reshape the attraction & retention practices as well as the avenues for promotion to make sure French companies mitigate the risk of leaky pipelines and offer equal career opportunities regardless of gender. The 30% Club France Investor Group doesn’t solely address the visible part of the iceberg; we want to bring our contribution to the 2030 United Nations’ Sustainable Development Goal SDG 5 in relation to gender equality. The French Investor Group aims to eventually open a French chapter of the 30% Club which would imply having the CEO/Chair pillar in addition to the investor pillar.

2022 Annual Report 4 30% Club France Investor Group La concrétisation comme l’effectivité des droits économiques des femmes constituent autant d’opportunités pour les individus – hommes et femmes –, les entreprises et notre économie ; elles requièrent, par conséquent, des politiques volontaristes et des engagements féministes. Le président Emmanuel Macron, en faisant de l’égalité entre les femmes et les hommes la grande cause de ses quinquennats, a permis d’accélérer la marche de l’Histoire en créant un momentum qui nous engageait à revoir les conditions du partage réel du pouvoir économique au sein des entreprises. En effet, un certain nombre de blocages constitutifs de notre organisation collective contraignent encore la marge de manœuvre économique des femmes, et entraînent une cascade de conséquences qui, bien souvent, entravent le développement de leur carrière et entérinent définitivement les inégalités de destin entre les femmes et les hommes. C’est dans cet esprit, qu’en 2021, j’ai rédigé une proposition de loi 1 qui consacre de nouveaux droits économiques pour les femmes et leur permet ainsi de conquérir leur statut de sujet économique, libre et autonome. Une loi qui s’adresse à toutes les femmes, quel que soit leur âge, qu’elles aient ou non des enfants, dans la diversité de leur parcours de vie, afin qu’elles aient toutes les moyens de saisir les potentialités des mutations économiques à l’œuvre, qui sont autant d’opportunités d’accomplissement. Je mesure, au nombre de sollicitations que je reçois, que le sujet est plus que jamais sur la table dans toutes les entreprises et je m’en réjouis ! Enfin, notre pays réfléchit à comment faire de la moitié de la population active une source de création de valeur, de richesse et d’emplois. Une réflexion d’autant plus nécessaire dans le contexte économique que nous connaissons. Et nous pouvons déjà affirmer que la loi, dont la séquence s’est déroulée sur toute l’année 2021, a fait progresser les choses. D’après la dernière édition de l’étude « Mixité au sommet » d’Heidrick & Struggles, en 2022, 31% des entreprises du SBF120 comptent au moins 30% de femmes dans leur comex contre 18% en 2020. De même, 9% en comptent au moins 40% contre 6% en 2020. Je crois qu’une part de plus en plus significative des grandes entreprises ont pris la mesure de l’enjeu que représente la mixité, à la fois pour assurer leur attractivité, mais également pour accélérer leur performance globale. À cet égard, la loi que j’ai portée – qui marque un changement majeur dans la gestion et la rétention des talents de l’entreprise – permettra une accélération de cette dynamique, en imposant des objectifs chiff rés ambitieux mais atteignables par les acteurs concernés. La féminisation des équipes dirigeantes est une formidable opportunité pour les entreprises ; un constat qui invite les acteurs à se positionner dès aujourd’hui sur cette question de manière ferme et engagée, sous peine de rater une marche essentielle à leur transformation et leur croissance. Je tiens à féliciter la branche f rançaise du 30% Club, et plus particulièrement Matt Christensen et Marie- Sybille Connan, pour leur engagement sincère en la matière, ainsi que leurs actions déterminées pour faire bouger les lignes dans le monde de l’investissement. Un secteur clef pour définir les orientations stratégiques de demain et où les choix de chacune et chacun d’entre vous engagent notre société tout entière. Ensemble, construisons la France de 2030 : un pays fort de tous ses talents ! Marie-Pierre Rixain Marie-Pierre Rixain , Member of the French Parliament English translation overleaf > 1 Proposition de loi qui a été adoptée à l’unanimité par l’Assemblée nationale en mai 2021 et promulguée par le président de la République, Emmanuel Macron, le 24 décembre 2021.

2022 Annual Report 5 30% Club France Investor Group The realization and effectiveness of women’s economic rights are true opportunities for both men and women, companies, and our economy; they, therefore, require proactive policies and feminist commitments. By making equality between women and men the great concern of his five-year term, President Emmanuel Macron has helped accelerate the march of history by creating a dynamic that commits us to reviewing the conditions of real economic power sharing within companies. Indeed, a certain number of blockages in our collective organization still constrain women’s economic room to maneuver and lead to a cascade of consequences which, very often, prevent the development of their careers and definitively confirm the inequalities of fortune between women and men. With this in mind, I drafted a bill in 2021 that enshrines new economic rights for women thus allowing them to conquer their status as f ree and autonomous economic actors. This law concerns all women - whatever their age, whether they have children or not, in the diversity of their journey - so they all have the means to seize the potential of the economic changes at work and have many opportunities for fulfillment. The number of requests I receive proves that this issue is on the table for all companies now more than ever and that is something I am delighted about! Finally, our country is thinking about how to make half of the working population a source of value creation, wealth, and jobs. This reflection is especially necessary for the current economic context. And we can already say that the law, which was carried out throughout the year 2021, has made progress. According to the latest edition of Heidrick & Struggles’ “Mixité au sommet” study of 2022, 31% of SBF120 companies would have at least 30% women in their executive committee, compared to 18% in 2020. Similarly, 9% will have at least 40%, compared to 6% in 2020. I believe that an increasingly significant proportion of large companies have taken measures for the challenge of gender diversity, both to ensure their attractiveness and to accelerate their overall performance. In this respect, the law that I introduced - which marks a major change in the management and retention of corporate talent - will accelerate this dynamic by imposing ambitious but achievable targets for the players concerned. The feminization of management teams is a tremendous opportunity for companies; it is a reality that invites the players to position themselves today on this issue in a strong and committed way or they will miss an essential step in their transformation and growth. I would like to congratulate the French investor group of the 30% Club, specifically Matt Christensen and Marie-Sybille Connan, for their sincere commitment to this issue as well as their determined actions to move the lines in the field of investment. This is a key sector for defining tomorrow’s strategic directions and where the choices each of you makes affect our entire society. Together, let’s build the France of 2030: a country with all its talents! Marie-Pierre Rixain Marie-Pierre Rixain , Member of the French Parliament

2022 Annual Report 6 30% Club France Investor Group As the Global Head of Sustainable and Impact Investing – and as a citizen – I’m convinced of the importance of diversity and equity in society. Therefore, it was natural for me to support the membership of AllianzGI to the 30% Club France Investor Group in March of 2021 as well as the chairmanship of the initiative in 2022. At AllianzGI, we aim to become a shaper of sustainable investing solutions, leading clients and investee companies on an inclusive transition pathway to a better future. More specifically, promoting equal financial and professional opportunities is part of our responsibility to society and one of the keys to generating sustainable returns. We strongly believe that inclusive and diverse companies lead to more creative, profitable, and sustainable outcomes. Matt Christensen, Global Head Sustainable & Impact Investment, Allianz Global Investors In the two years since the initiative’s launch, I’m pleased to see that the importance of gender diversity is increasingly acknowledged within French companies and that encouraging progress in terms of female representation on executive leadership teams is visible. Nevertheless, there is still a long way to go. By pooling our efforts under the 30% Club France, we as investors can help move the lines faster to drive genuine and sustainable change by looking not only at the executive committee but also at how companies build a gender-diverse talent pipeline. The 30% by 2025 is the floor, not the ceiling. The Rixain Law on economic and professional equity for women sets 40% by 2030 as the next f rontier. We are willing to do our part!

2022 Annual Report 7 30% Club France Investor Group After two years of existence, the 30% Club France Investor Group is now widely recognized as a credible force by SBF120 companies. We actively and constructively engaged with many constituents for the first or second time. More evidence of traction with the investor initiative is that new members joined us and showed their genuine interest in engaging with their investee companies. We observe the true willingness of many companies to learn about best practices on how to foster a more inclusive and diverse corporate culture. They are more and more convinced that their future success will be driven by their ability to attract and retain diverse talents and foster a more inclusive and creative corporate culture. In the meantime, we are fully aware that gender diversity is a journey. It will take time to see a better alignment between the percentage of women within a company and their representation in the highest operational roles. However, we are ready to take up that challenge collectively. We believe that healthy gender balance will lead to better decision making and ultimately better performance over Marie-Sybille Connan, 2022 Chair of the 30% Club France Investor Group the long term. Investors also have a societal role to play as active stewards to move the lines for a more inclusive, more diverse, and more successful society as recalled by the 5th Sustainable Development Goals set by the United Nations for gender equality by 2030. This year, we onboarded more investors in our initiative, engaged with more French firms, and met with relevant stakeholders such as lawmakers and experts to inform our engagement, demystify gender diversity, and overcome the many different obstacles that gender diversity is facing in practice. It is in this context that we had the pleasure of having an inspiring discussion with Marie-Pierre Rixain, Member of the French Parliament to whom we owe the law on gender professional and economic equity. 2022 was a very eventful and insightful year for the 30% Club France Investor Group. In this report, we share with you the insights and learnings f rom this campaign, and we hope that you will appreciate the reading as much as we are committed to contributing to better gender professional and financial equity.

In its second year of the campaign, the 30% Club France Investor Group conducted a wide variety of activities to engage with corporates, stakeholders, and experts, enabling us to develop key observations regarding gender diversity in France. We conducted 18 in-person engagement meetings and conversations via email. Through our dialogues, we observed that: • Compared to last year, companies are both more open to engaging with us and more prepared. The refusal to engage is more the exception than the rule, even though we faced some refusals under the pretext of “we already have 30% of women on our Executive Committee.” That’s not a good reason given that we look beyond the % of women on the Executive Committee because it is critical but not sufficient to make sure that there is sustainable change at all levels. • Most companies we met are convinced of the value of gender diversity. We have begun to see positive momentum emerge in the form of action plans and targeted goals, but these targets as well as their scopes (i.e., the executive body targeted) and time horizons lack homogeneity, making it difficult to work towards the goal of 30% female representation at the highest levels of management. That said, we need to be ambitious as well as pragmatic. Priorities are different across sectors, so it was interesting and critical to learn about the different blocking factors. • Two opposite trends are coming into play. The COVID-19 crisis had a disproportionately negative impact on women in attracting, retaining, and promoting talent while the enforcement of the Rixain Law acted as an accelerator of awareness for the importance of gender diversity. The issue is more acute in some sectors, particularly industrial and STEM activities, making the competition for attracting female talent more intense. The generalization of telework may accentuate the recruitment problem for those companies where this will not be possible due to the nature of the jobs. We will see in our dialogues how companies can remain attractive to women. Executive Summary • Sectors with high female employment rates (Financial Services and Insurance, Consumers) still have obvious glass ceilings. While there are targets and strategies, these sectors have a long way to go and changed very little compared to last year. We also discussed the notion of the multiplier effect (e.g., for each woman added to the C-Suite, there is a positive impact on senior leadership below the C-Suite). There is an obvious positive impact stemming f rom women as role models - women in the C-Suite are in positions of power and advocating for women in all roles. To drive meaningful change and realize the full power of the multiplier effect across their organizations, they will need to improve gender diversity at the highest levels. That said, this multiplier effect works no matter the sector. • We discussed at length the notion of the gender pay gap and observed some confusion concerning the equal pay gap and gender pay gap. While the equal pay gap means equal pay for equal work and no discrimination based on gender (forbidden by law in France), the gender pay gap captures the under-representation of women in senior, higher-paying positions. Closing the gender pay gap requires measures to break the glass ceiling through adequate, supportive, and relevant HR policies. It is different f rom possible discrimination captured through the equal pay gap. Through our “soft” engagement campaign, we sent a KPI list developed by the 30% Club France Investor Group to the SBF120 to outline our reporting expectations. From the companies that returned the KPI list to us, we observed that: • All KPIs were possible as each of them was at least once reported • There is a lack of consistency in how companies report on quantitative diversity data • There is a lack of granularity and transparency on key diversity data points • Global standards on gender diversity are needed so that employees in different countries enjoy equal benefits and opportunities, and companies disclose this information to ensure transparency Annual Report 2022 8 30% Club France Investor Group

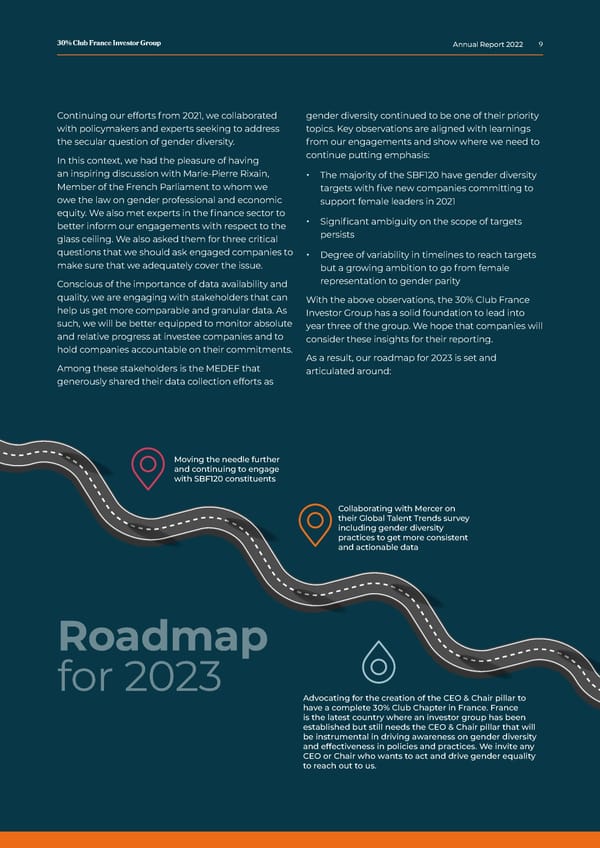

Continuing our efforts f rom 2021, we collaborated with policymakers and experts seeking to address the secular question of gender diversity. In this context, we had the pleasure of having an inspiring discussion with Marie-Pierre Rixain, Member of the French Parliament to whom we owe the law on gender professional and economic equity. We also met experts in the finance sector to better inform our engagements with respect to the glass ceiling. We also asked them for three critical questions that we should ask engaged companies to make sure that we adequately cover the issue. Conscious of the importance of data availability and quality, we are engaging with stakeholders that can help us get more comparable and granular data. As such, we will be better equipped to monitor absolute and relative progress at investee companies and to hold companies accountable on their commitments. Among these stakeholders is the MEDEF that generously shared their data collection efforts as gender diversity continued to be one of their priority topics. Key observations are aligned with learnings f rom our engagements and show where we need to continue putting emphasis: • The majority of the SBF120 have gender diversity targets with five new companies committing to support female leaders in 2021 • Significant ambiguity on the scope of targets persists • Degree of variability in timelines to reach targets but a growing ambition to go f rom female representation to gender parity With the above observations, the 30% Club France Investor Group has a solid foundation to lead into year three of the group. We hope that companies will consider these insights for their reporting. As a result, our roadmap for 2023 is set and articulated around: Annual Report 2022 9 30% Club France Investor Group Moving the needle further and continuing to engage with SBF120 constituents Collaborating with Mercer on their Global Talent Trends survey including gender diversity practices to get more consistent and actionable data Advocating for the creation of the CEO & Chair pillar to have a complete 30% Club Chapter in France. France is the latest country where an investor group has been established but still needs the CEO & Chair pillar that will be instrumental in driving awareness on gender diversity and effectiveness in policies and practices. We invite any CEO or Chair who wants to act and drive gender equality to reach out to us. Roadmap for 2023

2022 Annual Report 10 30% Club France Investor Group Candriam, Comgest, Generali IP, Groupama AM, and La Française AM joined us in the fourth quarter of 2022. After two years, the 30% Club France Investor Group is comprised of sixteen members with six trillion EUR in assets under management (AUM). • Marie-Sybille Connan, AllianzGI, Chair of the 30% Club France Investor Group • Anaïs Cassagnes, Amplegest • Molly Minton and Lorna Lucet, Amundi • Liudmila Strakodonskaya and Matthieu Firmian, Axa IM • Theany Bazet, Candriam • Cassandra Traeger, Columbia Threadneedle Investments • Alix Faure and Sebastien Thevoux – Chabuel, Comgest • Isabelle Delattre and Elodie Chrzanowski, Credit Mutuel AM • François Humbert, Generali Investments • Marine Dulon, Groupama AM • Diane Moulonguet, La Banque Postale AM • Deepshikha Singh and Claudia Ravat, La Française AM • Anna Hirai, LGIM • Camille Barre, Mirova • Corinne Gaborieau, Ostrum • Jessica Poon and Claire Mouchotte, Sycomore AM Investor Outreach

2022 Annual Report 11 30% Club France Investor Group Our Approach and Methodology As outlined in the statement of intent, the 30% Club France Investor Group uses engagement and stewardship activities to emphasize the importance of diversity to ourselves as investors and to our clients. Engagement Selection: Selecting Candidates by Assessing Absolute Performance To assess corporate performance on gender diversity, the 30% Club Investor Group uses the following ratio: Executive management was chosen as the indicator because it indicates the number of women at the top of the decision-making ladder at the company below the board. While companies have different names for the executive committee, we define it as the management level below the board. Data on the executive team is relatively easy to obtain and verify without third-party data providers. Comparing the % of female executive managers (FEM) to the % of females in the company allows us to assess performance between companies with differing percentages of females employed. While it is important to push for gender balance in all sectors, we acknowledge that certain sectors do not have as many females in the workforce such as construction and extractives. Wider female participation in certain sectors is a more complex issue that needs to be jointly addressed with public policy, particularly in STEM fields. Other sectors, such as consumers and luxury, have higher rates of female employment, but these higher rates are not often reflected in the composition of the executive management even when there are plenty of females in the talent pipeline, raising questions about the presence of the glass ceiling. Comparing % FEM to total % of females provides additional sector insights and peer-to-peer practices. 2022 Engagement Campaign Active Engagement Campaign In our second year, we continued our engagement campaign and conducted 18 in-person engagement meetings and conversations via email. Throughout our dialogue, companies demonstrated overall commitments and aspirations to achieve gender equality, but it is too soon to see if these verbal commitments will lead to concrete actions and meaningful change. Over the past two years, we have established a baseline for under- engaged companies and set specific next steps to track company momentum going forward. We also observed that some responded in writing, committed to setting up a meeting in the near future, or declined all dialogue with the investor group but declining is more the exception rather than the rule. Soft Engagement (Email Campaigns) In addition to our active dialogue with corporates, we conducted a “soft” email campaign to the SBF120. After the launch of the club in November 2020, we emailed a statement of intent explaining our two key objectives. A second email campaign was sent in May 2021 to investee companies with the KPI list of the SBF120, aiming to share our reporting expectations concerning gender diversity. This year, we sent an email to the SBF120 constituents highlighting our 2021 Annual Report as evidence of our commitment to the matter. In our second year, we continued our engagement campaign and conducted in-person engagement meetings and conversations via email. 18

2022 Annual Report 12 30% Club France Investor Group MEDEF Study on Gender Equality Commitments among SBF120 MEDEF is the leading network of entrepreneurs in France and a social partner for entrepreneurs helping to establish social dialogue. Over 95% of MEDEF members are small- and medium-sized enterprises (SMEs) representing various economic sectors. The organization promotes entrepreneurship and defends f ree enterprise, with one of its key focuses being job creation and sustainable growth as part of the long-term economic development of businesses. Sustainable development and social aspects of businesses are among the main topics on which MEDEF is continuously working. The organization has conducted various studies and regularly sets up surveys to gather relevant information on social, sustainability, and economic trends such as the socio-eco impact of digitalization, employment of disabled people, employee health & safety, and diversity & inclusion. Gender diversity continued to be one of the priority topics for MEDEF in 2022. For the second consecutive year, MEDEF experts conducted a data survey to identify gender diversity (feminization) levels in the composition of SBF120 companies’ executive bodies. The survey was successful, and MEDEF kindly shared with us some of their observations. Data stand for year 2021. Key Takeaways When reviewing the data provided by MEDEF, the 30% Club France Investor Group observed three key takeaways. Observation 1: The majority of the SBF120 have targets on gender diversity with five new companies committing to support female leaders in 2021 The rate of disclosure is quite high with 103 out of 120 companies having published information on gender diversity as regards the composition of their governing bodies. Moreover, 97 responding companies (versus 92 last year) have already published commitments and targets to increase gender diversity among their governing bodies. Six of the responding companies still have no gender diversity targets with two of them having zero women in governing bodies at the end of 2021 and two others not disclosing this information at all. We hope to see further improvements in the near future, with all SBF120 companies setting and reinforcing gender diversity targets.

2022 Annual Report 13 30% Club France Investor Group Observation 2: Significant ambiguity on the scope of targets persists The gender-diversity targets fixed by different companies as well as the scope of those targets (i.e., which executive body is targeted) and their time horizon lack clarity and homogeneity. In 2021, we continued to see SBF120 companies targeting different levels of senior and top management positions under their gender diversity policies. Those positions are described variously as “executive committee,” “executive positions,” “board of managing directors” (including or not the executive committee), “subsidiary or group-level executive bodies,” “10% of top managing positions,” or simply as “governing bodies” or “managers.” This variety grows as more denominations were used in 2021: among the new ones, we see “TOP 100, 200, or 300 managing positions,” “global leadership network,” “partnership pool,” “circle 1” or generally “managers and experts.” These differences in the scope of gender-diversity targets imply a lack of global maturity and consensus as regards the parity topic, despite some rapid progress in target-setting highly driven by the regulatory context. We still need to define what can and should be done at each level of management up to the highest positions. We acknowledge that targets at lower management levels are useful to build the talent pool, but they do not ensure that women are influencing key leadership dynamics at the very top. Observation 3: High degree of variability on timelines to reach targets but growing ambition to go from female representation to gender parity Variations in scope may partly explain differences in the level of commitment and targets set by different companies across the SBF120. We noticed that some targets are set with multiple deadlines to allow for gradual progress and stronger follow-up at each stage, with the first level of targets to be reached by some companies in 2022-2023 or 2024. We also see some companies engaging over the long term, with the longest commitments going up to 2027, 2030, or even 2050 (the latter is exceptional). However, gender-diversity targets, on average, are set to be reached within three to five years and aim (in most cases) to attain 30% and 40% female representation by 2023 and 2025, respectively. The most ambitious companies target 40% representation by 2022 and parity by 2023. With the parity trend growing, around two dozen SBF120 companies work to go beyond female representation and achieve gender parity by different target dates (2023 or 2025 with some exceptions targeting 2030). The results obtained by the responding companies in 2021 are reassuring: the majority have already reached 30% representation in the highest governing bodies targeted, with less than a third of respondents still having female talents underrepresented below 25% by the end of 2021. Overall, we believe these results bring good news as this trend confirms the feasibility of the 30% Club goal of at least 30% women in Executive Committees by 2025. Surely, the adoption of the Rixain Law will guide the companies in this journey.

2022 Annual Report 14 30% Club France Investor Group Sharing Best Practices Please find a few examples of the best practices we observed on the different pillars that were identified as evidence of a genuine strategy toward gender equity. Promotion & Meritocracy (Edenred, Business Services) We engaged with the Chairman & CEO to understand the corporate culture and practices of a company that drives or impedes a better representation of women at executive levels, given the current low level of representation (9% of the executive committee and only one woman as head of communication) despite a positive momentum at other levels (Top 400 f rom 21% up to 34% of women between 2018 and 2021). We appreciate the commitment to gender diversity and the involvement of the Chairman & CEO in this journey as he assured us that gender diversity was addressed with concrete examples. We will monitor progress over time as we know it will take time to get to the floor of 30% of the members of the ExCO, particularly given the age of the talent pipeline. Moreover, the reality is that the pipeline is skewed toward men because of historical patterns in recruitment and promotions. Pure meritocracy will need to be a little twisted to give room and opportunities for women. In a nutshell, the strategy adopted to foster female representation at the ExCo and build a sustainable pipeline of talent (Top 400) is articulated around: • External search obligation for headhunters to present at least a man and a woman for each position in the short-list of applicants - a requirement not easy to fulfill and time- consuming. • Internally, this gender-balanced approach is much more complicated to apply. It would be counterproductive to scare away talents that have developed over time within the firm and have contributed to corporate success. As such, the CEO is the arbiter and oversees recruitment for the Top 400 positions (now filled with 34% women). It’s a collegial process. • With equal skills and attitude, the least represented gender will be chosen, but the person of the underrepresented gender might still be selected even if they have a worse attitude & skills but estimates that attitude and skills are at the expected level for the position, and they have the potential to develop. If the applicant chosen is not of the underrepresented gender, a more in-depth analysis of the reasons for this choice will be requested to ensure that the process was carried out in compliance with the Group’s policy. • If they apply a principle of pure meritocracy, they are at risk of reproducing the past with a pool of 75% men and 25% women. Meanwhile, they must not scare away promising talent. There is a judgment call and trust that the candidate has sufficient skills and the attitude to “live” the position (“you have to know how to give a chance”). • Developing role models and inspiring women - women must be more visible, whatever their title or hierarchical position. For internal events (product keynotes, conventions, etc.), the audience must be 50% men and 50% women. Since 2019, the talent week training programs and the company’s executive academy have targeted at least 40% and 35% of women, respectively. The company put in place a coaching program for women (mentors for one year chosen among the management team) but also mandatory trainings on diversity and inclusion, unconscious bias, and ways of fighting the tendency to self-censorship in monthly meetings. Case Study 1

2022 Annual Report 15 30% Club France Investor Group Gender Pay Gap (SAFRAN, Aerospace & Defense) The equal pay gap and gender pay gap are two different notions. While equal pay gap means equal pay for equal work and no discrimination based on gender (which is forbidden by law in France), the gender pay gap captures the under-representation of women in senior, higher paying positions. Closing the gender pay gap requires measures to break the glass ceiling through adequate, supportive, and relevant HR policies. It is different than possible discrimination captured through the equal pay gap. When it comes to action plans to increase the share of women in senior positions and reduce the gender pay gap, we need proactive steps such as setting a target to increase female representation at management levels first and to strengthen the female talent pool to naturally have more candidates for senior positions promotion. Setting targets will hold the company accountable and can show the direction and ambition of the company. We understand the communication challenges behind target setting such as the risk of demotivating men. For the engaged company, this is not an issue as the objectives are clearly communicated and not perceived at the expense of men. A good practice to meet targets is through internal promotion rather than external recruitment. For this company, there is a specific context with a pyramid of age that will facilitate more women onboarding. As such, the company has adopted a voluntarist approach with 75% of retiring workers being replaced with women with equal competencies. We believe such an opportunity exists at many French companies with the 60s retiring in this decade. The company is activating two levers to reduce gendered pay. As explained above, developing the female talent pipeline but also using a pay increase envelope as a way of catching up and reducing the gap actively. Case Study 2

2022 Annual Report 16 30% Club France Investor Group The Merits of a Diversity, Equity, and Inclusion Audit (SCOR SE, Reinsurance) In 2021, the engaged company made additional commitments and conducted an external DEI audit that lasted three months and involved 12 people f rom their HR department. They contracted the Clear Company to carry out this DEI audit. We believe that such an investment is a good practice as they will have a good understanding of the state of play and where they must emphasis the impetus. It looks to be a good way to reconcile meritocracy and gender diversity. The idea is no longer to oppose meritocracy and gender diversity but to look to broader strengths and competencies brought about by cognitive diversity. They presented to the 30% Club the different aspects of the DEI audit, split into three parts. • A complete review of the company’s documentation (HR, procedures, internal communication, animation, results) in seven geographical areas chosen for their representativeness at the group level: UK, France, Switzerland, Germany, Ireland, APAC, and USA. The Clear Company also reviewed the recruitment process of 12 of the last candidates recruited. • 50 employees who are leaders in their position were interviewed individually to gauge leadership commitment to DEI. In parallel, they conducted 13 employee focus groups that covered geographic, newcomer, generational, and gender themes. 350 people were interviewed concerning their perception of the inclusive experience at the engaged company. • Positioning of the engaged company by the Clear Company relative to its industry peers. The Consulting Firm formulated recommendations in terms of Diversity, Equity, and Inclusion. • Communication of the D&I strategy to all employees with clear objectives. • Further developing KPIs on D&I, a complex subject because legislation differs greatly f rom one country to another on what information can be collected on employees. • Setting a relatively broad definition of D&I because of the very different ways of seeing it in different geographical areas. • The example should come f rom the top. Critical role of leadership, not just HR or a few colleagues. All managers must embrace it with a participation in training programs, sponsorship on projects, and applying an inclusive lens to all the decisions they make on employees. • Educating employees and managers on the subject with a terminology that evolves and involves setting up dialogue zones. • Working on culture and values • Implementing a wellness, mental health, and D&I policy The DEI audit will help meet its ambitions in terms of gender diversity and equity. In that respect, a particular focus was done on the gender pay gap as per their commitment to no gendered pay gap for equal positions. Currently, the gender pay gap is on average/median at nearly 30% because women account for only 10% of the 10 highest salaries. There is no cure-all solution, but the engaged company is taking action on the many levers contributing to the gender pay gap, particularly the attraction, development, and promotion of female talent to increase representation in the highest pay groups. A tangible example is the mapping of all the roles in the organization, seen as the opportunity to have a more granular monitoring of the situation, e.g., which jobs are occupied by women, for which hierarchical roles, and at which wages. What gets monitored gets measured and improved with the end purpose of ensuring fair compensation for employees, whatever their gender. Case Study 3

2022 Annual Report 17 30% Club France Investor Group We engaged with the Global Chief Diversity Equity Inclusion Officer to better understand how to address this very sensitive topic. This was one of the first French companies to put in place a Code of Ethics, back in the year 2000. More than twenty years later, the Code of Conduct is undergoing only its fourth edition which shows how comprehensive it was since the beginning. Being able to quickly identify ethical gaps is key to ensuring a quick response and implementation of corrective measures. As such, they have implemented in 2008 a policy and in 2018 a website where employees can report cases of bullying, sexual harassment, racism, homophobia, and transphobia (among others) called “Speak-Up”. Interestingly, this policy and platform allow employees (since 2008) and other stakeholders (since 2018, external staff, suppliers, subcontractors, clients, consumers, shareholders) to raise serious, ethical concerns so that the company can address them (e.g. a supplier being harassed by an employee). The reports made via this platform are directly received by the Ethics Department and this website is hosted by an external provider to ensure independence and is bound by a strict confidentiality obligation. Since speaking up is not always easy, the company has implemented a process that is strictly confidential and offers equal treatment and protection against any form of retaliation. In their Speak Up report, the concerned person will describe their concern as objectively as possible and in detail. Among several steps, they should: • Indicate when and how they became aware of the matter • To the extent of possible, provide all facts, information, or documents (regardless of format or support) that help substantiate the Speak Up report. If they are not sure that a particular element is true, they specify that it is an alleged element • Indicate how they can be contacted • indicate if, to their knowledge, internal or legal proceedings or equivalent (grievance, arbitration, injunction, mediation, complaint) are impending or ongoing. There is an internal communication led by the Chief Ethics Officer and the Chief Human Relations Officer and shared with all employees every year on 1st March, commemorating the “Zero Discrimination Day.” This internal communication is intended to bring attention not only to the reasons but also to demonstrate that the complaints are indeed taken into account and that remedial actions were taken (e.g. people leaving the company) so it makes clear that they are not only listening but also acting. The company also reports the number of potential non- compliant cases as well as the split (cause-related) and the actions taken in their annual report, a sign of transparency and accountability. Sexual Harassment (L’Oréal, Households & Personal Products) Case Study 4

2022 Annual Report 18 30% Club France Investor Group Thought Leadership and Key Learnings from Friends of 30% Club France Investor Group In 2022, the 30% Club France Investor Group continued to rally industry stakeholders around the same goal of sharing knowledge, best practices and tips to reach our 30% target most efficiently. As such, we organized discussions to share information and data with various experts. We sincerely thank them for their collaboration and praise them for their conviction. Fireside with Marie-Pierre Rixain, Member of the French Parliament. Sharing insights and recommendations to make sure that the law is impactful, e.g., meets its target and does not result in a “tick the box” exercise. The Copé - Zimmermann Law was instrumental in driving gender diversity at the board level but did not have the trickle-down effect at the ExCo as we hoped. • The challenge of gender diversity at ExCo is not commensurate with that at the Board level. For the latter, it’s about appointing non-executive directors f rom outside the company. With the Rixain Law, we are directly touching on the question of the glass ceiling for women and how to break it, offering equal job opportunities for men and women. • Gender breakdown at the executive level (essentially the 10 highest salaries) is intrinsically linked with the glass ceiling that women are facing. The more women with management/ business responsibilities there are, the more they will play as role models and women will gain self- confidence and raise their voices for promotion & salary equity. It’s the multiplier effect. The Gender Equality Index will be complemented with new indicators such as return f rom maternity leave. Keep in mind that it aims to be a tool for companies to achieve gender equity, and it is important to give them time to implement it. Pragmatism is paramount. Equality must be considered f rom a performance perspective. Leading by example. The top management has a role to play and can really make the difference. As a matter of example, one company in the luxury sector had 33% female representation at the ExCo while another only had 15% in 2020. CEO commitment is crucial. In general, they are convinced about it even though people tend to recruit those who look/think like them. We like to be with those who look and think like us, so it’s no surprise that the “boys club” mentality has lasted for decades alongside questioning women’s competences. The purpose of the Rixain Law is not to take opportunities f rom men but to rebalance the situation and finally offer equal economic and professional opportunities for men and women. It’s about societal fairness, economic competitiveness for French businesses, and young generations that won’t tolerate the status quo.

2022 Annual Report 19 30% Club France Investor Group Meritocracy or woman – alibi? Really? Quotas don’t come at the expense of meritocracy. We are not talking here about the “woman-alibi” as Christine Lagarde told me once. Roadblocks are more at the middle management level where managers can be reluctant to recruit women that could leave for maternity, ask for part time, or be perceived as less available due to family responsibilities. Such considerations and practices should be put in the past as they are no longer socially acceptable. What is their precise definition of “senior managers and members of the management bodies”? How to delimit this universe? • The 30% Club France Investor Group has observed that companies often have their own definition of governing bodies. For example, the governance of a large French bank is composed of two governing bodies: the general management and the executive committee. The “highest” body is the general management (five members), and it is entirely composed of men. Which one is the most relevant? • The notion of “management bodies” no longer poses any issue given that its definition has been discussed at length with lawyers and finally established in the French Code of Commerce that governs private companies. It covers both the executive committee and the management committee. The law concerns at least 2,000 companies and goes far beyond the SBF120 targeted by the 30% Club France Investor Group.

2022 Annual Report 20 30% Club France Investor Group The financial industry is a sector that starts off with an unbalanced gender parity in which the C-Suite is largely dominated by men. As shown in Deloitte’s latest report, women held 21% of board seats, 19% of C-suite roles, and only 5% of CEO positions in 2021 within global financial services institutions. The numbers speak for themselves, and sadly they have not changed much in the past 20 years. Where there is darkness, there is also light. While there is still much to be done, there is also hope that the financial sector could benefit f rom the “multiplier effect” which refers to a positive, quantifiable increase of women at the senior leadership levels for each woman added to the C-suite. So how do we get women added to key positions in financial services? To answer this question, on the 27th of October 2022, we had the honor of having two successful women, Amanda Pullinger and Virginie Maisonneuve, share how they broke the glass ceiling and how they are paving the path for the next generation of women. Amanda Pullinger was no stranger to being the only woman in the room which is why she is now helping women across the finance industry. After a f ruitful career in the hedge fund industry, she is now the CEO of 100 Women in Finance, whose mission is to strengthen the global finance industry by empowering women at every career stage and to achieve “Vision 30/40” - 30% of senior investment roles and executive committee positions held by women by 2040. To reach those targets, many barriers need to be broken down. The first key driver for change for Amanda is visibility. Women often are hardworking and put job completion as their top priority. However, working behind a desk all day leaves women little time and opportunity to network, speak on panels, and attend important events. This leaves women in the shadows. On the other hand, putting women in the spotlight will change people’s perceptions of them. People will see women as experts in their fields and recognize women for their competencies. To achieve this, the priority for managers is to actively give women opportunities to be visible, and women should seek out opportunities to be visible even if it could mean being uncomfortable at the beginning. To illustrate how visibility can be influential for others, Amanda shared with us a personal example in which she was inspired by the success of Margaret Thatcher. Amanda was the first person in her family to go to university, and like Margaret Thatcher, she went to the University of Oxford. Even though Amanda never met Margaret, her public visibility as Prime Minister of the U.K. gave Amanda someone to aspire to as a young woman. That is why Amanda believes it is important to increase the visibility of women because it has a positive ripple effect on other women’s trajectories along the way. The second challenge is to demystify the financial sector. If the next generation of women have female role models of senior investors and understand how it is possible to become one, this will be a game changer. That is why 100 Women in Finance launched a “Jump Start” program for university students to decode the financial industry by explaining different players and key roles in the sector as well as ways to obtain an internship in the field. Amanda believes it is not too late to educate and motivate women at the university level. What is more important is to cultivate a corporate culture that could attract female talent because it is the culture that drives women to join an organization. Overall, Amanda is cautiously optimistic for the future generation of women in the financial industry. Virginie Maisonneuve, Global CIO Equity of Allianz Global Investors, sets an example of how women could succeed in the sector. She is a global investment leader with over 35 years of performance track record in asset management. She highlighted the changes that she noticed during her career as a woman in the financial industry and that although the environment was still very imbalanced, some progress had been made f rom the time she started in the late 80s. One of the key points she made is the one of “ownership,” i.e., that it is important for women and all investment professionals who want to lead more impactful and better performing companies to “own” and lead actions to support its transformation in diversity in general and gender specifically (“just Fireside Chat with Amanda Pullinger, CEO de 100 Women in Finance, and Virginie Maisonneuve, AllianzGI’s Global CIO Equities

2022 Annual Report 21 30% Club France Investor Group do it!”). She also highlighted her efforts in this area via past leadership role as the chair of the CFA U.K. women’s network as well as more recently her being a founding partner of the Bloomberg Buy Side women’s network in Asia. Both organizations target the support of women in asset management via mentoring, engagement, and thought leadership. Another point that she believes is important is confidence. She believes it is one of the truly critical skills that women need to push through the glass ceiling. Even when women have 90% of the skills required for a new job, they often shy away f rom putting their hat in the ring as they believe anything short of 100% would be doomed to fail. This is a stark contrast to many male colleagues and can regrettably set women apart f rom having an opportunity to compete. Finally, to accelerate change, Virginie said that it would be a big step forward if financial companies were to set up diversity and inclusion codes and be more demanding f rom the search firms they partner with to source talent and demand diverse candidate pools to help accelerate pipeline challenges.

2022 Annual Report 22 30% Club France Investor Group Background We discussed the results of a study sponsored by Deloitte and 100 Women in Finance dealing with one of our engagement topics: what the state of play is for women in finance, whatever the continent, and recommendations to break the glass ceiling. Insights & Learnings The glass ceiling exists in finance, but it is less acute than in the other industries. In finance, the percentage of women on boards is 21% and 19% in C-suite roles worldwide. It’s quite low, below the threshold of 30%, but it’s above all other industries. In terms of CEOs (Fortune 2021 Global 500 list), only 5% of CEOS are women; there are actually only six women that are CEOs. COVID-19 had quite an impact on women in the workplace. 51% feel less optimistic about their career prospects today than before Covid. It is critical to develop an inclusive culture so that women can remain in the workplace. What might the future look like based on historical trends and patterns across the globe? Not great, very gradual, and fragile • From 1998 to 2021, data collected on the situation for women assessed possible pathways for the next decade. Patterns observed over the past two decades show how the situation for women in financial services could evolve by 2030. • Progress will be very gradual in the representation of women in all kinds of roles (next-gen, C-suite, senior leadership). The slope of the curve is rather flat. • Next-gen (e.g., all workforce levels and titles below senior leadership) figures are stalling in some regions due to the pandemic. Many women withdrew f rom the workforce during the pandemic to take care of their families. Another outcome of the study and key takeaway is the evidence of the multiplier effect. For every organization studied, Deloitte observed that for each woman added to the C-suite, there was a positive impact on senior leadership below the C-suite. In Europe, every woman in C-suite results in 2.6 more women. There is an obvious positive impact stemming f rom women as role models - women in the C-suite are in a position of power and advocating for women in all roles. For FSIs to drive meaningful change and realize the full power of the multiplier effect across their organizations, they will need to improve gender diversity at the highest levels. Inclusive culture = key to foster diversity in the workplace. How to encourage financial companies to have an inclusive culture: • Recruit & Retain: assess current gender gap and set ambitious but achievable targets for each role and communicate strategies aimed at narrowing gaps. Women shouldn’t be excluded f rom informal conversations at the executive committee, hence the need to create a genuinely inclusive leadership and culture. Need to develop inclusive role descriptions. • Address Persistent Challenges: provide formal sponsorship, mentorship, allyship programs; provide flexible working options that won’t hinder career progression opportunities; Provide support options for childcare and well-being • Cultivate Growth Opportunities: avoid a leaky pipeline. In progressing toward leadership positions, the proportion of women declines. Need to prepare women for the new positions. Think about succession planning and not just for the year ahead - do it with enough time to be able to have a sufficiently diverse pool of candidates. Laurence Dubois, Partner, Deloitte FSI Presentation on gender diversity in finance and their approach on breaking the glass ceiling & the multiplier effect Tips for the 30% Club France IG: three key/ critical questions we should ask companies when engaging the glass ceiling to make sure that we adequately cover the issue. • How do you foster an inclusive culture in your organization? • How do you help women prepare for their next position? • How have you organized succession planning for key leadership positions?

2022 Annual Report 23 30% Club France Investor Group Background Mercer presented their pay equity analysis methodology, aiming to meet the regulatory requirements of Anglo-Saxon investors but also those of the European Directive on Wage Transparency. Although the Directive has not yet passed, it has been reviewed by the Committees for Women’s Rights and Employment of the European Parliament, and they propose lowering the threshold for application to companies with more than 50 employees (instead of 250) and the gender pay gap at 2.5% (instead of 5%). Learnings & Insights The reasons for pay gaps are diverse. It is crucial to isolate the impact of different factors to adjust for the pay gap that is due to gender or other unjustifiable reasons. This can be understood as a differentiation between the explained and unexplained gender pay gap. Only an unexplained gender pay gap is unjustifiable and therefore a problem as an unexplained gap is usually much lower than the explained one since it excludes factors such as experience, role type, performance, location etc. In France, the raw gender pay gap is 20% of which 10% remains unexplained by objective and legitimate factors. Today, companies still tend to prefer an internal evaluation of pay gaps so they have more control over the outcome. This must be interpreted as a lack of willingness to target this issue with the needed seriousness. However, increasing coverage of the topic is helping – especially in the U.S. and the EU. Mercer proposes a methodology based on an assessment of the state of play then extrapolates how the representation of women, at each level of the firm, would evolve if the historical trend were to continue. Each additional curve provides an approximation of the future representation if the rates of recruitment, promotion, and departures & resignations, one by one, were made comparable to those of men. Mercer has developed this methodology not only to support companies in their gender pay equality trajectory but for investors that want to assess the impact of their investments and report on the key gender equality indicators under the United Nations SDG 5. Franck Juvin , Principal, Client Manager Ayce Nisancioglu , Senior Diversity, Equity and Inclusion Consultant Mercer on Gender Pay Gap “Raw” Pay Gap “Explained” Pay Gap “Unexplained” Pay Gap = + How average or median pay differs between women and men How pay differs because men and women are in different roles or have differing amounts of labour market experience etc. Residual pay gap that cannot be explained and may be due to pay inequities Tips for the 30% Club France IG: three key/ critical questions we should ask companies when engaging on gender pay gap to make sure that we adequately cover the issue: 1. Our research shows that formal pay equity processes drive gender diversity. Is pay equity a part of your organization’s philosophy or strategy? What are your organization’s primary objectives for analyzing pay equity (legal; internal or external pressures; ensuring fair pay; attract/retain best talent)? 2. Pay differences are permitted but must be based on legitimate and objective criteria unrelated to gender such as an individual’s competence and performance. Can your organization explain their pay gap that is more than 2.5% with legitimate and objective criteria not related to gender? 3. Today’s employees have increasingly high expectations around pay transparency. Reassuring employees that they are being treated fairly in comparison to their peers can have a positive effect on job satisfaction, employee engagement, and productivity. Is pay transparency part of your employee value proposition strategy that helps you attract and retain top talent?

2022 Annual Report 24 30% Club France Investor Group Debunking Myths on Gender Diversity We have debunked six myths on gender diversity. Conf ronting these pre-conceived biases enables investors to better deal with core issues that are impacting women f rom reaching top positions. Myth 1: “Women appointed because of positive discrimination obtain these positions due to their gender not their merit.” This myth was first debunked by Deborah Gilsan, founder of the 30% Club. Meritocracy is often used as an excuse to protect the status quo as people utilize overly narrow definitions of merit to hire candidates like their predecessors. There is no evidence showing that women obtain their positions solely because of their gender and not their skillset and merit. On the contrary, hiring f rom a more diverse pool will help ensure a company finds the best talent based on merit. Myth 2: “It is hard for our industry/company to find competent women, especially for top positions.” When companies across different sectors try to recruit women and provide them with proper tool and training, those women are found to be as competent and qualified as men for top positions. The 30% Club France Investor Group observed that companies in industries suffering f rom the lack of female employees achieve stronger progress on women representation in the top management level. Myth 3: “We need more time to set an achievable target.” It is important to first analyze the current constraints and cultural biases against gender diversity within an industry before setting a detailed action plan. We observed that the most efficient way to achieve the gender diversity goal is by setting ambitious targets – targets that seem unachievable at first are often surpassed in the end. We encourage companies to adopt aspirational targets for diversity as we believe measured targets are more likely to be achieved 1 . Myth 4: “We’re committed to diversity, but we’re waiting for it to happen organically.” If companies wait for female employment to grow organically, they may fail to attract and retain diverse talent. Women often leave an organization due to the lack of promotional opportunities. Therefore, accurate and comprehensive data is crucial as it helps companies identify problem areas (such as too few female senior managers) to implement targeted solutions. An oversight team is necessary to monitor the recruitment, retention, and promotion of women1. Myth 5: “Women just don’t want the top job.” While not everyone wants the top job regardless of gender, companies need to ensure that they offer a level playing field for diverse talent so that those who want the top job are provided with equal chance without biases and glass ceilings. If diversity and inclusion is a true strategic priority for a company, its culture will ensure that the best people can succeed regardless of gender1. Myth 6: “Women are not interested in networking and mentoring/being mentored.” There are several reasons why women ask for training and mentorship to advance their careers less often than men. One of them is that women tend to have additional responsibilities outside of their work f rom their homes and families. Nevertheless, companies should not draw the conclusion that women are not interested in building successful careers. Companies should provide proactive career development advice and consulting as well as appropriate work/life balance policies (e.g., maternity/ paternity leave) to help nurture new female leaders. 1 Myth first debunked by Clare Payn, former Investor Group Chair of the 30% Club UK and Senior Global ESG & Diversity Manager, LGIM; https://www.lgim.com/landg-assets/lgim/_document-library/capabilities/debunking-corporate-myths- about-diversity.pdf

2022 Annual Report 25 30% Club France Investor Group In 2023, the 30% Club France Investor Group aims to continue its dialogue on gender diversity with SBF120 constituents and promote activities that will contribute to the 5th Sustainable Development Goal of the United Nations. With the onboarding of more investors, we will have more capacity to engage with investee companies. In the second half of 2023, we will begin inviting CEOs and Chairs to participate in the Global Talent Trends survey on talents including gender diversity of Mercer to get more consistent and actionable data. What gets measured gets managed. We will advocate for the creation of the CEO & Chair pillar in order to have a complete 30% Club Chapter in France. France has been the latest country where an investor group has been established but still needs the CEO & Chair pillar that will be instrumental in driving awareness on gender diversity and effectiveness in policies and practices. We invite any CEO or Chair who wants to act and drive gender equality to reach out to us. We will also continue to meet with experts on gender diversity to enhance our approach and be in better position to formulate recommendations to investee companies. Future Plans The 2023 roadmap for the 30% Club France Investor Group in three ways: 1 Moving the needle further 2 Partnership with Mercer on their Global Talent Trends survey including gender diversity practices 3 Promoting a full 30% Chapter in France

2022 Annual Report 26 30% Club France Investor Group In order to ensure proper onboarding and transfer in knowledge among members, the 30% Club France Investor Group is instauring a co-chairing of the initiative over a two-year mandate. The existing co-chair assists the co-chair in their learning of the initiative, so that they will be equipped to support their successor in the second year of the mandate. Message from the Co-Chair of the 30% Club France IG As a fund manager leading a sustainable equities fund on gender diversity, I have witnessed the power of sustainable finance as a force to drive change at corporate level. As partial owners, investors have voting and engagement rights, two powerful tools that can influence corporate behavior and foster further accountability and transparency. As such, shareholder activism on social factors is gaining traction and interest given that climate action is directly linked with social justice. Nowadays, the incorporation of sustainability criteria into the stock selection process is becoming the norm rather than the exception, as it has been proven that environmental, social, and governance (ESG) factors directly influence a company’s long-term value and competitiveness, even if it doesn’t become immediately obvious in traditional financial analyses. However, sustainable finance is not only about environmental challenges but also the social factors and ethical management of a company. Subsequently, factors such as gender diversity, workplace well-being, health & safety standards, and fair remuneration affect all companies, either positively or negatively, as they permeate directly into the talent attraction and retention, the motivation and productivity of employees, and overall, into the business continuity. Theany Bazet, Candriam Co-Chair of the 30% Club France Investor Group for the 2023 Engagement Season I believe that long-lasting change is only driven by collective effort, so for that reason I have joined the 30% Club France Investor Group. But in order for the Club to reach its goal of achieving a minimum of 30% women within the SBF 120 executive teams by 2025, we need to ensure that women can find a safe space where they can build a career and thrive. In the end, female representation targets are only sustainable in time if companies are able to retain and develop their female talent so that these women can later feed into their executive and C-Suite positions pipeline. For that matter, this report is intended to share the knowledge built throughout the year, sharing examples of companies championing best practices and hopefully inspiring other corporates to follow suit and take action. Going forward, I am pleased to join Marie-Sybille as Co-Chair so that together with our community of 16 responsible engaged investors, we continue building bridges with corporations via active engagement and constructive dialogue. It is only by sharing best practices and bringing to light the blocking factors that we can advance gender diversity and drive systemic change. Moreover, we would like to contribute to develop the CEO/Chair pillar of the 30% campaign to have in France a full 30% chapter as is the case in the other countries. Doing so will strengthen the commitment of improving gender diversity in the higher ranks of their business and increase the probability for it to materialize. As the initiative will span over many years, we believe it’s good governance and as stewards of our companies, we walk the talk. In 2023, Candriam will be co-chairing the 30% Club France Investor Group alongside Allianz Global Investor.

2022 Annual Report 27 30% Club France Investor Group Becoming a Member All investors are welcome to join the 30% Club France Investor Group. We are more than happy to welcome members of any size, both small and large. Investor members do not have to be French in origin; they simply must have an interest in pushing for improved practices regarding gender diversity for the French SBF120. Any investors who are interested in becoming a member can contact us through our LinkedIn Page . In terms of time commitment and level of involvement, we require investor members lead engagement with at least one company. While many investors may choose to lead on more than one company, any additional involvement is optional. Led by the annual co-chairs, members of the group may choose to be more highly involved in the annual activities including participating in research, methodology creation, and proposing or participating in additional 30% Club activities such as guest speaker events. 30% Club Investor Group KPI List – Our Reporting Expectations for Corporates Our KPIs focus on 11 themes: • Governance • Talent Attraction • Job Quality • Promotion • Retention • Work-Life Balance • Equal Pay • Sexual Harassment • Supply Chain • Certification/Audit • Women Empowerment Principles The KPI list is a mix of indicators that are commonly – or should be commonly – reported as well as indicators that are a “tougher ask” for investee companies yet essential to better understand underlying practices that could be ultimately preventing women f rom reaching top management positions (such as gender breakdown of the % of return to work following parental leave). Appendix Objective 2: Disclosure Expectations from Investee Companies As part of our overall stewardship responsibilities on behalf of our members and clients, we actively engage with investee companies on corporate governance issues including the process used to identify suitable candidates for executive management teams. To provide investors with a comprehensive understanding of an investee company’s diversity and inclusion policies, practices, and processes, we expect companies to be transparent regarding the procedures used to find and appoint new members to the executive management team and how that process ensures a diverse leadership committee. We also call on companies to provide information on how diversity materializes at every level of management. We believe this transparency will allow investors and other stakeholders to understand how a gender-diverse talent pipeline is built up to the top. Objective 1: At Least 30% Women in the Executive Committee by 2025 As members of the French 30% Club France Investor Group, we expect executive management teams of SBF120 companies to appoint women to at least 30% of seats by 2025. This is the level at which critical mass is achieved and contributions f rom a minority group start being heard and valued, impacting leadership decision dynamics. We call on companies to consider women for operational roles, where they are often under- represented. We also encourage companies to develop an internal female talent pipeline and build on it when considering the appointment of a new woman to the executive management team. Key Objectives of the 30% Club France Investor Group

GOVERNANCE Yes/No Comments Are the company leaders accountable to drive gender diversity? If yes, who is accountable for gender diversity within the company (Board, Executive Committee, HR)? Yes/No Are gender diversity targets part of the KPIs used to assess the variable remuneration of executives and senior managers? Can you elaborate? Yes/No ATTRACTION Gender breakdown of each management level: % of females in your global workforce % of females in non – management positions % of females in management positions % of female in Senior Executives positions % of female in the Executive Committee Implementation of unconscious bias training and scope of beneficiaries (HR functions, management, global workforce) Yes/No Please specificy the scope of beneficiaries and any additional information you will be willing to share JOB QUALITY Gender breakdown of employment type: % of female in part-time employment % of female in temporary contracts and compared to men PROMOTION Gender breakdown of the internal promotion rate Commitment to consider at least one candidate f rom each sex for every succession and/or new managerial position appointment (whether internal or external/headhunters recruitments) Yes/No % of female which benefited f rom dedicated trainings to support access to leadership Do you have any mentoring programs to help develop talent for managerial and leadership levels ? Yes/No RETENTION Gender breakdown of the turnover WORK LIFE BALANCE (please specify the geographical coverage of the policies in place and local specificities if any) Paid Maternity leave in place and measures to encourage it Yes/No Is there a global minimum for Maternity Leave to address differences in standards globally? Yes/No Flexible work options in place (covering both working locations and hours) Yes/No Do you apply global standards on paid vacation? Yes/No Grender breakdown of absenteeism rate Yes/No EQUAL PAY (not only on the base salaries but also including discretionary pay) distinguish between base salaries and discretionary every time possible Median gender pay gap Average gender pay gap Pay gap by quartile % of female in Top 10 remuneration Do you have measures in place to address any gender pay gap, such as envelopes to rebalance pay gaps? Any other effective tool to remediate the situation? Yes/No MORAL & SOCIAL HARASSMENT Do you have in place an anti harassment policy? Can you elaborate on if and how it covers both social and sexual harassment? Yes/No Doo you monitor the number of harassment cases? If yes, what remediation steps do you enforce? Do you report on them? Yes/No SUPPLY CHAIN Do you have any policies and programs to address gender based discrimination and violence as well as female empowerment in global supply chains? Yes/No CERTIFICATION/AUDIT Has your organization undertaken a gender diversity audit process ? Yes/No EDGE (Economic Dividends for Gender Equality), GEEIS (Gender Equality European & International Standard) Has your organization undertaken a gender diversity certification process? If Yes, please specify both certification type and level reached. Yes/No If Yes, please specify both certification type and level reached WEP Is your organization signatory of the Women Empowerment Principles? Yes/No https://www.weps.org/ 2022 Annual Report 28 30% Club France Investor Group

2022 Annual Report 29 30% Club France Investor Group The 30% Club France Investor Group would like to thank Copylab for their assistance with editing and graphic design.